Open source and also going for an IPO? MiniMax doesn't want to be forgotten this summer.

Text by | Zhou Xinyu

Edited by | Su Jianxun

After DeepSeek made a bold move, to prove they are still in the game, the Six Little Tigers (MiniMax, Zhipu, Dark Side of the Moon, Baichuan Intelligence, Zero One Everything, and Jieyue Xingchen) need to demonstrate their ability to compete with DeepSeek.

Previously, Dark Side of the Moon and Zhipu had already released inference models comparable to DeepSeek R1. Recently, the Six Little Tigers have started a new round of competition in inference models.

First, in the early morning of June 17, 2025, Dark Side of the Moon open - sourced the large programming model Kimi - Dev - 72B. In the SWE - bench test for AI programming ability, this model with only 72B parameters outperformed R1 with 671B parameters.

Immediately afterwards, MiniMax followed OpenAI's example and announced a five - day new product release on the same day. As of June 19, MiniMax had released the MoE (Mixture of Experts) inference model M1, the video generation model Hailuo 02, and the general Agent product MiniMax Agent.

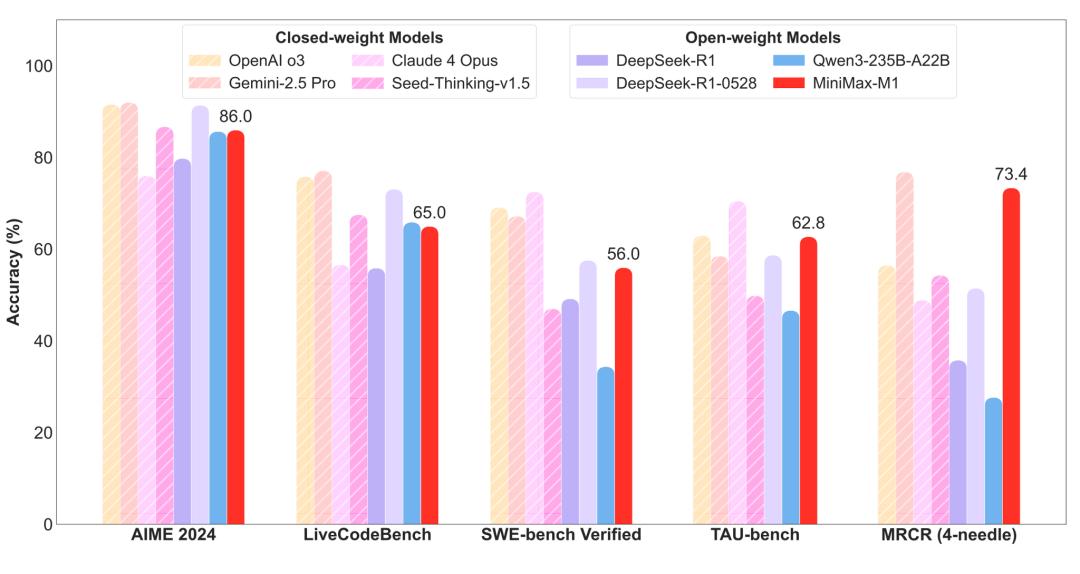

△The evaluation results of M1 on 17 mainstream evaluation sets. Source: MiniMax

Among them, the importance of M1 to MiniMax is evident. This is MiniMax's first answer to DeepSeek R1 after nearly three months of a blank period in the base model. The technical report shows that M1 supports an input context of 1 million, which is 8 times that of R1 and the highest level in the industry.

After the release of M1, Yan Junjie, the founder and CEO of MiniMax, posted: "For the first time, I felt that the mountain is not insurmountable."

Another piece of evidence that MiniMax is still in the game is its IPO plan.

In April 2025, Zhipu became the first company among the Six Little Tigers to submit a filing for listing guidance, officially embarking on the IPO path. Recently, another of the Six Little Tigers also showed signs of an IPO. Bloomberg reported, citing informed sources, that MiniMax plans to list on the Hong Kong stock market as early as this year and has hired a financial advisor for this IPO.

Video Generation and Agent: MiniMax Bets on the Next Talkie

For a long time, the only product that MiniMax could showcase was Talkie, an overseas product that had long ranked among the top three in the global role - playing app download list.

Other products, whether it was the domestic version of Talkie, "Xingye", or "Hailuo AI" (formerly "Hailuo Wenwen"), which was initially launched as a productivity tool, did not reach Talkie's level in terms of commercialization or user scale.

The single pillar product also planted risks for the enterprise. MiniMax has already tasted the bitter fruit.

In early December 2024, several live - social apps, including Talkie, were taken off the shelves for rectification on the global iOS platform. It took nearly half a year for Talkie to be relaunched. An insider told us that the number of Talkie users did not decrease significantly, but the growth rate slowed down a lot.

