How did CARYU become the top player in the collectible merchandise economy?

At the beginning of 2025, the spotlight in the Hong Kong stock market was on two consumer stocks.

One is Laopu Gold, which went public in 2024. Its stock price rose by 496% and 230% in 2024 and 2025 respectively, and its market value exceeded HK$130 billion. The other is Pop Mart. Its stock price increased by 347% and 78% in 2024 and 2025 respectively, and its market value exceeded HK$210 billion.

The former broke through the circle with the collectible and luxury attributes of its products, with a revenue growth of 167% in 2024. The latter benefited from the explosion of the trendy toy and goods economy, with a revenue growth of 107% in 2024. Both have shown independent market trends in the current consumption cycle.

Although the product forms of the two companies are very different, their common hidden attributes are: collectible value + cultural symbol. This means that the significant explosions in the performance and stock prices of companies like Pop Mart and Laopu Gold are not individual phenomena but a major trend at the track level.

For example, at the beginning of 2025, Bruk, a building toy brand, successfully landed on the capital market. So far, its stock price has risen by more than 100%, and its market value has exceeded HK$30 billion. The latest financial report shows that Bruk's revenue growth rate in 2024 exceeded 150%.

Recently, KAYOU, the leading company in the trading card industry, submitted its prospectus for listing on the Hong Kong stock market again. In 2024, KAYOU's revenue exceeded 10 billion yuan, with a year - on - year growth rate of 277.78%. Its revenue scale is already close to that of Pop Mart.

Compared with Pop Mart, which has stronger trendy toy attributes, and Bruk, which has stronger building toy attributes, KAYOU is one of the more orthodox players in the goods economy track. The trading cards, badges and other goods that are popular among young people are precisely KAYOU's core products.

A purer "goods economy" concept company

"Goods" is a homophone for "Goods" (peripheral products). It was originally a nickname for peripheral products of anime, game IPs and other things in the second - dimension circle. The "goods economy" has fermented from the craze of young people "buying goods".

Different from hard peripherals such as figurines and models, "goods" belong to soft peripherals with low prices and high consumption frequencies. The price of domestic "goods" is usually between 10 - 30 yuan, and that of imported "goods" is generally between 30 - 60 yuan. Specific products include badges, trading cards, colored paper, standing signs, laser tickets, etc. According to the statistics of Guoyuan Securities, looking at the breakdown of goods products, currently badges account for about 40%, trading cards account for 30% - 40%, and other categories account for about 20%.

KAYOU is the largest trading card brand in China. According to the statistics of CIC, in 2024, KAYOU's retail sales of trading cards reached 8.2 billion yuan, with a market share as high as 71.1%. At the same time, the company's product line has also extended to other goods products such as badges, standing signs, and dolls. If goods products such as trading cards, badges, and standing signs are combined into the general entertainment toy category, KAYOU's GMV in 2024 was 21.9 billion yuan, still accounting for 13.3% of the domestic general entertainment toy industry's market share and ranking first.

In addition, KAYOU has successfully "crossed over" to the stationery industry in recent years, launching a series of general entertainment stationery products such as pens and notebooks with well - known IPs, and quickly standing out in the industry. According to CIC statistics, in 2024, the retail sales of its stationery business in the domestic general entertainment stationery market had reached 513 million yuan, with a market share of 24.3%, ranking first.

