National Bureau of Statistics: New home sales across the country reached 4.9 trillion yuan in the first seven months, and inventories continued to decline.

On August 15th, the National Bureau of Statistics released data on the basic situation of the national real estate market from January to July. Statistics show that core indicators such as the sales area, sales volume, and newly started construction area of new homes are still in a downward trend.

However, as the decline in new housing starts is greater than the decline in sales, the inventory of unsold commercial housing across the country continued to decline in July. It has been decreasing for 5 consecutive months since the inventory peak at the end of February this year, with a total reduction of 34.05 million square meters, a decline of about 4.3%.

In terms of market demand, from January to July, the sales area of newly built commercial housing was 515.6 million square meters, a year-on-year decrease of 4.0%; among them, the sales area of residential housing decreased by 4.1%. The sales volume of newly built commercial housing was 4.9566 trillion yuan, a decrease of 6.5%; among them, the sales volume of residential housing decreased by 6.2%.

Source: National Bureau of Statistics

The market demand remains at a low level, but the financing situation of real estate development enterprises has improved. Statistical data shows that from January to July, domestic loans of real estate development enterprises reached 920.7 billion yuan, a 0.1% increase; the use of foreign capital was 1.7 billion yuan, a 3.2% increase; self - raised funds were 2.323 trillion yuan, an 8.5% decrease; deposits and advance receipts were 1.6815 trillion yuan, a 9.9% decrease; personal mortgage loans were 791.8 billion yuan, a 9.3% decrease. From January to July, the funds in place for real estate development enterprises totaled 5.7287 trillion yuan, a year-on-year decrease of 7.5%, mainly dragged down by the sluggish sales end.

