The largest IPO this year: Figma defines the most popular AI scenario | Krypton - Hard Tech

Author | Song Wanxin

Editor | Huang Yida

A new star tech stock has emerged. The collaborative design platform Figma became the focus of the market with a 250% surge on its first day of listing.

On the day of Figma's listing, it opened at $83, more than doubling its offering price of $33. During the session, it once approached $125, a gain of over 277%. It finally closed at $115.5, a 250% jump on the first day, with a market value reaching $56.3 billion.

Notably, Figma's IPO subscriptions were nearly 40 times oversubscribed. In contrast, the subscriptions for Circle, the first stablecoin stock that became extremely popular, were only 20 times oversubscribed.

Nowadays, there are numerous AI application targets. Why is Figma so strongly pursued by capital? Analyzing Figma's business, it may be highly representative, almost hitting all of Wall Street's expectations for AI: vertical scenario applications, high monetization efficiency, and solving the problem of low stickiness in most AI applications.

01 Cloud - Collaborative Adobe

In the creative software industry, the three companies currently attracting the most attention are Adobe, Canva, and Figma. All three focus on graphic design, but Canva and Adobe focus on graphic and image design, while Figma focuses on UI/UX design for apps and web pages.

In the UI/UX field, Figma climbed to the top position in market share in 2020 and has maintained it ever since.

The key turning point in Figma's market share growth was its strategic adjustment during the pandemic. Originally, the company's products were mainly targeted at professional designers. To adapt to the trend of cloud - based office work, the company launched a series of new products, covering all front - end workflows. This directly increased the number of users and user stickiness, creating a growth flywheel for Figma.

After that, Figma essentially transformed from a design software into a "front - end collaborative development operating system."

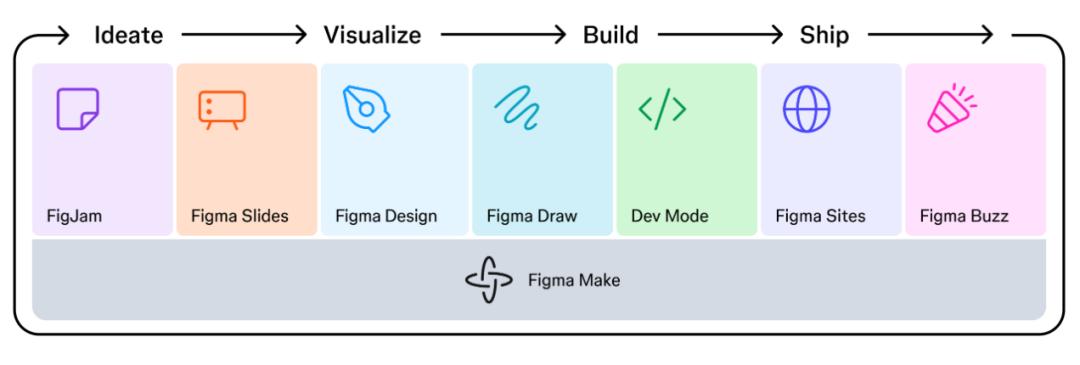

Figma's current product matrix design mainly consists of an ecosystem of multiple products, enabling different front - end development positions to jointly participate in the same project on the Figma platform.

In the prospectus, Figma described how several of its products form a workflow platform - FigJam, Figma Slides, Figma Design, Figma Draw, Dev Mode, Figma Sites, and Figma Buzz, covering the entire process from a creative idea to a product in the hands of users.