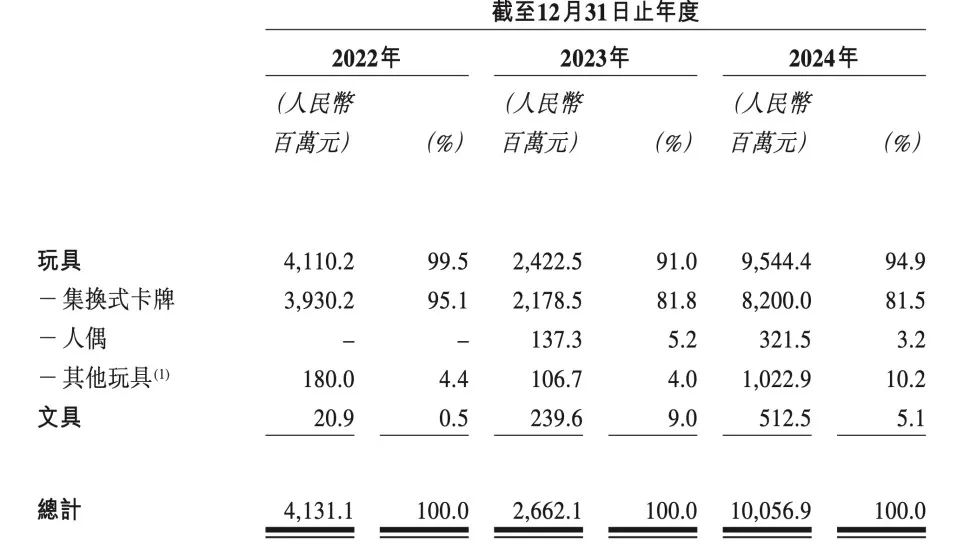

Focusing on KAYOU's own performance, the company currently has two main sources of income: toy products and stationery products. Among them, toys include three major types of products: trading cards, dolls, and other toys (badges, standing signs, trading card collection albums, and stickers).

The prospectus shows that in 2024, KAYOU's total revenue was 10.057 billion yuan. Ranking the product revenues from high to low, the revenue from trading cards was 8.2 billion yuan (accounting for 81.5%), other toys 1.023 billion yuan (accounting for 10.2%), stationery 513 million yuan (accounting for 5.1%), and dolls 322 million yuan (accounting for 3.2%).

In terms of trends, KAYOU's revenue structure shows a diversified trend, and the label of a comprehensive goods brand is becoming increasingly prominent, while the pure trading card attribute is gradually weakening. For example, the revenue share of trading cards decreased from 95.1% in 2022 to 81.5% in 2024, while the revenue share of other toys increased from 4.4% to 10.2%.

Figure: KAYOU's revenue composition; Source: Prospectus, compiled by 36Kr

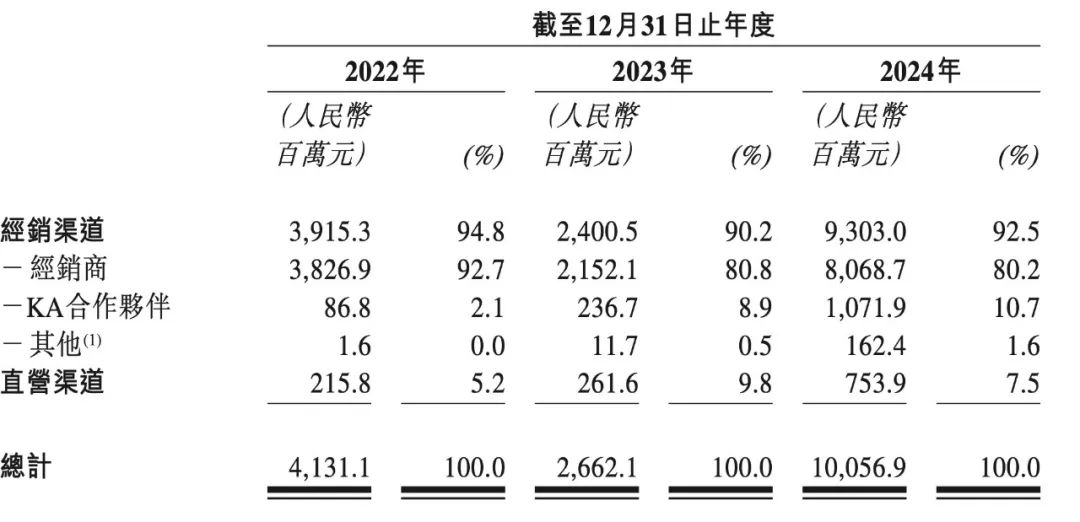

In terms of sales channels, KAYOU mainly expands rapidly through the distribution channel and has tried to build a direct - sales channel in recent years. The distribution channel mainly includes distributors (stationery stores and toy stores near schools), KA partners such as large retailers, and small retail stores such as KAYOU Centers operated by franchisees. The direct - sales channel includes offline direct - sales flagship stores, offline vending machines, and online self - operated stores.

