72 hours after the launch of Xiaomi YU7: Competitors are busy cutting prices, there's no worry about supply, and products with large space still have opportunities.

The Xiaomi YU7 has kicked off a new round of battles in the automotive market.

After the pre - order started at 22:00 on June 26th, the Xiaomi YU7 achieved 200,000 large - scale pre - orders and over 120,000 locked orders in just 3 minutes. This not only broke the record set by Xiaomi's own SU7 but also left an outstanding mark in the history of the Chinese automotive industry.

The segment where the Xiaomi YU7 lies, the 200,000 - 300,000 yuan pure - electric SUV market, is a highly contested territory in the automotive industry.

The Tesla Model Y, starting at 263,500 yuan, sold over 480,000 units in 2024 and has been the most popular model in China for two consecutive years. The market share of the Model Y has attracted many domestic manufacturers to compete.

XPeng once launched the G6 model targeting the Model Y. With its cost - effectiveness and intelligent features, the XPeng G6 achieved an average monthly sales volume of 8,000 for six consecutive months after its launch. The Zhijie R7 under Hongmeng Zhixing, with a starting price of 259,800 yuan, sold over 10,000 units for three consecutive months at the beginning of its launch. However, the sales of these domestic pure - electric SUVs were unstable. They only had a short - term boom and were soon suppressed by new products and price wars, leading to a decline in sales.

In contrast, although the refreshed Model Y has faced some controversies, its sales prove Tesla's brand moat. From March to May 2025, the Model Y delivered a total of 92,000 new vehicles.

Now, with the launch of the Xiaomi YU7, it is almost the only model that can compete with Tesla in terms of brand power and appeal. What kind of market feedback has the Xiaomi YU7 received 72 hours after its launch?

On - site at the stores: Each salesperson has locked over 100 orders, and the longest delivery cycle has reached 60 weeks

Lei Jun publicly stated in a media interview after the press conference that within less than 3 minutes of the Xiaomi YU7's launch, there were 196,000 orders and over 120,000 locked orders. Three days after the press conference, 36Kr visited several Xiaomi car stores in Beijing.

Actual shot of the Xiaomi YU7 at the store

“On the morning after the launch, the system showed that I already had 100 users who locked their orders,” several salespeople told 36Kr. “Among these locked - order users, most of them transferred from the SU7, and the Pro version orders accounted for the majority.”

However, weekends are the peak period for customers visiting Xiaomi stores.

Some salespeople told 36Kr that there are 10 test - drive cars in the store, and they were almost in use non - stop from 10:00 am to 7:00 pm on weekends. “Users who made appointments have to wait in line for the test - drive, and those who came to the store without an appointment can only take a look at the cars in the showroom.”

Several salespeople told 36Kr that most of the users received on weekends are new or additional car buyers. After the test - drive, most of them prefer the basic version, which is different from the users who locked their orders on the first day. “But the user profile is still quite similar. The YU7 is mainly targeted at young people and young families, which is a bit different from our expectation of family - oriented customers.”

Regarding the delivery time, on the Xiaomi car app, the delivery cycle for the basic version is estimated to be 57 - 60 weeks (15 months), 50 - 53 weeks (12 months) for the Pro version, and 37 - 40 weeks (10 months) for the Max version.

Salespeople told 36Kr that users who locked their orders on Friday still have a chance to pick up their cars this year. However, most users in their stores still want to see the car before locking the order. “For users who lock their orders this week, no matter which version they order, the hope of getting the car this year is slim.”

With 289,000 large - scale pre - orders in one hour after the launch and a production - scheduling cycle as long as 60 weeks, competitors naturally cannot sit idle in the face of the Xiaomi YU7's booming success.

