Five Questions about Liangpinpuzi "Selling Itself" to State-owned Capital | Krypton - Major Events

Author | Chen Sizhu

Editor | Xie Yunzi

After a series of self - rescue measures such as changing the management, reducing prices, and transforming failed, the "first stock of high - end snacks" chose to be sold.

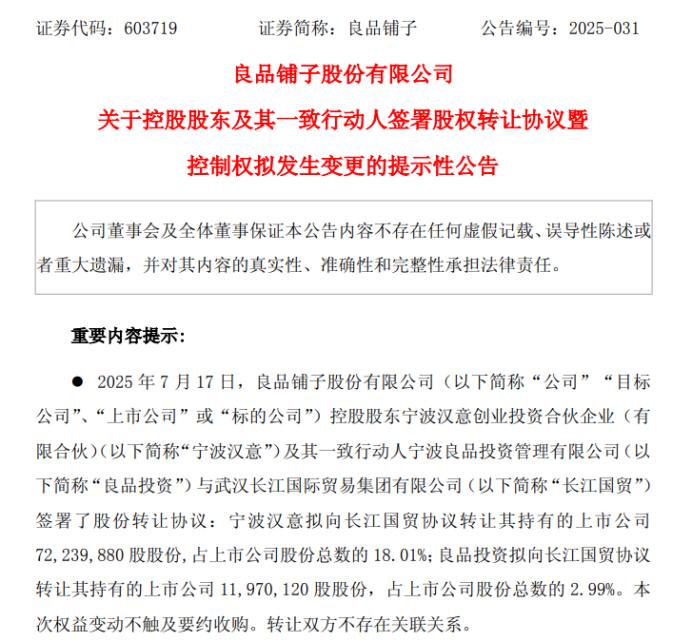

On July 17, Liangpinpuzi announced that its controlling shareholder, Ningbo Hanyi, and its persons acting in concert, Ningbo Liangpin, planned to transfer 72.24 million shares and 11.97 million shares of Liangpinpuzi to Yangtze River International Trade at a price of 12.42 yuan per share through a negotiated transfer respectively, accounting for 18.01% and 2.99% of Liangpinpuzi's total share capital respectively, with a total price of 1.046 billion yuan.

Meanwhile, Dayong Co., Ltd., the second - largest shareholder of Liangpinpuzi, also planned to transfer 8.99% of its shares in Liangpinpuzi to Yangtze River International Trade at a price of 12.34 yuan per share, with a total amount of 445 million yuan.

According to Aiqicha, the actual controller of Yangtze River International Trade is the State - owned Assets Supervision and Administration Commission of Wuhan. This means that if the transfer agreement can be successfully implemented, the Wuhan SASAC will hold 29.99% of Liangpinpuzi's shares and become its largest shareholder.

However, at present, this equity transfer is not going smoothly.

On the day when Liangpinpuzi released the announcement, another state - owned enterprise, Guangzhou Light Industry, sued Ningbo Hanyi over an equity transfer dispute and applied for property preservation, freezing 19.89% of Liangpinpuzi's shares held by Ningbo Hanyi.

Liangpinpuzi also mentioned in the announcement that the freezing of shares and the lawsuit may lead to uncertainties in the transfer of control rights between Ningbo Hanyi and Yangtze River International Trade.

As of the time of publication, Liangpinpuzi's share price was 13.09 yuan per share. Since the announcement date, its share price has fallen by nearly 5% in total, and its market value is only 5.249 billion yuan.

Image source: Company announcement

Is it "selling the same shares twice"?

The biggest uncertainty in this transaction comes from the agreement reached between Ningbo Hanyi and Guangzhou Light Industry.

To resolve its own debts, Ningbo Hanyi once sought to sell some of its shares in Liangpinpuzi through a negotiated transfer. In May this year, Ningbo Hanyi signed an "Agreement" with Guangzhou Light Industry, stipulating that after Guangzhou Light Industry conducted due diligence on the company, it planned to acquire some of the shares in Liangpinpuzi held by Ningbo Hanyi and then invest in and control Liangpinpuzi.