As of 2024, the company had 217 distributors, 39 KA partners, and 351 KAYOU Centers in the distribution channel; the direct - sales channel had 32 offline direct - sales flagship stores, 13 online self - operated stores, and 699 vending machines. In terms of revenue, KAYOU's distribution channel revenue was 9.303 billion yuan, accounting for 92.5%, and the direct - sales channel revenue was 754 million yuan, accounting for 7.5%. From the relative change trend of the revenue of the direct - sales and distribution channels, the direct - sales channel shows a steady upward trend, with its share increasing from 5.2% in 2022 to 7.5% in 2024.

The distribution channels such as toy stores and stationery stores near schools played an important role in KAYOU's early expansion. The company's products can accurately reach the Z - generation, the core consumer group, through the distribution channel and quickly spread in the form of "social currency", achieving the effect of consumer aggregation. After the early extensive expansion, KAYOU has now increased the refined management of distributors, and the number of distributors has decreased from 290 in 2022 to 217 in 2024.

Figure: KAYOU's sales channel composition; Source: Prospectus, compiled by 36Kr

Rich IP system and strong risk - resistance ability

For all kinds of goods products, IP is the soul and a prerequisite for the success of the product. KAYOU recognized the importance of IP early on. In 2018, it launched its first trading card series based on the authorized IP of Ultraman, officially starting its substantial business operations. Based on this, it gradually built an IP matrix mainly composed of authorized IPs and supplemented by self - owned IPs.

As of 2024, KAYOU has 69 authorized IPs, including Ultraman, My Little Pony, Ye Luoli, Douluo Continent Animation, Egg Party, Naruto, Jujutsu Kaisen, Detective Conan, and Harry Potter, as well as self - owned IPs such as KAYOU Three Kingdoms.

In recent years, in the anime market, an important source of IP, there has been an obvious trend of the rise of domestic anime and the decline of Japanese anime. There are an endless stream of popular domestic anime IPs. Against this background, KAYOU has quickly increased its investment in domestic anime IPs and has successively obtained a number of popular domestic anime IPs such as Nezha: Birth of the Demon Child, The Bad Guys, and A Record of Mortal's Cultivation to Immortality.

In addition, the "Z - generation" has shown an obvious upward trend in the recognition of Chinese style and Chinese fashion culture. Based on this, in 2023, KAYOU cooperated with the well - known Chinese painter Dai Dunbang to launch trading cards based on China's Four Great Classical Novels. At the same time, in April 2023, KAYOU launched its first original IP product, KAYOU Three Kingdoms, injecting youthful and innovative expressions into the content of traditional Chinese culture. It was selected as one of the top ten digital culture IPs in the Report on the International Communication Index of Chinese Cultural Symbols.

According to the prospectus, as of 2024, KAYOU has launched 49 trading card series, three doll series, and four stationery series themed on KAYOU Three Kingdoms. The cumulative total transaction amount has reached 234 million yuan. For KAYOU, which is trying to build its own IP for the first time, this is undoubtedly a surprising achievement.

Therefore, having a high sensitivity to the changes in the IP market trend, daring to take the lead in layout, and updating IP in a timely manner are important supports for KAYOU to gain an edge in the industry.

On this basis, maintaining the popularity of IP and extending the life cycle of IP through various operation means to maximize the commercial value of IP is the core for KAYOU's products to have collectible and social attributes.

First, each IP series is equipped with a unique, diverse, and multi - echelon product system. For example, just for the Ultraman IP, as of 2024, KAYOU has launched a total of 320 trading card series and 42 stationery series based on more than 50 Ultraman hero characters. Second, interactive gameplay such as competitive battles is added to the products, and a level system and puzzle elements are embedded, which enhances the fun and social attributes of the products. For example, the hero battle events operated by KAYOU not only greatly increase the social attributes of trading card products but also promote the maintenance of the popularity of trading cards.

It can be said that the construction of a large - scale, diverse - style, and rich - level IP system forms the foundation for KAYOU's performance growth. However, market concerns have also followed. The focus of the debate is: Will KAYOU's authorized IPs face the risk of non - renewal?