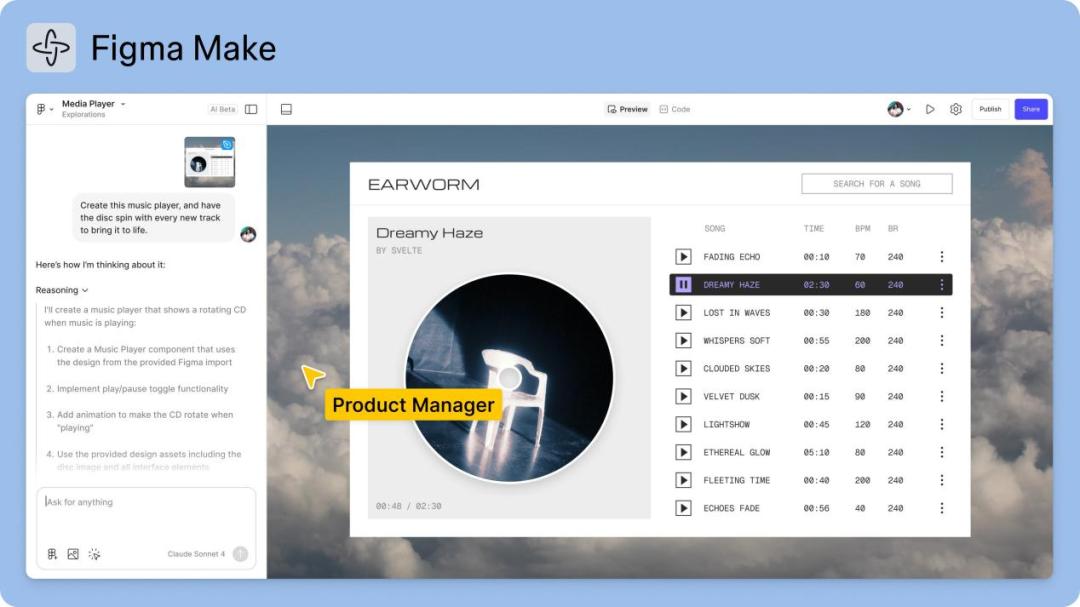

Among them, the AI product Figma Make is integrated into the underlying layer of the entire platform, which can empower every role in the entire workflow. This plays a significant role in connecting complex requirements.

For example, front - end engineers can use Figma Make to quickly generate a basic code directory from a finalized Figma design draft. For non - developer groups such as designers and product managers, they can generate interactive prototypes based on UI diagrams created in Figma.

(Source: Figma prospectus)

Through such a product structure, Figma has bound various front - end development - related positions to its platform. According to the Figma prospectus, Figma currently has 13 million monthly active users, of which only one - third are designer users, and the remaining two - thirds include front - end engineers, product managers, marketing personnel, and other functions.

When office relationships and processes are strongly bound to a platform, user stickiness will naturally increase, and the industry's dominant position will become more stable.

Figma pointed out in the prospectus that its ability to quickly establish so many vertical demand applications is due to the fact that it built its software platform on the browser at an early stage. This technological foundation allows files in different formats and files of the same format but different versions in design work to be compatible, thereby achieving the effect of inter - connection and collaboration among different job types.

This workflow model that breaks the "islands" in design is Figma's revolutionary innovation, which is why many industry insiders believe that Figma is a typical disruptive technology company.

In terms of business model, Figma adopts a typical SaaS model - individual designers within an enterprise can use basic functions for free. As the number of users increases, it spreads to the entire team, and finally converts into paying enterprise users.

