Huishang Bank is selling properties worth 820 million yuan in Beijing, and Vanke is its fifth-largest shareholder.

During the cycle of interest rate cuts and deleveraging, banks are facing tough times, especially city commercial banks.

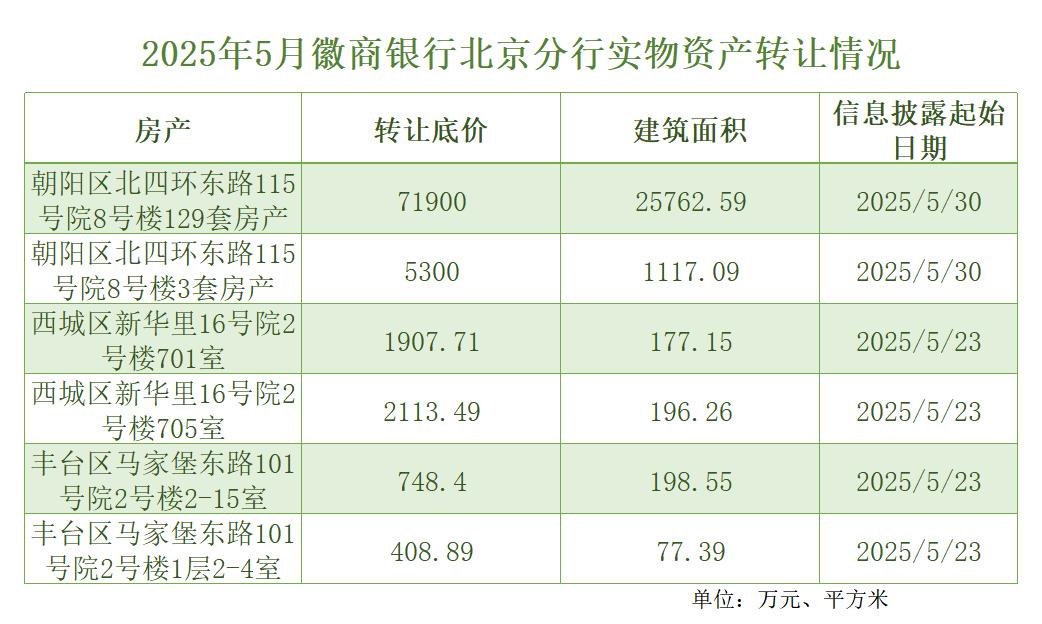

Recently, the Beijing Branch of Huishang Bank Co., Ltd. listed more than 130 properties for transfer on the Beijing Equity Exchange, with a total transfer reserve price of approximately 824 million yuan.

Information source: Beijing Equity Exchange

The properties include office spaces, commercial properties, apartments, and parking spaces, all approved for transfer according to the "Minutes of the President's Office Meeting of Huishang Bank (No. 1)".

Among them, the most significant asset is 132 properties on the East North Fourth Ring Road. According to Gaode Map, this is the Huishang Bank Building, which is also the office location of the Beijing Branch of Huishang Bank.

However, the asset transfer information on the Beijing Equity Exchange shows that approximately 16,000 square meters of office space in the Huishang Bank Building up for transaction has been completely vacated.

Current status of the transferred assets in the Beijing Huishang Bank Building

According to the data disclosed in the 2024 annual report, Huishang Bank ranks seventh among city commercial banks with an asset scale of approximately 2 trillion yuan, making it one of the top players in the city commercial bank sector.

Picture source: Research on City Commercial Banks

It is worth mentioning that Vanke currently holds approximately 7% of the shares in Huishang Bank, ranking as the fifth - largest shareholder.

Vanke's total shareholding in Huishang Bank amounts to approximately 970 million shares, worth over HK$3.1 billion, held respectively by Wkland Finance Holding Company Limited and Wkland Finance Holding II Company Limited, subsidiaries of Vanke.

Vanke's investment in Huishang Bank dates back to 2013 when Huishang Bank went public in Hong Kong. Vanke subscribed for more than HK$3 billion independently, becoming one of the five cornerstone investors.

This investment became Vanke's largest - scale equity investment outside the real estate sector after its listing.

