Mobvoi has launched new hardware. The so - called "first stock in AIGC" is in urgent need of new stories.

Text by | Zhou Xinyu

Edited by | Su Jianxun

One year after going public as the "first stock in the AIGC concept," on June 25, 2025, Li Zhifei, the long - absent founder and CEO of Mobvoi, appeared at the company's press conference. During the sharing session, he smiled as he shared an actually "painful" insight:

"Only a few giants in the world can develop large - scale models. To be honest, large - scale models are not something we can afford to play with."

Rather than just an insight, the above conclusion is actually an industry consensus. Li Zhifei also needs to help Mobvoi move on as soon as possible.

His sharing almost covered a host of current popular concepts such as Agent and AI Coding. When it came to the company's actual business, the result Li Zhifei finally presented was an AI card - style voice recorder for the domestic market, TicNote, which is equipped with Mobvoi's newly developed Agent, Shadow AI.

Previously, TicNote was launched in the overseas market on April 17. This is also the first smart hardware product launched by Mobvoi since its listing on the main board of the Hong Kong Stock Exchange on April 24, 2024.

△TicNote and Shadow AI. Image source: Mobvoi

The card - style voice recorder is one of the few categories of AI hardware that has achieved successful Product - Market Fit (PMF). Previously, Shenzhen startup Plaud earned $10 million in revenue in 2024 by selling magnetic card voice recorders overseas.

Li Zhifei also admitted at a media exchange meeting that TicNote will inevitably be compared with Plaud. However, for Mobvoi, the current approach to hardware development will be more conservative. At the media exchange meeting, Li Zhifei did some calculations: Previously, developing original hardware required an investment of tens of millions of yuan, and selling 100,000 products was needed to break even.

He said that currently, Mobvoi prefers to find mature hardware forms in the market and focus on the development of AI software, competing with software.

The last time Li Zhifei appeared publicly in a high - profile manner was in April 2023. At that time, he, along with Wang Huiwen and Wang Xiaochuan, entered the large - scale model field in a high - profile way and released the large - language model "Sequence Monkey" benchmarked against ChatGPT in April.

Later, Mobvoi made rapid progress and, in April 2024, listed on the Hong Kong Stock Exchange under the banner of the "first profitable stock in the AIGC field."

However, after listing, Mobvoi rarely appeared at the center of the narrative. This silence is partly because Mobvoi's main battlefield is overseas. On the other hand, since listing, Mobvoi has launched many technologies and products, but there are few highlights.

Now, the large - scale model "Sequence Monkey" has stopped iteration, and the digital humans and AI dubbing applications launched by Mobvoi are not in the first echelon of applications.

