In - depth Observation of WRC 2025: We've compiled the six most notable robot investment themes and potential companies for you.

When pushing open the north gate of Yichuang International Convention and Exhibition Center, the low - pitched exclamations of the crowd greet you. Some people are holding their phones to catch the moment when a boxing - shaped robot swings its arm, while others are so captivated by the precise movements of a robotic arm picking up scattered parts that they can't take their eyes off it for a single second.

This year's WRC is more like a major test of "delivery capabilities". More than 500 enterprises from around the world have brought new products in all categories of industrial, service, special - purpose, and humanoid robots to the stage. Over 100 new products are making their debuts, among which 50 complete - machine manufacturers are concentrating on the "humanoid" track.

An investor at the scene whispered with emotion, "Last year's keyword was'showcasing skills', while this year it's 'being able to do practical work'." And the prediction from Shoucheng Capital is even more straightforward - the global shipments of humanoid robots will exceed 10,000 units this year, and there will be five or six single manufacturers with shipments exceeding 1,000 units.

As a first - tier expert consulting firm deeply rooted in Silicon Valley, we have not only sorted out six robot investment themes that are most worthy of attention for investors, but also selected the most representative listed companies and high - potential Silicon Valley startups under each theme.

Next, let's follow the pulse of the exhibition site and the direction of global capital to see which names are moving from the demonstration stage to the production line and which Silicon Valley startups are standing at the forefront of the next wave of growth.

Six Major Themes of Robot Investment

Behind "delivery" lies a huge and precise industrial chain. Any robot that can "do practical work" relies on the coordinated operation of its "brain, nerves, joints, muscles, and eyes". For investors in the secondary market, understanding these six major themes is the key to accurately identifying the core targets in different segments.

Theme 1: Embodied AI and Software Platforms

Hardware determines the lower limit of a robot, while AI software determines its upper limit. This is the fundamental difference between "being able to do work" and "being smart enough to do work", and it is also the area with the fastest - growing future value.

When large models evolve from language (LLM) to behavior (LBM - Large Behavior Models), robots can truly understand the physical world and perform complex tasks. This is also the ultimate moat for all complete - machine manufacturers.

Market Representatives:

NVIDIA: It is the absolute leader in underlying computing power. It not only provides GPUs but also offers "operating - system - level" support for the entire industry through the Project GR00T humanoid robot basic model and the Isaac Sim simulation platform, attempting to replicate its ecological advantages in the AI field.

Microsoft: Through its strategic investment in OpenAI, it is deeply involved in empowering robots with large models. Its Azure cloud platform also provides massive computing power for the model training of countless robot companies.

High - Potential Silicon Valley Startups:

