Can the new growth points support Baidu's long-term AI narrative? | Zhike

Author | Ding Mao

Editor | Huang Yida

After the Hong Kong stock market closed on August 20th, Baidu Group released its financial report for the second quarter of 2025.

Overall, Baidu's financial report for this quarter slightly exceeded market expectations. In particular, its new AI - related businesses recorded a high - speed expansion of 34%. Regarding the commercialization progress of the much - anticipated AI search transformation, at the earnings conference after the release of the financial report, Baidu for the first time revealed that it had conducted small - scale tests on the monetization ability of a part of its AI search in the second quarter and had seen good results. It also clarified the commercialization path of AI search. This undoubtedly enhanced the market's confidence in Baidu's future return to an expansion cycle in terms of performance.

So, how is the quality of Baidu's financial report this quarter? What is the underlying logic behind the expansion of its new AI businesses? Is it still worth paying attention to in the future?

The Surge in Demand for Smart Cloud Drives the Revenue of New AI Businesses to Exceed 10 Billion Yuan

In terms of revenue, in Q2 2025, Baidu achieved a total revenue of 32.7 billion yuan. In terms of revenue composition, Baidu's core revenue was 26.3 billion yuan, and iQiyi's revenue was 6.6 billion yuan. Among the core revenue, online marketing recorded a revenue of 16.2 billion yuan this quarter, and non - online marketing revenue exceeded 10 billion yuan for the first time, a year - on - year increase of 34%. This was mainly driven by the growth of businesses such as smart cloud under the promotion of new AI fields. The revenue growth rate of the smart cloud business this quarter was 27%.

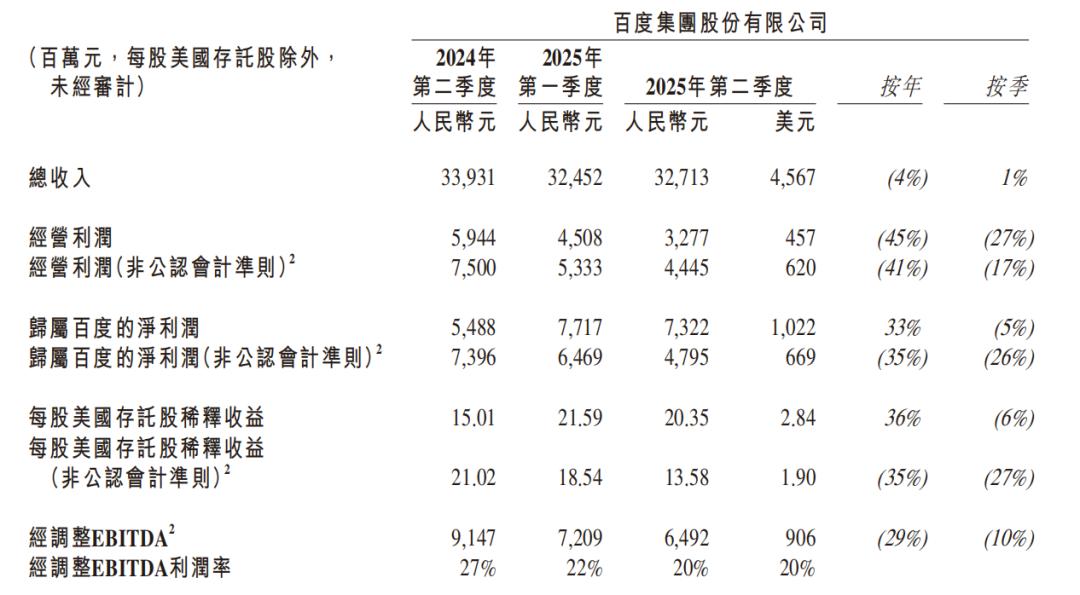

Chart: Baidu's Single - Quarter Revenue and Profit Performance Data Source: Company Financial Report, Compiled by 36Kr

In terms of profit, affected by the continuous surge in cost investment under the AI transformation, in Q2 2025, Baidu achieved an operating profit of 3.3 billion yuan. Among them, the core operating profit was 3.3 billion yuan, corresponding to a core operating profit margin of 13%. During the same period, Baidu's net profit attributable to the parent company was 7.3 billion yuan, a year - on - year increase of 33%. Among them, the core net profit attributable to the parent company was 7.4 billion yuan, a year - on - year increase of 35%, corresponding to a core net profit margin attributable to the parent company of 28%.