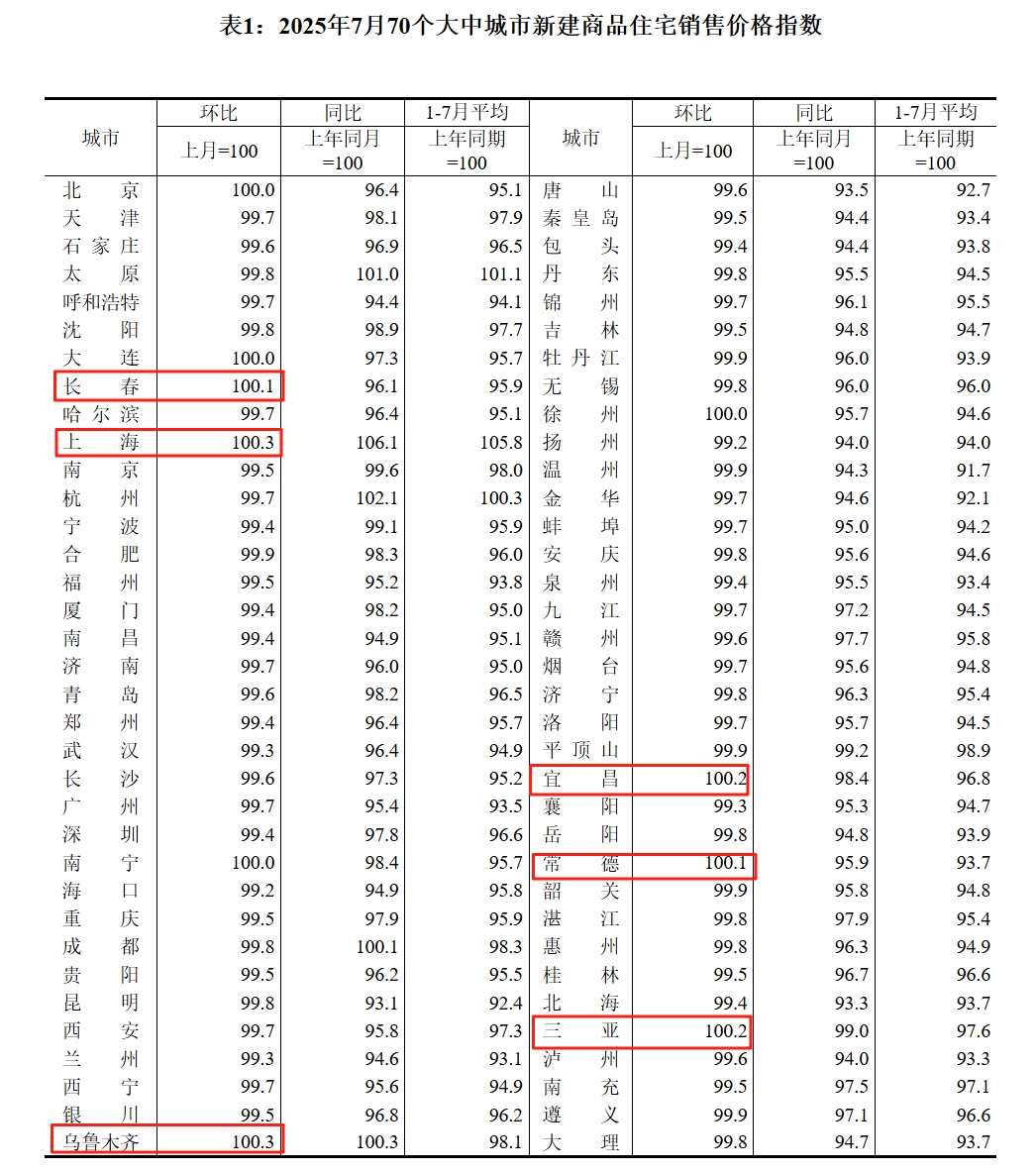

In the market, in July, the sales prices of commercial residential buildings in cities of all tiers continued to decline month - on - month.

Among them, the sales price of newly built commercial residential buildings in first - tier cities decreased by 0.2% month - on - month, with the decline narrowing by 0.1 percentage points compared with last month; the sales price of newly built commercial residential buildings in second - tier cities decreased by 0.4% month - on - month, with the decline expanding by 0.2 percentage points; the sales price of newly built commercial residential buildings in third - tier cities decreased by 0.3% month - on - month, with the same decline as last month.

In first - tier cities, compared with the sales price in June, the price in Beijing remained flat, Shanghai increased by 0.3%, while Guangzhou and Shenzhen decreased by 0.3% and 0.6% respectively.

In second - tier cities, the sales price of new homes in Sanya has been rising for 4 consecutive months.

In the second - hand housing market, among 70 large and medium - sized cities in July, only Taiyuan saw a month - on - month increase, Xining remained flat, and the rest of the cities saw price declines. Among them, Beijing, Shanghai, Guangzhou, and Shenzhen decreased by 1.1%, 0.9%, 1.0%, and 0.9% respectively.

Source: National Bureau of Statistics

Zhang Bo, the dean of the 58 Anjuke Research Institute, analyzed that in the second - hand housing market, the downward trend of housing prices has intensified. Combining with the online data of Anjuke, the decline in the popularity of house - hunting and the prolongation of the listing duration also reflect the continuous weakness of market demand. Although the listing supply and operation vitality have improved slightly, they are difficult to offset the negative impact, which is also related to the seasonal off - season and the market confidence of homebuyers. Specifically, there are obvious differences among different cities and regions. The real estate market presents a differentiated pattern where core cities are stabilizing and warming up, while non - core regions are continuously adjusting. The prices in high - level cities still have strong resilience, but the market sentiment has cooled down. For example, the listing duration in Shanghai has increased by 12.23%. Weak second - tier, third - tier, and fourth - tier cities are facing "double hits in volume and price" and prominent inventory pressure.

Recently, various local policies have been frequently introduced. In particular, the relaxation of purchase restrictions outside the Fifth Ring Road in Beijing and the further optimization of regulatory policies in Hainan have brought an increase in market popularity in August. The continuous introduction or implementation of local policies, such as "trading in the old for the new", housing voucher resettlement, and the relaxation of housing provident fund policies, aim to break through the replacement chain. However, the implementation effect and intensity of these policies still need to be continuously observed in the August market.