ZhiKe | Why is Wall Street scrambling for this stablecoin stock?

Author | Huang Yida

Editor | Zheng Huaizhou

Recently, the stablecoin concept in the A-share market has been extremely popular. Since the release of the Wind Stablecoin Index on June 3rd until now (as of July 11th), the maximum increase of the index during this period has exceeded 40%. It can be said that stablecoins are one of the hottest topics in the A-share market recently.

Chart: Trend of the Wind Stablecoin Index; Source: Wind, 36Kr

Meanwhile, with the listing of Circle, the issuer of stablecoins, on the New York Stock Exchange in early June, a wave of stablecoin fever has quickly emerged in the U.S. stock market. Circle's IPO not only received more than 25 times over - subscription. Driven by investors' enthusiasm, both the stock price and valuation soared. The increase from June 5th until now has exceeded 190%, and the amplitude during this period was as high as 758%. The PE - TTM at the highest valuation was close to 400x, and the market boom far exceeded market expectations.

So, what are Circle's core businesses? What is the business logic of stablecoin issuers? Why do investors give Circle such a high valuation?

01 Reserve income is the pillar of Circle's operating income

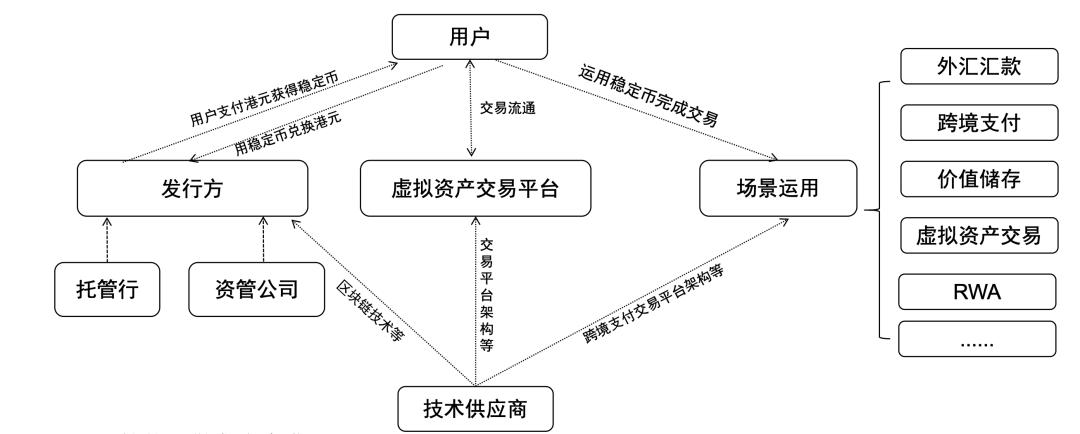

In our previously published strategy article "What investment opportunities are hidden in the globally popular stablecoins?" , we have provided a detailed introduction to the basic situation of the stablecoin market, covering core contents such as the types of stablecoins, the current market size, and future development expectations. Regarding the stablecoin market itself, its main participants include issuers, trading platforms, technology providers, and customers.

Chart: Main participants and operating mechanism of the stablecoin market; Source: Guosen Securities, 36Kr

As the first stablecoin - related stock, Circle is currently one of the most important issuers in the stablecoin market. Public information shows that as of Q2 2025, the total market value of USDC, the stablecoin issued by it, is approximately $60 billion, accounting for about 24% of the stablecoin market share. In terms of the competitive landscape, the stablecoin market is currently monopolized by two oligarchs. USDT, issued by Tether, has a market share of up to 60% in the total market value during the same period. The total market value of USDC issued by Circle ranks second, and the combined market share of these two major currencies, USDC of Circle and USDT of Tether, reaches an astonishing 84%. The total market value of other stablecoin types is far lower than these two giants.

