ZhiKe | Are medical funds about to recoup their losses?

Author | Huang Yida

Editor | Zheng Huaizhou

In the A-share market, there are few industry sectors that have experienced a continuous bear market for more than three years, and the pharmaceutical sector is a typical example. From July 2021 to before the start of the September 24th market last year, this sector underwent a continuous three-year downward adjustment. During this period, the Shenwan Pharmaceutical and Biological Index dropped by as much as 54%, and the market value of the sector was nearly halved. Many leading pharmaceutical stocks also simultaneously fell into a double correction of valuation and performance.

During the period when the pharmaceutical sector was continuously sluggish, the once-glorious pharmaceutical-themed funds (hereinafter referred to as: pharmaceutical funds) also lost their former luster. According to Wind statistics, dragged down by the long-term bear market in the pharmaceutical sector, even with the boost of the September 24th market last year and the rebound of the pharmaceutical sector this year, as of May 28th this year, about two-thirds of the more than 600 existing pharmaceutical funds currently have a net asset value below 1, and the lowest is even only 0.35.

However, in the short term, after entering 2025, more than half of the pharmaceutical funds have achieved positive returns this year (as of May 28th). Those with excellent performance, such as Great Wall Pharmaceutical Industry Selection, Yongying Pharmaceutical Innovation Smart Selection, Hua'an Pharmaceutical Biology, and Bank of China Health Care, have returns in the range of 47% - 56% during the same period, and their rankings among similar funds are also at the forefront. It seems that the spring of pharmaceutical funds has returned.

So, what are the core factors driving the recovery of pharmaceutical funds this year? Can pharmaceutical funds still be bought now?

01 The rebound of the pharmaceutical market supports the strengthening of pharmaceutical funds at the beta level

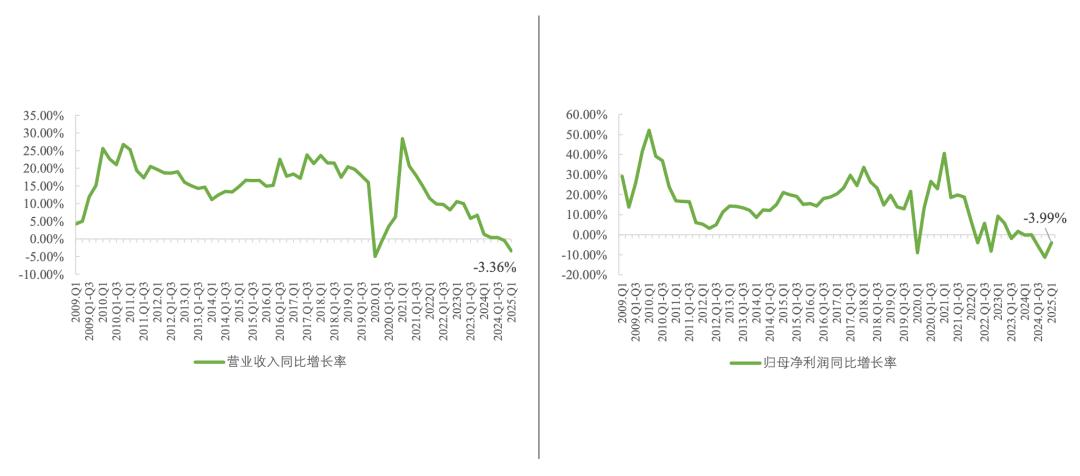

Pharmaceutical funds have shown relatively weak performance in recent years. Without style drift, due to the restriction of the investment scope by themes, the fund performance has been mainly dragged down by the pharmaceutical sector. One of the fundamental factors for the continuous adjustment of the pharmaceutical sector is that the performance growth of the pharmaceutical sector has been continuously slowing down since 2021. According to the calculations of sell-side analysts, after excluding some outliers, the operating income of the pharmaceutical sector decreased by 0.5% year-on-year in 2024, and the net profit attributable to the parent company decreased by 11% year-on-year.

