DJI enters the robot vacuum cleaner market. Companies like Yunjing and Dreame should be on high alert.

The already crowded floor cleaning robot market has welcomed a new player.

On August 6th, DJI announced the launch of its first floor cleaning robot, ROMO, bringing new variables to the floor cleaning robot industry that has already entered a red - ocean competition.

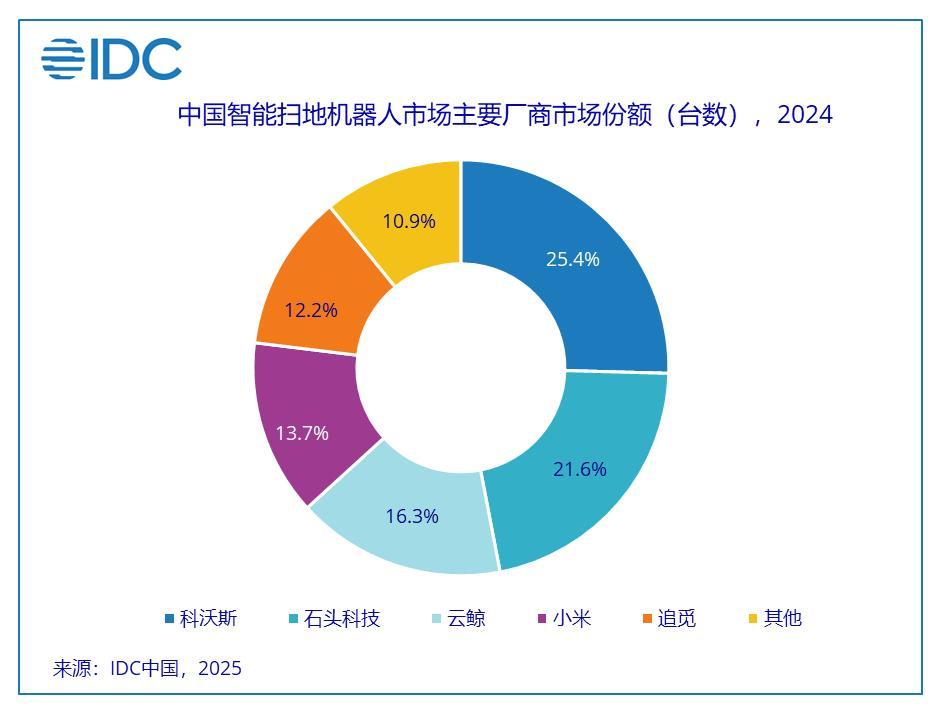

Before DJI entered the market, the floor cleaning robot industry had already formed an obvious head - effect.

According to the "Global Smart Home Device Market Quarterly Tracking Report" released by IDC, in 2024, the top five floor cleaning robot brands, including Ecovacs, Roborock, Yunjing, Xiaomi, and Dreame, accounted for nearly 90% of the domestic market share, leaving extremely limited space for other brands.

What drives new players to jump into this red ocean is the continuously growing market and the current low penetration rate.

According to IDC data, in the first quarter of 2025, the shipment volume of the Chinese floor cleaning robot market reached 1.188 million units, a year - on - year increase of 21.4%. The shipment volume growth rate has exceeded 20% for two consecutive quarters. At the same time, according to Statista statistics, the penetration rate of floor cleaning robots in China is about 6%, which still has a huge room for improvement compared with the generally over 10% penetration rate in European and American countries.

Before DJI entered the market, most of the latecomers in the floor cleaning robot track relied on ODM and sinking channels to quietly sell products. Among them, there were some traditional home appliance giants, but their technological contributions in this track were very small.

In fact, the floor cleaning robot track has not welcomed a truly powerful new player for a long time.

Why did DJI choose the floor cleaning robot track?

DJI's entry into this track was actually earlier than expected.

According to a report from "Jiadianwang", DJI's floor cleaning robot project was launched in 2020, and its R & D cycle has exceeded five years. The internal code name of this project is "Ground Space Intelligent Explorer", which concisely explains DJI's intention to apply its aerial technology to the ground.

According to another report from "LatePost", DJI postponed the release of its floor cleaning robot in 2023 and 2024 respectively. The report said that in May 2024, the floor cleaning robot project was even completely restarted. The reason was that after DJI CEO Wang Tao saw the product planned for launch, he immediately decided not to sell it and directly sell the second - generation product. A DJI insider said, "It's basically like making a new product from scratch."

With such an investment, DJI's intention is obvious. They want to find a mass - market track to expand the breadth of their hardware ecosystem.