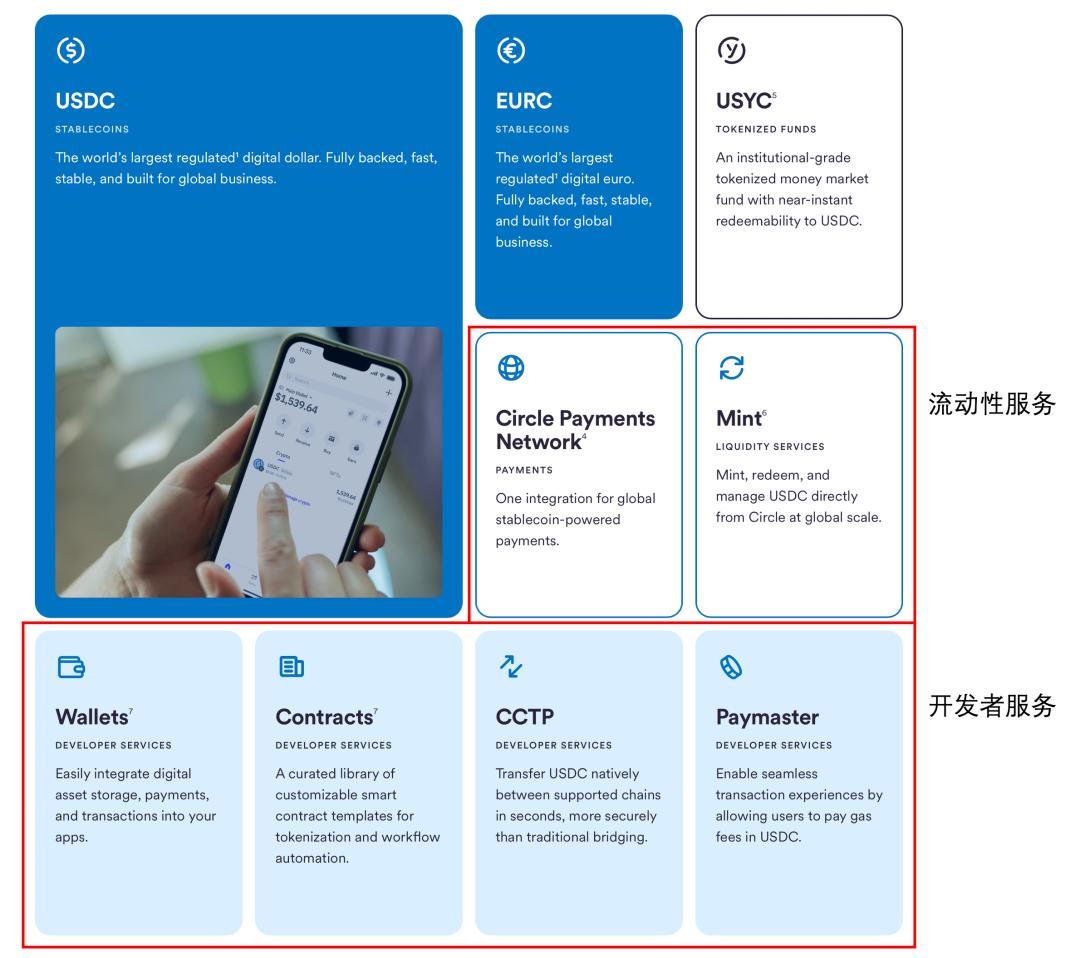

Looking at Circle's business, the most core business is the issuance and subsequent operation and maintenance of stablecoins, and the vast majority of the company's revenue also comes from this. After Circle acquired the largest tokenized fund, Hashnote, it also included the operation of the tokenized fund USYC in its main business. As of early June this year, the management scale of USYC was less than $400 million. Given Circle's nature as a fintech enterprise, in order to maintain its business ecosystem, it also provides corresponding liquidity services and developer services for financial customers and developers.

