The coming-of-age ceremony for AI glasses lies in payment.

In 2025, many industry insiders refer to it as the "Year of AI Glasses." From the beginning of the year to the summer, manufacturers such as Rokid, Meizu, Quark, Xiaomi, and TCL Thunderbird took turns to launch new generations of smart glasses in less than half a year. The time interval between new product launches was compressed to a few weeks. Almost every industry exhibition and media event was accompanied by the debut of a new product.

They have different development paths: Rokid continues to focus on voice assistants and AI interaction, emphasizing "understanding and responding"; Meizu focuses on spatial computing and immersive experiences; Quark combines generative AI with visual search; Xiaomi bets on shooting and recording functions, trying to turn AI glasses into the user's "second pair of eyes" on the go.

However, regardless of how diverse they are in technology and form, they almost all reach a consensus on one function - payment.

Since Rokid Glasses first collaborated with Alipay to achieve "payment with a glance" in June, many products such as Xiaomi AI Glasses, Quark AI Glasses, and TCL Thunderbird X3 Pro have followed suit, successively connecting to Alipay's full - set of capabilities from "payment with a glance" to the security risk control system.

Every leap in payment experience is often accompanied by a change in consumption patterns. This was the case from cash to card payment, and from quick payment to QR - code payment. This time is no exception. Smart glasses may reach the tipping point from being a gadget for tech enthusiasts to a daily tool for ordinary consumers.

01. Payment Opens the "Go - Out - Ready" Entrance for Smart Glasses

However, for smart glasses to truly enter daily life, two thresholds need to be crossed first.

The first threshold is the maturity of technology. Early products had shortcomings in display clarity, battery life, and weight balance. Prolonged wearing could easily cause discomfort such as dizziness and pressure on the nose, directly affecting the possibility of daily use.

Fortunately, in the past two years, the industry has continuously iterated in aspects such as lightweight optical modules, battery energy - efficiency management, and heat dissipation and weight - distribution design. These problems have been significantly improved. The weight of current mainstream new products has dropped below 60 grams, the battery life generally exceeds 8 hours, and the stability of display and sensing is closer to the requirements for all - day wearing. The technological bottleneck is changing from an obstacle to a controllable variable.

The second threshold is high - frequency and essential scenarios. Many consumers buy smart glasses driven by novelty. After taking a few photos and trying real - time translation a few times, the glasses are put aside. The reason is the lack of sufficient reasons to "take them out." Smart glasses can only truly become "glasses" from "devices" when their functions are closely bound to daily habits.

Therefore, the breakthrough for the industry does not lie in simply adding flashy functions, but in finding usage scenarios that can be integrated into users' daily lives and triggered repeatedly. The popularization paths of smartphones and smartwatches in the past have proven that high - frequency and essential needs are the core driving force for cultivating wearing habits.

Recent industry explorations mainly focus on finding usage scenarios for smart glasses that can replace or even surpass mobile phones by introducing functions such as navigation, payment, and AI assistants, thereby increasing the necessity for users to wear them.

For example, real - time navigation is an obvious essential need for people with a poor sense of direction. Especially in scenarios such as walking and cycling, glasses can provide route prompts without interrupting the movement rhythm. If combined with AI to automatically plan the optimal route, the convenience will be significantly improved. Data from iResearch shows that navigation/positioning services have entered the top three AI glasses functions that consumers are concerned about.

The payment function is another "killer app" to change users' habits. Adults initiate more than 10 payment actions on average every day, covering the entire life scenarios from buying breakfast to entering the subway and signing for takeaways. This high - frequency and essential need naturally fits the "look - up - and - use" interaction mode of smart glasses. Once the experience is smooth and the sense of security is sufficient, it may reverse - promote the cultivation of wearing habits.

