With a single - season revenue of 154 million yuan, Pony.ai is now a stock with a skyrocketing revenue in the Robotaxi sector.

The substantial growth of Robotaxi is more vigorous than ever.

Not only are the leading players frequently expanding their operating scopes, but the performance presented by various players is also booming. Pony.ai, the benchmark concept stock of Robotaxi, recently released its Q2 financial report, showing an obvious growth curve:

The company's single - quarter revenue reached 154 million yuan, a year - on - year increase of 75.9%. The revenue from its core business, Robotaxi, doubled year - on - year, and the passenger fares soared by more than three times year - on - year.

However, this performance is just the prelude to an explosion.

Since its listing, Pony.ai publicly disclosed its fleet size for the first time. There are already over 500 Robotaxi vehicles.

The production of the seventh - generation Robotaxi, which was launched in June, has completed the production capacity ramp - up. More than 200 vehicles have been produced within two months, and the company is very confident that it will deploy over 1000 vehicles by the end of the year.

Peng Jun, the founder and CEO of Pony.ai, summarized this Q2 financial report with a professional term:

The path to achieving positive unit economic benefits for Robotaxi is clearly visible.

How did Pony.ai perform in Q2?

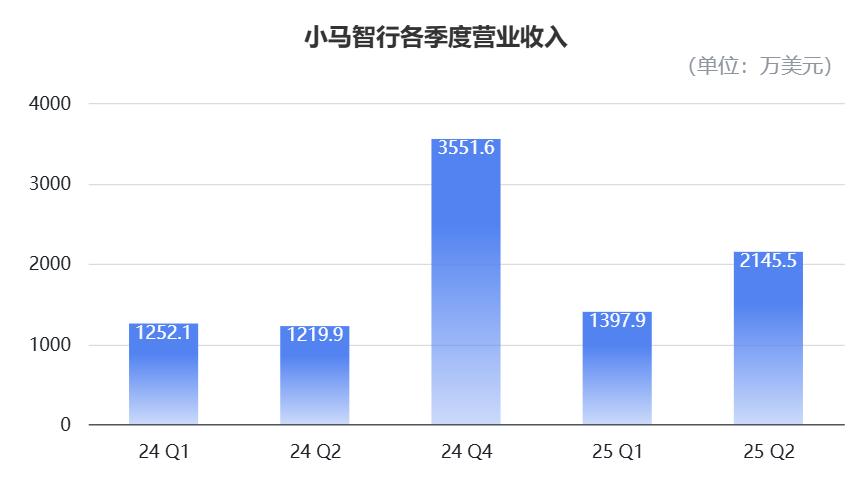

In the second quarter of this year, Pony.ai's total revenue was 154 million yuan (approximately 21.5 million US dollars), a year - on - year increase of 75.9% and a quarter - on - quarter increase of 53.5%.

△

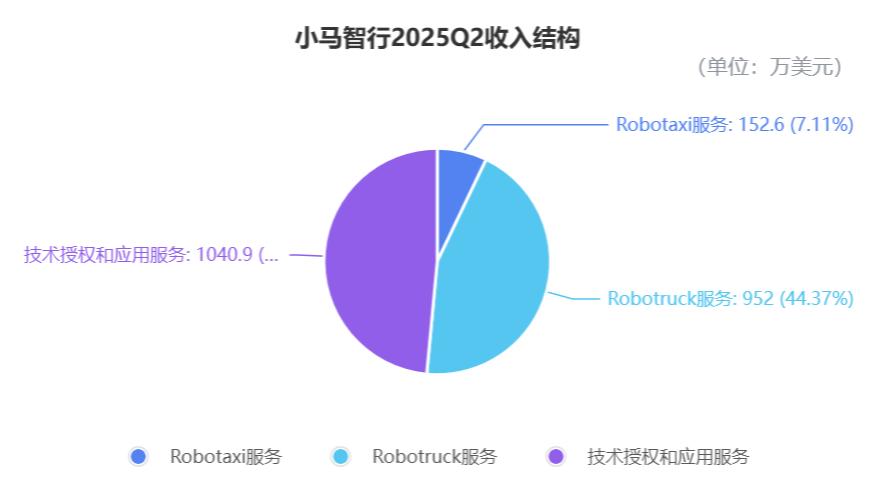

According to the business sources, Pony.ai divides its revenue into three categories: Robotaxi services, Robotruck services, and technology licensing and application services.