Chart: Changes in Baidu's Single - Quarter Profit Data Source: Wind, Compiled by 36Kr

Overall, affected by the phased nature of the AI transformation of search, Baidu's core advertising performance still faced certain pressure this quarter. However, benefiting from the high - growth trend of AI, the smart cloud business continued to achieve steady growth, which to some extent alleviated the pain of the transformation of traditional businesses.

Looking to the future, under the strategic principle of "All in AI", Baidu's long - term performance is not pessimistic.

On the one hand, with the steady progress of the AI transformation of search, benefiting from the expansion of its capabilities and the broadening of commercialization paths, it is expected to further improve the user experience and conversion efficiency of the search business in the future, and drive the bottom - up recovery of traditional online marketing performance.

In July this year, Baidu Search underwent its biggest overhaul in a decade. Not only was the search box upgraded to a "smart box" that supports multi - modal question - asking methods such as text input of over a thousand characters, pictures, and voice, but also benefiting from the support of full - stack AI capabilities, search results have changed from traditional link displays to structured answers and task deliveries. With the accelerated progress of the AI search transformation, in July, the proportion of AI - generated content on Baidu's mobile search result pages increased to 64%.

The direct benefits brought by AI search are reflected in the continuous improvement of user indicators. According to the financial report data, in June, the monthly active users of the Baidu APP reached 735 million, a year - on - year increase of 5%. In the second quarter, the average daily usage time of users increased by 4% year - on - year.

At the earnings conference after the release of the financial report, Baidu for the first time disclosed the commercialization path and progress of AI search. Baidu made it clear that the AI search function can effectively enhance the user experience, which helps with the monetization of some search keywords and thus expands the advertising inventory. At the same time, thanks to innovative tools such as AI agents and digital humans, which can better connect search results with the real world and improve the ability to meet user needs, it promotes the transition of the business from the CPC (cost - per - click) model to the CPS (cost - per - sale) model, providing greater monetization space in the future.

In terms of business progress, Baidu said that it had tested the monetization ability of a part of its AI intelligent search in the second quarter and showed an optimistic prospect. This means that if the commercialization progresses smoothly in the future, it is expected that the empowerment of traditional online marketing business by AI search may start to be reflected in the performance around the end of this year.

On the other hand, under the general trend of AI technology equalization, benefiting from the steadily growing demand for AI training and inference in China and the deployment demand for private all - in - one machines, new AI businesses such as Baidu Smart Cloud are expected to see continuous volume growth, contributing long - term and stable increments to the company's performance.

According to the latest data, in the large - model bidding market in 2025, Baidu Smart Cloud ranked first in both the number of winning bids (48 projects) and the winning bid amount (510 million yuan) and continued to lead in key industries such as finance, energy, government affairs, and manufacturing.

The Full - Stack AI Capability is the Underlying Logic for the Rapid Growth of New Businesses

In this quarter's financial report, a notable point is that Baidu's revenue from new AI - related businesses exceeded 10 billion yuan for the first time this quarter, a year - on - year increase of 34% compared to the same period last year.

Chart: Performance and Changes of Baidu's Single - Quarter New AI Businesses Data Source: Wind, Compiled by 36Kr

Behind the expansion of new AI businesses, firstly, it benefits from the expansion of smart cloud business revenue driven by the rapid growth of subscription - based AI infrastructure. The financial report data shows that the growth rate of the smart cloud business this quarter reached 27%.

Secondly, innovative businesses represented by intelligent driving have also seen good growth, providing support for the growth of new businesses. According to the financial report, since this year, the globalization of Luobo Kuaipao has continued to accelerate. Recently, it reached strategic cooperation with Uber and Lyft successively and will deploy driverless cars in Asia, the Middle East, and Europe. Benefiting from this, in Q2, the number of global travel services provided by Luobo Kuaipao exceeded 2.2 million, a year - on - year increase of 148%. As of August, the cumulative number of global travel services exceeded 14 million, and its footprint covered 16 cities around the world.