At that time, Tan Huajie, the then - secretary of Vanke's board of directors, explained: Compared with Vanke's annual sales of over 100 billion yuan, the investment in Huishang Bank is not large. It is a strategic investment aimed at better meeting the financial service needs of the company's customers. Investing in a bank can create synergies, enabling the company to be the first to provide leading domestic community financial services to customers and enhancing the company's competitiveness in comprehensive residential services.

When Huishang Bank was first listed in Hong Kong, Vanke held approximately 8% of the shares, making it the single largest shareholder. Later, Vanke did not buy more shares, and its shareholding ratio was gradually diluted to 7%.

Shareholder information of Huishang Bank

When Huishang Bank went public in Hong Kong, the issue price was HK$3.53 per share. As of the time of writing, the latest share price is HK$3.26 per share.

Calculated based on the book value, Vanke's investment has not suffered a loss in asset value so far, but the actual situation is not so optimistic.

Two months ago, COFCO Biotech Co., Ltd., one of the shareholders of Huishang Bank, cleared its 40.3095 million shares in the bank. After 90 days of listing for transfer and five rounds of price cuts, the shares were finally sold at approximately a 35% discount.

Since last year, affected by the "withdrawal from the financial sector" order for central and state - owned enterprises, state - owned shareholders of Huishang Bank, including Anhui Dongfeng Electromechanical Technology Co., Ltd., Maanshan Iron & Steel (Group) Holding Co., Ltd., Anqing CSSC Diesel Engine Co., Ltd., and COFCO Group, have successively cleared their shareholdings. As Vanke has now become a "state - owned enterprise", it is not ruled out that Vanke may sell its shares in Huishang Bank in the future.

The good news is that once the transaction is completed, billions of funds will help Vanke resume its business operations.

Vanke

In recent years, Huishang Bank has been entangled in disputes with its shareholder, the "Zhongjing Group".

Public information shows that Zhongjing Xinhua Asset Management Co., Ltd., under the "Zhongjing Group", holds 10.59% of the shares in Huishang Bank, making it the second - largest shareholder.

The largest shareholder, holding 11.22% of the shares, is the Deposit Insurance Fund Management Co., Ltd., a wholly state - owned company established by the People's Bank of China in May 2019 with the approval of the State Council. It does not participate in the actual operation of Huishang Bank.

This means that in Huishang Bank, where the shares are very dispersed, the management actually has the final say.

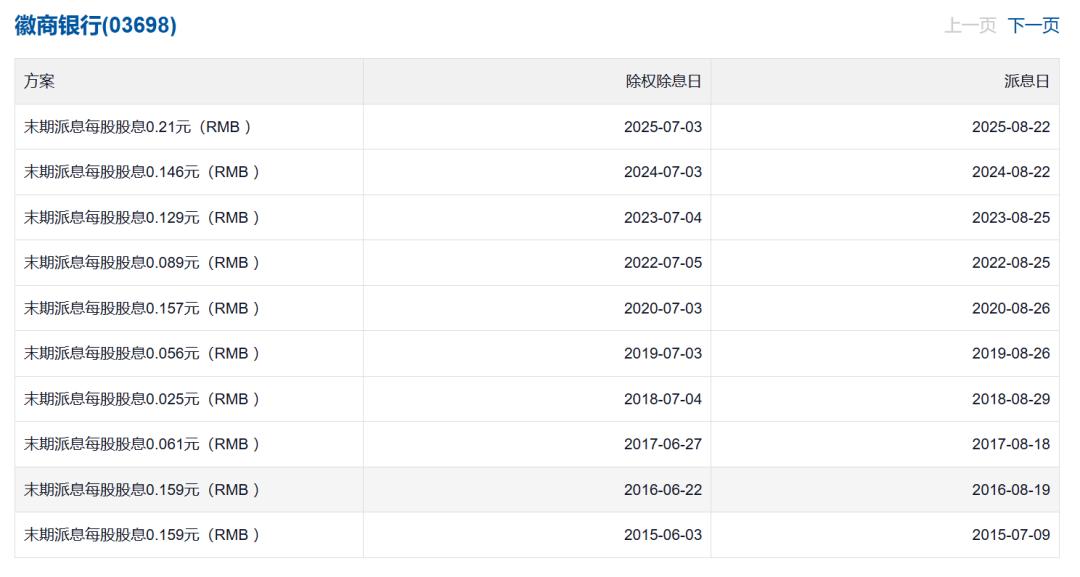

Since 2016, the cash dividend ratio of Huishang Bank has dropped significantly, which has become one of the main points of conflict between Huishang Bank and the "Zhongjing Group".