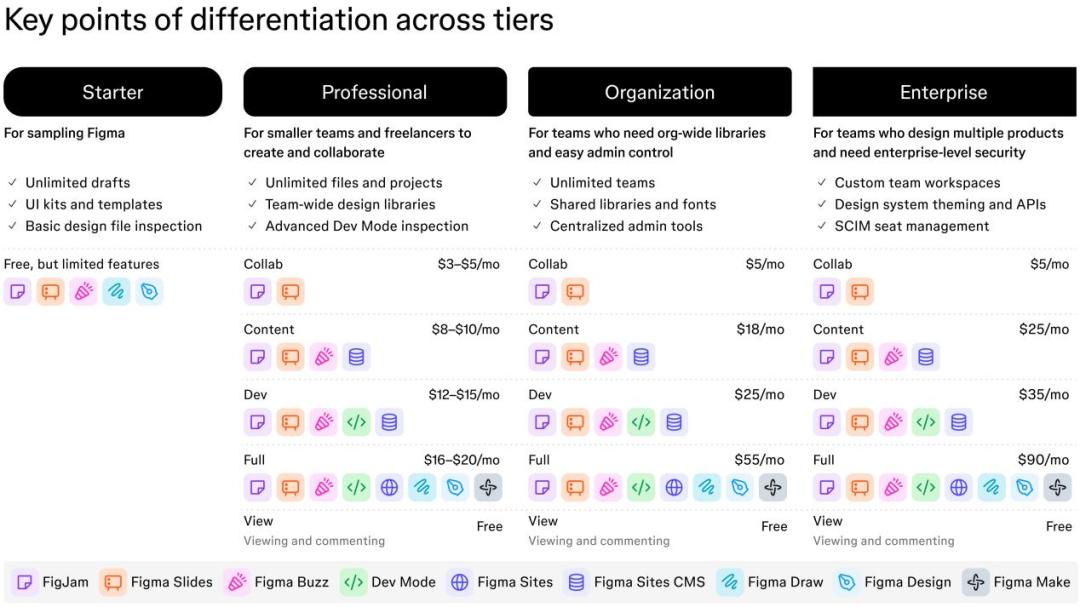

The prospectus shows that Figma's subscription - based payment model designs different packages for different job requirements and workflows. Under the three major categories of Professional, Organization, and Enterprise, there are product packages for four usage scenarios: Collab, Content, Dev, and Full, with corresponding prices ranging from $3 per month to $90 per month.

(Source: Figma prospectus)

Figma said that nearly 70% of its revenue last year came from customers of the Organization and Enterprise subscription plans. It can be seen that Figma's B - end customers are the main source of revenue. Compared with C - end users, the approach of gradually increasing penetration within a company based on the workflow is obviously more efficient.

02 High Stickiness and High R & D Investment

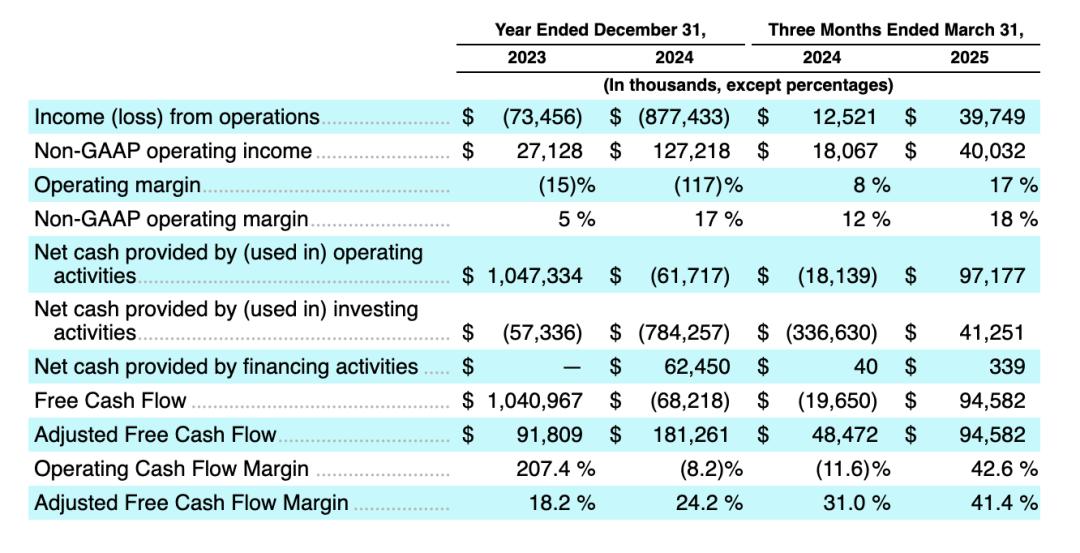

Through the PLG (Product - Led Growth) strategy and the SaaS model focusing on B - end users, Figma's financial data shows a solid foundation.

(Source: Figma prospectus)

The prospectus shows that in terms of revenue, Figma achieved revenue of $749 million in 2024, a year - on - year increase of 48%, outpacing all US software companies in terms of growth rate. In the first quarter of this year, revenue reached $228 million, with a year - on - year growth rate of 46%, similar to the full - year growth rate in 2024. Based on this, the rolling 12 - month revenue can be calculated as $821 million.

According to institutional estimates, from 2021 to 2025, Figma achieved a high compound annual growth rate of 53% in revenue.

In terms of profit, Figma's gross profit margin remained at around 90%. With the support of high gross profit, the company has passed the break - even point and achieved operating profit in the fourth quarter of last year and the first quarter of this year. The high - speed growth of cash flow in previous years has allowed Figma to gradually enter a virtuous cycle of self - financing.