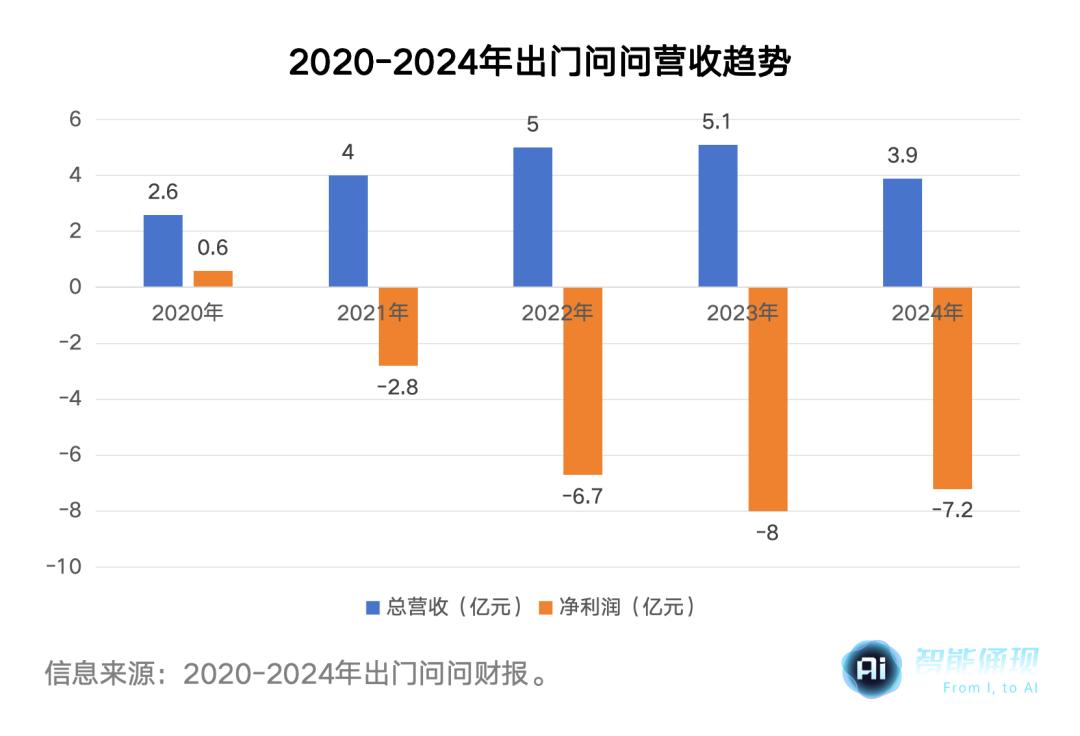

This lackluster performance is reflected in the company's financial results. Since 2021, Mobvoi has still not been able to get out of the quagmire of losses.

Chart by Intelligence Emergence

The halo of the "first stock in the AIGC concept" has faded. One year ago, Mobvoi's IPO price was HK$3.80 per share. As of June 2025, the stock price has dropped to around HK$0.35.

However, Li Zhifei's belief in AI has not been shattered. At the press conference, he mentioned that Agent has restored his belief in AGI. Moreover, he believes that TicNote will be a successful product. "I've failed too many times. I also need positive feedback."

"Copying" Plaud's Model and Telling a New Story about Hardware and Software

Smart hardware was once Mobvoi's most important business line. The smartwatch TicWatch was also the first hit product since Mobvoi was founded. At its peak, the TicWatch product line alone could achieve an annual global sales volume of 1 billion yuan.

However, for a long time, even after launching smart headphones and speakers, Mobvoi has never replicated the glory of TicWatch in the field of smart hardware where it excels.