Breaking it down, the risks of authorized IPs mainly include the inability to renew the contract and the increase in renewal costs. The risk of not being able to renew the contract when it expires is not significant for KAYOU. IP authorization is a commercial behavior. IP licensors mainly use the one - time prepayment + sales or production ratio sharing model for charging. The growth of KAYOU's sales will also increase the profits of IP licensors. In essence, they have a co - existing relationship. In addition, according to KAYOU's prospectus, IPs that will expire after 2028 account for as high as 76% of the company's current revenue. Therefore, whether the current IPs expire is not the main factor affecting KAYOU's fundamentals.

Regarding the issue of the increase in renewal costs, KAYOU also has sufficient time and space to deal with it. First of all, the renewal cost depends on the degree of KAYOU's and the licensor's dependence on the income of a single IP. In 2022, the income from KAYOU's top five core IPs accounted for as high as 98%. However, as KAYOU's IP system continues to be enriched, the income share of its top five IPs has dropped to 86% in 2024 and is in a continuous downward trend. From a cost perspective, in 2022, 2023, and 2024, the proportion of KAYOU's authorized IP costs to revenue was only 5.1%, 5.8%, and 7.6% respectively. The authorized IP costs have little impact on KAYOU's gross profit margin, and the company also has sufficient profit margins to deal with the changes in IP costs.

Overall, supported by KAYOU's strong insight into IP, the company has built a multi - level and diversified IP matrix and has rich operation means to maintain the popularity of IP. The risk of non - renewal of authorized IPs that the market is worried about is not significant, and KAYOU also has sufficient time and space to deal with the issue of the increase in renewal costs.

The industry has a long - term and prosperous future with strong growth potential

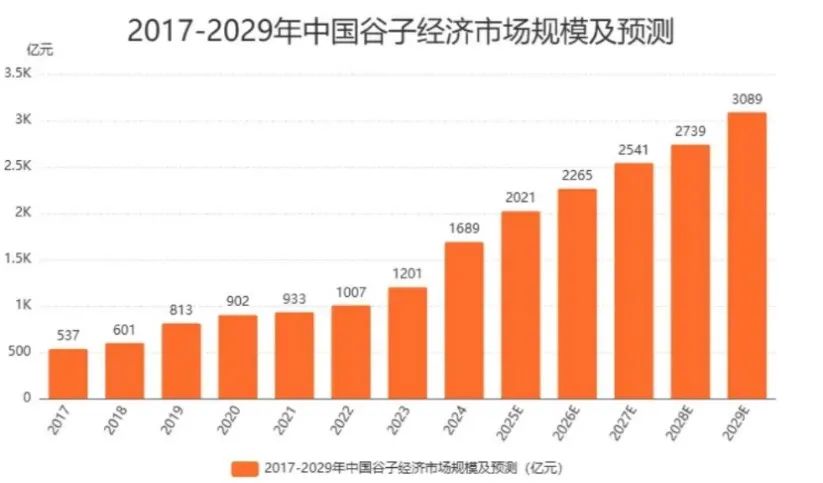

Although the capital market only began to pay attention to the goods economy in 2024, the entire industry has maintained high - speed growth for many years.

Specifically, the goods economy includes the entire chain from IP creation and incubation to product sales and content distribution. According to the calculation of iiMedia Research, the market scale of China's goods economy exceeded 50 billion yuan in 2017, and reached 168.9 billion yuan in 2024. The compound growth rate from 2017 - 2024 was nearly 18%, and 2019 and 2024 were the two years with the fastest growth rates, reaching 33% and 41% respectively. iiMedia Research predicts that by 2029, China's goods economy is expected to reach a scale of 300 billion yuan. The compound growth rate from 2024 - 2029 is about 13%.

Figure: Forecast of the market scale of the goods economy; Source: iiMedia Research, compiled by 36Kr

In the long run, the goods economy represented by trading cards also shows obvious characteristics of being resistant to the economic cycle.

Taking Japan as an example, according to the statistics of CICC, after the Japanese bubble burst in the 1990s, the growth rate of the total retail sales of social consumer goods declined, and the compound growth rate from 2002 - 2022 was only 0.8%. However, from 2002 - 2014, "commodification", the largest part of the Japanese anime industry, drove the overall growth of the Japanese anime industry with a compound growth rate of 3.5%, far outperforming the growth rate of retail sales. From the perspective of growth characteristics, the market scale growth rate of the "commodified" anime industry is highly volatile due to the influence of IP iteration and has a low correlation with the growth rate of retail sales. In the case