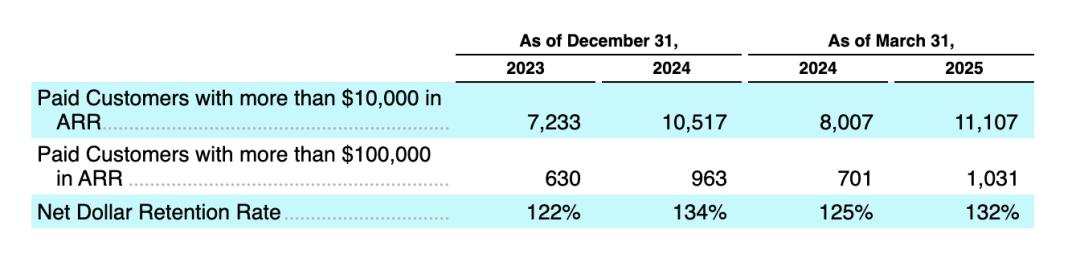

From Figma's prospectus, the growth of its top - paying B - end customers is quite remarkable. Data shows that as of March this year, the number of paying customers with an ARR (Annual Recurring Revenue) of over $10,000 increased by 39% year - on - year, and the number of customers with an ARR of over $100,000 increased by 47% year - on - year.

The prospectus points out that as of March this year, 78% of the Forbes Global 2000 companies use Figma, but only 24% of these customers have an ARR of over $100,000, which means there is still significant room for the company to penetrate the market in the future.

(Source: Figma prospectus)

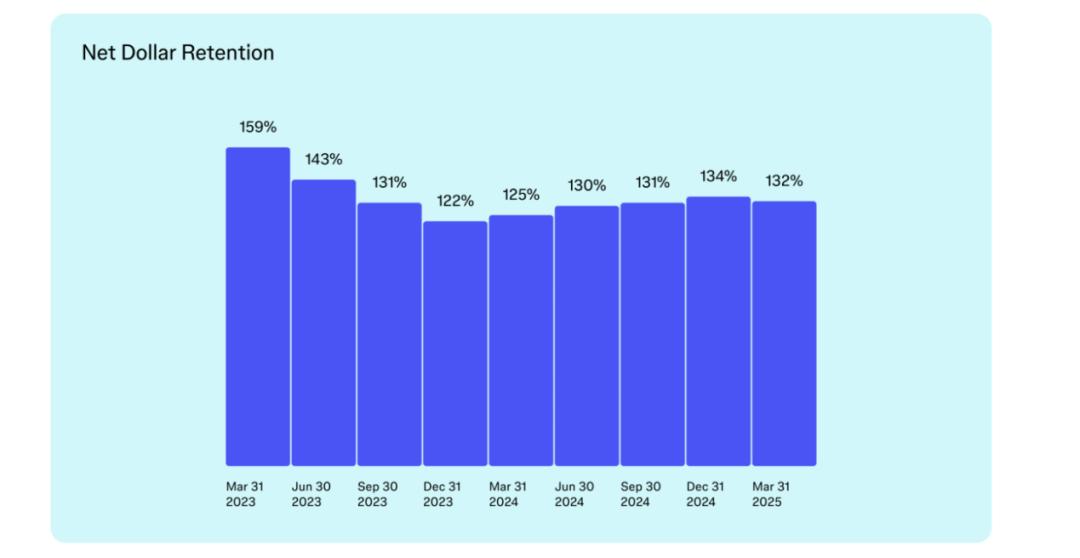

For SaaS companies, Net Dollar Retention is a key indicator to measure the revenue retention of existing customers. From this indicator, after Figma launched the product FigJam in 2022, its net revenue retention reached a peak of 159% in the first quarter of 2023 and then declined throughout the year. Figma explained that this was due to the impact of the macro - economic downturn on corporate budgets.

Since 2024, with the stabilization of the macro - economy and the launch of the flagship product Dev Mode, the company's net revenue retention indicator has gradually recovered and stabilized at around 130%.

(Source: Figma prospectus)

In terms of profit, the prospectus shows that Figma had a net loss of $732 million in 2024, mainly because the company recorded stock option grant expenses of $948 million in that period, which had a significant impact on the company's net profit attributable to shareholders. Looking at the more accurate Non - GAAP profit data, in 2023 and 2024, it achieved profits of $27 million and $127 million respectively.