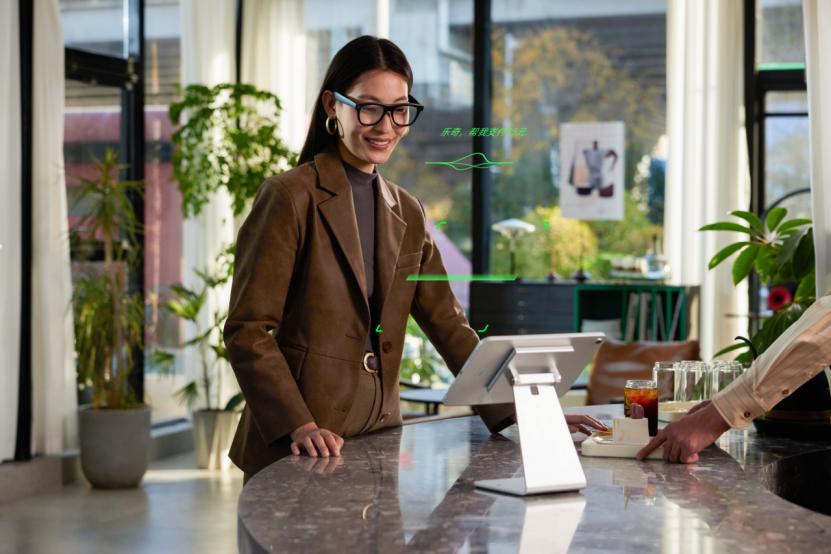

Some companies with a keen sense of smell have taken the lead in implementing this scenario. Take Rokid Glasses as an example. The process of completing a payment is very simple: users first bind the glasses with their Alipay account in the Rokid App and record their voice as the basis for voiceprint verification. When they need to pay, they say "Leqi, pay 10 yuan", look at the merchant's payment code with their eyes, and then say "Confirm payment" after the glasses complete the recognition, and the transaction is completed.