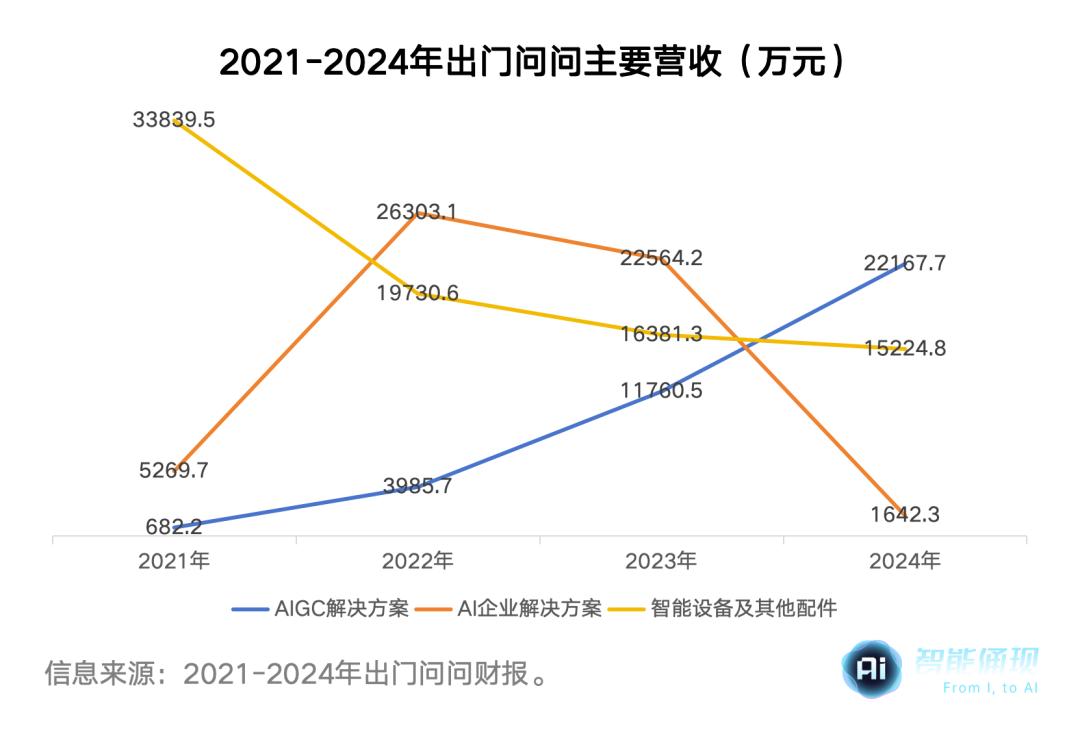

Financial reports show that since 2021, Mobvoi's revenue from smart devices and other accessories has declined for four consecutive years. Even the sales of the star product TicWatch series have shown a downward trend: 60,000 fewer units were sold in 2023 than in 2022, and 126,000 fewer units were sold in 2022 than in 2021.

Chart by Intelligence Emergence

Manufacturers such as Huawei, Xiaomi, and Samsung are competing fiercely in the smart hardware market, squeezing Mobvoi's living space. More importantly, these smartwatches rely on the mature software and hardware ecosystems and brand effects of mobile phone manufacturers. Mobvoi, which has long relied on cooperation with ODM manufacturers to "brand" and output hardware products, does not have an absolute moat for its hardware products.

The development of edge - side models has given Mobvoi, which has long lacked new hardware stories, a glimmer of hope for a comeback.

Since 2024, you must be familiar with the wealth myths of these hardware products: The smart ring Oura Ring from Finland had sold 2.5 million units and achieved sales of $500 million by June 2024; a Dongguan company, Liberlive, sold a stringless guitar and achieved an annual revenue of 1 billion yuan in 2024.

However, when entering the field of AI smart hardware, Mobvoi still follows its old comfort zone: finding fields that have been verified by others and have a low entry threshold.

This time, the target for Mobvoi to "copy" is the AI recording card Plaud Note, which earned $10 million in revenue in 2024. This company from Huaqiangbei targeted the pain point that iPhones cannot record calls and sold a card - style recorder that can be magnetically attached to the back of a mobile phone, ranking first on Amazon.

Li Zhifei told media such as Intelligence Emergence that previously, the cost of hardware development was very high. R & D alone might cost tens of millions, and selling more than 100,000 products was needed to make a profit. Now, he prefers to develop some hardware with mature forms to reduce the cost of hardware R & D.

△Left: Plaud; Right: TicNote. Image source: Amazon product image

Li Zhifei admitted during a media exchange that the sales of TicNote, which is very similar to Plaud in appearance and function, were "very low" in the first month of its overseas release.

Now, Mobvoi is targeting the domestic market, where Plaud has not entered and the competition is relatively sparse. The basic version of the domestic TicNote is priced at 999 yuan, which is a bit cheaper than Plaud (US$159, about 1,140 yuan).

However, apart from the education and home sectors, the domestic market for smart hardware has not been fully verified. In addition, AI headphones with call - recording functions launched by iFlytek, Philips, etc., have established user habits in advance. Replicating Plaud's success in the domestic market is likely to lead to acclimatization.

Mobvoi's strategy is to use the advantage of software to create differentiation for its hardware in the domestic market, that is, relying on the Agent named Shadow AI.