Creating the next Talkie has been a long - standing proposition for MiniMax. It wasn't until September 2024, when MiniMax released the video generation model "Hailuo Video I2V - 01" and launched it on Hailuo AI, that things took a turn for the better.

Actually, when MiniMax entered the video generation field in 2024, there were many skeptics in the market. At that time, Kuaishou's Keling AI was already in the domestic market. Soon after the release of Hailuo AI, ByteDance also launched two video generation models, Seeweed and PixelDance. Not to mention overseas, products like Sora and Runway had an absolute first - mover advantage.

For MiniMax, the success of Hailuo AI in the video generation field was also somewhat accidental.

An employee told us that MiniMax initially positioned the video model as part of the productivity tool ecosystem. In September 2024, Yan Junjie also said at a media meeting: "To achieve a high level of user coverage and usage depth, the only way is to generate dynamic content rather than just relying on text."

Hailuo AI was able to stand out among established companies because the video creation market has diverse aesthetics. "Each video generation model has different aesthetics and styles, which means different models have their own users," an industry insider told "Intelligent Emergence". For example, Hailuo AI, which features animation creation, has a high reputation among the anime community.

According to data from the AI product list, since its launch, Hailuo AI has ranked first among video generation products on the global list for six consecutive months, surpassing Kuaishou's Keling AI and ByteDance's Jimeng AI. As of January 2025, the overseas version of Hailuo AI had reached 16.35 million visits, more than six times that of the domestic version.

This means that after Talkie, Hailuo AI has become another successful product of MiniMax in the overseas market.

In March 2025, MiniMax changed its previous product layout of "emotional companionship + productivity tools". It renamed the original productivity tool "Hailuo AI" to "MiniMax", which focuses on text generation and understanding; "Hailuo AI" now focuses on multi - modal content such as images, audio, and videos.

After the partial success in the video field, MiniMax's ambition is to create the next Talkie in the application field.

The general Agent "MiniMax Agent" became the leading application in MiniMax's release week, aiming to compete with the popular Manus.

△MiniMax Agent. Source: MiniMax official website

The Six Little Tigers Queue up for IPO: Revenue is a Big Hurdle

In the first half of 2024, it was the heyday of the Six Little Tigers. Almost every company set extremely optimistic and aggressive listing goals: to go public within five years, or even three years. In contrast, SenseTime and Cloudwalk, among the "Four AI Dragons", took nearly seven years from establishment to listing.

Just one year later, the dream of a quick IPO for nearly half of the Six Little Tigers has been shattered in the industry's reshuffle. Few of the little tigers can meet the requirements of IPO in terms of revenue scale, business competitiveness, and management stability.

The Six Little Tigers need an IPO. On the one hand, with the competition in model technology far from over, continuous R & D and iteration still require substantial funds. On the other hand, an IPO also sends an optimistic signal to the market for the enterprise. Initiating an IPO is the best evidence for the Six Little Tigers to stay in the game.

In April 2025, Zhipu submitted a filing for listing guidance to the Beijing Securities Regulatory Bureau, becoming the first company among the Six Little Tigers to officially sprint for an IPO.

However, even though there are recent reports of a potential Hong Kong listing, MiniMax still has a long way to go before initiating an IPO. Multiple insiders told "Intelligent Emergence" that MiniMax has been preparing IPO materials, but it is difficult to officially start the process this year.

There are many pros and cons to consider behind an IPO. In recent years, the liquidity of the Hong Kong stock market has declined significantly, and the trading volume of the Growth Enterprise Market has continued to fall. In 2022 and 2023, there were no new listings on the Hong Kong Growth Enterprise Market for two consecutive years, and the average daily trading volume was only HK$130 million.

An investor analyzed to "Intelligent Emergence" that even though the conditions of the Hong Kong Growth Enterprise Market are relatively lenient, "companies that can meet the requirements of the Main Board have all gone to the Main Board."

However, listing on the Hong Kong Main Board places higher requirements on the company's cash flow. The relevant regulations show that for specialized technology companies that are not yet commercialized (meaning their revenue in the last fiscal year did not reach HK$250 million), although there is no revenue requirement, they need to provide a credible path for product commercialization and proof of sufficient operating funds.

A typical example of an unsuccessful IPO is Megvii Technology, one of the "Four AI Dragons". Since submitting its IPO application in September 2021, Megvii Technology has had to suspend the process several times due to reasons such as supplementing financial data. Finally, on November 29, 2024, Megvii officially announced the end of its three - year IPO journey.

We learned that among the Six Little Tigers, only Zhipu has an annual revenue of over HK$100 million (about 91.599 million yuan) in the past two years.

Increasing revenue is an important proposition for MiniMax this year. Previously, MiniMax's revenue mainly came from advertising and subscriptions of Talkie, which was relatively single - sourced and riskier.