In terms of R & D investment, the R & D expenses in 2023, 2024, and the first quarter of 2025 were $165 million, $751 million, and $70 million respectively. Among them, the stock compensation expenses in the R & D expenses in 2024 were $500 million. After excluding this part of the impact, the R & D expense ratio basically remained above 30%.

In comparison, Adobe's R & D expense ratios from 2022 to 2024 were 17%, 18%, and 18% respectively. The R & D expense ratios of most large software companies are generally above 20%. It can be seen that Figma has a relatively high R & D investment intensity, which is conducive to maintaining technological leadership.

Overall, Figma's total operating expense ratios in the first quarter of 2023, the first quarter of 2024, and the first quarter of this year were 97.8%, 83.8%, and 74.1% respectively, showing a downward trend.

It can be inferred that in the first quarter of this year, when Figma's revenue increased by 46% year - on - year, its operating expenses only increased by 29%, indicating that the scale effect of the business has gradually emerged. As the number of users and revenue continue to grow, the company's costs will be further diluted, driving the expense ratio to decline further.

It can be seen that Figma has entered the stage of performance realization. Revenue growth is the core support, and high R & D intensity helps to consolidate the company's high - tech attributes. Looking to the future, based on high - barrier businesses as a competitive foundation, with the continuous penetration of AI tools, further strengthening of the technological attributes will be the core driving force for the company to increase its valuation ceiling in the future.

03 AI Further Drives Valuation

In the secondary market, the investment logic of the AI sector in the US stock market this year has shifted from being driven by computing power last year to the feedback of application performance. From Applovin, Palantir to Figma, their solid fundamentals, combined with the practical application prospects of AI in vertical scenarios, have made them the targets of capital inflows.

In the case of Figma, it is regarded as a disruptor of Adobe, representing the replacement of old productivity by new productivity. A research report from First Shanghai pointed out that Figma is now a cloud - collaborative version of Adobe. If its story can be realized, it will be the most anticipated scenario in the market: vertical AI + cloud - collaborative Adobe.

AI was mentioned more than a hundred times in the prospectus, obviously indicating that it is the most important strategic position for Figma in the next step.

In the prospectus, Figma said that the rapid evolution of generative AI and the changes in the market competition pattern are reshaping the design software industry in which it operates. To consolidate its leading position, the company is accelerating the layout of AI functions.

It should be noted that Figma's current high - speed growth comes from the high stickiness brought by "cloud collaboration" rather than AI, which has just started in the company's business. For example, the flagship AI product Figma Make was launched in May this year, and its impact on performance still needs to be verified.

Objectively speaking, although Figma's AI content is still relatively low at present, the initial feedback on AI products such as Figma Make from the industry is quite positive, which gives the market confidence in its future AI - related performance.

Many market voices believe that Figma Make is one of the representative products of AI Native because its greatest advantage is that it is embedded in Figma, enabling seamless integration with the Figma ecosystem and thus being closer to the user's workflow in operation.

(Source: Figma prospectus)

MarketWatch pointed out that Figma not only introduces generative AI capabilities into design collaboration tools but also positions itself as an end - to - end platform from "idea to prototype." Its functions such as Make, Buzz, and Slides form a complete AI - driven product line.

This is what differentiates Figma from other application products in the market that focus on single - point AI capabilities, enabling it to solve more complex requirements.

Andrew Reed, a partner at Sequoia Capital and a member of the Figma board of directors, once said that compared with 2022, Figma's capabilities in the AI field are now more solid, which has become the key to driving the re - evaluation of its valuation.

Currently, the high valuation of Figma in the secondary market is mainly based on the expectations brought by AI. On the basis of its solid product strength, high - speed business growth, and monopoly position in the segmented market, the company's reasonable development of AI is of revolutionary significance, not only strengthening the technological barrier but also greatly expanding the imagination space.

Therefore, even though Figma's AI has not yet translated into performance, the market is willing to give it a relatively high valuation based on positive expectations. As of August 11, after several days of adjustment, Figma's stock price has fallen back to around $80, with a latest market value of $40 billion and a corresponding price - to - sales ratio of 48x. Horizontally, the price - to - sales ratios of most SaaS companies are between 10x and 15x. The price - to - sales ratio of CoreWeave, a cloud service company that went public in March this year, is 21x. Therefore, Figma's high valuation requires caution regarding the risk of a correction.

Typical examples include Circle