Youzan has finally turned a profit.

Youzan, which had been losing money for years, has finally turned a profit.

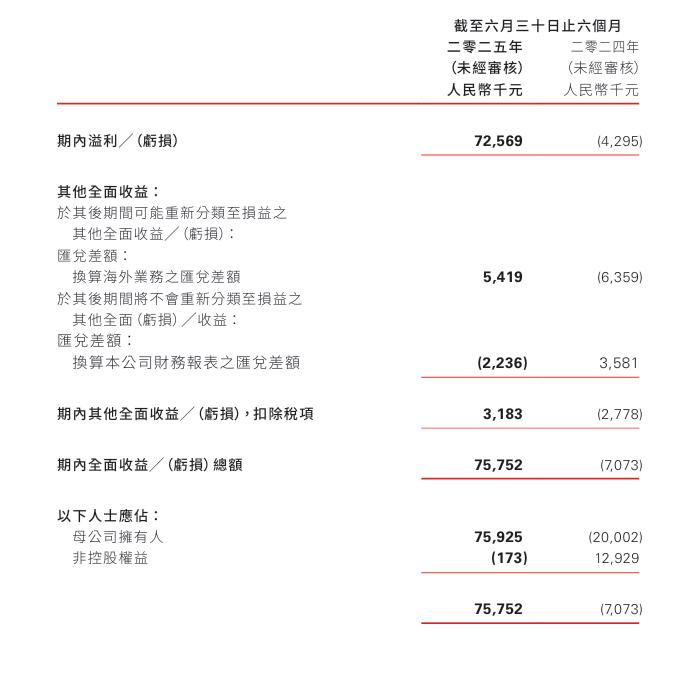

Recently, Youzan released its financial report for the first half of this year, with a net profit of approximately 73 million RMB.

For a long time in the past, Youzan's profitability has been questioned by the market. Except for achieving a net profit attributable to the parent company of 7.429 million in the whole year of 2023, Youzan has been deeply mired in the quagmire of losses over a longer period. In the first half of this year, Youzan finally got rid of the cloud of losses, but there are still more challenges ahead.

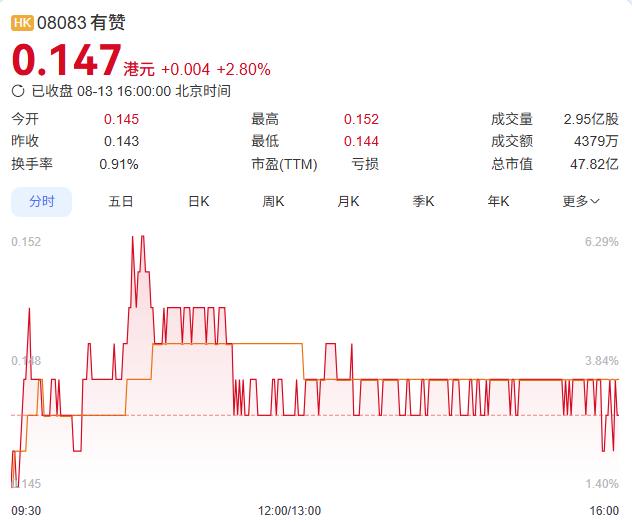

As the first stock in the WeChat ecosystem, Youzan's stock price once reached a peak of over 70 billion, but now it is only 4.7 billion.

It is generally recognized in the industry that it is difficult to do SaaS business in China. Firstly, enterprises have a low willingness to pay. Secondly, enterprises have high customization requirements, which increase R & D costs and delivery difficulties. As a result, domestic SaaS enterprises have been in a state of "losing money to gain popularity" for a long time. Against this background, Youzan submitted a profitable financial report. Does this mean that Youzan is returning to its peak?

01 Youzan Stops Losing Money, with the Sales of a Single Merchant Reaching 930,000

In the past two years, the SaaS market has shown a complex situation where opportunities and challenges coexist. In terms of market size, the scale of the Chinese SaaS market reached 49.82 billion yuan in 2024, a year - on - year increase of 31.6%. In terms of profitability, most domestic enterprises in the SaaS track have been in a state of "losing money to gain popularity" in the past, but there were positive changes in 2025. In August, many SaaS enterprises listed on the Hong Kong Stock Exchange disclosed their semi - annual reports or forecasts, and their performance generally improved.