In the global drone market, DJI has a market share of over 80%, with an overwhelming advantage. However, compared with traditional consumer electronics products, the user base of drones is small, and the market growth rate is slow. For the general public, drones are still in the category of "non - essential and low - repurchase".

In the action camera field, which DJI regards as its "second growth curve", although it is closer to consumers' daily needs than drones, the market size is still limited and the growth is slow. According to Frost & Sullivan data, the global action camera market size was 31.44 billion yuan in 2023 and is expected to reach 51.35 billion yuan in 2027, with a compound annual growth rate of only 13.0%.

Market demand has driven DJI to make breakthroughs in its hardware ecosystem. But why did it choose the floor cleaning robot track?

Currently, the solutions commonly adopted in this track include visual recognition, path planning, motor - electronic control coordination, and radar obstacle avoidance. These technologies are highly consistent with those used in aircraft. This means that DJI can directly apply the technologies and algorithms used in aircraft to floor cleaning robot products, skipping the early and arduous R & D stage.

A DJI floor cleaning robot R & D engineer revealed at a communication meeting before the release of ROMO: "Currently, with only minor adjustments to the visual positioning system used by DJI, the mapping accuracy can be improved by 30%."

Obviously, the underlying logic for DJI to target the floor cleaning robot track is that floor cleaning robots have broad market prospects. In the era of the lazy economy, freeing hands has become the pursuit of the younger generation, which has also provided a solid mass base for cleaning appliances, including floor cleaning robots.

Driven by market demand and supported by strong technological capabilities, DJI has for the first time shifted from the sky to the ground, acting as a catfish to stir up this mature market.

Brand entry is the appearance, and technological invasion is the core

In the current floor cleaning robot market, the four leading brands have built their own barriers, but they also have obvious weaknesses.

As the technological benchmark in the industry, Roborock's moat is mainly reflected in its brand image in the high - end market, its strong in - house R & D ability for the whole machine, and its global layout with overseas channels contributing more than 40% of its revenue. Roborock's products have always maintained a high level in terms of technological stability and user experience, and the accuracy and reliability of its laser navigation algorithm are well - known in the industry.

However, Roborock's weaknesses are also obvious. Its long - term reliance on the laser tower solution has limited its product form innovation, and the problem of limited body height has never been fundamentally solved. It is relatively conservative in the application of visual algorithms, and its steady innovation rhythm may cause it to miss disruptive opportunities.

As an established player in the industry, Ecovacs' greatest advantage lies in its strong supply - chain integration ability and large - scale production advantage. At the same time, it has rich experience in channel construction and brand marketing, especially its stronger penetration ability in the sinking market compared with its peers.

However, Ecovacs is facing the challenge of continuous pressure on profit margins. Its R & D investment as a proportion of revenue is significantly lower than that of Roborock, and it mostly adopts a "following" strategy in technological innovation, which makes it relatively passive in the face of technological changes.

The rise of Yunjing has proven the power of single - point breakthrough. Its original concept of the "automatic mop - washing" fully automatic base station has, to a certain extent, helped users solve the pain points in key links.

However, Yunjing's weakness also lies here. Its product line is relatively single, and its growth ceiling is obvious. After the "cleaning base station" standard it pioneered was popularized in the industry, Yunjing quickly fell into the quagmire of homogeneous competition, and its relatively weak accumulation in core navigation technology will be infinitely magnified in the new round of competition.

Dreame Technology represents another development path. With high - speed digital motors as its core technology, it has horizontally expanded to multiple categories such as hair dryers, floor scrubbers, and robot dogs, and has achieved rapid growth through strong marketing promotion. Dreame does have its own unique advantages in motor technology, and the suction power and cleaning effect of its products have always been good.

However, the problem Dreame faces is that its R & D resources are scattered across multiple categories, and the energy of its core team may be diluted. More importantly, its proud motor advantage may be significantly diluted when facing DJI, a "professional in power systems".

DJI's entry has brought new variables to the industry. DJI hopes to break the relatively solidified market of floor cleaning robots with a pure - vision solution. This also means that the choice of technological route will become the new direction leading market changes in the future.

The currently commonly used laser navigation solution in the industry is mature and reliable, but the cost and form limitations are becoming increasingly prominent. While the vision - based navigation relied on by DJI has broad prospects, the technological threshold and mass - production difficulty are relatively high. At this critical technological turning point, whoever can achieve a breakthrough first will take the initiative in the next round of competition. DJI's entry, precisely at this most sensitive time, directly challenges the technological foundation of existing players with its accumulation in vision technology.

However, the choice of technological route requires a longer - term market precipitation and the cost of user education. During the technological game period, the existing market advantages will be magnified.