Pony.ai attributed the revenue growth to the increase in revenue from Robotaxi services and technology licensing and application services.

What's special about this quarter is that there was an obvious change in the revenue structure:

Technology licensing and application services became the major source of revenue in Q2. The single - quarter revenue was 74.6 million yuan, a year - on - year surge of 901.8%. The proportion of this revenue in the company's total revenue increased from 8.52% in the same period last year to 48.52%.

The financial report explained that the increase in this part of the revenue was due to the increased customer demand in the robot delivery field. Therefore, the orders and delivery volume of the autonomous domain controller (ADC) products increased accordingly.

However, Pony.ai didn't overly emphasize the growth of this part of the business. Its main focus remained on the core business, Robotaxi.

The revenue from the Robotaxi business also showed considerable growth. The company's revenue from Robotaxi in Q2 was 10.9 million yuan, a year - on - year increase of 157.8%.

Currently, there is no clear boundary between the narrow and broad definitions of Robotaxi. If strictly defined as "driverless taxis", Pony.ai is already the top - ranked company in terms of Robotaxi revenue.

Meanwhile, the revenue from Robotruck services was 68.2 million yuan, a year - on - year decrease of 9.9%. This was actually the result of Pony.ai's active adjustment. The company is focusing on high - profit revenue, so it actively optimized its operating structure.

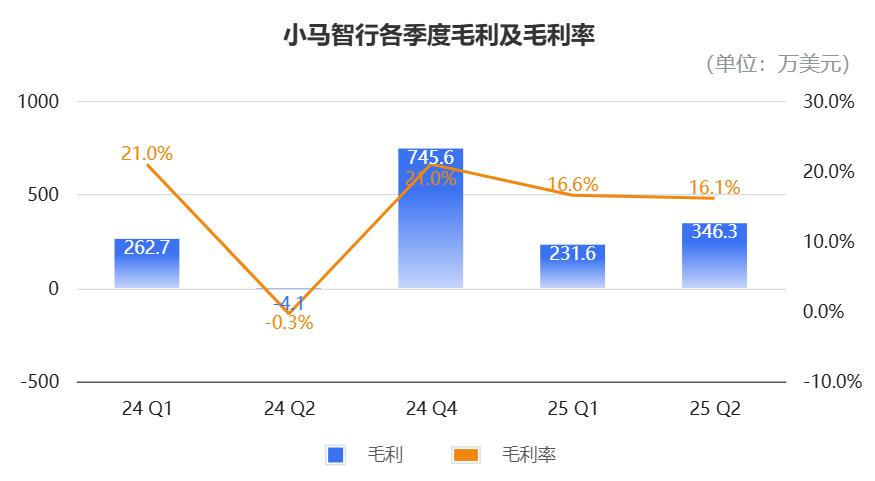

In terms of profit, Pony.ai's gross profit level increased significantly.

In the second quarter, Pony.ai's gross profit was 24.8 million yuan, significantly higher than the gross loss of 290,000 yuan in the same period last year.

Meanwhile, the company's gross profit margin in Q2 was 16.1%, while it was - 0.3% in Q2 2024.

Pony.ai stated that the significant increase in the gross profit margin was mainly because the company is promoting the strategy of "focusing on high - profit revenue business" in its Robotaxi and Robotruck services, which also reduced the volatility of the gross profit margin.