It is understood that this agreement made provisions on due diligence arrangements, investment arrangements, pre - emptive rights, liability for breach of contract, etc. At that time, the actual controllers of the company, Yang Hongchun, Yang Yinfen, and Zhang Guoqiang, confirmed the content of the agreement version and issued a commitment letter.

It is worth mentioning that Ningbo Hanyi and its persons acting in concert did not finally sign the relevant equity transaction agreement on May 28. When Ningbo Hanyi turned to choose the Wuhan state - owned assets, Guangzhou Light Industry sued it instead, demanding that it transfer the shares at a price of 12.42 yuan per share and complete the equity change procedures.

Regarding this dispute, Liangpinpuzi responded to Jiemian News that it would not affect the normal progress of the overall transaction (equity transfer with Yangtze River International Trade). Liangpinpuzi said, "Perhaps both state - owned assets believe that (the listed company) is a high - quality target, and the parties to the transaction have differences in business negotiations."

Dong Yizhi, a lawyer from Shanghai Zhengce Law Firm, also told 36Kr that this transaction does not constitute "selling the same shares twice", but may constitute a civil breach of contract because the validity of the two contracts is different.

"The 'Agreement' signed between Ningbo Hanyi and Guangzhou Light Industry belongs to a preliminary contract (intention agreement), which does not specify core terms such as the equity transfer time and payment method, so it does not have the effect of mandatory performance. While the contract signed with Yangtze River International Trade is a formal contract (formal transfer agreement), which can directly require the performance of the transfer obligation."

Dong Yizhi also said that Guangzhou Light Industry's equity freezing takes precedence over Yangtze River International Trade. "If the lawsuit result is favorable to Guangzhou Light Industry, it may prevent Yangtze River International Trade from obtaining control smoothly or require readjusting the acquisition plan."

This also means that before the result of the lawsuit is finalized, the final direction of Liangpinpuzi remains uncertain.

Basic situation of the freezing of Ningbo Hanyi's shares; Image source: Company announcement

Why is it in urgent need of help?

Actually, before planning to hand over the control rights, Liangpinpuzi had experienced a period of turmoil.

