Is vivo "weathering the storm" and ready to take on Apple head - on?

The MR headset that vivo has been hyping up for years has finally arrived!

On August 21st, vivo's first MR headset, the vivo Vision Explorer Edition, was officially launched, marking vivo's entry into the mixed - reality headset market.

Taking a closer look at the specifications of the vivo Vision Explorer Edition, it's easy to think of the Apple Vision Pro, which is also launched by a mobile phone manufacturer, Apple.

This inevitably raises questions. How competitive is the vivo Vision Explorer Edition? Can it compete with the Apple Vision Pro? More importantly, why does vivo want to enter the headset field?

In fact, after the mobile phone industry entered the stock market, high - end development has become a major trend. The "multi - model strategy" and the advantage in mid - range phones that vivo relied on have gradually weakened, and its market share has declined.

More importantly, from TVs to mobile phones and then to MR headsets, MR is regarded as the next - generation revolutionary product with the potential to replace mobile phones.

vivo has to make forward - looking arrangements. The launched vivo Vision Explorer Edition can also be seen as an important fulcrum of vivo's spatial computing strategy and will become the "front - end entrance" for future robots to perceive the environment.

How "sincere" is the first MR headset, the vivo Vision Explorer Edition?

vivo has high hopes for this MR headset. However, this new product is not making its first appearance in the public eye. In March this year, vivo showcased its design at the Boao Forum for Asia.

Even earlier, at the end of 2024, Hu Baishan, the executive vice - president, chief operating officer, and the dean of vivo's Central Research Institute, revealed that vivo's mixed - reality team had expanded to a scale of 500 people and planned to launch a high - fidelity prototype experience in September 2025.

Not long ago, Hong Yi, the general manager of vivo's smart terminal products, also promoted the vivo Vision Explorer Edition on Weibo, recommending a new way to relax to netizens: lying on an office chair to watch blockbusters. Wearing the vivo Vision is like bringing an entire IMAX theater with you.

So, what's the quality of this new MR product that bears vivo's strategic ambitions?

Let's start with the appearance. The vivo Vision Explorer Edition features a three - dimensional geometric flowing mirror and a floating micro - slit design. To reduce weight, it uses an integrated design of the middle frame and the fan. The whole device weighs about 398 grams, making it the lightest in the world. It also supports magnetic optical lenses ranging from 100 to 1000 degrees.

In terms of configuration, the vivo Vision Explorer Edition uses a Micro - OLED screen with a binocular 8K ultra - high - definition resolution and a 94% DCI - P3 wide color gamut. In addition, with its self - developed spatial computing algorithm and equipped with the Qualcomm Snapdragon® XR2+ Gen 2 platform, it has ultra - low - latency full - color see - through, greatly optimizing the visual and interactive experience and providing stronger overall performance.

In terms of interaction, the vivo Vision Explorer Edition supports 1.6° high - precision eye - tracking and 26 - degree - of - freedom micro - gesture recognition, replacing the controller for interactive control and enabling natural eye - hand multimodal interaction.

Meanwhile, it supports spatial videos and photos taken by some mobile phones, providing a more three - dimensional viewing effect.

Currently, the vivo Vision Explorer Edition is not available for public sale. Starting from August 22nd, offline experiences will be available in cities such as Beijing, Shanghai, Shenzhen, Guangzhou, Hangzhou, and Nanjing.

Compared with the 600 - 650 - gram Apple Vision Pro, the vivo Vision Explorer Edition has an obvious advantage in weight, with the overall weight reduced by about 40%.

Compared with the "sincerity" of the vivo Vision Explorer Edition, what the outside world is more concerned about is why vivo, a leading mobile phone manufacturer, has chosen to enter the headset market?

Aiming at the robot scenario, is MR the fulcrum?

Most of a company's motives can be attributed to making profits. Simply put, making money is the lifeblood of any market - oriented enterprise.

vivo is no exception. In fact, its attempt to enter the headset market is closely related to the pressure it faces.