Chart: Circle's main business; Source: Company official website, 36Kr

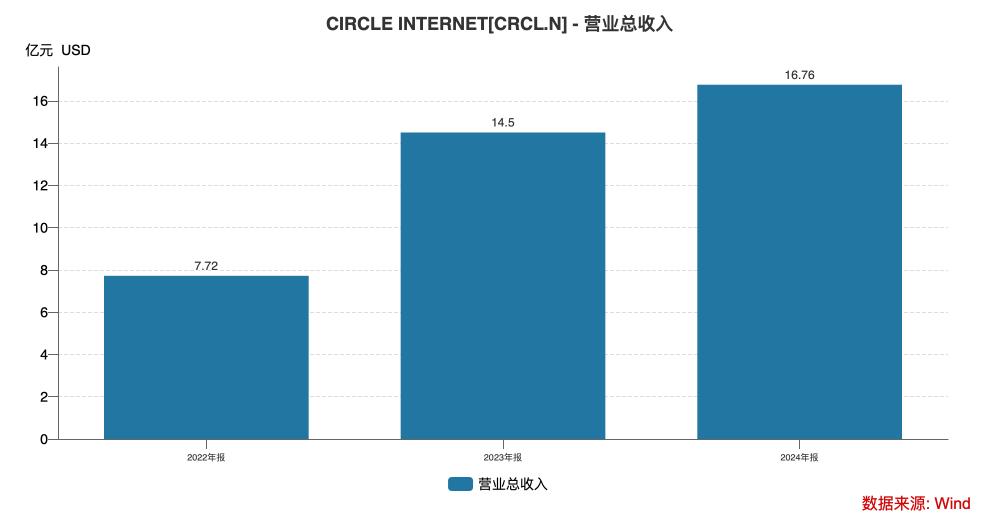

From the revenue side, the company's financial reports show that from 2022 to 2024, Circle's operating revenues were $772 million, $1.45 billion, and $1.676 billion respectively. Among them, the vast majority of the revenue comes from reserve income. In 2023 and 2024, the proportion of reserve income in Circle's total revenue was 99%.

Chart: Circle's operating revenue in recent years; Source: Wind, 36Kr

The reserve income of stablecoin issuers is based on the characteristic that stablecoins are pegged to specific assets. Taking Circle as an example: Circle deposits customer funds into a reserve account. The interest and dividends generated by interest - bearing assets such as cash, U.S. Treasury bonds (mainly short - term bonds), and the Circle Reserve Fund configured in this account are the reserve income. In addition, Circle also has a small amount of service income related to stablecoins included in other income.

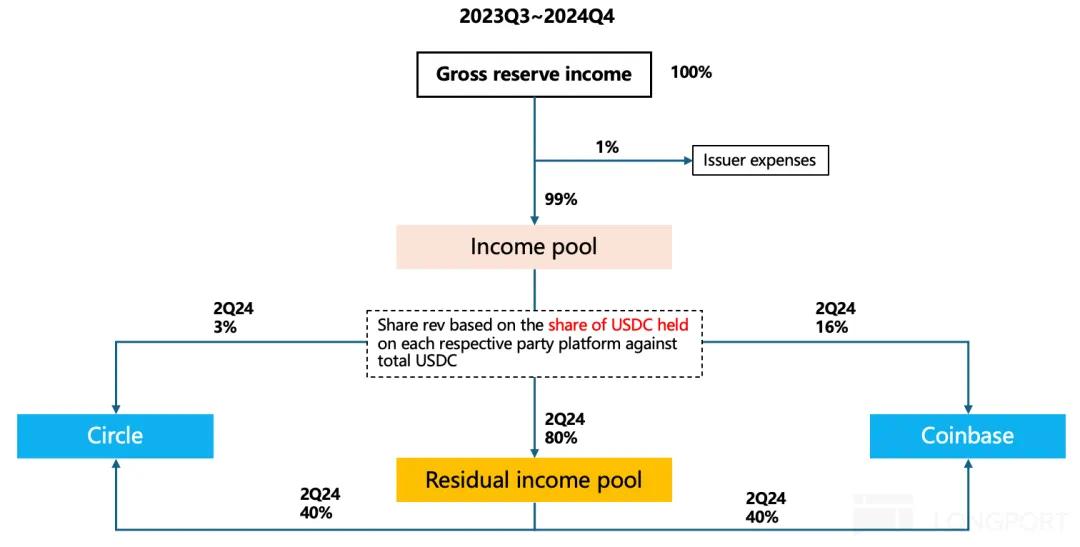

On the cost side, Circle's most significant expenditure is the distribution cost paid to Coinbase. According to the data disclosed in the company's financial report, in 2024, the distribution fee paid by Circle to Coinbase was as high as $900 million, accounting for about 54% of the total revenue during the same period. Correspondingly, Circle's gross profit margin in 2024 was 39%. In addition to the distribution cost, the cost expenditure also includes a small amount of transaction and other costs. From a long - term trend perspective, Circle's gross profit margin has been declining year by year in recent years. The main reason is that Circle re - signed a distribution cooperation agreement with Coinbase, and the change in the revenue - sharing ratio between the old and new agreements is the main reason for the company's declining gross profit margin year by year.