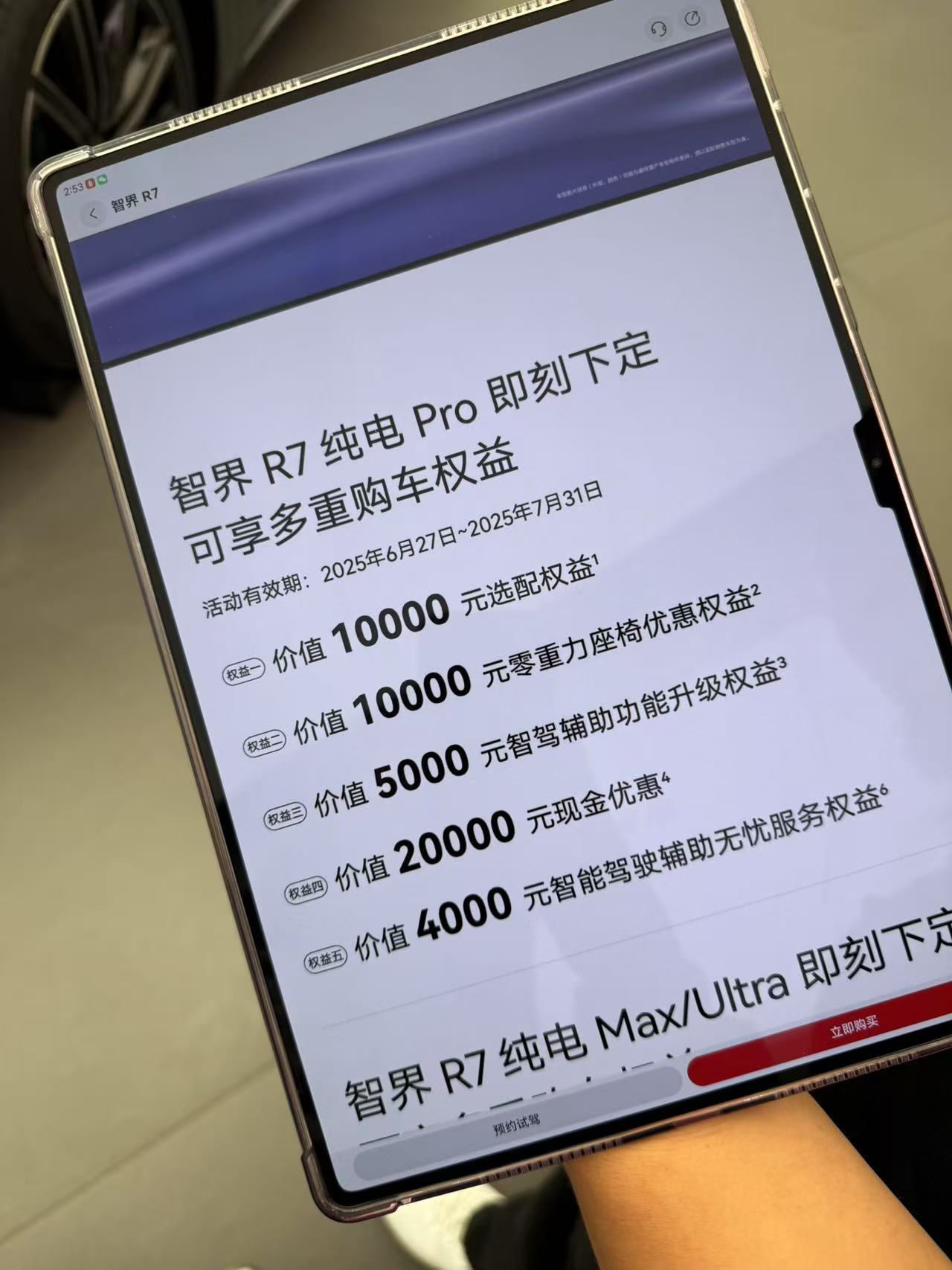

Limited - time discount policy for the Zhijie R7

Hongmeng Zhixing has launched a limited - time discount activity for the Zhijie R7. Since June 27th, the car price has been directly reduced by 20,000 yuan in cash. In addition, there is a 10,000 - yuan discount for the zero - gravity seat, a 10,000 - yuan option - selection fund, and a series of discounts for assisted driving.

However, several salespeople at Hongmeng Zhixing stores told 36Kr that the price - cut discount did not have a significant effect. “Weekends should be the prime time for car - viewing, but the number of customers who visited the store spontaneously this weekend was average, and there was no obvious increase in the number of users who made online appointments to view the cars.”

Tesla Model Y, the biggest competitor of the Xiaomi YU7, has responded relatively calmly.

Tesla salespeople from stores in multiple cities across the country told 36Kr that the head office has not announced any price - cut or subsidy policies. “Xiaomi has sold out its production capacity for this year. Customers who pick up their cars next year will have to pay over 10,000 yuan in purchase tax. Tesla still has an advantage. Our products are stable, and our delivery ability is strong.”

Xiaomi's supply chain: Pre - emptive supply - guarantee actions, no worries about supply

36Kr reported a year ago that on the day after the Xiaomi SU7 press conference, Xiaomi's car supply - chain team rushed to various parts of the country to discuss component supply issues with key suppliers. Xiaomi, which had insufficient countermeasures for its first car, seems more confident with the launch of its second car.