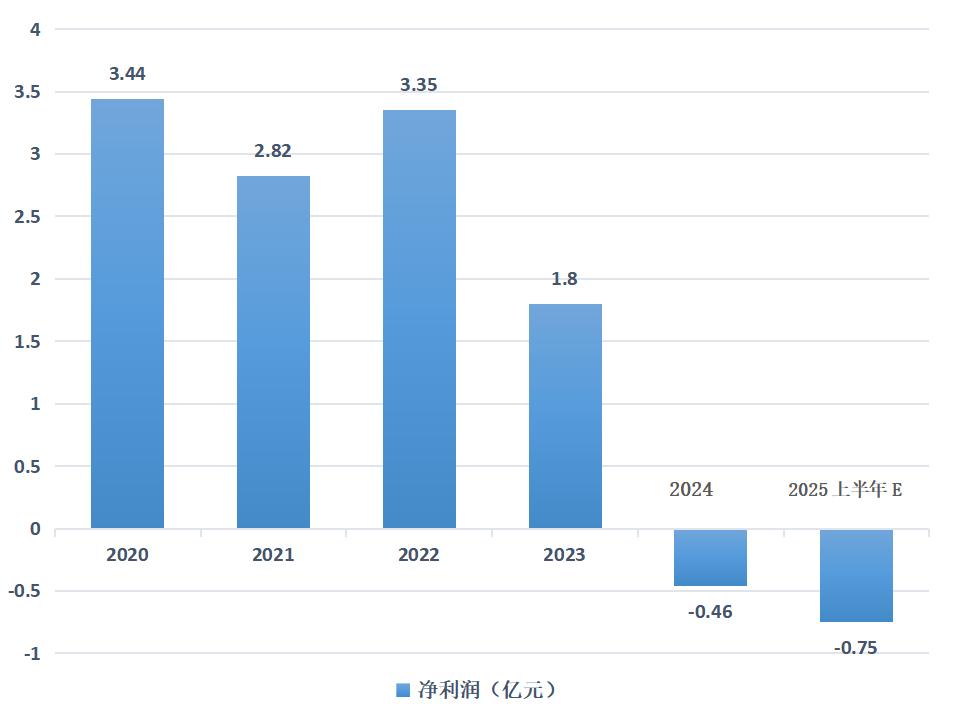

The financial reports show that from 2020 to 2022, Liangpinpuzi's revenues were 7.894 billion yuan, 9.324 billion yuan, and 9.44 billion yuan respectively. While the growth rate slowed down significantly, capital also began to "recede". In 2021, Hillhouse began to plan to reduce its holdings after the first batch of restricted shares became tradable and completed the liquidation of its shares in Liangpinpuzi in February 2024. Subsequently, Capital Today also reduced its holdings.

To save its performance, Liangpinpuzi also tried hard to rescue itself.

In November 2023, the original founder Yang Hongchun stepped down, and the co - founder Yang Yinfen became the chairman.

At that time, Yang Yinfen had several judgments: in terms of channels, the online traffic in the casual snack market had shifted and competition had intensified, and new offline retail species had emerged; in terms of users, consumption had entered a rational era, and the consumption levels of different groups were more differentiated and distinct; in terms of the company itself, the organization was bloated, there was overstaffing, and bureaucratism and departmentalism had emerged.

And the "cure" that Yang Yinfen proposed was to make the prices more affordable while ensuring product quality. Since then, Liangpinpuzi has launched the largest - scale price - cut campaign in its history. Unfortunately, the price cut not only failed to promote revenue growth but also led to a sharp decline in profits. In 2024, Liangpinpuzi's revenue decreased by 11% year - on - year, and its net profit showed a direct loss.

In March 2025, Yang Yinfen resigned from the positions of chairman and general manager of the company. Meanwhile, the company elected Cheng Hong as the chairman of the third - term board of directors; in the following month, the founder Yang Hongchun took on the heavy responsibility of general manager again.

Along with this management change, Liangpinpuzi's business segment expanded from casual snacks to the entire food category. It not only sells snacks but also sells the raw materials for making snacks and their derivatives. For example, at the end of April this year, Liangpinpuzi was selling navel oranges while also selling milk - orange toast and orange zongzi made from navel oranges.

However, this series of reforms still failed to reverse Liangpinpuzi's decline. According to the performance forecast disclosed by the company on July 15, it is estimated that the net loss in the first half of 2025 will be between 75 million yuan and 105 million yuan.

Profit chart of Liangpinpuzi in the past five years; Data source: Company announcement, 36Kr

In the view of Wen Zhihong, an expert in chain operation and the general manager of Hehong Consulting, Liangpinpuzi did not optimize its supply chain well, so it failed to reduce costs. "On this premise, price cuts can only maintain revenue. As the customer unit price and gross profit decline, losses are inevitable."

Shen Meng, the executive director of Chanson Capital, even said bluntly that the frequent changes in management and strategic adjustments show that Liangpinpuzi's overall business thinking is chaotic. "This large - scale equity transfer also shows that the actual controller lacks confidence in the company's future development."

What can the Wuhan SASAC bring?

So, will the Wuhan state - owned assets be a good choice for Liangpinpuzi?

Regarding the choice of introducing a state - owned strategic shareholder this time, Liangpinpuzi disclosed two reasons in the announcement: First, use Yangtze River International Trade's experience in comprehensive supply - chain services for transformation to form the company's full - chain industrial ecosystem of "one product, one chain, one park"; Second, the change of control rights will be more conducive to optimizing the company's equity structure and governance mechanism.

It is generally believed in the industry that the entry of state - owned assets can at least provide financial support for Liangpinpuzi. The 1.046 billion - yuan entry fee can reduce the major shareholder's pledge ratio, thus alleviating the short - term debt pressure and cash - flow shortage to a certain extent.

In addition, in terms of the supply chain, Yangtze River International Trade can also provide more help to Liangpinpuzi.

