“Annual revenue of tens of millions of US dollars” is the biggest lie in this AI application track.

Text | Zhou Xinyu

Editor | Su Jianxun

"We've been marginalized."

This is the recent sentiment of an AI industry insider to us. The team he belongs to is part of an AI emotional companion app, one of the "Six AI Tigers." Just a year ago, it consistently ranked among the top three in the AI social list and was regarded as a model for AI going global.

Recently, however, this popular product led by its founder has significantly laid off employees in its product operation and commercialization teams, leaving only a small number of staff for maintenance.

This is not an isolated case.

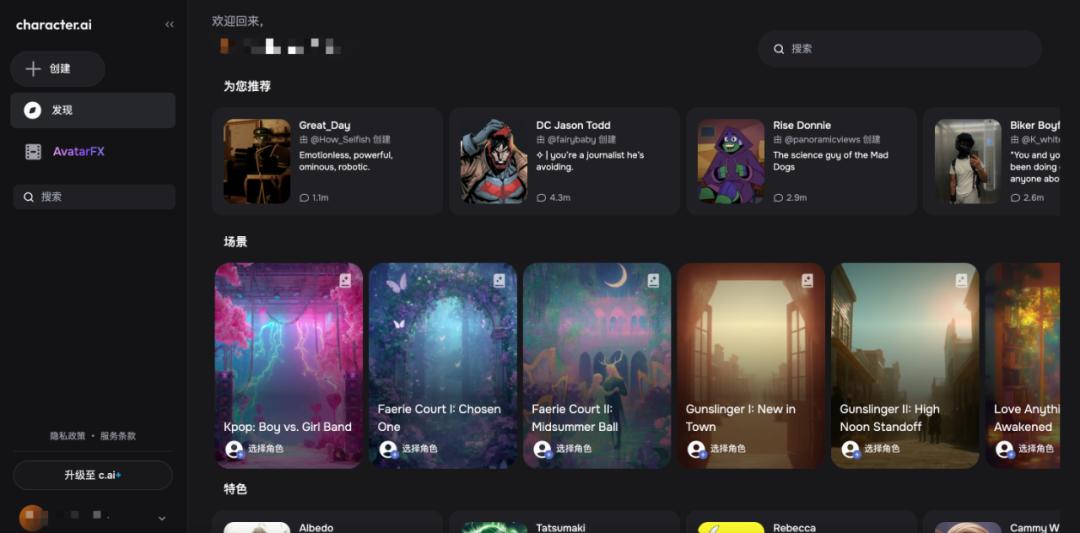

AI emotional companion apps are products that meet users' emotional needs through interactions with AI characters. In this field, there are many well - known AI apps, such as MiniMax's Talkie, ByteDance's Maoxiang, and the US - based Character.ai.

However, AI emotional companionship is experiencing a widespread decline.

In the domestic AI emotional companion market, growth has started to slow down. According to Diandian Data, from January to May 2025, the monthly downloads of ByteDance's Maoxiang on the Apple platform dropped from 2.64 million to 610,000, and the DAU (Daily Active Users) dropped from 590,000 to 490,000. Similarly, for Xingye, another leading product, the monthly downloads on the Apple platform also dropped from 4.86 million to 930,000.

The same decline is also evident overseas. Character.ai, the pioneer that popularized AI emotional companionship, seemingly has an enviable 233 million monthly active users. However, the user payment rate is not high, and the ARPU (Average Revenue Per User) is as low as $0.72.

At the beginning of 2024, AI emotional companion products were one of the hottest categories in the venture capital circle. In the view of many industry insiders, this "emotion - based" track has high user stickiness and can be monetized immediately through subscriptions. At that time, the story of Character.ai, "a 12 - person team achieving $15 million in ARR (Annual Recurring Revenue)," was extremely alluring.

△Character.ai. Image source: Charater.ai official website

In the first half of 2024, almost every one of the "Six AI Tigers" large - model companies had an AI emotional companion product. At that time, a product manager from an AI model company told Intelligent Emergence: "If you don't have an AI emotional companion product in your product matrix, you're not even qualified to say you're deploying AI applications."

But now, AI emotional companionship almost occupies half of the "graveyard" of AI applications.

Intelligent Emergence reported exclusively that "Maopao Ya," which was regarded as an important consumer - facing direction by Jieyue Xingchen, almost stopped operating in December 2024 due to under - expected data. Zhipu's AiU and Yuezhianmian's overseas AI pet companion app Ohai both ended up failing due to regulatory issues or low revenues.

Under the once - bustling appearance, AI emotional companionship is actually a low - profit category. Yongchao, the product manager of AiU, once told the media: (AI emotional companionship) seems lively, but in fact, there are no products that have achieved good results. There are only 5 products in China with a daily active user base of over 10,000.