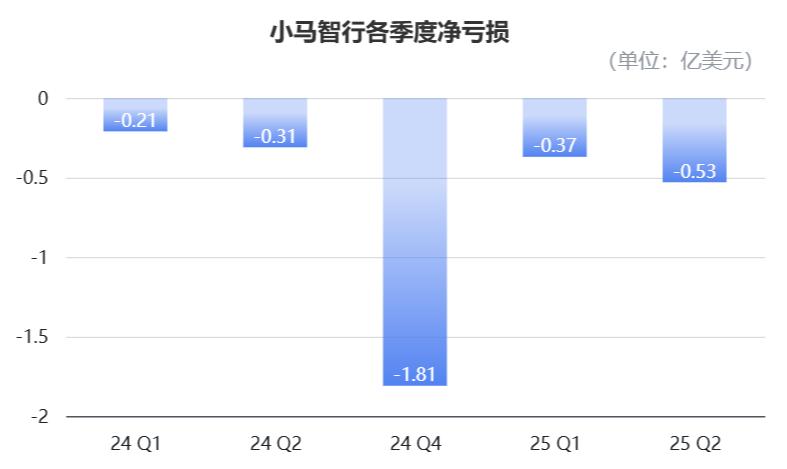

However, the net loss did not narrow this quarter.

The company's net loss in Q2 was 380 million yuan, higher than 220 million yuan in the same period last year. The adjusted net loss was 330 million yuan, a year - on - year increase of 52%.

The increase in gross profit while the expansion of the net loss actually corresponds to the increase in operating expenses.

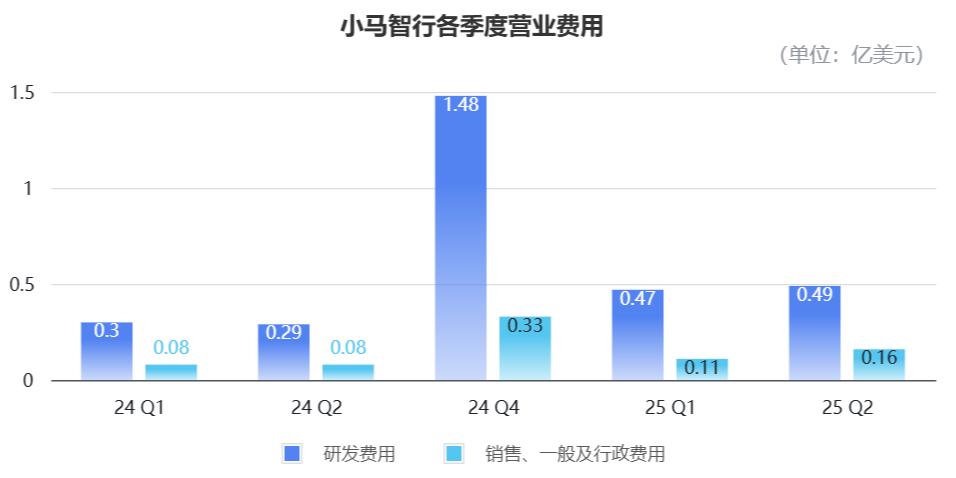

In the second quarter of this year, the company's operating expenses were 464 million yuan, a year - on - year increase of 75.1%.

Among them, research and development expenses were 350 million yuan, a year - on - year increase of 69.0%. The reason for the increase was the investment in the mass production of the seventh - generation vehicles and the increase in the salaries and benefits of R & D personnel to enhance technological capabilities.

Selling, general and administrative expenses were 113 million yuan, a year - on - year increase of 97.3%. This increase was due to the growth of professional service fees. Meanwhile, as the company is preparing for large - scale deployment, personnel expenses also increased.

Actually, it can be understood that Pony.ai's current increased investment is paving the way for a large - scale explosion.

Meanwhile, as of the end of the second quarter, the company's cash and cash equivalents, short - term investments, restricted cash, and long - term debt instruments for wealth management were approximately 5.356 billion yuan, indicating that it still has abundant cash reserves.

Therefore, after a simple analysis of Pony.ai's financial report, it can be found that the company's business, especially its Robotaxi services, has reached the verge of an explosion. Perhaps for this reason, well - known investor Cathie Wood invested 12.9 million US dollars in Pony.ai in a single day.

