Tide Pharmaceutical: Another listed company emerges in Qiantang, Hangzhou, the world's third-largest peptide CRDMO.

On June 30, 2025, Ted Medicine (Zhejiang) Co., Ltd. (hereinafter referred to as "Ted Medicine") was officially listed on the Hong Kong Stock Exchange. In this listing, a total of 16.8 million H shares were offered globally, accounting for 11.85% of the total share capital after the issuance. The offering price was set at HK$30.60 per share, and the public offering was oversubscribed by 301.15 times. As of the close on the first day, Ted Medicine's stock price was HK$30.8, and its market value was HK$4.4 billion.

Ted Medicine is a biopharmaceutical company located in Qiantang, Hangzhou. It provides full - cycle services from early discovery, pre - clinical research, clinical development to commercial production, mainly including peptide NCE discovery and synthesis (CRO services) and peptide CMC development and commercial production (i.e., CRDMO services).

According to the prospectus, as of December 31, 2024, Ted Medicine's project pipeline included 1,217 ongoing CRO projects and 332 ongoing CDMO projects, and it strategically focused on the pipeline construction in the GLP - 1 field. In terms of sales revenue, Ted Medicine was already the world's third - largest CRDMO focusing on peptides in 2023, with a global market share of 1.5%, second only to Swiss leading companies Bachem and PolyPeptide.

Like the leading domestic CXO companies, most of Ted Medicine's revenue also comes from overseas, with the United States being its largest market. To avoid potential adverse impacts from future US policies and regulations, part of the funds raised by Ted Medicine in this listing will be used to expand production capacity investment in the United States.

1. Raising funds for listing to expand production capacity

Ted Medicine was established in 2020. Its core entity is its subsidiary, Zhongtai Biochemical. Zhongtai Biochemical was founded in 2001 by Li Xiang, an executive director of Ted Medicine, and it was one of the first domestic companies engaged in peptide CRDMO.

Peptides are compounds mainly used in the pharmaceutical and cosmetic fields. CRDMO refers to Contract Research and Development Manufacturing Organization, which provides comprehensive services for pharmaceutical companies from drug R & D, drug formulation development, clinical trial supply to commercial production.

In 2003 and 2005, Xu Qi, the chairman and CEO of Ted Medicine, and Li Xiangli, an executive director, joined Zhongtai Biochemical successively. In 2015, Xinbang Pharmaceutical acquired 100% of the equity of Zhongtai Biochemical for RMB 2 billion. After 2018, due to challenges such as intensified industry competition and internal integration, Zhongtai Biochemical's performance fluctuated. In 2020, Xinbang Pharmaceutical divested its assets for RMB 750 million, and Zhongtai Biochemical was acquired by Ted Medicine, which was founded by Xu Qi and Li Xiangli.

The prospectus shows that Ted Medicine's revenues from 2022 to 2024 were RMB 350 million, RMB 330 million, and RMB 440 million respectively, and its net profits were RMB 53.98 million, RMB 48.91 million, and RMB 59.17 million respectively. In 2024, Ted Medicine was rated as a high - growth biopharmaceutical enterprise in Zhejiang Province and a national specialized and sophisticated "little giant" enterprise.

Facing industry competition, the main challenge currently faced by Ted Medicine is to break through the production capacity bottleneck. In 2023, Ted Medicine's annual production capacity of peptide API was 500 kilograms, with a batch capacity of 20 kilograms and a utilization rate of 68.2%. In contrast, Nuotai Biotech's peptide production capacity has reached the ton - level scale, Wuxi AppTec's solid - phase peptide synthesis production capacity has increased to 3.1 tons, and Shengnuo Biotech's technological transformation project and fundraising project are also expected to increase its peptide production capacity to over 1.2 tons.

Therefore, Ted Medicine stated that 76.4% of the HK$411 million raised in the listing will be used to build or acquire production parks in China and the United States to improve production capacity.

In addition, Ted Medicine disclosed in the prospectus that it strategically focuses on the pipeline construction in the GLP - 1 field. In recent years, GLP - 1 drugs represented by semaglutide (a special type of blockbuster peptide drugs) have achieved explosive sales, becoming the main driving force for the growth of the global peptide drug market. According to Frost & Sullivan data, the market size reached US$38.9 billion in 2023, with a compound annual growth rate of 33.2%.