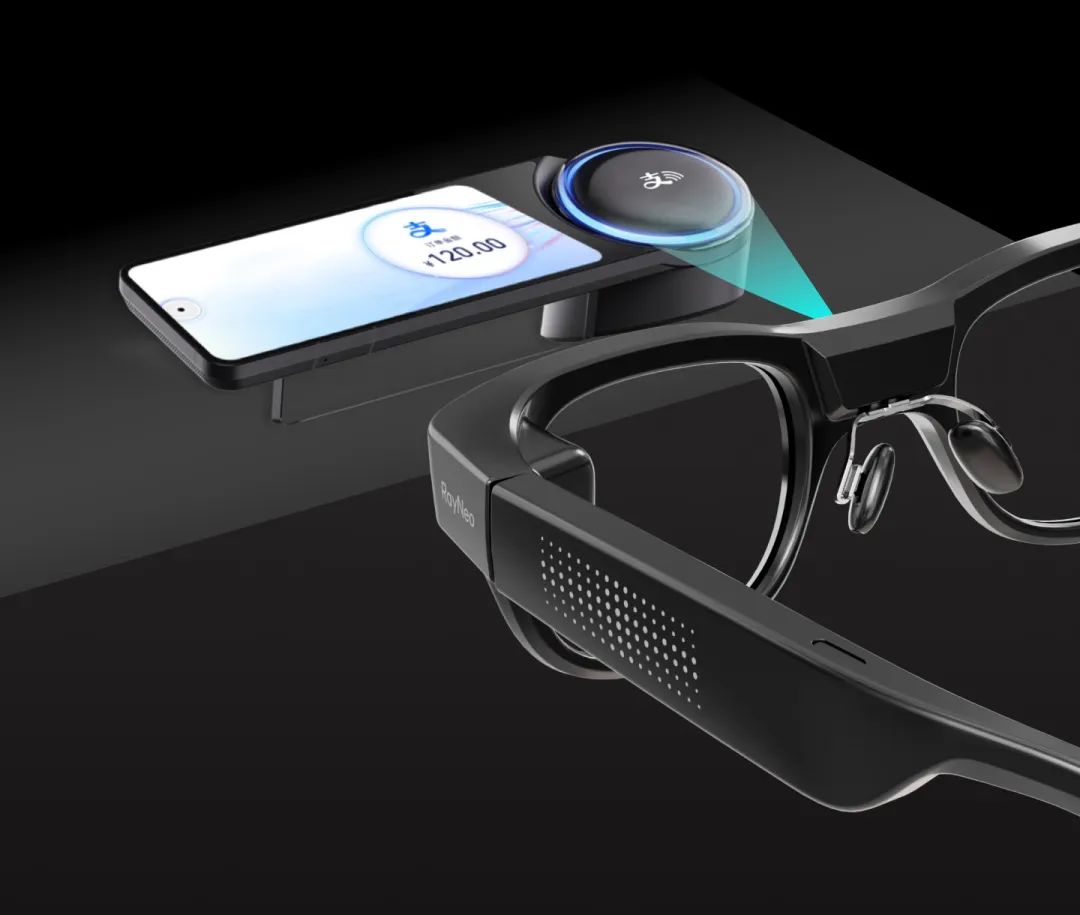

Currently, the interaction mode and scenario density of glasses payment are still expanding. On August 14th, TCL Thunderbird X3 Pro announced that it was equipped with Alipay, becoming the world's first AI glasses that can complete payment by looking at the merchant's payment device. In addition to looking at the merchant's QR code, users can also complete the payment by looking at the merchant's "Alipay Tap - to - Pay" device.

In real - life use, this convenience is particularly prominent. During the morning rush hour when buying breakfast, there is no need to take out the phone in a crowded queue; when buying water while cycling or buying groceries in the market with both hands full of bags, there is no need to stop and take out the phone to scan the code.

From the perspective of industry evolution, the introduction of payment is an important watershed. In the past, QR - code payment quickly transformed smartphones from communication tools into transaction entrances; in the field of smartwatches, Apple Pay was also one of the key functions to open up daily use - it gave users a reason to raise their wrists and interact with the device every day.

After Apple Watch was connected to Apple Pay, its payment usage rate soared in just two years, becoming one of the main interaction scenarios among smartwatch users. Statistics show that by the end of 2023, about 37% of Apple Watch users used the mobile payment function.

These growth data clearly show that once the payment scenario is established, the product will experience explosive growth in usage frequency and user base in less than two years.

In this regard, payment can be regarded as the industry's coming - of - age ceremony.

02. Payment Breakthrough: Chinese AI Glasses Are Becoming the "Top Winners"

The global smart glasses market is looking for a "killer app," but there are obvious differences in the payment function. Apple has not entered the market yet, and Apple Pay does not have cross - platform general capabilities; Meta's glasses still lack a payment module in terms of functions. Overseas giants are still waiting and watching or restricted by basic conditions.

In this situation, Chinese manufacturers have taken the lead in finding a breakthrough - embedding payment into smart glasses and launching it as a standard feature in the market.

Behind this, there are not only structural differences in the payment systems but also the advantages of infrastructure formed by more than a decade of digital social construction in China, the globally leading smart hardware supply chain, and the ecological synergy speed brought by the unified market.

Firstly, there are structural differences in the payment systems between domestic and overseas markets.

In Europe and the United States, the underlying mobile payment depends on the bank card network and POS terminals. Most transactions are completed through the NFC function of mobile phones with a "tap - to - pay" method. This system operates smoothly on mobile phones, but it encounters natural obstacles when migrating to glasses - glasses lack the physical conditions for card - tapping. Taking off the glasses and then tapping the POS machine is not only clumsy but also goes against the original intention of hands - free operation and seamless interaction of wearable devices, and it is almost unfeasible.

China's path is completely different. Since the rise of quick payment more than a decade ago, network payment in the form of QR - code payment has penetrated into almost all trading scenarios - from convenience stores and vegetable markets to taxis and street stalls, payments can be completed with a mobile phone. China's mobile payment coverage rate has reached 86%, ranking first in the world. This means that the infrastructure supporting glasses payment has already been in place, there is no need to transform the merchant's receiving hardware, and there is no need to re - educate users.

Secondly, it is the maturity of the industrial chain.

China is one of the few countries in the world with the full - chain capabilities from optics, display, electronics, module processing to complete machine assembly. The localization rate of core components such as SoC, optical modules, and display modules required for AI glasses has exceeded 60%, and some links are globally leading.