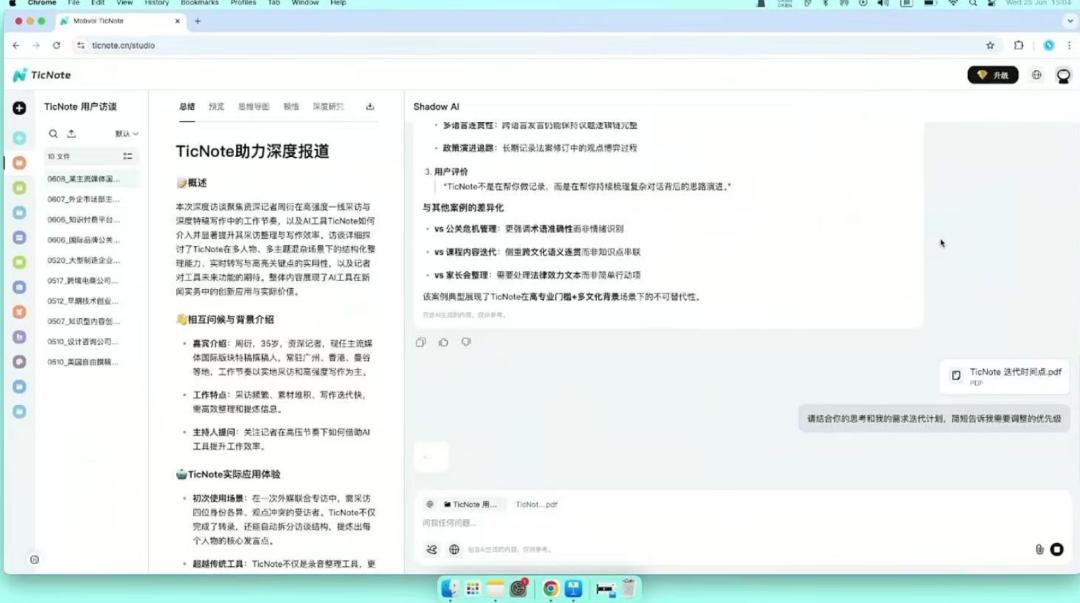

This Agent can provide AI functions such as real - time Q&A, in - depth thinking, voice recording summarization, and online search based on voice - to - text transcription. Overseas, Shadow AI is connected to models such as GPT - 4o, GPT - 4o mini, and DeepSeek R1.

△The user interface of Shadow AI. Image source: Mobvoi's on - site demonstration

However, the AI software market in China is even more competitive. In the voice - to - text transcription field alone, there are already iFlytek with a rich hardware ecosystem, as well as free services like Feishu Miaoji and Tongyi Qianwen. Moreover, restricted by regulations, there are not many high - performance models available for connection in China, and the performance will inevitably be different from that overseas.

Copying the model of a successful company is indeed a conservative approach. However, the AI industry is changing rapidly, and one solution may not be suitable for different markets and consumer groups.

Li Zhifei said that the team debated for a long time before targeting the domestic market. "But finally, we also thought that the domestic market is an opportunity." He has no expectations for hardware sales: "Ultimately, we still need to use hardware to iterate software."

Low Business Barriers Make It Harder to Make Profits Overseas

Going global to seek profits has now become an industry consensus. As a company that made its fortune by exporting hardware overseas, going global from the start was also Mobvoi's instinctive reaction after entering the large - scale model field.

Judging from Mobvoi's revenue performance in recent years, going global was a wise move.

The 2024 financial report shows that Mobvoi's overseas business revenue was 163 million yuan, accounting for 41.8% of the annual total revenue. At the 2024 annual performance briefing, Li Zhifei said that over 95% of smart hardware products are sold in overseas markets, and the software business also has a user base large enough to achieve self - sufficiency overseas. The financial report shows that in 2024, the revenue from AIGC solutions increased by 88.5% compared with 2023.

However, even though Mobvoi has found the right main battlefield, there are hidden crises in its revenue. In 2024, the year when AI applications going global boomed, Mobvoi's annual revenue (390 million yuan) was at its lowest level in the past four years.

The "medicine" for going global is not as effective as before. The reasons are, on the one hand, the increasingly fierce competition in the market, and on the other hand, the low business barriers.

Many employees describe Mobvoi's business as more cautious. At the 2024 World Artificial Intelligence Conference, an employee told Intelligence Emergence that the company prefers to initiate projects in scenarios that have been verified by the market.