Under this trend, as of the last practical and feasible date, Ted Medicine was conducting nine NCE GLP - 1 molecule development projects with seven customers to develop oral and/or injectable GLP - 1 molecule products, including a semaglutide generic drug project.

2. Overseas revenue accounts for nearly 80%, and local production capacity is increased to cope with the impact of tariffs

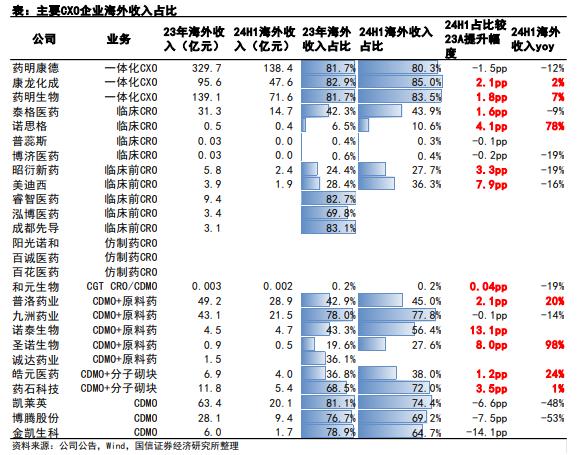

Benefiting from the "engineer dividend", Chinese CXO companies have become important partners of global MNCs and Biotechs in the past decade with the competitive advantages of high - quality, high - efficiency, and high - cost - effectiveness. The proportion of overseas revenue of leading CXO companies reaches about 80%.

Proportion of overseas revenue of major CXO companies

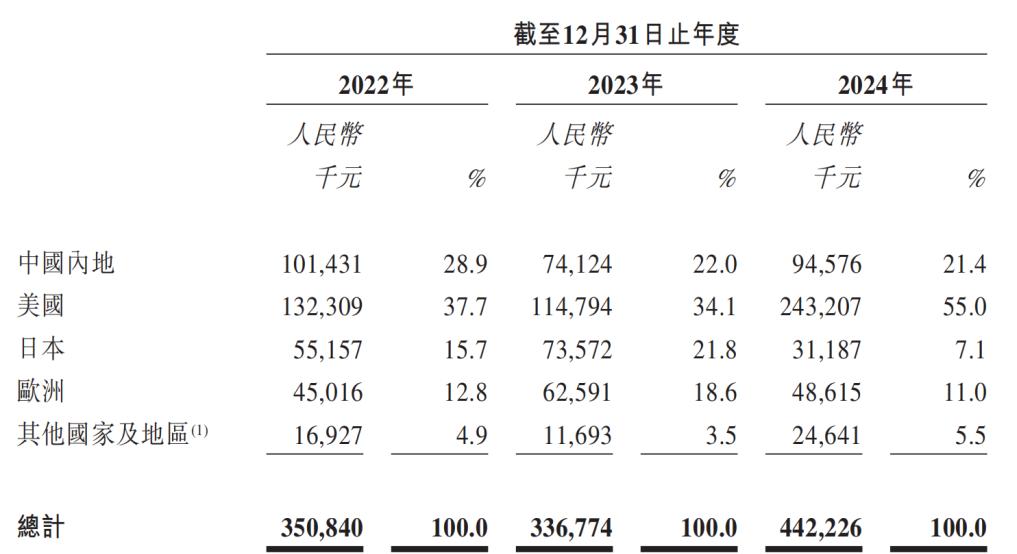

In 2023, the proportion of Ted Medicine's overseas revenue also reached 78%. Currently, it has established stable customer relationships and service scopes in more than 50 countries, with the United States, Japan, Europe, South Korea, and Australia being the main markets. Moreover, the growth rate of overseas revenue is faster than that in the domestic market. In 2024, overseas revenue increased by 32.4% year - on - year to RMB 348 million, higher than the domestic revenue of RMB 95 million in the Chinese mainland and the growth rate of 27.6%.

The United States has always been Ted Medicine's largest market. The prospectus shows that from 2022 to 2024, the revenue contributions from the United States accounted for 37.7%, 34.1%, and 55.0% respectively. The increase in Ted Medicine's revenue in 2024 was mainly due to the increase in revenue from a US customer focusing on GLP - 1 drug development.

Source: Ted Medicine's prospectus

Since last year, the uncertainty of US tariff policies has increased. Although as of the last practical and feasible date, Ted Medicine has not encountered problems such as customers renegotiating prices due to tariffs and canceling orders, and in the first quarter of 2025, the total revenue from US customers actually increased compared with the same period in 2024, to avoid potential negative impacts from future tariffs, such as increased operating costs and even supply chain disruptions, Ted Medicine is also taking countermeasures.