The significance of this maturity lies not only in completeness but also in response speed and synergy efficiency. At the stage when the form and interaction mode of glasses are still in the stage of rapid trial - and - error, the domestic supply chain can complete prototype verification, mold adjustment, and small - batch trial production within a few weeks. Hardware manufacturers, module suppliers, and AI software teams can collaborate face - to - face in the same area. For example, they can directly adjust the lens parameters and algorithms according to the recognition speed of payment QR codes under different lighting conditions.

In the past few years, the promotion of domestic substitution of core components has enabled manufacturers to optimize algorithms for local AI models more flexibly in the hardware architecture, improving the operation efficiency and experience consistency on the device side. The mature mass - production capacity also ensures that once a new function is verified, it can be replicated across the entire product line in a short time, quickly forming a market scale.

Thirdly, it is the speed of ecological aggregation.

The "unity" of the Chinese market brings a unique advantage - once a certain standard or ability is verified, the entire upstream and downstream of the industrial chain can quickly complete adaptation and large - scale replication. When the HarmonyOS was first launched, hardware manufacturers, software developers, and service providers almost completed the access within the same period, forming a rapid closed - loop from the system to applications.

The ecosystem of smart glasses payment is also taking shape in a similar way: Brands such as Rokid, Xiaomi, Quark, and TCL Thunderbird have successively launched "payment with a glance," promoting it from a highlight function of individual products to an industry standard in a short time.

This efficient aggregation not only accelerates the cultivation of users' habits but also promotes the supply chain, software teams, and service platforms to further optimize the functional experience. For a new hardware form, this means that R & D iteration, market cultivation, and ecological construction can be carried out almost simultaneously, rather than going through a long period of standard competition and fragmented adaptation like in the European and American markets.

It is precisely the simultaneous availability of technological conditions, infrastructure, industrial chain, and ecological synergy that gives China a rare first - mover advantage in the implementation of smart glasses payment and may form a scale barrier first in the next round of global wearable device competition.

03. On the Eve of Explosion: Chinese Smart Glasses Are Accelerating Evolution

In 2025, the growth rate of AI smart glasses is refreshing industry expectations. Wellsenn XR predicts that the global sales volume will reach 3.5 million pairs this year, a year - on - year increase of 230%; by 2029, this figure is expected to exceed 55 million pairs.

Meta CEO Mark Zuckerberg even asserted that in the future, people without artificial intelligence glasses will be at a disadvantage because it will become the main way for users to interact with AI in the next few years.

However, in comparison, the global smartwatch shipments reached about 150 million units in 2024, more than 40 times the current scale of smart glasses. It can be seen that although the growth rate is remarkable, smart glasses still have a long way to go before truly entering the mass market - they need not only technological progress but also to cross several structural thresholds:

Firstly, users' habits are still being cultivated. From "usable" to "willing to use and use frequently," continuous usage scenarios driven by high - frequency and essential needs are required. Secondly, the product form still needs to be optimized. Weight, battery life, and all - day wearing experience need further breakthroughs. Thirdly, the popularization of security and trust mechanisms. When the device holds a large amount of personal information, users must be sufficiently confident in its payment and identity verification.

These challenges are difficult to be completely solved in the short term. Fortunately, the industry has found a breakthrough to quickly boost the penetration rate - payment.

More importantly, payment is not a single - point function but an "entrance" to activate the entire ecosystem. Once connected, various services and applications around payment will be implemented accordingly. When the hardware, algorithms, network, and payment system form a closed - loop, glasses are no longer just display and interaction terminals but nodes for real - time perception, decision - making, and execution - both a platform for human - AI collaboration and a carrier for identity and services.

The current smart glasses market is at the "pre - Android era" - major global manufacturers are conducting their own trials, and there are huge differences in technological routes and product definitions, and a unified standard has not yet been formed. The Chinese market, supported by digital infrastructure, a unified market, hardware manufacturing, and ecological synergy, is crossing the payment watershed.

In the future, whoever can replicate this first - mover advantage in more scenarios may define the pattern of the next - generation smart terminals.