In the first quarter of this year, the overall performance of the pharmaceutical sector showed some marginal improvement, supporting the stabilization and recovery of the index performance. The financial report data shows that in the first quarter of 2025, the revenue of the pharmaceutical sector decreased by 3.4% year-on-year, and the net profit attributable to the parent company decreased by 4% year-on-year. Even though the year-on-year negative growth of the pharmaceutical sector's revenue has deepened, there have been some signs of stabilization on the profit side. Although the release time of the first-quarter report lags behind the market performance, investors have long anticipated the marginal improvement of the pharmaceutical sector's performance.

Chart: Year-on-year revenue and year-on-year net profit attributable to the parent company of the pharmaceutical sector; Source: Industrial Securities, 36Kr

From a fundamental perspective, after two years of 2023 and 2024, the high-base effect of the epidemic-related sub-sectors has basically been smoothed out, and the year-on-year performance of the pharmaceutical sector may release stronger elasticity. In terms of policies, the current pharmaceutical-related policies are generally stable and positive, continuously supporting pharmaceutical and medical device innovation. In particular, it is proposed to further optimize the centralized procurement of generic drugs, which has played a key role in improving market sentiment.

On the demand side, against the background of an aging population, the demand related to medicine is accelerating, and this long-term core logic supporting the performance growth of the pharmaceutical sector will continue. In terms of industry prosperity, domestic innovative drugs have entered the harvest cycle. With the improvement of policy expectations and the favorable cycle positions of some varieties, the prosperity of the pharmaceutical manufacturing industry will also see marginal improvement.

While the fundamental expectations are positive, due to the long-term adjustment of the pharmaceutical sector in the past few years, the valuation has continuously refreshed historical lows. So whenever sell-side analysts recommend the pharmaceutical sector, the core logic includes low valuation and sufficient safety margin. Reflected in the data, the price-to-earnings ratio of the Shenwan Pharmaceutical and Biological Index reached a low of only 29x at the beginning of the year, corresponding to a 10-year percentile of 26%. It can be seen that referring to historical valuations, the pharmaceutical sector at the beginning of the year was indeed very attractive in terms of safety margin. Even the current 10-year percentile is only 42% (as of May 28th), which is far from being overvalued.

By simply reviewing the performance of the pharmaceutical market this year, the Shenwan Pharmaceutical and Biological Index has risen by 3.76% from the beginning of the year to date (as of May 28th). In terms of the trend, it can be divided into two stages with April 7th as the boundary. The trends in the two stages are similar, both showing an oscillating upward trend. The maximum increases of the Shenwan Pharmaceutical and Biological Index in the two stages are 13% and 10% respectively.

Chart: Trend of the Shenwan Pharmaceutical and Biological Index; Source: Wind, 36Kr

Therefore, the outstanding performance of the pharmaceutical sector in specific bands lies in the fact that investors first have the expectation of the sector's stabilization, which drives the index to rise. Then, as the first-quarter reports are gradually disclosed, the above expectations are fulfilled to a certain extent. The sharp decline on April 7th was mainly affected by the tariff incident. The continuous rise of the pharmaceutical sector in the second stage is precisely because after the good expectations are fulfilled and there is still a safety margin, which jointly drives investors' continuous buying behavior.

02 Innovative drugs are the alpha of the pharmaceutical sector at present

Although the performance of the pharmaceutical market this year is relatively good, the overall increase of the pharmaceutical market since the beginning of this year is less than 4% (as of May 28th). Looking at the performance of funds, ETF funds such as Cathay Pacific CSI Biomedical ETF and E Fund CSI 300 Pharmaceutical ETF, which track the pharmaceutical market, have similar returns to the pharmaceutical market during the same period.

The maximum increase of the pharmaceutical market in specific bands this year is only 13%. So for those excellent pharmaceutical funds that have achieved more than 40% returns since the beginning of this year, the slight rebound of the pharmaceutical market in 2025 is only a beta-level factor for the strengthening of pharmaceutical funds. And obtaining alpha through active stock selection is the main reason for driving excellent pharmaceutical funds to achieve high returns this year, and their stock selection logic is worth learning from by investors.