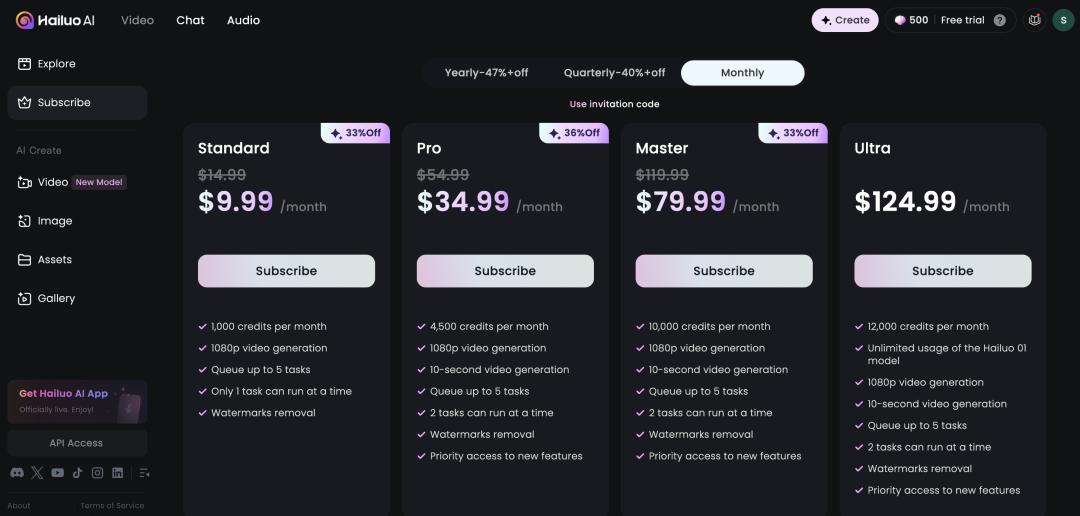

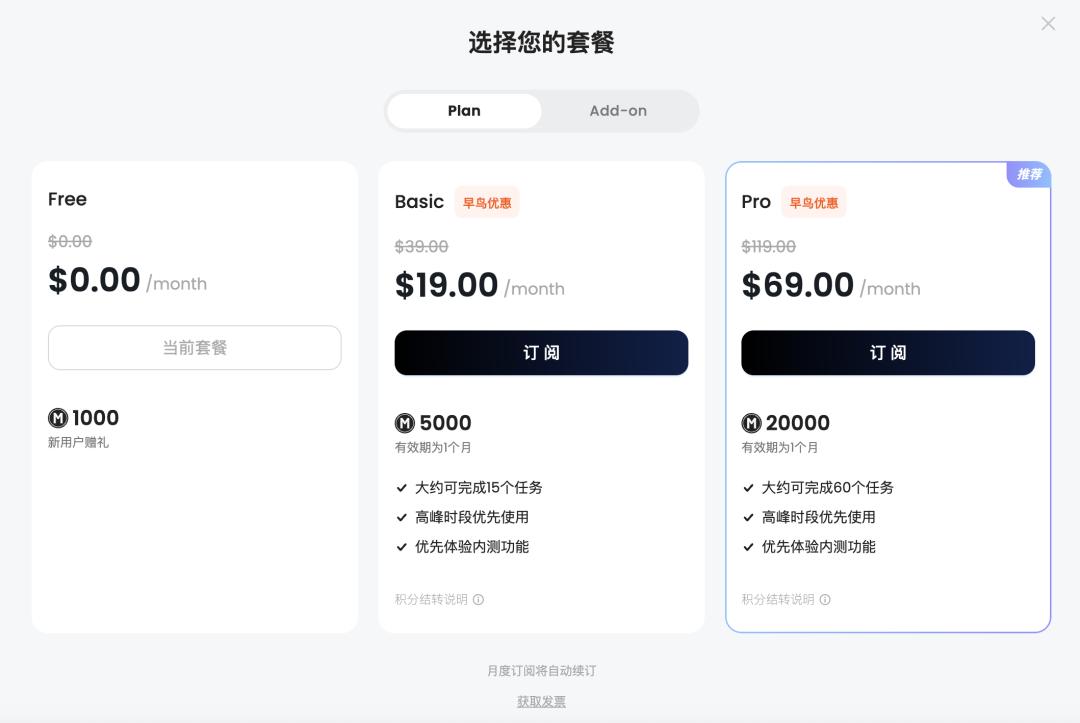

Now, MiniMax's path to expand its revenue includes, on the one hand, expanding its product lineup. Both Hailuo AI and the newly launched MiniMax Agent have launched subscription services. On the other hand, it is targeting the overseas market with higher willingness to pay. The recently released models and products are simultaneously promoted and launched overseas.

△Hailuo AI subscription plan. Source: Hailuo AI official website

△MiniMax Agent subscription plan. Source: MiniMax Agent official website

The IPO stories of Zhipu and MiniMax have just begun. How to withstand the financial scrutiny is the test that these remaining Six Little Tigers need to face next.

Welcome to communicate!

Welcome to follow!