Chart: Revenue - sharing ratio under the new distribution agreement after Q3 2023; Source: Dolphin Research, 36Kr

Looking back at history, we can see that Circle and Coinbase have a deep - seated relationship. The two jointly established the Centre Consortium in 2018, each holding 50% of its equity, and issued USDC with Centre as the issuer. Although Circle acquired the remaining equity of the Centre company held by Coinbase in August 2023 and fully took over the operation and maintenance of USDC, Circle still maintains a strategic cooperation relationship with Coinbase. Currently, Coinbase is the most important distribution channel for USDC.

In order to expand the entire stablecoin market, the continuous and in - depth cooperation between Circle and Coinbase is inevitable. The business logic lies in: The significance of stablecoin trading platforms represented by Coinbase is that they need stablecoins as trading media and payment tools, while stablecoin issuers represented by Circle need trading platforms like Coinbase to provide trading scenarios for stablecoins, and it is also an important guarantee for the compliance of stablecoins. The combination of the two forms the basis of the stablecoin trading ecosystem, thereby attracting more users to participate.

The long - term trend presented by Circle's expense side is as follows: From 2022 to 2024, the overall level of period expenses was relatively stable, generally in the range of $450 million - $500 million; the period expense ratio decreased to a certain extent. The period expense ratios from 2022 to 2024 were 65%, 31%, and 29% respectively. The decrease in the period expense ratio mainly benefited from the continuous decline of relevant operating expense ratios driven by the scale effect under revenue growth.

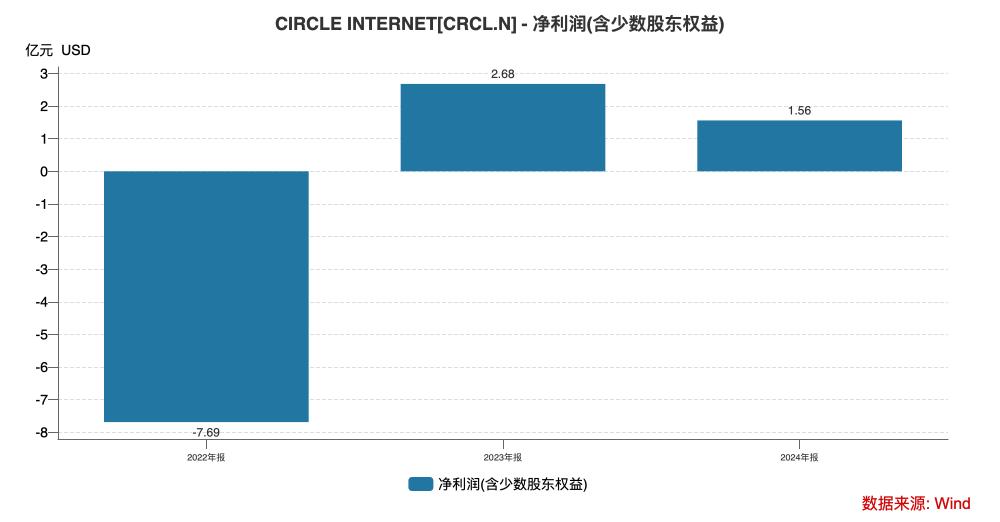

In terms of profit, Circle achieved its first profit during the reporting period in 2023, with a net profit of $268 million that year. In 2024, due to the implementation of the newly signed distribution agreement, the company's gross profit decreased. Coupled with a slight increase in period expenses, Circle's net profit in 2024 was only $156 million, a year - on - year decrease of about 42%.

