ZhiKe | After going public, the luster fades and Bruk's performance takes a turn for the worse.

Author | Fan Liang

Editor | Ding Mao, Huang Yida

At 10 p.m. on August 22nd, Brook's financial report was finally released.

According to the data for the first half of 2025 released by Brook, the company achieved an operating income of 1.338 billion yuan, a year-on-year increase of 27.9%, and an adjusted net profit of 320 million yuan, a year-on-year increase of 9.6%. In comparison, Brook's revenue growth rate and adjusted net profit growth rate in 2024 were 156% and 702% respectively. Pop Mart's revenue growth rate and adjusted net profit growth rate in the first half of 2025 were 204% and 363% respectively.

Undoubtedly, whether compared with its own performance in 2024 or with Pop Mart in a similar track, Brook's performance report did not meet the market's expectations.

On the first trading day after the performance release, Brook's stock price fell by more than 10%. And the capital market seems to have the ability to foresee the future. After its listing on the Hong Kong Stock Exchange in early January this year, driven by Pop Mart, Brook's stock price rose by more than 220% at its highest this year, and its market value once approached the HK$50 billion mark. However, it then declined all the way to around HK$30 billion in market value and fell to about HK$25 billion on August 25th.

So, why did Brook's performance stall after its listing? Is the company still overvalued?

Low - price products increase sales volume but not revenue

In the first half of 2025, the sales volume of its core product, building - block character toys, increased by 96.8% year - on - year, rising from 56 million pieces to 111 million pieces, but the revenue growth rate in the same period was only 27.9%.

The core reason for this huge difference is the low - price strategy. The company launched a large - scale promotion of the "Starry Edition" series with a retail price of 9.9 yuan in the first half of 2025. The sales volume of this series reached 49 million pieces, contributing most of the sales volume growth. If this impact is excluded, the sales volume growth rate of Brook's original price - range products was only about 11%.

Brook's strategy of expanding the customer base by lowering the price range with low - price products has a long history. As early as 2023, the company launched the "Starlight Edition" products at 19.9 yuan; at the end of 2024, it entered the market with the 9.9 - yuan Transformers "Starry Edition" and quickly expanded this product line to multiple IPs such as Ultraman and Kamen Rider. Brook's Taobao flagship store shows that it currently sells a boxed product called the Heroic Mobilization Starry Edition (containing 12 pieces), randomly providing small building - block products of 3 IPs including Ultraman, Kamen Rider, and Super Sentai.

However, the risk of the low - price strategy is that it may erode the market share of the original high - price products. But Brook still actively promotes this strategy, and the reason behind it may point to the pressure on its terminal sales.

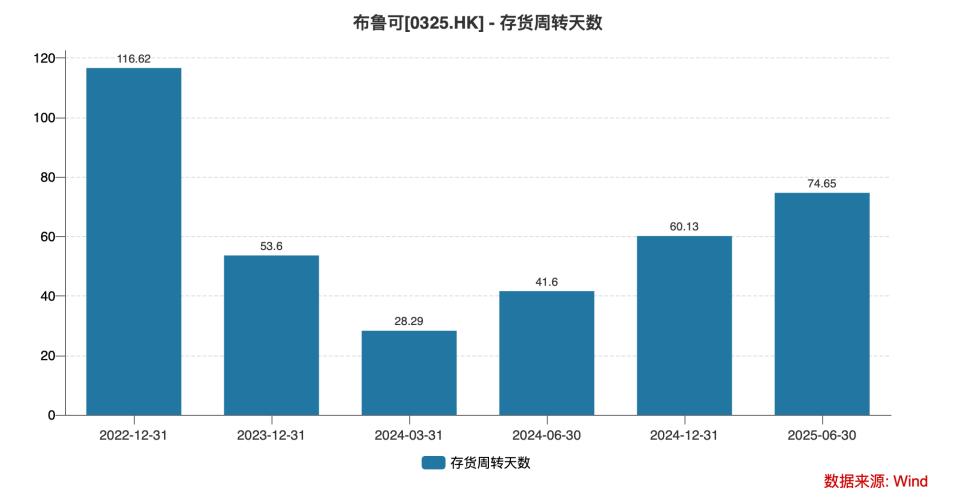

A key indicator confirms this pressure: the company's inventory turnover days have continuously increased from a minimum of 28 days in 2024 to 75 days in the first half of 2025. Considering that Brook mainly adopts the distribution model and does not have a large - scale inventory demand, the increase of this indicator is particularly worthy of vigilance. In contrast, Pop Mart, which mainly uses the direct - sales model, has reduced its inventory turnover days from 130 days to 87 days in the same period. Therefore, the abnormal increase in Brook's inventory level may very likely reflect that the turnover speed of its products at the distributor level is lower than the production expectation.

This may be due to two reasons. One is that the company may have pressured distributors to take inventory during the IPO stage, resulting in high distributor inventories; the other is that the retail - end sales are cold, and distributors' willingness to purchase goods has weakened. If the actual situation belongs to the former, then after the distributors digest their inventories, Brook's inventory pressure will also be greatly reduced, and the company's performance will continue to return to the growth track.