According to Aiqicha, the companies in which Yangtze River International Trade participates in holding shares include Wuhan Youhao Cross - border E - commerce Co., Ltd., Wuhan Yangtze River Land Port International Supply Chain Co., Ltd., Jinkong Hualiang (Hubei) Grain Logistics Co., Ltd., etc. Its business scope covers multiple fields such as cold chain, food, and cross - border e - commerce. These resources and capabilities may help Liangpinpuzi reduce the cost pressure of its supply chain.

Image source: Aiqicha

In the equity transfer announcement, Liangpinpuzi also said that the two parties will strengthen supply - chain synergy to help the company transform from "quality snacks" to a "quality food" ecosystem.

Of course, it is not uncommon for state - owned assets to enter a company but fail to improve its business.

In 2019, the chain supermarket enterprise Renrenle was acquired by Qujiang state - owned assets, but its performance failed to "recover". In 2024, its net loss reached 17.2965 million yuan, and it was delisted by the Shenzhen Stock Exchange on July 4 this year.

On January 15, 2023, BBK announced that the State - owned Assets Supervision and Administration Commission of Xiangtan City would become the actual controller. The next day, after BBK's stock resumed trading, it directly reached the daily limit, but then quickly declined in the following trading days, and the stock price was even once lower than before the suspension.

In Shen Meng's perception, "state - owned enterprises in the central and western regions are relatively conservative in market promotion and marketing." He believes that after Liangpinpuzi is taken over by Yangtze River International Trade, it is difficult to bring more surprises to the market.

Wen Zhihong holds an optimistic attitude towards this equity transfer. In his view, Zhongbai Group under the Wuhan SASAC has been actively reforming. From this perspective, the Wuhan SASAC has relatively rich experience in market - oriented transformation and may become Liangpinpuzi's white knight.

What will happen to the founders?

In addition, what people are quite concerned about is the issue of whether the founders of Liangpinpuzi will stay or leave.

In 2005, after Kelon was acquired by Hisense, Yang Hongchun gave up a lucrative salary and invited Yang Yinfen, Zhang Guoqiang, etc. to jointly start the entrepreneurial journey of Liangpinpuzi.

It can be seen from the current equity structure that the actual controllers of Liangpinpuzi, Yang Hongchun, Yang Yinfen, Zhang Guoqiang, and Pan Jihong, indirectly hold 35.23% of Liangpinpuzi's shares through Ningbo Hanyi. Yang Hongchun, Yang Yinfen, and Zhang Guoqiang also hold 2.99% of the shares through Liangpin Investment. After the equity transfer, Ningbo Hanyi will only hold 17.22% of Liangpinpuzi's shares, and the shares allocated to Yang Hongchun will be even less.

Image source: Company announcement

Even though the relevant parties said that the founder Yang Hongchun has not "left" and will remain as a senior executive and retain his status as an important shareholder. However, the shares held by Yang Hongchun are difficult to shake the control and the next - step plan of Yangtze River International Trade. The new board of directors restructuring plan shows that Ningbo Hanyi has the right to nominate four non - independent director candidates and three independent director candidates, while Ningbo Hanyi only has the right to nominate one non - independent director candidate and one independent director candidate.

Shen Meng believes that after the smooth end of the transition period, the founders of Liangpinpuzi may gradually withdraw from the listed company. He also emphasized that no matter who is at the helm of Liangpinpuzi, they will continue to face the cruel competition pressure in the snack industry.

Where is the direction of transformation?

In 2020, Liangpinpuzi was listed on the A - share market, becoming the veritable "first stock of high - end snacks" and also a representative of consumption upgrading at that time. Its total market value once exceeded 34 billion yuan.

Today, the market competition pattern of casual snacks has changed greatly.

On the one hand, the online sales front has shifted from traditional comprehensive e - commerce platforms such as Taobao and JD.com to interest - based e - commerce platforms such as Douyin.

On the other hand, mass - market snack brands are encircling the traditional snack market at a lower cost by virtue of their supply - chain advantages of direct connection with manufacturers.

Moreover, compared with the high - end snack brands like Liangpinpuzi,