Chart: Circle's net profit in recent years; Source: Wind, 36Kr

02 How to understand Circle's current extremely high valuation

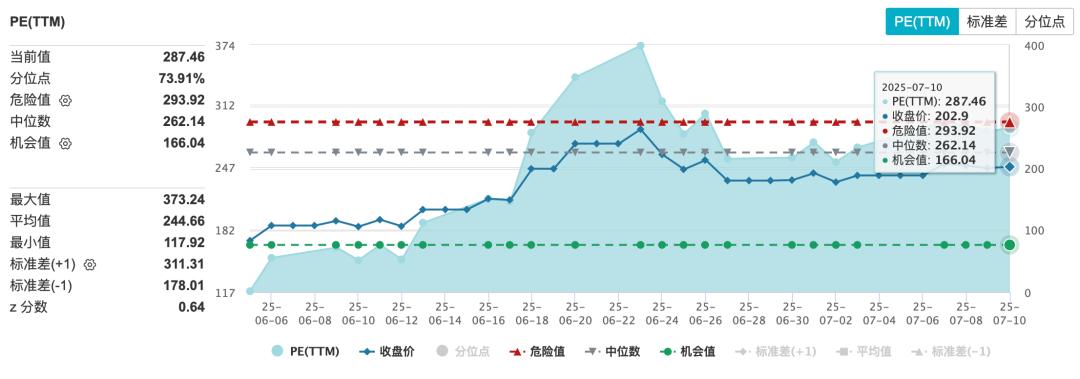

Since Circle was listed on the New York Stock Exchange on June 5th this year, its valuation has skyrocketed. The PE - TTM once reached a high of 373x. Although it has declined since then, as of July 11th, the pre - market PE - TTM of the U.S. stocks was still as high as 287x. Investors give Circle such a high valuation, seemingly without considering revenue, cost, or profit. The emergence of such a valuation level that deviates from the fundamentals essentially reflects investors' firm optimism about the stablecoin market.