Several supply - chain insiders told 36Kr that before the YU7 press conference, Xiaomi held several meetings with supplier companies to confirm the supply and delivery issues. “Even on the morning of the press conference, Xiaomi car sent us another message asking us to ensure on - time, high - quality, and sufficient delivery.”

Xiaomi's Phase I factory is currently in orderly production, manufacturing the SU7, SU7 Ultra, and YU7 simultaneously. There are already a batch of YU7 cars parked in the parking lot of the Phase I factory.

36Kr reported that Xiaomi's Phase II car factory will be completed in June and will be officially put into production from July to August. An industry insider told 36Kr that the construction progress of Xiaomi's Phase II car factory is over a month ahead of schedule and has now entered the preparation stage for production.

The launch of the Phase II factory will surely relieve the current 60 - week delivery pressure. However, it will still take time for the new factory to reach full production capacity. It took 3 months for the Phase I factory to reach a monthly production capacity of 10,000 units and half a year to reach 20,000 units per month.

For Xiaomi, the top priority now is how to quickly increase production capacity, relieve the 60 - week delivery pressure of the YU7, and achieve continuous growth in orders.

Product analysis: Xiaomi targets young people, there are still opportunities in the family - use market

Before the launch press conference, only the exterior of the Xiaomi YU7 was shown at Xiaomi car stores, and the interior was not open to the public. After the full - scale launch, the product competitiveness of the Xiaomi YU7 has become clearer.

For Xiaomi, a “high - performance” car brand, the YU7 with an air - suspension configuration seems to lose a bit of Xiaomi's “soul.”

Several SU7 users who visited the store to experience the YU7 told 36Kr that in terms of handling, the YU7 has a significant gap compared with the SU7. “The YU7 feels a bit wobbly. Several of us who test - drove it said so, and even the salesperson agreed. If I were using the car alone, the YU7 is not that good.”

On the other hand, several users who placed orders told 36Kr that their impression of the Xiaomi YU7 is that it has a large interior space but a small trunk. Compared with the Xiaomi SU7 sedan, the YU7 has improved headroom and legroom. The rear - seat with a maximum adjustment range of 135 degrees allows the rear passengers to have a more comfortable sitting position.

Due to the long front end and the pursuit of a comfortable interior space, the trunk space of the Xiaomi YU7 is a bit limited. Not only is the depth limited, but the sloping back of the trunk door also reduces the usable height of the trunk.

The upper one is the Tesla Model Y, and the lower one is the Xiaomi YU7

In addition, the design of the front windshield instrument panel of the Xiaomi YU7 is not very user - friendly.

At a Xiaomi store, a female user about 160 cm tall told 36Kr that the raised front end and a black screen in front of the YU7 blocked the driving view. “I can see clearly when I adjust the seat to the highest position, but then it's uncomfortable to step on the accelerator and brake. The SU7 doesn't have this problem at all.”

With a trunk space that is difficult to meet the needs of family users and a driving position that is not very friendly to female drivers, the Xiaomi YU7 has difficulty striking a balance between its cool exterior design and the delicate needs of family users. It is more of an SUV model suitable for young people's daily commuting.

There are still opportunities in the pure - electric SUV market for family - use scenarios.

The left one is the Tesla Model X, and the right one is the Li Auto i8

Li Auto will launch a new 6 - seat pure - electric SUV, the i8, in July. A store staff member told 36Kr that the five - seat pure - electric SUV i6, which has the same positioning as the Xiaomi YU7, will also be launched in September this year.

Judging from the released information, Li Auto clearly has a deeper understanding of family users. The short and narrow front end can provide more interior space and a better driving view, and the rear - end design is more friendly to the trunk space.

More importantly, Li Auto already has a certain market reputation and brand appeal. Its pure - electric series will have a natural first - mover advantage among family users, who happen to be the largest group of Chinese car consumers.

With the popularity of the Xiaomi YU7, a new chapter in the pure - electric car market war has begun. This all - around war focusing on users, prices, experiences, and production capacity is just heating up.

The Tesla Model Y still ranks first with its brand moat and stable delivery. Competitors like Hongmeng Zhixing and XPeng have quietly launched price wars and strategic adjustments. More importantly, Li Auto, which understands the needs of family users well, has its pure - electric SUV i6 ready to be launched in September, targeting the huge family - use market that the YU7 has not fully met.

Whoever can more accurately grasp the core needs of different users, more efficiently solve the delivery problems, and gain an advantage in continuous technological iteration and cost control will be the final winner in this ever - changing pure - electric SUV market full of top - notch competitors.