Heavy Spending | Are Luxury Goods Losing Their Appeal in China as the Middle Class Faces Setbacks?

Author | Chen Sizhu

Editor | Xie Yunzi

“Compared with three years ago, the number of customers at Beijing SKP has decreased by two - thirds, and there was a cliff - like drop at the end of last year.”

On the last day of 2024, Zhang Yao left her job at a luxury brand, bidding farewell to her more than a decade - long career as a salesperson at a luxury counter. In her memory, throughout 2024, it became normal for the sales staff to wait idly for customers. The previous work scenario in the store, where they served customers around the clock and even extended the closing time until midnight, has disappeared.

Zhang Yao's perception is also a microcosm of the sluggish luxury market.

Objectively speaking, the instability of the global economy is profoundly affecting the development of the luxury industry. When people's disposable income and expected income decline, their consumption behavior becomes more conservative.

On April 17th, Hermès released its financial report for the first quarter of 2025. Calculated at constant exchange rates, its revenue in the first quarter reached 4.13 billion euros, a year - on - year increase of 7%, which was lower than the market expectation of 4.16 billion euros.

Looking at different regions, the Japanese market performed the strongest, with a 17% growth. However, the Asia - Pacific region excluding Japan only had a 1% growth.

Almost simultaneously, the LVMH Group also released its financial report. In the first quarter, it continued the downward trend of the past year. Its total revenue decreased by 3% year - on - year to 20.3 billion euros, and almost all business departments showed a decline.

In addition, on the other side, the Kering Group also had a poor start due to “Gucci being continuously abandoned by Chinese consumers”. The financial report showed that in the first quarter of 2025, the total revenue of the Kering Group declined by 14% to 3.883 billion euros, and the revenue in the Asia - Pacific market declined by 25% year - on - year.

In the secondary market, the stock prices of luxury groups have also been falling continuously. After the release of the performance, Hermès' stock price fell by nearly 4%. So far this year, Kering Group's decline has exceeded 16%, and LVMH Group's decline has exceeded 20%.

Whether it is from Zhang Yao's personal observation or the performance of major luxury groups, a clear fact is that in the Chinese market, luxury brands seem to be having trouble selling.

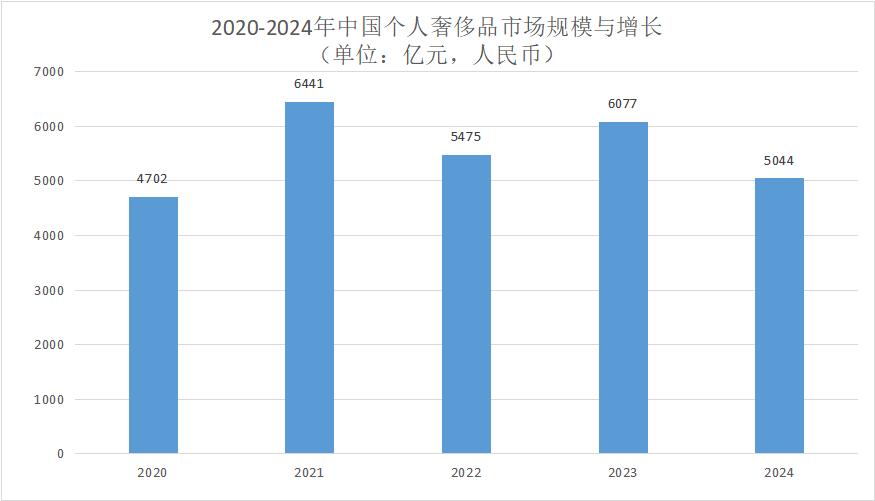

Data source: Yao Ke Research Institute, Accenture China; Chart by 36Kr

The Middle Class is Shrinking, and the “Price - Hike Strategy” is No Longer Effective

“Many customers who used to be able to buy three or four items at once now only look but don't buy, or only purchase classic products that are more value - preserving.” Zhang Yao told 36Kr. In her observation, the first customers to “disappear” were the “middle class” represented by the working - class population.

All along, VIC customers (high - value customers) have supported the basic performance of luxury brands, but the contribution of the large - scale middle class to the sales volume of luxury goods cannot be ignored.

Morgan Stanley once wrote in a research report that most luxury brands still rely on consumers from the middle to upper - middle class to achieve growth. “Relying solely on high - net - worth individuals cannot support the mid - to high - single - digit growth rate of the industry.”

When the global economy enters a downward cycle, the middle class represented by the working class is experiencing a split.

In the book “The M - shaped Society: The Crisis and Business Opportunities of the Disappearance of the Middle Class” by Kenichi Ohmae, the phenomenon of Japanese society changing from being dominated by the middle class to having two extremes of the rich and the poor was described: When the two ends of the rich and the poor in the M - shaped society expand and the middle class gradually disappears, the market business opportunities and marketing rules also change accordingly.

Against this background, the price - hike strategy commonly used by luxury brands to combat economic fluctuations is gradually losing its effectiveness.

With consecutive price hikes, in 2023, Chanel achieved record - high performance, and the Asia - Pacific region where China is located contributed more than half of the turnover. According to Chanel's logic, price hikes can screen out high - net - worth individuals with stronger payment capabilities and help the brand resist uncertainties.

However, when the price anchor exceeds the public's psychological threshold for luxury goods, the side effects brought about by the step - by - step price hikes are gradually becoming prominent.

A small - scale survey by 36Kr found that among consumers who used to have the habit of buying luxury goods, 65.95% of them have reduced the frequency of purchasing luxury goods in the past year.