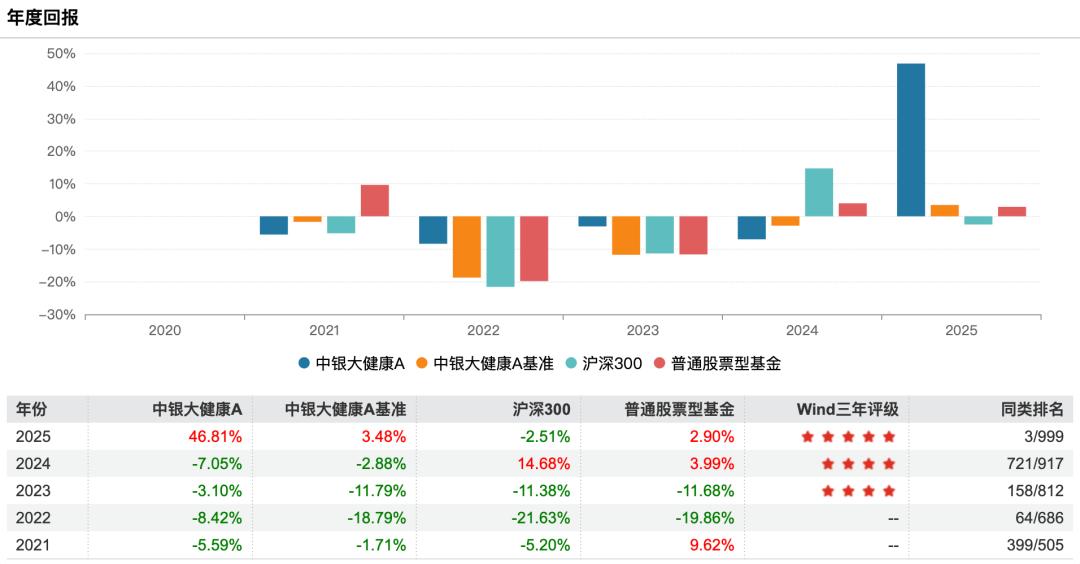

Taking Bank of China Health Care A as an example, the fund was established in May 2020, just in time for the epic market of the pharmaceutical sector driven by the epidemic. About 1.863 billion yuan was raised when it was established. However, due to the continuous adjustment of the pharmaceutical sector, the fund size shrank to 274 million yuan at the end of 2024, and the fund shares decreased from 186.3 million at the time of establishment to only 27.8 million at the end of 2024.

After entering 2025, the fund shares decreased to 26.9 million in Q1 of 2025, while the fund size increased to 334 million yuan. It can be seen that against the background of investors reducing their holdings, the fund has achieved a return of up to 47% since the beginning of this year (as of May 28th), and the increase in the fund size is mainly achieved through the expansion of the asset side.

In terms of heavy holdings, the top ten heavy holdings of the fund in Q1 of 2025 are Hengrui Medicine, Xinnuowei, Baili Tianheng, BeiGene, InnoCare Pharma, Rongchang Biopharmaceuticals, Haixike, Xinlitai, Kelun Pharmaceutical, and Constellation Pharma. All of these 10 stocks are popular innovative pharmaceutical companies in recent years, and all of these ten stocks rose in Q1 this year, with the increase range during the same period being 6 - 52%.

Chart: Top ten heavy holdings of Bank of China Health Care A in Q1 of 2025; Source: Wind, 36Kr

From a long-term perspective, among the top ten heavy holdings in Q1 of 2025, many stocks have been continuously held in heavy positions. For example, Rongchang Biopharmaceuticals has been held in heavy positions for 9 consecutive quarters, and Hengrui Medicine, BeiGene, and Kelun Pharmaceutical have been held in heavy positions for 8 consecutive quarters. These targets are all core enterprises in the field of domestic innovative drugs. Combined with the fact that other heavy holdings are also innovative pharmaceutical companies, it can be seen that the long-term investment strategy of this fund is to firmly be optimistic about domestic innovative drugs.

