Everyone wants to make deliveries, but who actually does? A question with three question marks.

The number of participating enterprises has soared from 800 to 1,200, a year-on-year increase of 50%; 1.481 billion yuan has been raised, and 19,000 robots and related products have been sold; humanoid robots have taken the "C position" for the first time, accounting for 42%, surpassing industrial robots (38%). The remaining 20% consists of service robots, special robots, and other categories, each showing their capabilities in the "new force" camp.

On August 12, the 2025 World Robot Conference came to an end. This year, the Yizhuang National Exhibition Center was noticeably more crowded than last year.

Behind the excitement and noise is the common psychological state of enterprises - caution, anxiety, and the "delivery pressure" that is difficult to openly express. The capital market is no longer easily impressed by the word "anthropomorphic," and customers are too lazy to listen to you boast about how powerful the model is or how amazing the parameters are; they are more concerned about whether the machine can be delivered on time and appear on their production lines to work honestly.

In other words, after the rapid technological demonstrations, robot companies are facing a more realistic test.

Therefore, let's break down "delivery" into three quantifiable questions:

Order delivery: Who has signed purchase orders (POs)?

Scenario delivery: Are the robots running 24/7 in real working conditions?

Financial delivery: Is the robot revenue of listed companies separately listed in the financial statements, and what is the proportion?

Let's take a look at the industry trends revealed by this year's World Robot Conference with these three questions in mind.

Who Gets the Orders?

At this year's conference, the commercial progress of humanoid robots became the focus. Many leading companies publicly announced their order achievements, attracting industry attention.

According to statistics, as of early August, Unitree Technology won 68 bids, Ubtech won 16 bids, and Zhipu Robotics has won 9 projects this year. The number of projects won by these companies this year is close to or exceeds the total of last year.

In mid-July, China Mobile launched a procurement project for humanoid robot products with a total amount of 124 million yuan. Finally, Zhipu Robotics and Unitree Technology won the bids. Among them, Zhipu Robotics won a bid worth 78 million yuan and will deliver 200 sets of full-size bipedal humanoid robots, with a tax-included unit price of approximately 390,000 yuan; Unitree Technology won a bid worth 46.05 million yuan and will deliver 200 small-size humanoid robots, with a tax-included unit price of approximately 230,000 yuan. This has set the current record for the largest single humanoid robot order in China.

According to the public information on China Mobile's procurement and bidding website, Zhipu Robotics and Unitree Technology won the bid for the "Procurement Project of Humanoid Bipedal Robot OEM Services of China Mobile (Hangzhou) Information Technology Co., Ltd. from 2025 to 2027." The robots purchased this time will be mainly used in application scenarios such as scientific research, inspection, and services.

Not long ago, the veteran humanoid robot enterprise Ubtech also won a large - scale procurement order for robot equipment worth 90.5115 million yuan, breaking the previous industry record. Dongfeng Motor recently reached an agreement with Ubtech, planning to let Ubtech's humanoid robots be piloted on the production line; the new - energy vehicle startup NIO has also tested Ubtech's Walker S humanoid robot in its factory.

According to the "Winning Bid Announcement of the Robot Equipment Procurement Project" released by the China Tendering and Bidding Public Service Platform on July 18, Ubtech won the 90.5115 million yuan robot equipment procurement project of Miyee (Shanghai) Automotive Technology Co., Ltd. (referred to as "Miyee").

Jiao Jichao, the vice - president of Ubtech, revealed at the WRC conference that the expected delivery volume of industrial humanoid robots this year is about 500 units, mainly used in industrial scenarios such as handling, sorting, and quality inspection. The customers mainly include automobile manufacturers, 3C, and semiconductor enterprises.

Among the emerging players, Songyan Power has shown particularly outstanding performance. In July this year, it announced that it mass - produced and delivered 105 humanoid robots in a single month, becoming the first enterprise in China to deliver over 100 units in a single month. The company became well - known overnight through the humanoid robot marathon at the beginning of the year. One month after the event, it received over 2,000 intention orders with a contract value of over 100 million yuan. Thus, following Unitree Technology, Songyan Power has become the second humanoid robot manufacturer in China to clearly enter the "thousand - unit sales" threshold and firmly ranks in the first echelon of commercialization. It is reported that nearly 100 Zhipu Expedition A2 - W robots have been deployed in the Fuling Precision Factory, achieving actual "on - the - job" applications.

It can be said that from the centralized procurement of central government - owned giants to the batch delivery of startup companies, it is now clear "who has the orders."

Of course, it's not just humanoid robots that are involved in "order delivery." The leading players in the service robot field also have outstanding performance.