Let's first look at a set of data: We learned that the average daily revenue of a leading overseas AI emotional companion product is stable within $40,000 - and its real annual revenue is far from the externally - promoted "tens of millions of dollars in ARR."

Contrary to the "low income" is the high investment in advertising. Intelligent Emergence learned that this product spends tens of millions of dollars on growth every quarter.

The imbalance between investment and return is partly due to the current limitations of models in long - term memory and consistency, which cannot meet users' needs for virtual emotional companionship. As a result, users' willingness to use and pay is limited.

A report released by QuestMobile shows that in the first half of 2024, the average monthly usage days of mainstream AI emotional companion apps were generally less than 5 days. An investor also told us, AI emotional companionship is a 'pseudo - need' for most people: "People still prefer to develop real relationships."

The monetization ability under the "pseudo - need" is doomed to be limited.

The monthly revenue from user payments of the leading AI product mentioned above is only four or five hundred thousand dollars. Many insiders mentioned that in order to increase revenue, the company added many paid features, but with little success.

On the other hand, under the pressure of financing and competition, most AI emotional companion apps set extremely aggressive growth targets in 2024. Given the current situation where product strength cannot support these growth targets, companies can only rely on short - sighted advertising investment.

For example, we learned that for a leading AI emotional companion app, reaching 1 million DAU was once the primary goal. At the peak, the product had as many as twenty or thirty advertising channels, consuming hundreds of thousands of dollars a day.

The high investment has resulted in poor user retention and ROI. "The next - day retention rate once reached over 50% through promotion, but then quickly dropped to 20% or 30%," an employee told us. As for growth - oriented advertising, "the ROI has never been positive."

Regulation is a problem that the AI emotional companion category has always been unable to avoid.

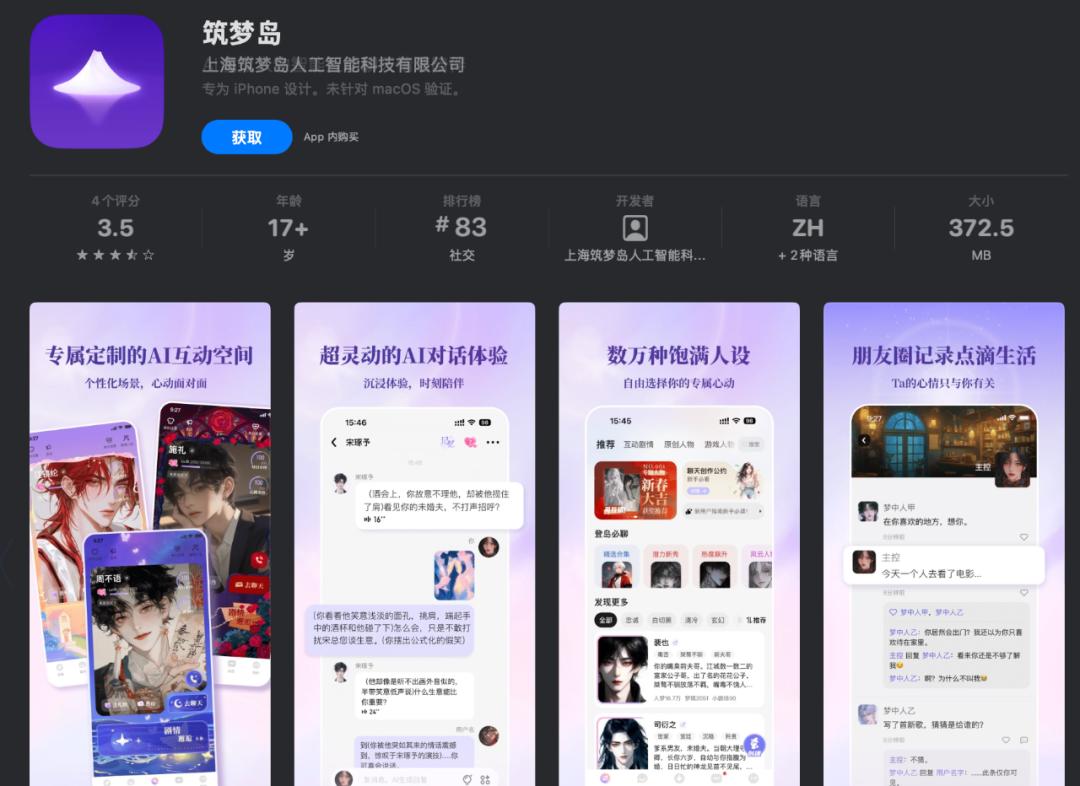

This hanging "Sword of Damocles" has led to the global delisting of star AI emotional companion products such as Talkie, LiveMe, and Tango. At the end of June 2025, "Zhumu Island," an AI emotional companion app under Yuewen, was summoned by the Cyberspace Administration of China for containing content related to underage pornography and was delisted for rectification.