For leading enterprises like Roborock and Ecovacs, their positions are relatively stable in the short term. Roborock's brand image in the high - end market and its global channel layout form a solid defense line, while Ecovacs has strong anti - risk ability with its multi - brand matrix and scale advantage.

They have enough time and resources to observe, learn, and adjust their technological routes. They may even quickly make up for their visual technology shortcomings through acquisitions or cooperation.

However, Yunjing and Dreame will face more direct challenges.

Yunjing's success is based on the single - point innovation of the "fully automatic base station". When DJI enters the market with better navigation technology and equally powerful base - station functions, Yunjing's single product line gives it almost no strategic depth, making it extremely difficult to defend.

Dreame's situation is also not optimistic. Its proud "high - speed motor" differentiation advantage will be significantly diluted when facing DJI, which is more professional in power systems. At the same time, its R & D resources scattered across multiple home appliance categories may make it difficult for it to concentrate its firepower to quickly respond in the core battlefield of floor cleaning robots.

DJI also has three hurdles to cross

However, DJI is not invincible. To break through in the highly competitive floor cleaning robot market, it will also face many challenges.

First is the challenge at the supply - chain level. For the high - performance visual module used in DJI's ROMO, the mass - production yield rate and cost control will be the key to its large - scale production. Any technological problems that occur during the mass - production process may affect its market promotion rhythm.

It is reported that DJI's ROMO floor cleaning robot was originally planned to be released in June this year, but the release was postponed to August due to some problems. According to a DJI insider, the main reason for the postponed release was problems encountered in the mass - production of ROMO - related components.

This is not the first time that DJI has postponed the release of a new product due to yield - rate problems. As early as the release of the Mavic 2 series in 2018, the release was postponed by one month due to mass - production difficulties with the modular camera and the 360° obstacle - avoidance system. In 2025, the release of the Mavic 4 Pro was also postponed by three weeks due to a defect in the electronic ND filter technology.

Secondly, the industry - wide problem of low gross profit margins will also bring more uncertainties to DJI.

Ecovacs, once known as the "king of floor cleaning", has seen a continuous decline in net profit since 2022, with a decline of over 60% in 2023. In 2024, the company's revenue reached 16.542 billion yuan, but its net profit was only 806 million yuan, which is still less than half of the peak in 2021.

Another leading company, Roborock, is not in a much better situation. In 2024, it ranked first in global sales volume and sales revenue, with a year - on - year increase of 20.7% in shipment volume. Its revenue reached 11.945 billion yuan, a year - on - year increase of 38.03%, but its net profit attributable to shareholders decreased by 3.64% year - on - year to 1.977 billion yuan.

In the first quarter of 2025, the divergence between revenue and profit further intensified. Against the background of national subsidies, Roborock's revenue increased by 86.22% year - on - year, but its net profit attributable to shareholders decreased by 32.92% year - on - year.

Both companies' financial reports have mentioned the problems of rising costs and declining gross profit margins due to market competition. Obviously, this has become the norm in the current floor cleaning robot industry, and even DJI cannot be spared.

In addition, DJI also has to face the challenge of sales channels. Different from traditional "niche - market" categories such as drones and action cameras, floor cleaning robots face a larger market space and more sinking sales channels.

The three models of ROMO floor cleaning robots are priced at 4,699 yuan, 5,399 yuan, and 6,799 yuan respectively, significantly higher than the industry average selling price. According to IDC statistics, the average unit price of global floor cleaning robots in 2024 was only 452 US dollars, about 3,200 yuan. Obviously, DJI's products set themselves as high - end products from the beginning of their release.

To sell more high - end products in the Chinese market and even the global market, the construction of more sinking channels has become a top priority.

The research report data released by GF Securities in 2024 confirms this. In 2024, the average online selling price of floor cleaning robots in the Chinese market was 3,282 yuan, while the average offline selling price was as high as 4,710 yuan. This means that building a more complete sinking channel is the core lever to influence the purchasing decisions of mid - to - high - end consumers.

Fortunately, DJI has already established a relatively complete offline channel. Its stores are spread across major Chinese cities, and they can provide a ready - made offline display and experience platform for ROMO in a short time, thereby significantly reducing the decision - making threshold for high - end consumers and providing the most critical channel fulcrum for DJI to quickly open up the offline high - end market.

In the future, to continuously break through the market scale, expanding and sinking the existing channels is still the only way for DJI to continuously break through the market scale.

However, even facing many challenges, DJI's entry means that a new round of reshuffle in the floor cleaning robot industry is imminent.

In this competition, whoever can truly break through the shackles of the existing market and technology will seize the opportunity and break through first in the future red - ocean competition.

This article is from the WeChat official account "Tencent Technology", author: Mumu. It is published by 36Kr with authorization.