Li Tong, the founder of Keenon, recently revealed that the cumulative deployment of the company's various robot products has exceeded 100,000 units; since the beginning of this year, the orders have grown rapidly, especially in the overseas market, where the order volume has increased by at least 50% year - on - year. Keenon's strategy is very practical - "let the orders come before the technology": instead of being restricted to whether the robots are in the industrial, service, or medical fields, they first look for "simple positions" that the current technology can handle to enter. This practical strategy has helped them quickly finalize a large number of orders and has also proved that there are indeed rigid demands in some niche scenarios.

Looking globally, the arms race of order delivery is a global phenomenon.

Tesla has attracted much attention since it announced the Optimus humanoid robot project. Elon Musk claims that thousands of robots will be mass - produced in 2025, and the production will increase exponentially in the following years. European automotive giants are also not far behind: at the beginning of this year, BMW has reached a cooperation with the humanoid robot startup Figure and is preparing to deploy Figure's robots in its factory in South Carolina for trials.

It is foreseeable that getting "real - money" orders is just the first step. Whether these orders can be successfully fulfilled and whether the robots can be delivered to customers on schedule will become the touchstone to verify the company's strength.

"Scenario Delivery" Is the Real Testing Ground

At present, many robots delivered this year are still mainly active in relatively friendly environments. According to statistics, the application scenarios where current humanoid robot orders are implemented are mainly in the interactive service fields such as performances, greetings, explanations, and museum tours. Intuitively, there is still a long way to go before robots can directly undertake complex industrial production tasks. Many robots mainly serve as "mascots" or novel attractions: greeting customers in business halls, acting as tour guides in scenic areas, and dancing or showing martial arts at conferences.

Compared with the situation last year when there were many humanoid robots in the exhibition hall but few could move, almost every manufacturer can list the actual implementation scenarios of their robots this year, and the transformation from showy technology to mass production and implementation has begun. However, most of these implementation scenarios still remain at the non - core demonstration level and are not the real rigid - demand positions in the production process.

Of course, the situation is changing. Some robots have finally entered the "24/7" testing stage.

The procurement project of an automotive technology enterprise won by Ubtech requires its industrial - version humanoid robots to enter the production line and undertake tasks such as parts handling. At the conference, Ubtech also brought five humanoid robots. Among them, the Walker S2 features "autonomous hot - swapping battery replacement," and the S1 completed sorting and collaborative handling on the simulated production line, demonstrating the combined working mode of "auxiliary robot + main robot." The company has publicly set the annual goal of "delivering a thousand units" and disclosed large orders worth nearly 100 million yuan, obviously aiming to be the "first to hand in the paper" for mass production and delivery. However, according to industry insiders, the current attempts in industrial scenarios are still "application demonstrations for local positions" - in other words, they are just decorations, not crucial roles on the assembly line.

The procurement project of China Mobile undertaken by Zhipu Robotics and Unitree Technology focuses more on public service scenarios. The customized bipedal robots will be used in the operator's business halls to perform greeting and reception tasks. Although these scenarios are not rigid industrial positions, they also put forward substantial requirements for the robot's stability, recognition ability, and service response. It is also reported that nearly 100 Zhipu Expedition A2 - W robots have been deployed in the Fuling Precision Factory and are actually "on the job."

In non - industrial fields, Unitree Technology's humanoid and quadruped robots are also gradually opening the verification window for "24/7 operation." Its products have entered the laboratories of universities such as Sun Yat - sen University and Shenzhen University for scientific research and teaching; they have also been purchased by water supply companies, science and technology museums, and other units for security inspections and public displays. Overseas, Unitree has also signed a procurement agreement with a warehousing and logistics enterprise in the United States to provide hundreds of quadruped robots for warehouse inspection tasks. These robot dogs are designed for long - term autonomous patrols and are naturally suitable for high - frequency, high - intensity tasks.

In addition, Galaxy Universal is deploying its wheeled robots in "unmanned pharmacies" for actual operations and is also conducting feasibility tests in scenarios such as power inspection and factory logistics; the wheel - legged robot of Seer Robotics simulated the conveyor belt environment at the conference site and automatically completed cargo handling without remote control, demonstrating the stability and efficiency of a "silent worker"; while the "Xiaomai" robot of Magic Atom is only responsible for ringing the bell to announce the time at meetings, but with its "punctual, stable, and non - showy" performance, it has been hailed by the audience as the "most worker - like" robot.

At the same time, DJI continues its consistent approach. Its industrial drones and ground robots are distributed in multiple exhibition areas, performing tasks such as high - altitude inspection, AI recognition, and autonomous operation. They don't compete for attention but are always stable.