Specifically, Ted Medicine plans to increase its local production capacity in the United States. It will complete the construction of the Rocklin Park in California in the second half of 2025, providing GMP - compliant production, analytical development, quality control, and stability testing services for peptide APIs, with an annual production capacity increase of about 100 - 300 kilograms.

Increasing production capacity investment in the United States has actually become a common choice for the global innovative drug industry to cope with tariff threats. In May 2024 alone, three Chinese CXO companies announced their overseas expansion progress: Wuxi AppTec's R & D and production base in Singapore was put into operation, Boteng Co., Ltd.'s R & D and production base in Slovenia was put into operation, and Kingsley Pharmaceutical completed the layout of its first R & D and production base in Europe.

Meanwhile, global MNCs are also strengthening the closed - loop supply chain and bringing manufacturing back to the United States. Multinational pharmaceutical companies such as Eli Lilly, Johnson & Johnson, and Pfizer have all been expanding their self - built production capacity in the United States since this year. This trend may also lead to an increased risk of order loss for Chinese CXO companies in the future.

In addition, Ted Medicine also plans to support US customers in setting more favorable tariffs for the APIs it supplies and divert more global orders to regions outside the United States.

In addition to the shadow of tariffs, the draft of the "Biosafety Act" passed by the US House of Representatives last year prohibits entities receiving federal funds from using biotechnology from companies associated with foreign adversaries, which also has a negative impact on Chinese CXO companies' business in the United States. In response, Ted Medicine stated that since the company has not been rated as a "biotechnology company of concern" as defined in the proposed "Biosafety Act", the risk of impact on its operations in the US market is relatively low.

3. The third listed company in Qiantang District in 2025

It is worth mentioning that as a company based in Qiantang District, Hangzhou, Ted Medicine is already the third listed company in the district since the first half of this year. As a result, the number of newly - listed companies in Qiantang District continues to rank first among all districts and counties in Hangzhou.

Qiantang District can be regarded as the "heart" of Hangzhou's biopharmaceutical industry. In the "2025 Hangzhou Unicorn and Potential Unicorn Enterprise List" released in April 2025, there were 125 potential unicorn enterprises in the life - health field, of which 34 were from Qiantang District, leading the list with a proportion of 27.2%. Ted Medicine is also on the list.

Relying on the China Medicine Port and the industrial funds in Qiantang District, Qiantang District has been vigorously developing the biopharmaceutical industry in recent years to attract high - quality biopharmaceutical companies to settle down. In 2021, the R & D and production headquarters base for peptide drugs built by Ted Medicine in Qiantang District was included in the "152" project of provincial, municipal, and county - level leaders in 2021 (the "152" project refers to major industrial projects with a total investment of RMB 10 billion, RMB 5 billion, and RMB 2 billion respectively, which are planned and promoted by the leaders of governments at all levels and relevant units in Zhejiang Province each year). In the same year, Ted Medicine also received an investment of RMB 100 million from Qiantang (New) District's innovative industrial investment entity, Qiantang Heda Industrial Fund.

Ted Medicine's park in Qiantang, Hangzhou

Currently, Ted Medicine's Qiantang Park bears the production capacity for its Chinese business. There is a cGMP workshop with a construction area of over 15,000 square meters in the park. The annual production capacity of API is 500 kilograms, with a batch capacity of 20 kilograms and a utilization rate of 68.2% (using a total of 19 synthesis lines and 16 purification lines on average). It can handle multiple purchase orders of 100 - kilogram level and has the annual production capacity of 1 - 17 kilograms of oligonucleotides.

The prospectus shows that part of the funds raised by Ted Medicine in this listing will be used to expand the production capacity of the existing Qiantang Park and build or acquire new facilities in the next 2 - 3 years to increase its annual production capacity by about 2,000 kilograms.

In addition to the Qiantang Park, Ted Medicine is also building new facilities in the Medicine Port Town Park for the research, formulation development, and pilot - scale production of peptides and oligonucleotides. The prospectus shows that the Medicine Port Town Park covers an area of about 10,000 square meters and has a construction area of about 26,700 square meters. The main structure has been completed, and it is expected to be put into operation in the second half of 2025.