From 2016 to 2024, the cash dividend ratios of Huishang Bank were 9.82%, 3.34%, 7.79%, 19.44%, 0, 10.78%, 13.37%, 15%, and 20% respectively. Compared with 34.99%, 30.97%, and 28.52% in the first three years after listing, the overall ratio has dropped by more than half.

Source: Xueqiu

At the 2016 annual general meeting, the Zhongjing Group proposed a cash dividend of 30% of the net profit, but the proposal was not passed.

Subsequently, the Zhongjing Group submitted proposals to increase the dividend ratio in 2017 and 2024, both of which were rejected, and the conflict between the two parties deepened.

According to a report in the article "Zhongjing Group's Exclusive Response to the Equity Dispute: Irreconcilable Conflicts with Huishang Bank, 'Forced Counter - attack' Against the Old Ally Shanshan Group" in the Economic Observer on July 2021, Gao Yang, the actual controller of Zhongjing, said, "We have irreconcilable conflicts with the bank's board of directors..."

Regarding the problems encountered by Huishang Bank on its way to listing on the A - share market, Gao Yang said bluntly, "The bank's failure to list is not Zhongjing's problem. The management has a lot of problems of its own. A group of people who don't understand banking business are in the bank's management positions. The result is predictable, and this has led to many difficulties in the daily operation of the bank. Look at other banks, such as Ningbo Bank and Industrial Bank. The management of Huishang Bank is far from satisfactory."

The conflict between the Zhongjing Group and Huishang Bank involves key issues such as the dividend ratio, the issuance of preferred shares, the return to the A - share market for listing, and the adjustment of the management.

Although Huishang Bank's total assets exceeded 2 trillion yuan for the first time at the end of 2024, it has yet to be listed on the A - share market.

Recently, the 2024 annual report data released by Huishang Bank showed that last year, Huishang Bank's revenue was 37.128 billion yuan, a year - on - year increase of 2.10%; the net profit was 15.917 billion yuan, a year - on - year increase of 6.18%.

Although the revenue and total profit have increased, the profitability is declining. In 2024, Huishang Bank's return on assets (ROA) was 0.83%, a decrease of 0.06 percentage points compared with the beginning of the year; the return on equity (ROE) was 11.86%, a decrease of 0.66 percentage points compared with the previous year; the net interest spread was 1.49%, and the net interest margin was 1.71%, a decrease of 16BP and 17BP respectively compared with the beginning of the year.

More surprisingly, according to incomplete statistics by the media, in 2024, the financial regulatory authorities imposed administrative penalties on Huishang Bank totaling more than 20 million yuan, including six fines of over one million yuan, all related to violations in credit business.

Among them, the Hefei Ningguo Road Sub - branch was fined 5.5 million yuan, the highest fine of the year, for defects in the whole - process management of working capital loans. The Ningbo Branch was fined 2.6 million yuan for six credit - related violations, and the head office was fined 3.95 million yuan for issues such as imprudent inter - bank credit management and inaccurate data in the EAST system. These issues have raised questions about Huishang Bank's internal control.

The company's annual report also revealed that as of the end of 2024, Huishang Bank received 3,059 customer complaints, a significant increase of 26.24% compared with the previous year.

In the non - performing loan data announced at the end of 2024, the non - performing amount of personal loans increased by 1.562 billion yuan, and the non - performing loan ratio increased from 1.13% to 1.51%, the largest increase among all business segments.

Non - performing assets of Huishang Bank at the end of 2024, source: Company's 2024 annual report

Industry professionals believe that in terms of the difficulty of disposing of different types of non - performing loans, whether through direct recovery or litigation, the disposal cost of retail assets is relatively higher. Even if non - performing assets are disposed of in batches through bad - debt write - offs, retail assets cannot be written off immediately after becoming non - performing. In practice, a large number of mortgage loans and credit card overdrafts are difficult to dispose of through write - offs. Therefore, due to the increase in the proportion of personal non - performing loans in Huishang Bank's non - performing loans, the cost and difficulty of disposing of non - performing assets in the future may increase, making it difficult for Huishang Bank to significantly reduce the non - performing loan ratio in the short term.

Huishang Bank's current disposal of scattered properties in Beijing may be related to this.