In the first half of 2025, Youzan's revenue was approximately 710 million yuan, a year - on - year increase of about 4%, and the net profit was approximately 73 million yuan, successfully turning losses into profits.

Specifically analyzing this financial report, according to Jiedian Finance, the turnaround from losses to profits mainly depends on two aspects:

The first aspect is to optimize the business structure and increase the proportion of high - margin businesses: From the perspective of revenue composition, the revenue of Youzan's merchant solutions increased significantly. In the first half of 2025, this part of the revenue was approximately 338 million yuan, a year - on - year increase of 10.3%.

This growth is mainly due to the rapid development of businesses such as Youzan's logistics solutions. In contrast, the revenue of subscription solutions was approximately 374 million yuan, a year - on - year decrease of 1.0%.

Jiedian Finance found through sorting out the financial report that Youzan focused more on business segments that can bring high added value and high margins during the business promotion process. For example, it provides more in - depth and targeted solutions for high - margin industries such as chain merchants and cake baking. By providing precise services to such customers, Youzan improved the profitability of its overall business, optimized the revenue structure, and laid the foundation for turning losses into profits.

The second aspect is to deepen merchant services and improve customer quality and ARPU (Average Revenue Per User): In the first half of 2025, the GMV generated by merchants through Youzan's solutions was approximately 49.8 billion yuan. The average sales of a single merchant were approximately 930,000 yuan, a year - on - year increase of about 11%.

This figure means that Youzan has achieved remarkable results in merchant services, increasing merchants' dependence on and investment in the Youzan platform. To achieve this effect, Youzan optimized its products and services. For example, it launched intelligent agents such as "WeChat Mini - store Custody" and "Youzan's Local Life Solution for Xiaohongshu". These measures helped merchants improve their operational effects and achieve performance growth, making merchants willing to pay higher fees and increasing Youzan's ARPU (Average Revenue Per User).

In the context of increasingly fierce market competition, product innovation and strengthened services have become the keys for Youzan to maintain business growth and successfully stop losses in the first half of the year.

02 Can Youzan Retain More Merchants by Reducing Costs with AI and Expanding Customers through Sales?

"You just need to wait for customers to come to the store and ship the goods according to the orders. Leave the rest to Youzan's intelligent system." This is a sentence from Youzan's 12th - anniversary PPT "Do a Non - Competitive Business".

Behind this ambitious statement lies the difficult SaaS business of Youzan.

Youzan rose rapidly with the wave of WeChat business. Its e - commerce platform based on the WeChat ecosystem helped merchants establish their own online stores on WeChat and was quickly welcomed by the market. However, with the decline of the WeChat business model and the rise of various platforms and channels, the number of Youzan's customers decreased significantly.

To regain the market, Youzan has taken many actions this year. According to Jiedian Finance, the key to improving the business lies in technological innovation.

Only by leveraging AI technology can the operational efficiency and product competitiveness be improved.

In recent years, AI technology has been widely used within Youzan and in services for merchants, greatly improving operational efficiency. Internally, due to the use of AI tools, R & D labor expenses have been reduced, R & D costs have decreased year - on - year, and at the same time, the collaboration efficiency has been improved, enabling Youzan to achieve large - scale profitability while maintaining the rapid iteration of product services.

When serving merchants, Youzan empowers multiple links such as marketing and customer service through AI.

For example, AI customer service robots can independently handle a large number of consultations, improving service efficiency. AI precision marketing analyzes and recommends based on merchants' own data, helping merchants tap the value of internal customers and improve marketing effects, etc.

In addition to technological innovation, optimizing the sales system and enhancing market expansion capabilities are also important.