Smartphones are vivo's core business, and vivo mainly targets the mid - range phone market. For a long time in the past, brands such as Coolpad, Meizu, Gionee, Redmi, Honor, and Lenovo have all focused on mid - range phones.

Among these players, vivo is a "dark horse". Before 2014, vivo was just a minor player in the smartphone market. 2015 was a turning point. In that year, vivo's sales exceeded 35 million units, and it leaped to become the fourth - largest domestic mobile phone brand.

In 2021, vivo reached its peak. In the first quarter of that year, with sales of 21.6 million units, vivo took the top spot in the Chinese market for the first time and officially entered the first echelon of the Chinese mobile phone market.

Looking back at vivo's rise, the "multi - model strategy" was the key driving force. In 2021, vivo and its sub - brand IQOO jointly launched 49 mobile phones, an astonishingly high frequency of new product releases. In contrast, OPPO (including Realme and OnePlus) launched 42 models, Honor launched 23 models, Xiaomi (including Redmi) launched 21 models, and Huawei launched 11 models during the same period.

Obviously, vivo follows the "high - volume" approach. In 2022, vivo and IQOO continued with the "multi - model strategy" and jointly launched more than 40 models. Also in 2022, vivo maintained its position as the number one in domestic shipments.

In addition to the "multi - model strategy", vivo also focused on four major areas: design, imaging, system, and performance, successfully creating a brand image of high - cost - performance in the mid - and low - end markets.

For example, in terms of imaging, vivo specifically established a research and development team of a thousand people and jointly established an imaging laboratory with Zeiss, focusing on the consumer needs of mobile imaging and technological breakthroughs in the industry, and gradually becoming a benchmark in mobile imaging.

Based on the "multi - model strategy", leadership in niche areas, and the advantage of offline store channels in the sinking market, vivo has become a veritable leader among domestic mobile phone brands.

Shipment volume is the key to a mobile phone manufacturer's survival. From 2021 to 2022, vivo topped the Chinese mobile phone market for two consecutive years, becoming the domestic brand with the highest shipment volume.

However, unfortunately, its performance declined in the second quarter of 2023. Although it maintained its first - place position in the domestic market with shipments of 11.4 million units, its market share dropped to 18%.

The domestic market is highly competitive, and the overseas market is also challenging. According to a Canalys report, in India, Southeast Asia, and Africa, Apple and Samsung have become market leaders, followed by Xiaomi, Transsion, and OPPO. vivo's competitiveness is significantly weaker.

Looking back, vivo's rise is largely due to implementing strategies suitable for the local market during the release of the smartphone industry's dividends.

However, it's worth noting that the mobile phone market has changed. The mid - and low - end markets are being squeezed by high - end phones, and the shipment volume in the Chinese mobile phone market has been declining for more than seven years. In other words, the mobile phone industry has long been a stock market.

In 2024, as many as 396 new mobile phone models were launched in the Chinese market. In the fiercely competitive mid - and low - end markets, the advantages of vivo's software, hardware technology, and channels established in the early stage are being broken. According to IDC data, in Q1 2025, vivo's market share dropped to 14.6%, ranking fourth.

Beyond smartphones, making forward - looking arrangements for the next - generation products is a new story that vivo urgently wants to tell the outside world.

If we look at vivo's overall layout, it's not difficult to find that the MR headset is just one part of vivo's strategy to break the deadlock. Previously, vivo also established a Robotics Lab to connect the physical world and the digital world through robots.