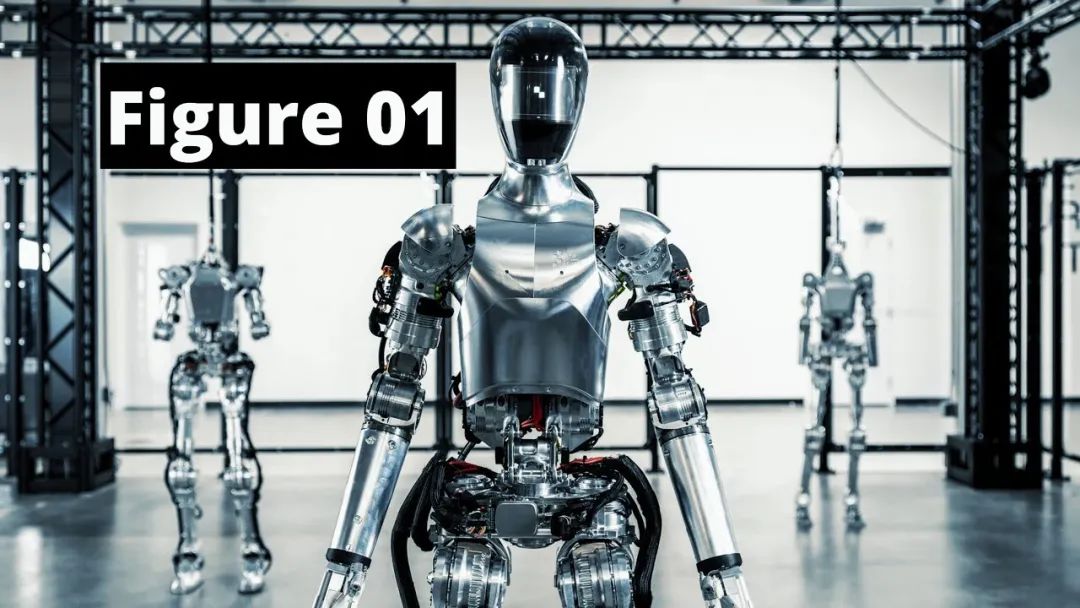

Figure AI: It is the hottest star in the market. Its Figure 01 robot integrates OpenAI's large model and has received investments from giants such as Microsoft, NVIDIA, and Amazon founder Jeff Bezos. It is a model of the combination of "top - notch AI" and "top - notch hardware".

Sanctuary AI: It focuses on the general artificial - intelligence robot Phoenix™ and is equipped with its self - developed Carbon™ AI control system. It emphasizes "thinking, learning, and acting like a human" and is a strong competitor on another "full - stack self - developed" technology route.

Theme 2: Performance and Cost of Core Hardware

Every smooth and powerful movement of a robot relies on the precise support of its "joints" (reducers), "muscles" (servo systems), and "tactile sense" (force sensors).

The performance and cost in this field directly determine the speed and scale of the commercialization of robots. Especially for humanoid robots that pursue cost - effectiveness, "reducing costs and increasing efficiency" is the core proposition, which also provides great opportunities for the domestic supply chain.

Market Representatives:

Reducers: Green Harmonic, Shuanghuan Transmission. As one of the hardware components with the highest cost proportion in robots, the localization process of harmonic reducers and RV reducers is the focus of market attention.

Servo Systems: Inovance Technology. As a leader in the industrial automation field, it has rich experience in core components such as robot servo systems and controllers and is a key player in the domestic supply chain.

Sensors: Coliy Sensor. Torque sensors endow robots with the ability of fine - operation and are the key to achieving safe human - robot interaction. The market demand is booming as the intelligence level of robots increases.

Theme 3: Multimodal Perception Systems

For robots to "do work" in unstructured home, factory, and outdoor environments, they must have perception capabilities beyond traditional 2D cameras. Multimodal perception that integrates 3D vision (depth cameras), LiDAR, force sense, and hearing is a necessity for robots to "see" and "understand" the complex world.

Market Representatives:

Orbbec: It is one of the few companies in the world that master core 3D vision perception technology. Its depth - camera products have been widely used in various service robots and consumer electronics products.

KEYENCE: It is the absolute leader in the global industrial vision and sensor field. Its high - precision and high - stability products are the "standard eyes" for robots in the high - end manufacturing field.

High - Potential Silicon Valley Startups:

Strella Biotechnology: It is an excellent example of "perception implementation". The company uses its sensing technology to monitor the ripeness of fruits, helping distributors reduce food spoilage. This demonstrates the ability of advanced perception technology to create significant commercial value in specific vertical industries.

Theme 4: Intelligent Upgrade of Industrial Robots

Don't just focus on humanoid robots. The industrial robot market, which has the largest stock and the most mature applications, is being profoundly reshaped by AI and collaborative robots (Cobots). The industry trend is shifting from "machines" that replace simple and repetitive labor to "intelligent partners" that can work side by side with engineers and workers to handle complex tasks.

Market Representatives:

FANUC, ABB: They are representatives of the traditional "Big Four" in the industrial robot field. They are actively embracing AI and launching more intelligent and user - friendly product lines to consolidate their market positions.

Universal Robots: It is the pioneer and leader of global collaborative robots (its parent company is Teradyne). Its products are known for their safety and ease of programming and are opening up new application scenarios.