In the words of Peng Jun, the founder and CEO of Pony.ai:

The path to achieving positive unit economic benefits for Robotaxi is clearly visible.

What are the advantages of the improving unit economic benefits?

What is unit economic benefits?

Simply put, it refers to the revenue, cost, and profit brought by each unit product transaction.

Taking cars as an example, it means calculating how much money the manufacturer (or dealer) can actually earn after deducting the costs directly related to each car sold.

If the unit economic benefit is negative, it means "losing money on each car produced". The larger the scale, the greater the loss. If the unit economic benefit remains negative for a long time, it will put great pressure on the enterprise.

Therefore, the value of this internal indicator is very important when a company evaluates the pros and cons of its commercialization model.

So, how is the "improving unit economic benefits" of Pony.ai's Robotaxi reflected?

Actually, the clues can be found in this financial report:

As mentioned earlier, the company's Robotaxi revenue in Q2 increased by 157.8% year - on - year. If we further analyze its Robotaxi business, we can find that it can be divided into two parts: metered service revenue and project - based engineering solution services.

The metered service revenue, that is, passenger fares, is most closely related to ordinary people and can be most easily perceived by the outside world. In this quarter, according to Pony.ai, the passenger fare revenue soared by more than 300% year - on - year.

Moreover, Peng Jun reiterated the next - step goal, saying that the company is very confident that it will achieve the goal of 1000 Robotaxi vehicles by the end of 2025 - which is actually the break - even point per vehicle in the company's early planning.

This confidence is not blind but comes from two substantial progresses:

On the one hand, it comes from cost reduction.

This cost mainly refers to two parts. One is the cost of the vehicle itself, and the other is the operating cost of the fleet.

Looking at the vehicle itself, Pony.ai is currently promoting the mass production of the seventh - generation Robotaxi in cooperation with BAIC and GAC.

The vehicle body uses 100% automotive - grade components. The cost of the autonomous driving kit has been significantly reduced by 70% compared with the previous generation, and it has a designed service life of 10 years/600,000 kilometers.

In terms of fleet operation, Pony.ai's vehicle insurance costs are decreasing, and the ratio of remote assistants to vehicles is increasing.

The company plans to achieve a ratio of 1:30 between remote assistants and vehicles by the end of the year, which means higher efficiency in vehicle operation and monitoring.

On the other hand, the substantial progress comes from the scale expansion of Robotaxi.

The "scale" here has three meanings. Let's look at them separately:

Firstly, it refers to the fleet size. Since its listing, Pony.ai publicly disclosed its latest fleet size for the first time. The total number of Robotaxi vehicles has exceeded 500.

The production of the seventh - generation Robotaxi, which was launched in June, has completed the production capacity ramp - up and entered the stable production stage. More than 200 Robotaxi vehicles have been produced within two months.

Calculated in this way, with the production capacity ramp - up, an average of 100 vehicles are produced per month. So, it is indeed possible that the total fleet size will reach 1000 by the end of the year.

Secondly, it refers to the operating scope. Pony.ai's domestic and overseas operating scopes are both expanding rapidly.

In China, Pony.ai is currently the only company conducting fully driverless Robotaxi paid - operating services in Beijing, Shanghai, Guangzhou, and Shenzhen. The total operating area in first - tier cities has exceeded 2000 square kilometers.

Overseas, Pony.ai has a presence in the Middle East, Europe, and Asia. It has entered Seoul, South Korea, for 24/7 testing. In June, it launched testing in Lellingen, Luxembourg and plans to expand to more regions. It also plans to conduct the first road tests in Dubai this year and start fully driverless commercial operations next year...

Thirdly, it refers to the operating mode.

Pony.ai has conducted 24/7 autonomous driving tests in Beijing, Shanghai, Guangzhou, Shenzhen, and Seoul, South Korea. Currently, in some areas such as Guangzhou and Shenzhen, the