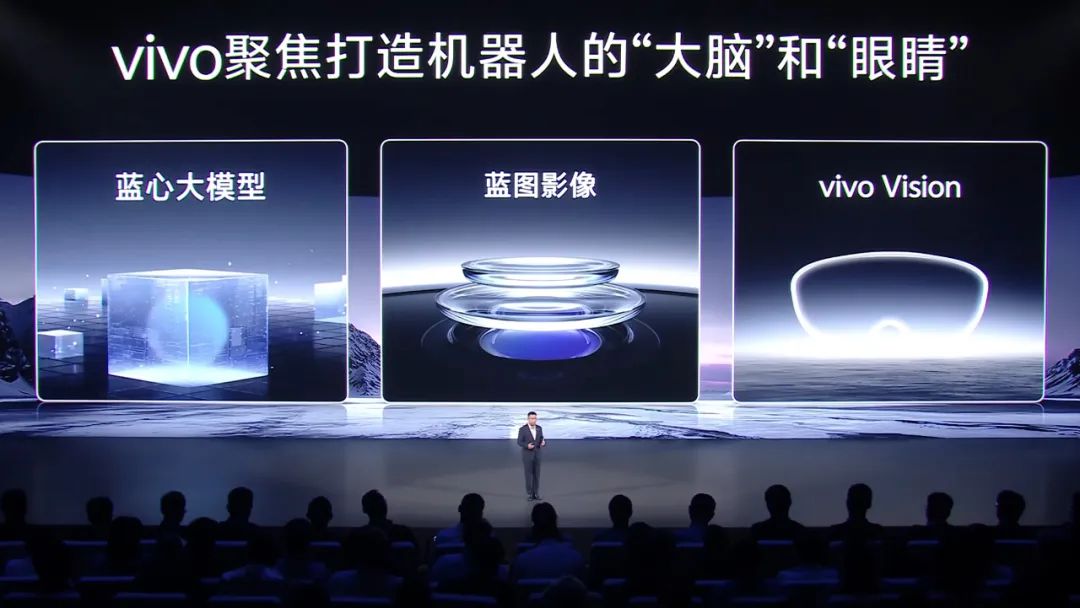

According to vivo, its approach can be briefly described as relying on vivo's "Blue Technology" accumulation in the fields of AI large models and imaging, combined with real - time spatial computing capabilities. vivo focuses on incubating the "brain" and "eyes" of robots, targeting the consumer market and focusing on robot products for home scenarios.

From an overall perspective, the vivo Vision Explorer Edition can be seen as a phased achievement of vivo's progress towards the robot scenario.

In December 2023, Hu Baishan said that MR is the key technology for robots to have strong spatial perception capabilities.

Is it worth "tying a bottle of purified water on your head"? Is there a future in the headset business?

vivo's targeting of the headset market is not a whim. Based on its leadership in the imaging field, in 2024, vivo proposed that three major trends would emerge in the future of imaging: security, 3D imaging, and XR technology.

Based on this, vivo expanded planar imaging to the spatial field and once cooperated with the smart glasses brand Rokid to explore 3D imaging. Therefore, vivo is not without a foundation in headset products.

But the key question is, is the headset field a promising or profitable one?

Before the vivo Vision Explorer Edition, there were already many products globally, such as the Apple Vision Pro and Samsung's Project Moohan.

Take the Apple Vision Pro as an example. Although it represents the peak of global mixed - reality technology in terms of technology, its poor wearing comfort and high price are off - putting, and it has never really opened up the market.

Just imagine, the Apple Vision Pro weighs 600 - 650 grams, more than one catty. Who would want to tie a bottle of purified water on their head for a long time?

What's more embarrassing is that apart from specific scenarios such as gaming and watching movies, consumers can hardly find a reason to wear the Apple Vision Pro for a long time. In short, the usage scenarios and product positioning are still in a chaotic state.

With the example of the Apple Vision Pro, it's not hard to predict the fate of the vivo Vision Explorer Edition.

Of course, the vivo Vision Explorer Edition also has the potential to surpass the former. Currently, it's just an exploratory version. The key lies in whether it can further achieve lightweight design, have a more affordable price, a richer ecosystem, more convenient operation, better service, and a lower learning cost in the future.

In January 2023, Shen Wei, the usually low - key founder of vivo, said that the situation in the smartphone industry will be quite severe in the next three to five years.

Obviously, vivo's senior management has realized that vivo needs to break the deadlock. However, whether the MR headset can support vivo in telling a good new story at this stage remains to be verified by the market.

This article is from the WeChat official account "Yiou.com" (ID: i - yiou), author: Wang Yuanlei. It is published by 36Kr with authorization.