The AI boom has triggered a global wave of wealth creation, giving rise to a new batch of billionaires.

Currently, the artificial intelligence (AI) craze has rapidly sparked the most eye - catching wealth - creation wave in recent years. Behind this trend, AI startups such as Anthropic, Safe Superintelligence, OpenAI, and Anysphere have all completed huge financings this year. The new funds not only inject strong momentum into the AI industry but also give rise to dozens of new billionaires.

As time goes by, especially after the initial public offerings (IPOs) are gradually implemented, the AI wealth currently accumulated in the private sector will accelerate into the circulation. This process will not only reshape the wealth distribution pattern but also bring unprecedented historical opportunities for asset management companies. There will be new expansion spaces in terms of asset allocation, risk management, and personalized services.

The Explosive Growth of AI Wealth

According to data provided by CB Insights, a market intelligence and data analysis company, there are currently 498 AI "unicorns" (private AI companies valued at over $1 billion) globally, with a total valuation of up to $2.7 trillion. Among these companies, 100 were established after 2022. In addition, there are more than 1,300 AI startups valued at over $100 million.

This wealth wave is not limited to the private sector. The stock prices of listed AI - related companies such as Nvidia, Meta, and Microsoft have continued to rise, the business of data center and computing power infrastructure companies has increased significantly, and combined with the high salaries of AI engineers, the scale of personal wealth accumulation far exceeds that of the previous two technological waves. Andrew McAfee, co - director and chief researcher of the MIT Initiative on the Digital Economy, said, "Looking back at the data of the past 100 years, we have never witnessed a historical precedent of wealth creation on such a scale and at such a speed."

The New Generation of AI Billionaires

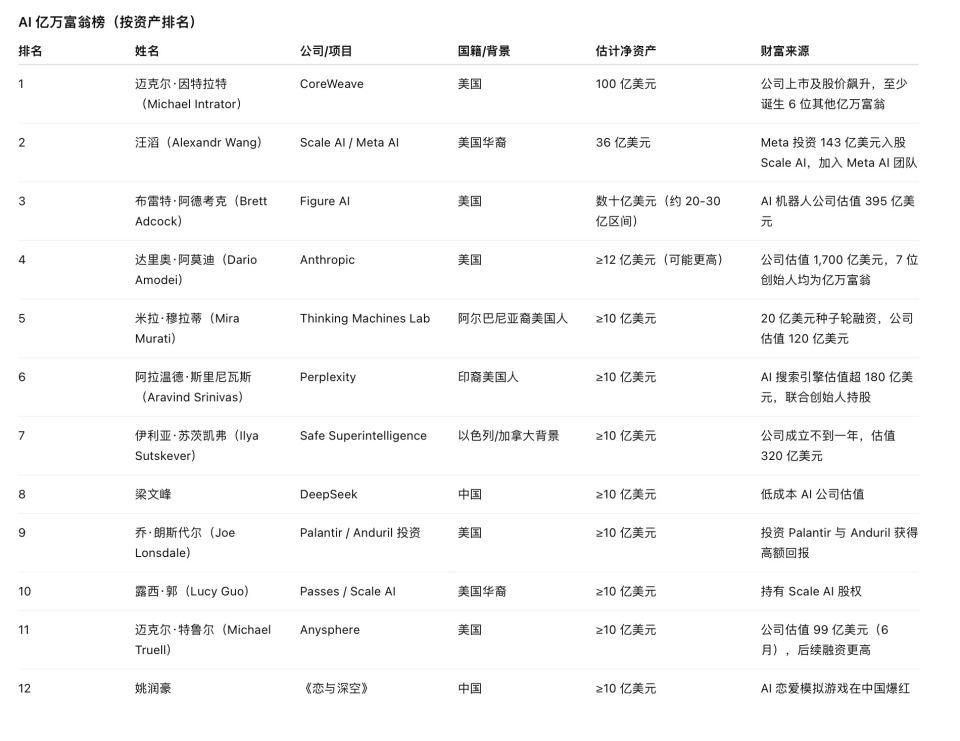

Ranking of newly - emerged AI billionaires with a net worth of over $1 billion

A group of new billionaires are emerging with the soaring valuations of AI companies. According to an estimate by Bloomberg in March this year, the world's four largest private AI companies have created at least 15 billionaires with a net worth of over $1 billion, and their total net assets reach $38 billion. Since then, more than a dozen "unicorn" enterprises have stood out.

After leaving her position as the former chief technology officer of OpenAI in September last year, Mira Murati founded the startup Thinking Machines Lab in February this year. It is reported that Murati completed the largest - ever seed - round financing in July this year, with an amount of $2 billion, valuing the company at $12 billion.

Anthropic is in talks to raise $5 billion at a valuation of $170 billion, almost three times its valuation in March this year. According to people familiar with Anthropic, the company's CEO, Dario Amodei, and the other six co - founders may now be among the billionaires with a net worth of over $1 billion.