So, what is the underlying logic behind the rapid growth of Baidu's new AI businesses? Behind the rapid growth of new AI businesses is Baidu's full - stack capabilities in the AI field, from chips - cloud - basic models - frameworks - upper - layer applications. This is not only the key for Baidu to continuously widen its moat in the AI field but also the confidence for its AI business to grow in the B - end market and continuously explore innovation in the C - end market.

Chart: Comparison of Baidu's Full - Stack AI Capabilities Data Source: Official Websites of Various Companies, Compiled by 36Kr

At the infrastructure layer, Baidu takes its self - developed Kunlun Chip and Baidu Smart Cloud as the core to build the core foundation of its AI strategy, ensuring the autonomy and controllability of computing power infrastructure. At the model layer, the leading ERNIE large - model creates a traffic entry for cloud computing and forms an important part of the ecosystem. By adhering to the strategy of dual - open - source models and together with platforms such as PaddlePaddle, it has built a complete developer ecosystem, realizing the core path of "attracting developers with top - level models, lowering the threshold with full - stack tools, and feeding back technology iteration with an open - source ecosystem", and promoting continuous cost - reduction and efficiency - improvement of AI. At the application layer, currently, Baidu has a wide layout of application scenarios in the 2B/2C markets. Driven by the traffic advantage of its search business itself and the reshaping of application forms by AI, the moat of its AI products continues to deepen.

Reflected at the commercialization level, in the B - end market, Baidu uses its cloud business as a lever to promote the implementation of related businesses. On the one hand, it builds general capabilities with a full - stack AI technology foundation to achieve cost - reduction and efficiency - improvement of solutions. On the other hand, it reconstructs the efficiency of vertical scenarios through diverse industry characteristics, providing one - stop solutions for enterprise users while also taking into account the personalized needs of different industries. In this process, Baidu's AI technology and business also form a positive cycle, opening up more profit space through technological innovation.

With the rapid expansion of B - end commercialization and a leading AI technology foundation, Baidu has more capabilities to continuously explore C - end application scenarios. From search, Baidu Netdisk, and Baidu Wenku as AI traffic entrances, to ERNIE Bot and Wen Xiaoyan defined as personal AI assistants, and then to the application of digital humans, the continuous expansion of C - end scenarios lays a solid foundation for Baidu's long - term commercialization implementation.

The Current Valuation Does Not Fully Price in the AI Increment

In summary, although the AI transformation of search has brought short - term pain to Baidu's performance, Baidu's full - stack layout in the AI field, the closed - loop of ecological scenarios, and the strategic determination of long - term investment have continuously widened its moat in the AI business field. In the future, with the continuous increase in AI content, benefiting from the cost - reduction and efficiency - improvement of traditional businesses reshaped by AI and the continuous expansion of the scale of new AI businesses, in the long run, Baidu's growth logic remains clear.

In terms of valuation, as of the close on August 20th, Baidu's market value was 214.4 billion yuan, corresponding to a P/E ratio of 7.8 times. Whether compared with the company's historical average level or with peer companies such as Google and Alibaba at home and abroad, the overall valuation is at a relatively low level. If we deduct the net cash of 155 billion yuan on the books, Baidu's actual market value is only nearly 60 billion yuan. In 2024, Baidu's net profit after deducting investment income and interest income was about 18 billion yuan. Even if the profit of traditional businesses is under pressure this year, currently, Baidu's actual valuation level may be underestimated.

Chart: Changes in Baidu's Valuation Data Source: Wind, Compiled by 36Kr

This naturally reflects the market's concerns about the short - term performance fluctuations caused by Baidu's business transformation. On the other hand, it also shows that the market has not fully priced in the imagination space brought by AI to Baidu's long - term performance. Therefore, in the long run, Baidu's investment value is still worth paying attention to, but in the short term, under the influence of sentiment, it is still necessary to pay attention to the emergence of a performance inflection point.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be made with caution. In any case, the information in this article or the opinions expressed do not constitute investment advice for anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention to provide underwriting services or any services that require specific qualifications or licenses for any trading parties.