Due to the overall weakness of the pharmaceutical sector, domestic innovative drugs have also undergone long-term adjustment following the market in the past few years. The maximum drawdown of the Wind Innovative Drug Index from 2021 to date (as of May 28th) has exceeded 50%. It is precisely because of the persistence in domestic innovative drugs that the annual returns of Bank of China Health Care A have been negative in the past four years.

Chart: Annual returns of Bank of China Health Care A; Source: Wind, 36Kr

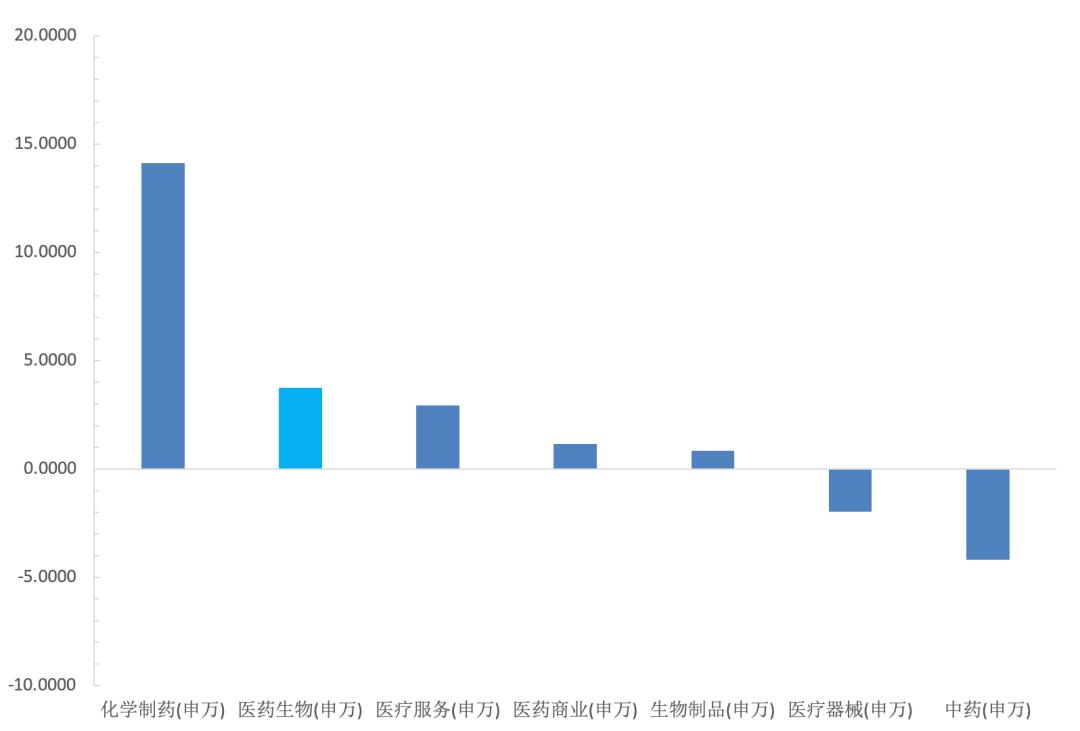

After entering 2025, the pharmaceutical market has shown a slight rebound, and there are obvious differences among sub-sectors. From the beginning of the year to May 28th, the performance of the second-level industries of the pharmaceutical sector in the Shenwan classification, from best to worst, is as follows: chemical pharmaceuticals, medical services, pharmaceutical commerce, biological products, medical devices, and traditional Chinese medicine.

The reason why chemical pharmaceuticals have performed the best is mainly due to the fact that some innovative drugs have started to gain momentum in the domestic market, and the dual drivers of innovative drugs going global have promoted growth. In terms of generic drugs, the impact of centralized procurement is gradually being cleared, and the policy expectations are positive. In terms of raw materials for drugs, the cycle is in a favorable position. The overall operation of the sector is stable. Especially, the performance in the first-quarter report has strengthened the above expectations, ultimately driving chemical pharmaceuticals to lead the rise in the pharmaceutical sector.