Youzan has made progress in the construction of the sales system, and the number of salespeople has increased. In the first half of 2025, there were approximately 750 people. The company has formed precipitation and experience in sales system construction and sales talent training, and has built a business model that can achieve large - scale profitability. Jiedian Finance believes that this enables Youzan to more accurately reach target customers, tap potential merchant resources, and convey the advantages of Youzan's products and services to more customers during the market expansion process, thus promoting business growth.

03 By Building an Ecosystem, Can Youzan's SaaS Business Be Easier?

In the past, a major shortcoming of Youzan was its ecological dependence. To solve this problem, Youzan has carried out expansions in three aspects:

The first aspect is to build platforms on multiple platforms and not put all eggs in one basket

In the past few years, Youzan has tried to break the shackles of a single ecosystem through cross - platform cooperation. In addition to the early - stage WeChat ecosystem it relied on, it has successively achieved system interoperability with platforms such as Alipay Mini - programs, QQ Mini - programs, and Xiaohongshu, allowing merchants to conduct business synchronously on different platforms.

For example, through Youzan's system, merchants can list products and manage orders on multiple channels such as WeChat official accounts, Alipay lifestyle accounts, and Xiaohongshu stores at the same time, avoiding major impacts on their business caused by policy changes or traffic fluctuations on a single platform. This cross - platform layout not only broadens merchants' traffic entrances but also enables Youzan to get rid of excessive dependence on a specific ecosystem and enhances the anti - risk ability of its business.

The second aspect is to expand offline business scenarios and expand the business territory to physical stores

An important layout of Youzan is to extend from the online to the offline and build an integrated online - offline service system. It has launched solutions such as Youzan Retail and Youzan Chain, focusing on three major business scenarios: in - store, home - delivery, and off - store, and providing full - process services such as membership management, product management, and inventory management for physical retail merchants.

In the view of Jiedian Finance, the expansion of the store SaaS business enables Youzan not to be limited to online e - commerce services but to penetrate into offline retail scenarios, attracting a large number of physical merchants to settle in, thus reducing dependence on the pure online ecosystem and forming a business pattern of coordinated development between online and offline.

The third aspect is to build its own platform and attract more people to build the ecosystem together

In 2019, Youzan received investment led by Tencent, accelerating the layout of store Internetization. In the same year, it cooperated with Baidu, Tencent Advertising, etc., and launched various support programs to expand traffic channels. In addition, Youzan's service market was launched, introducing third - party service providers to build an open ecosystem. Since 2020, it has reached cooperation with Alipay Mini - programs, QQ Mini - programs, Xiaohongshu, etc., achieving system interoperability and further expanding the business ecosystem. From 2024 to 2025, Youzan vigorously promoted the application of AI technology, empowering links such as marketing and customer service. Through an open platform, customized services, and the introduction of ecosystem partners, it met the diverse and personalized needs of customers and entered the stage of ecosystem construction and value - added business expansion.

After several layouts, Youzan's performance finally shows an upward trend. But it is still not time to celebrate victory.

In recent years, Internet giants such as Alibaba and Tencent have crossed into the SaaS field, relying on their large user bases, strong financial strength, and mature technology systems. Taking the multiple cloud service products launched by Alibaba Cloud for enterprises as an example, which cover cloud servers, databases, security protection, etc., they have quickly occupied a considerable share in the SaaS market by virtue of the technology and customer resources accumulated in the cloud computing field, bringing great competitive pressure to SaaS start - ups focusing on vertical fields.

At the vertical track level, Weimob has a similar business model to Youzan, and the competition between the two is particularly fierce. Weimob and Youzan have a large overlap in customer resources. When competing for small and medium - sized merchant customers, the two sides compete fiercely in terms of price strategy and service quality. In addition, competitors such as Keryun and Kemen are deeply involved in their respective areas of expertise, forming a competitive situation with Youzan. In the face of more intense market competition, Youzan still needs to continuously highlight the characteristics and advantages of its products to stand out in the competition.

*The title picture is generated by AI

This article is from the WeChat public account "Jiedian Finance" (ID: jiedian2018), author: Lingdu. It is published by 36Kr with authorization.