Multimodality and hardware have always been Mobvoi's comfort zones. Since listing, AI dubbing products, AI digital humans, AI video generation, and smart hardware have been the four main directions of Mobvoi's business. Each product is either a continuation of Mobvoi's old business or a scenario that has been proven successful by applications such as Runway and Filmora.

However, a verified scenario often means a large number of entrants. Taking the digital human scenario as an example, according to Tianyancha data, in 2024, the number of Chinese companies related to the R & D and application of digital humans reached 1.144 million, and from January to May 2025, 174,000 new companies were registered.

As the competition becomes more intense, Mobvoi still does not have its own core advantages in terms of product form or underlying technology.

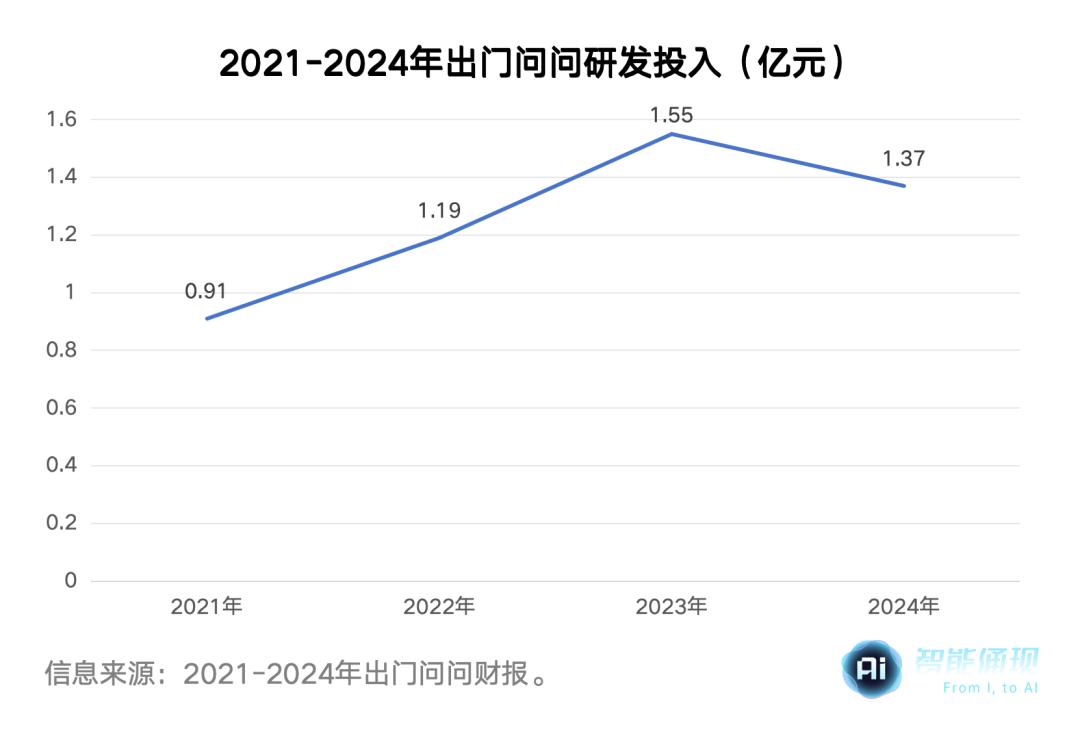

Regarding AI technology, an employee told Intelligence Emergence that currently, Mobvoi's large - scale model R & D mainly involves distilling or fine - tuning open - source models on the market. "In early 2024, the company basically gave up training and iteration."

Chart by Intelligence Emergence

Now, by entering the Agent battlefield with an AI voice - recording product, Li Zhifei is also aware that this is an area with few competitive barriers. He told Intelligence Emergence that he values user needs more and uses his knowledge to help ordinary users solve pain points in the process of using AI tools, such as writing prompts.

One year after listing, the "first stock in the AIGC concept" has reached an awkward point: conservative products and mediocre technology. Whether Shadow AI and TicNote can become memorable new stories still remains to be tested by the market.

Welcome to communicate! :)