High - Potential Silicon Valley Startups:

Covariant.AI: Founded by a student of "AI Godfather" Yann LeCun, it is committed to providing a general "brain" for various industrial robots, enabling them to handle constantly changing items and tasks in warehouses. It is a typical representative of "software - defined hardware".

Theme 5: Logistics and Special - Purpose Application Scenarios

Before humanoid robots achieve generalization, wheeled, bipedal, or quadrupedal robots for specific scenarios are the fastest - growing commercialization track. Especially in fields such as e - commerce warehousing, automated factories, security inspections, and post - disaster rescue, the demand is clear, and the value is measurable. These are excellent test beds for verifying technologies and business models.

Market Representatives/Mature Enterprises:

Boston Dynamics: Its Spot quadrupedal robot dog has become a benchmark for special - purpose applications. After being acquired by Hyundai Motor, it is accelerating its commercial deployment in fields such as industrial inspections and public safety.

Geek+: It is a unicorn in the global warehousing and logistics AMR (Autonomous Mobile Robot) market. Through solutions such as "goods - to - person", it has achieved large - scale deployment in thousands of warehouses around the world.

High - Potential Silicon Valley Startups:

Agility Robotics: Its star bipedal robot Digit has "secured" a contract with Amazon and is conducting pilot work in warehouses. This is a crucial step for humanoid robots to move from the laboratory to real - world commercial scenarios, and its commercial progress deserves high attention.

Theme 6: The Competition of Complete Humanoid Robots

This is the "vast expanse of the technological universe" and the ultimate narrative in the capital market. The smooth movements and task - execution abilities demonstrated by major manufacturers at the WRC are the result of comprehensive competition in terms of capital, technology, and supply chain. At the current stage, the core of investment is to determine who can first turn the unit economic benefits positive in specific scenarios and achieve the leap from "burning money" to "self - sustaining".

Market Representatives:

Tesla: With its advantages in AI, vision algorithms, and supply chain, its Optimus robot is considered one of the most promising players. Every technological iteration affects the market's nerves.

High - Potential Silicon Valley Startups:

Apptronik: A team that emerged from NASA's "Apollo Program". Its humanoid robot Apollo is designed to work collaboratively with humans in factories and warehouses, with clear commercialization goals.

1X Technologies: Another Norwegian company that has received investment from OpenAI. Its wheeled robot EVE has been deployed on a large scale, and it is promoting the commercialization of its humanoid robot NEO, taking a practical "wheeled - to - legged" route.

Conclusion

This huge industrial - ecosystem map clearly shows where the opportunities lie, but it also brings more complex problems:

Facing dozens of reducer companies, how to judge which one's technology truly has long - term competitiveness?

When all humanoid robots claim to be driven by large models, how to evaluate the true level of their "intelligence"?

Behind the amazing demonstration of a Silicon Valley startup, what are the real challenges in its supply chain and cost control?

Research and decision - making in the secondary market require cutting through the fog of public information to touch the real pulse of the industry. The most efficient way is to have direct conversations with the people who are shaping this industry.

Do you want to discuss the ultimate architecture of "Embodied AI" with the former head of NVIDIA's Isaac platform?

Do you want to have the former core engineer of Boston Dynamics deeply analyze the real advantages and disadvantages of different robot technology routes for you?

Do you want to talk with the commercialization expert who is deploying robots on a large scale in Amazon warehouses about the real challenges and returns of implementation?

When your team is arguing endlessly about the technology route, when your investment decision is pending, when your product strategy is in the fog... Please remember that the confusion you are facing may be the journey that an expert has already overcome. We at GRT believe that real first - hand experience always comes from the people who are driving industry change.

GRT has more than 30,000 senior executives from first - tier Silicon Valley companies, core technology experts, well - known university professors, and entrepreneurs. They not only have profound industry experience but also are deeply involved in industrial transformation and have vivid and reliable first - hand insights.

This article is from the WeChat official account "