Chart: Brook's inventory turnover days. Source: Wind, 36Kr compilation

From the perspective of gross margin, expanding the low - price - range products has also affected Brook's gross margin level. In 2024, under the scale effect brought about by the company's self - built production capacity and a significant increase in sales scale, Brook's gross margin reached 52.6%. In 2025, although the sales volume of Brook's products continued to increase significantly, the company's gross margin decreased by more than 4 percentage points compared with 2024, which means that the gross margin of its 9.9 - yuan low - price products may also be lower than that of other price - range products.

In addition, after a successful IPO, Brook signed 13 new IPs and launched 273 SKUs in the first half of 2025. As of the end of 2024, Brook had a total of 682 SKUs. Therefore, the depreciation pressure related to molds caused by the significant expansion of Brook's SKUs has also affected the company's profit level.

Looking at the transmission path, among the cost/expense items, Brook's total depreciation was 53 million yuan, a year - on - year increase of 140%, of which the depreciation related to molds increased by 200% year - on - year. The total intangible asset amortization (mainly for IP) was 33 million yuan, a year - on - year increase of 120%. The growth rates of both were far higher than the revenue growth rate, and the combined proportion of total revenue reached 6.43%, while it was 3.54% in the same period in 2024. Therefore, the low gross margin of low - price products, combined with the significant increase in the company's SKUs and the low revenue growth rate, resulting in the inability to effectively amortize depreciation and amortization expenses, is the main reason for the decline in the company's gross margin.

Generally speaking, the main reason why Brook's performance did not meet expectations is that the growth of its original price - range products was slow, and the newly added low - price - range products failed to effectively drive revenue growth.

Chart: Brook's cost and expense composition. Source: Company announcement, 36Kr compilation

The overseas business has great potential

Although Brook's overall revenue and profit growth rates did not meet the market's expectations, there is still a non - negligible bright spot in the company's financial report: the overseas business is growing at a high speed.

The financial report data shows that Brook's cumulative overseas operating income in the first half of 2025 was 110 million yuan, a nine - fold increase compared with the same period last year, accounting for 8% of the total revenue. In comparison, Pop Mart achieved over 100 million yuan in overseas revenue in 2021, and its overseas business accounted for about 2% of the total revenue that year. It can be seen that Brook's overseas business progress is quite rapid.

Looking at different overseas regions, the North American market had the highest growth rate. In the first half of 2025, Brook's revenue in North America was 43 million yuan, a year - on - year increase of more than 20 times. Similarly, Pop Mart also had the highest growth rate in the North American market. Brook disclosed in its financial report that the United States and Indonesia are the two countries with the highest revenue in the overseas market.

Chart: Brook's overseas sales situation. Source: Company announcement, 36Kr compilation

According to Zhongyou Securities, Brook's price range in the European and American markets is mainly between 80 - 300 RMB. The representative product is Transformers, mainly targeting adult collectors. The sales channels are mainly Amazon and Toys "R" Us; in Southeast Asia, the product positioning is similar to that in the domestic market, covering the price range of 19.9 - 50 yuan. The representative product is Pokémon, and the channels are mainly convenience stores such as 7 - Eleven.

From this perspective, Brook mainly sells products in the higher - price range overseas. Inferring from this, as mentioned above, the sales volume growth rate of Brook's original price - range products was about 11%. It is speculated that this growth rate is mainly contributed by the overseas business. After excluding the 9.9 - yuan products, the sales volume growth rate of Brook's domestic business may be lower than 11%.

Chart: Brook's overseas product layout. Source: Zhongyou Securities, 36Kr compilation

How to view the current valuation?

From the perspective of valuation, if the adjusted net profit of about 320 million yuan in the first half of the year is simply annualized, the annual profit will be about 640 million yuan, and the corresponding forward price - to - earnings ratio (PE) is still in the range of 35 - 40 times, similar to Pop Mart's valuation level. This means that the market still has expectations for Brook's future performance growth.

At such a valuation level, both companies must prove their value with future performance:

Pop Mart needs to prove that after the great success of the Labubu hit IP, its growth momentum is sustainable rather than short - lived. Brook needs to prove that the slowdown in revenue growth after the IPO is only a short - term adjustment, and the company's long - term growth logic (i.e., the product expansion strategy targeting all demographics, all price ranges, and global markets) has not been disrupted.

From a timing perspective, the "test periods" for the two companies in the market are also different. For Pop Mart, with its strong performance in the first half of the year, it is almost certain to achieve the high - growth target for the whole year of 2025. The real key lies in whether it can maintain growth in 2026. However, Brook is under immediate pressure. If the company cannot show a more convincing performance growth rate in the second half of 2025 to address the market's concerns about its slowdown in growth, its valuation will face continuous downward pressure, and the current adjustment may not be over yet.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice for anyone. Before making an investment decision, if necessary, investors must consult professionals and make careful decisions. We have no intention of providing underwriting services or any services that require specific qualifications or licenses for the trading parties.