Chart: Percentage changes in the pharmaceutical market and second-level industry indices since the beginning of this year (as of May 28th); Source: Wind, 36Kr

Since domestic innovative pharmaceutical companies are mainly concentrated in the chemical pharmaceutical sub-sector, the chemical pharmaceutical sector not only leads the rise among second-level industries this year, but some individual stocks have also achieved amazing returns. For example, the increases of Baili Tianheng and BeiGene, which are heavily held by Bank of China Health Care A, have been 76% and 60% respectively this year (as of May 28th), and the increases of Rongchang Biopharmaceuticals and Xinnuowei, also its heavy holdings, have both exceeded 20% during the same period.

Therefore, the differentiation among sub-sectors of the pharmaceutical industry this year is also reflected in the performance of some pharmaceutical funds, that is, most funds that heavily hold innovative drugs have achieved good returns. In addition to Bank of China Health Care A, which was analyzed in detail above, pharmaceutical funds such as Great Wall Pharmaceutical Industry Selection, Bank of China Hong Kong Stock Connect Pharmaceutical A, Yongying Pharmaceutical Innovation Smart Selection, and Hua'an Pharmaceutical Biology, which rank among the top this year, mostly hold innovative drugs among their heavy holdings.

It can be seen that the pharmaceutical funds that have performed outstandingly from the beginning of the year to date (as of May 28th) are more focused on innovative drugs. Although holding strong stocks in other sectors can also help funds obtain high returns, the performance of other sub-sectors during the same period is generally weaker than that of the pharmaceutical market. The investment opportunities in innovative drugs this year are obviously more definite.

03 Can pharmaceutical funds still be bought?

To answer this question, we actually need to answer two main questions. One is whether the market of innovative drugs can continue. The other is whether there are still relatively definite investment opportunities in other sectors.

Regarding the first question, first of all, the country's support for innovative drugs is gradually increasing. Especially since 2024, there have been continuous favorable policies. As a new quality productive force, innovative drugs are expected to develop rapidly under the favorable policies. Secondly, domestic innovative drugs themselves have entered the harvest cycle, and future performance is an important observation window.

In terms of valuation, the current 5-year PE percentile of the Wind Innovative Drug Index is 31% (as of May 28th), and there is still some room for improvement. So future performance is the key to digesting the valuation. Only when good expectations are continuously fulfilled can the upward space for valuation be opened. From an external environment perspective, both overseas and domestic are in an interest rate cut cycle, which not only directly benefits innovative drugs but also has a certain positive impact on risk appetite.

In other sectors, the pharmaceutical manufacturing industry includes some raw materials for drugs belonging to chemical pharmaceuticals and some CXOs belonging to medical services. Generally speaking, the current cycle position of the pharmaceutical manufacturing industry is relatively favorable, and the demand is also guaranteed. Without considering other disturbances, the performance is expected to recover.

Among medical services, private chain medical institutions, such as ophthalmology and dentistry, have strong brand effects. With the continuous weak economic recovery and the continuous clearance of supply, the performance of these targets is also expected to benefit. For pharmaceutical commerce, the focus is mainly on the four major pharmacies. The mergers and acquisitions of leading companies are still the main highlight. Currently, the main long-term logics are the improvement of the chain rate and the outflow of prescriptions, so the expected future elasticity is limited.

Biological products mainly include blood products and vaccines. Both are subject to many policy restrictions. Relatively speaking, vaccines have more elasticity. In terms of medical devices, they are mainly affected by policies such as centralized procurement, DRGs, and compliance. We still need to wait for the performance inflection point. The short-term performance pressure of traditional Chinese medicine is mainly due to base factors and policy factors. From the policy context, there are still certain investment opportunities in the future.