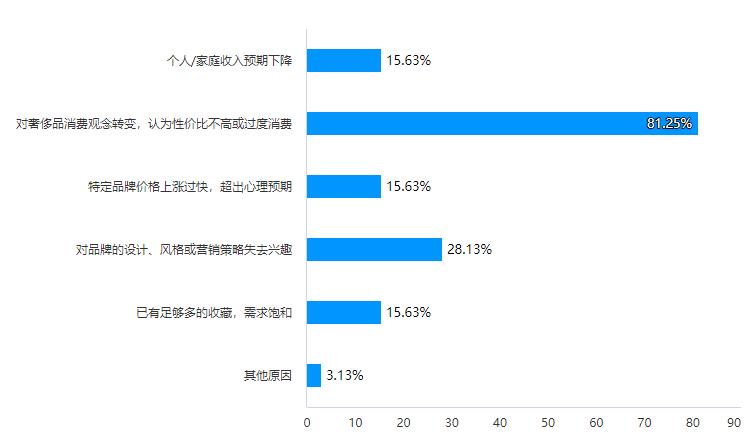

Among them, 81.25% of the consumers attributed the reason to “a change in the consumption concept of luxury goods, believing that the cost - performance ratio is not high or it is excessive consumption”; another 15.63% also reported that “the brand's price has risen too fast, exceeding their psychological expectations.”

Main factors for consumers to reduce the purchase of luxury goods (multiple choices), Chart by 36Kr based on the survey results

It is worth noting that as the middle class pursues cost - performance more, people are also more willing to choose to consume overseas where the exchange rate and tax rate are lower.

Wang Yijun, the president of the Song Division of Accenture Greater China, said that consumers prefer to buy luxury goods when traveling overseas, which has also led to the spill - over of domestic consumption.

At the same time, some luxury brands are also adjusting their expansion speed in the Chinese market.

Du Bin, the secretary - general of the Brand Professional Committee of the Shanghai Shopping Center Association, told 36Kr that in the past year, most top - tier luxury brands have become more cautious in their expansion strategies in China. “The good locations originally reserved for top - tier luxury brands can now be easily taken by other brands.”

After entering 2025, the Kering Group also entered a wave of store closures. Its two major brands, Gucci and Bottega Veneta, respectively closed several stores in Beijing, Shanghai, Chengdu, and Taiyuan.

Being Diversified by Gold and Affordable Luxury Brands, How Can Luxury Brands Break the Deadlock?

“When the story can no longer be told, price cuts may be the best adjustment measure.”

In the view of Tang Xiaotang, an independent fashion analyst and the founder of No Fashion Chinese Network, luxury giants need to lower their stance to cater to the trend of consumption segmentation. “Especially for some entry - level products, the rapid price hikes have led to the loss of a group of entry - level consumers.” To a certain extent, this has caused a generational gap in customers.

However, at present, luxury giants have not given up the price - hike strategy.

In May this year, Stéphane Bianchi, the deputy CEO of the LVMH Group, publicly emphasized that the luxury brands under the company still have a price - hike space of 2% to 3% per year, and this will not have a significant impact on the demand of luxury customers. Previously, Hermès also announced at the beginning of the year that it would raise the prices of its entire product line by about 6% to 12%.

This seems to mean that luxury brands still hope to emphasize their scarcity to VIC customers with higher prices. It is worth noting that in the current Chinese market, the core users of luxury brands are being “intercepted” by Lao Pu Gold.

In sharp contrast to the deserted luxury stores, Lao Pu Gold, which has a certain value - preserving function, often has long queues, which has also made luxury groups smell a sense of crisis.

Stéphane Bianchi once told the media that he noticed that Chinese consumers' interest in domestic brands was increasing day by day, especially the demand for some Chinese jewelry companies had exploded. Although he did not “name names”, LVMH obviously paid attention to the development of Lao Pu Gold.

Nicolas Bos, the CEO of the Richemont Group, even said frankly that Lao Pu Gold can keep it continuously creative.

While Lao Pu Gold is in the ascendant, affordable luxury brands represented by Coach have also taken in some of the diverted middle - class consumers.

The financial report of Tapestry, Inc., the parent company of Coach, showed that in the first quarter of this year, its total sales increased by 7% year - on - year to $1.584 billion, and its net profit soared by 45% year - on - year to $203.3 million. The main reason for the performance increase was the significant increase in the sales of the core brand, Coach.

Tang Xiaotang also said that while the prices of luxury goods are skyrocketing, the cost - performance ratio of affordable luxury brands is more prominent. In the Chinese market, Coach's “miu” - style product design and its market adjustments by entering emerging channels such as Douyin and De Wu have greatly catered to the preferences of Chinese young consumers.

According to the prediction in the report of Bain & Company, by 2030, millennials (people born between 1981 and 1996) will contribute more than half of the luxury purchasing power. Perhaps for this reason, changing the design concept and marketing model to attract more young consumers is becoming a new direction for luxury brands.

In recent years, Gucci has successively carried out cross - border collaborations with well - known IPs such as Doraemon and Disney in order to connect with young people. At the same time, more and more brands are also eyeing the beauty track.

In March this year, LVMH officially launched the beauty category La Beauté Louis Vuitton. The Kering Group also continued to increase its investment in the beauty market in 2025, releasing multiple new products of Balenciaga and Alexander McQueen.

In Wang Yijun's view, beauty products with lower prices can become “entry - level products” to attract more young people to enter the market, and at the same time achieve more comprehensive product coverage.

When the era of “bags can cure all ills” is over and the use value of commodities is gradually returning, for luxury giants, how to achieve continuous growth in the Chinese market and how to find new opportunities in the gradually segmented middle - class group have become more crucial issues to consider than ever before.

(Zhang Yao in the article is a pseudonym)

Follow for more information