△Zhumu Island. Image source: Zhumu Island App Store download page

The delisting of apps has directly halted the growth of AI emotional companion apps. According to multiple insiders, after a leading AI emotional companion product was relaunched, its monthly organic growth rate dropped from 20% to below 10%, and its MAU (Monthly Active Users) also declined at a rate of about 10% per month on average.

In order to be quickly compliant and relaunched, app manufacturers have crudely set prohibited words to avoid crossing the red line. However, the price paid is the user experience.

An employee of a leading AI emotional companion app gave an example. To be compliant, the team set "take off" as a prohibited word. Once the word "take off" appears in the conversation between the user and the intelligent agent, the conversation may be blocked, or the user may even be banned. As a result, "even words like 'take off a hat' and 'talk show' cannot be sent."

In 2025, as the frenzy returns to rationality, the AI emotional companion apps still in the arena have reached a point of reflection and regrouping.

An obvious change is that the aggressive growth has ended, and the ROI of advertising has become a more valuable indicator.

An insider told Intelligent Emergence that the leading AI emotional companion product mentioned above has cut its advertising budget by nearly 90%. "Now the company is starting to optimize the ROI of advertising and invest more in channels or periods with better ROI," an employee said.

Given that the user experience is still restricted by model performance, re - defining what "AI emotional companionship" is also very important. An investor told us that emotional companionship and virtual dating may be limited in market space.

Shifting from emotional companionship to a content community is the attempt that Character.ai is making. Since being acquired by Google in August 2024, Character.ai has focused its function iteration on building a content community and providing multi - modal creation tools such as image and video.

Despite the decline in growth and commercialization, AI emotional companionship still has great monetization potential in the current AI application market.

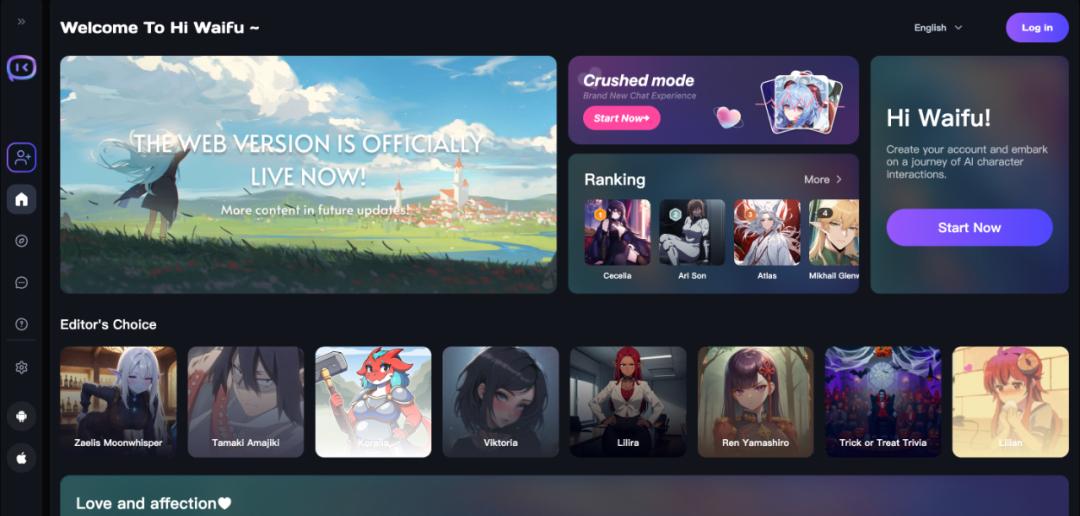

△Hiwaifu. Image source: Hiwaifu official website

Taojiang, the founder of Hiwaifu, an AI emotional companion app with revenues exceeding 20 million yuan in 2024, mentioned in a media interview that he found that products with real - life - like AI companions have stronger monetization ability than those with anime or game - style designs. The reason is that the user profile of the former is more inclined towards middle - aged people, who have stronger spending power. 'We're also considering whether we can expand in the direction of 'companionship for the middle - aged and elderly' in the future.'

Moreover, due to restrained advertising investment and controlled team size, Hiwaifu made a profit in its first year of launch.

An investor said bluntly that Character.ai still has over 200 million MAU. With this user base and community ecosystem, making money is not a problem at all.

"Facing such a large - scale user group, the functions and business models of AI emotional companion products have not hit the mark," he hopes that entrepreneurs will go against the prevailing pessimistic voices in the market. "AI emotional companionship is not dead; it's just that people haven't fully explored its potential."