It can be said that in many fields outside of industry, the vision of "robots working continuously" is becoming a reality.

Looking at global trends: Although Figure AI did not appear at the conference, its valuation has approached $4 billion, and it has reached a cooperation with BMW to pilot the deployment of its bipedal robot Digit in the logistics scenario. On the Tesla side, in June, it announced that two Optimus prototype robots had been deployed in its factory workshop and had started to autonomously complete some assembly line tasks. Although the scale is still small, it has taken the key step from the "laboratory to the production line" - Elon Musk's predictions of "mass production in 2025" and "selling price lower than that of cars" still have enough appeal to investors. In this field, Musk's competitors are also running: Boston Dynamics' humanoid robot Atlas still focuses on scientific research and performances, but the bipedal robot Digit of the American startup Agility Robotics has been in trial operation in a logistics warehouse (its partners include GXO, a logistics company under Gap, etc.).

Both at home and abroad, the industry generally recognizes that only when robots can operate stably in real scenarios for a long time and are verified to be "useful and durable" can large - scale commercialization truly begin. Currently, many humanoid robot orders are concentrated in non - core scenarios such as performances and displays because there is a "gap between technological ideals and commercial realities" - to truly make robots take on the role of productive forces, many lessons need to be learned in terms of reliability, cost, and standardization.

Can Revenue and Profits Withstand Scrutiny?

It's not enough to deliver the robots to the customers; ultimately, they must also be "reflected in the financial statements."

Since the beginning of this year, the global robot industry has been booming in both the primary and secondary markets:

Ubtech has successfully listed on the Hong Kong Stock Exchange, becoming the "first humanoid robot stock";

Figure AI has received huge financing in the private market, and its valuation has approached $4 billion;

Many robot concept stocks have also caught the wave of AI, and their stock prices have risen one after another.

However, through the ups and downs of the capital market, we need to distinguish which are the short - term speculative bubbles and which are the real recognitions of long - term value.

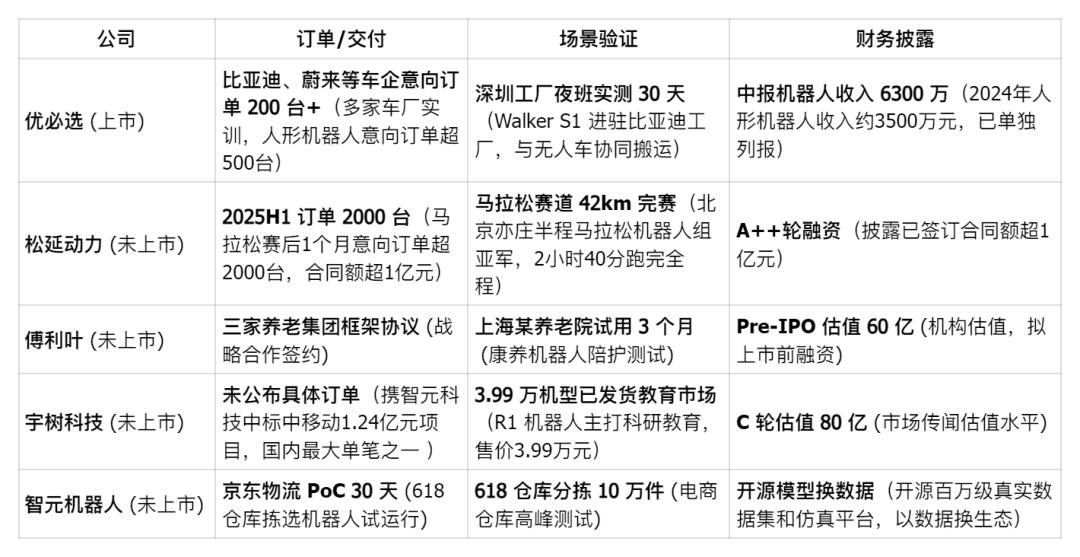

Currently, only a few enterprises can write "robot revenue" in their financial statements. Here is a comparison of the delivery paths of five representative complete - machine manufacturers:

Among these enterprises, Ubtech has the most detailed disclosure: in 2024, the annual revenue was 1.305 billion yuan, and the revenue from humanoid robots was about 35 million yuan, accounting for only 2.7%, and the annual delivery volume was only 10 units. This means that at the current stage, there is still an obvious gap between "Demo - level delivery" and "commercial monetization." Although Ubtech's executives emphasize that "they are not in a hurry to achieve break - even but focus more on implementation verification," the reality of a loss of 1.16 billion yuan has also made the market start to question: When will the mass