Chart: Circle's valuation analysis; Source: Wind, 36Kr

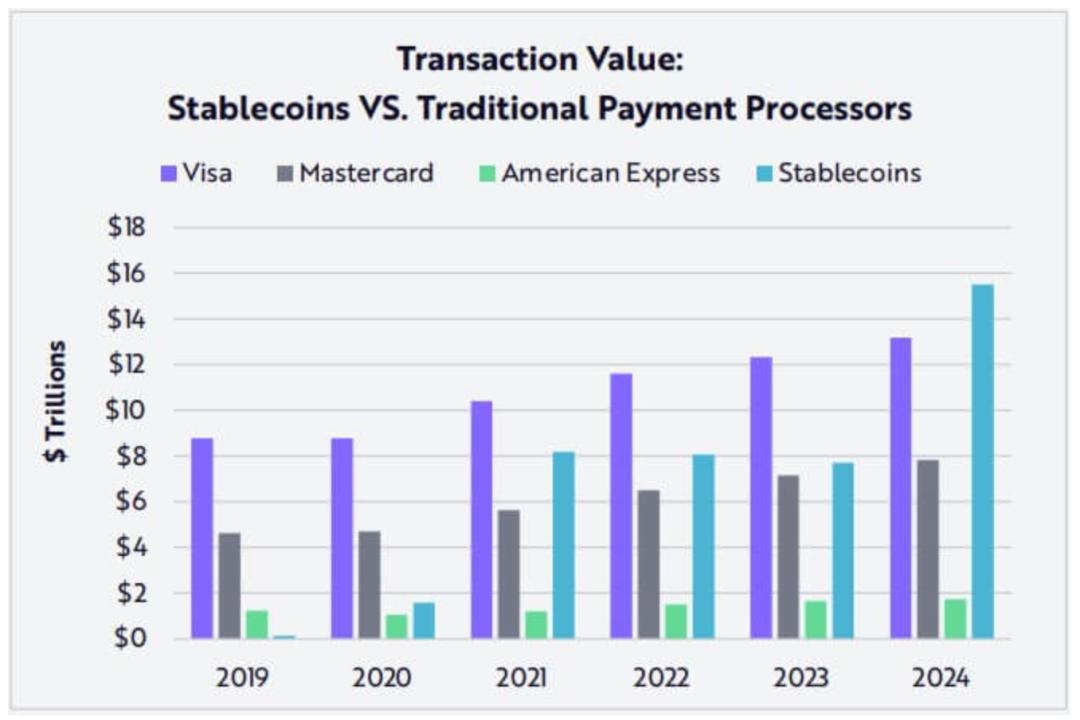

Regarding the current situation of the stablecoin market, public information shows that the total market value of global stablecoins has exceeded $250 billion (as of June 10th), and both the number of users and the trading scale have maintained rapid growth in recent years. In terms of transaction volume, stablecoins have shown even more remarkable performance. A report from ARK Invest shows that in 2024, the total global transaction volume of stablecoins reached as high as $15.6 trillion, exceeding the transaction volumes of Visa and Mastercard during the same period. Deutsche Bank's statistical data shows that the transaction volume of stablecoins in 2024 was as high as $27.6 trillion, more than the combined total of Visa and Mastercard. Regardless of the measurement method, the growth rate of stablecoin transaction volumes in recent years has been far higher than that of traditional payment channels.

Chart: Transaction volume of stablecoins in recent years; Source: ARK Invest, 36Kr

Although the stablecoin market has shown considerable explosive power at present, compared with market expectations, the current market size and growth rate are far from satisfactory. The current mainstream expectation is that by 2035, the market size of stablecoins will reach at least $4 trillion, more than 16 times the current level, with an annual compound growth rate as high as 32%. The current U.S. government expects that by the early 2030s, the market size of stablecoins will reach $3.7 trillion, 15 times the current level, with a corresponding CAGR of up to 80%.

The reason why the capital market and the U.S. government are so optimistic about the future of stablecoins is that, from a medium - term and macro perspective, the U.S. government has sufficient motivation to vigorously develop stablecoins. Its main intention is to continuously maintain the hegemonic position of the U.S. dollar in the digital age. Relying on the characteristics of stablecoins as digital currencies, it can bypass traditional banks and the SWIFT system and continue to promote "dollarization" in regions such as Southeast Asia and Africa, consolidating the status of the U.S. dollar as the global reserve currency.

From a short - term perspective, given that the most important reserve assets of U.S. dollar - denominated stablecoins are the U.S. dollar and U.S. Treasury bonds, stablecoins may become one of the "super buyers" of U.S. Treasury bonds in the future.

Recently, U.S. macroeconomic data and economic and financial data show that the U.S. economy is facing certain recession pressure. Debt expansion is a traditional means to hedge against recession, but the current monetary policy of the Federal Reserve is a major constraint on the U.S. government's debt expansion. Moreover, in the context of the tariff war, due to geopolitical factors, the demand for U.S. Treasury bonds from some traditional buyers of U.S. Treasury bonds also has certain uncertainties, which not only affects the implementation of the U.S. government's fiscal policy but also has a certain negative impact on the credit of U.S. Treasury bonds.

Therefore, the short - term policy logic of the U.S. government to vigorously develop stablecoins is as follows: With the rapid expansion of the stablecoin market, especially the rapid growth of stablecoin issuance, it will drive the synchronous expansion of U.S. Treasury bond reserves. For the U.S. government, on the one hand, it enhances the stability of the capital market's ability to absorb U.S. Treasury bonds; on the other hand, developing stablecoins to bypass the Federal Reserve is beneficial for short - term debt expansion. For U.S. Treasury bonds themselves, stablecoins being pegged to U.S. Treasury bond assets also provides an additional guarantee for the credit of U.S. Treasury bonds.

The U.S. government has implemented the policy of vigorously developing stablecoins into relevant policies. On June 18th this year, the U.S. Senate passed the "GENIUS Act". This act is the first federal regulatory framework for stablecoins in the United States, marking that stablecoins have been included in the U.S. national financial regulatory system, and from a regulatory perspective, it requires stablecoins to be 100% pegged to U.S. dollar assets.

Speaking of Circle again, behind investors giving it an extremely high valuation, they not only see the good prospects of the stablecoin market but also, based on the current duopoly competition pattern in the stablecoin market, as the stablecoin market enters the fast - lane of development, Circle, as one of the oligarch