Anysphere was valued at $9.9 billion in its financing in June. A few weeks later this year, reports said the company's valuation had soared to between $18 billion and $20 billion, which could make its 25 - year - old founder and CEO, Michael Truell, worth over $1 billion.

Nevertheless, most of the AI - related wealth creation is still concentrated in private companies, making it difficult for equity holders and founders to cash out immediately. Different from the large number of company listings during the Internet boom in the late 1990s, current AI startups can remain private for a longer time with the continuous investment from venture capital funds, sovereign wealth funds, family offices, and other technology investors.

Meanwhile, the booming secondary market for private equity provides a liquidity exit channel for shareholders of private companies. Through structured transactions, equity holders can transfer their rights and interests to other investors. In addition, more and more founders are using methods such as equity - backed financing to activate their assets, further expanding the scope of capital operation.

The AI Craze Is Highly Concentrated in Silicon Valley, USA

OpenAI is planning a secondary - market sale of private equity to provide cash support for its employees, and its valuation may rise from $300 billion in March to $500 billion.

Dozens of private enterprises are being acquired or merged, also providing a cash - out channel for investors. After Meta invested $14.3 billion in Scale AI, its founder, Alexandr Wang, joined Meta's artificial intelligence team. According to CB Insights, since 2023, there have been 73 liquidity events, including mergers and acquisitions, IPOs, reverse mergers, or controlling transactions. After Meta's investment, Lucy Guo, another co - founder of Scale AI (who left in 2018), bought a luxury mansion in the Hollywood Hills of Los Angeles for about $30 million.

However, this AI craze is still highly concentrated in the San Francisco Bay Area of the United States, reminiscent of the Internet bubble era. According to the Silicon Valley Institute for Regional Studies, Silicon Valley companies raised over $35 billion in venture capital last year. Data from New World Wealth and Henley & Partners shows that the number of billionaires in San Francisco (82) has exceeded that in New York (66), and the population of millionaires in the Bay Area has doubled in the past decade, while that in New York has only increased by 45%.

According to Sotheby's International Realty, the sales volume of luxury mansions worth over $10 million in San Francisco reached a record high last year. The soaring rents and housing prices are largely attributed to the AI craze. This marks a drastic turn for a city that was deeply trapped in a "decline cycle" a few years ago.

"The geographical concentration of this AI wave is astonishing," McAfee said. "The talents who can found, finance, and grow technology companies are still concentrated here. For the past 25 years, people have always said that 'the era of Silicon Valley is over' or that some place will become the 'new Silicon Valley', but Silicon Valley remains Silicon Valley."

The Liquidity Trend of AI New - Rich Wealth

As time goes by and companies go public, the wealth of many private AI companies will gradually be converted into liquid assets, bringing historical opportunities for wealth management institutions. According to the observations of technology consultants, major private banks, comprehensive securities firms, independent advisors, and boutique institutions are all actively approaching the elite in the AI field, hoping to win their business.

However, similar to the Internet - era billionaires, it may not be easy for traditional wealth management companies to attract the new AI rich. Simon Krinsky, an executive director of Pathstone and former managing director of San Francisco's Hall Capital Partners, pointed out that most of the AI - related wealth is still locked in the equity of unlisted companies and is difficult to directly convert into manageable assets. He said, "The truly liquid part of this wealth is actually very limited. Although there are some ways to cash out, the scale of liquid funds is much smaller compared to the employees of listed technology companies such as Meta or Google."

In the future, this wealth will gradually release its liquidity and become high - quality resources that wealth management institutions compete for. Krinsky believes that the wealth management behavior of AI billionaires may be similar to that of the Internet new - rich in the 1990s. Initially, these Internet new - rich would use their available funds to invest in technology companies they were familiar with - these companies usually came from their social circles, colleagues, or co - investors. He said, "They tend to invest in companies similar to the source of their wealth."

However, after learning the lesson of over - concentrating wealth in high - risk industries, Internet billionaires began to turn to professional wealth management. As natural changemakers, many of them even tried to reshape the wealth management industry in their own ways. For example, Jim Clark, the founder of Netscape, founded MyCFO because he was dissatisfied with traditional banking.

Krinsky said that today's AI entrepreneurs are likely to follow the same path. They may use technological means to revolutionize the wealth management industry, just as generative AI has shown its potential to increase customer service efficiency by 70% and shorten the product development cycle by 25%.

Although AI entrepreneurs may bring about changes, ultra - high - net - worth AI founders will ultimately need the customized services provided by professional wealth management teams, including tax planning, estate arrangement, asset allocation, and risk - diversification strategies. After all, after the burst of the Internet bubble in 2000, the market's demand for professional wealth management increased significantly, and this experience also applies to the AI era.

This article is from "Tencent Technology", author: Wuji. Republished by 36Kr with permission.