ZhiKe | Hengrui's stock price soared 30% in half a year. Is the $6 billion order a pie in the sky or real money?

Author | Huang Yida

Editor | Zheng Huaizhou

Since the beginning of this year, the concept of innovative drugs has been booming. Many pharmaceutical funds that were widely criticized in the past few years have turned profitable again due to their heavy investment in innovative drugs. As the flagbearer of domestic innovative drugs, Hengrui Medicine (hereinafter referred to as: Hengrui) has seen its stock price rise continuously since entering 2025. As of June 11, its maximum increase this year has exceeded 30%. Looking at a longer period, Hengrui's current stock price has doubled compared to its phased low in 2022.

Chart: Stock price trend of Hengrui Medicine; Source: wind, 36Kr

So, what are the core factors driving the continuous rise of Hengrui Medicine's stock price this year? Based on the current valuation, is Hengrui overvalued?

01 The continuous realization of the logic of BD going global drives the stock price up

The moderate rise of Hengrui's stock price in the past three years and the continuous rise since the beginning of this year are, on the one hand, against the backdrop of the overall weakness of the pharmaceutical manufacturing industry. Its own performance is relatively stable. The core logic behind this is that innovative drugs have contributed stable revenue and substantial profits to the company, and have become the cornerstone of performance growth. At the same time, benefiting from the previous strategic transformation, the impact of the centralized procurement of generic drugs on the company's performance has been significantly weakened.

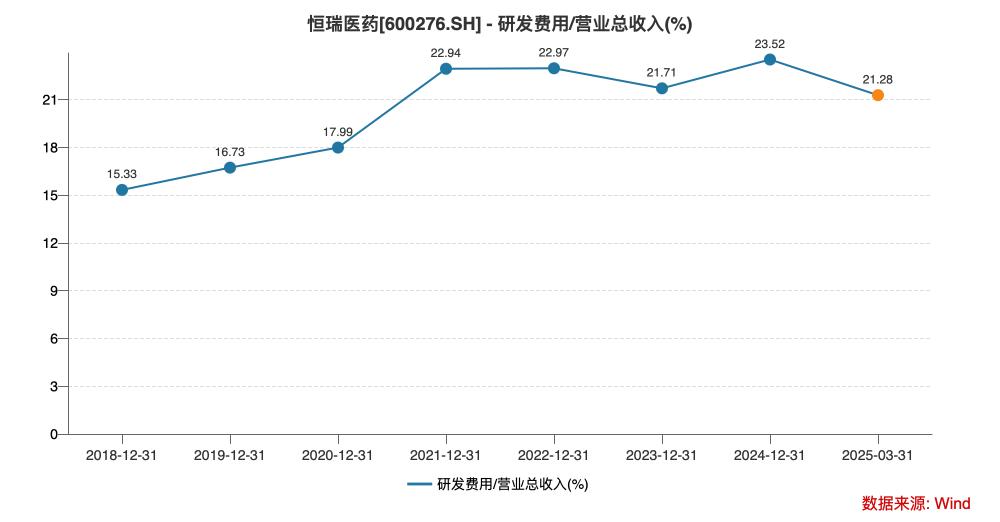

On the other hand, Hengrui leads the industry in R & D. In terms of R & D intensity, the company's R & D expense ratio has been above 20% in recent years, comparable to those well - known multinational pharmaceutical giants. The number of R & D personnel has also shown an overall increasing trend. In terms of the R & D pipeline, the indications are mainly anti - tumor, and also cover multiple categories such as autoimmune diseases, diabetes, cardiovascular diseases, anti - infection, blood, pain management, ophthalmology, and respiratory system. In terms of R & D progress, from 2018 to 2024, Hengrui had an average of two innovative drugs approved each year, and the advantage of pipeline reserves has been continuously highlighted.

Chart: R & D expense ratio of Hengrui Medicine; Source: wind, 36Kr

In recent years, the going - global of the pharmaceutical industry has been on the rise. As the flagbearer of Chinese innovative drugs, Hengrui has also done very well in the going - global of innovative drugs, which is an important marginal increment of performance growth. The logic of BD going global is continuously being realized, which is another core factor driving the continuous rise of Hengrui's stock price this year. According to the information disclosed in Hengrui's 2024 annual report, during the reporting period, it received a 160 million euro upfront payment for an out - licensing deal from Merck Healthcare and a 100 million US dollar upfront payment for an out - licensing deal from Kailera Therapeutics, etc., and recognized them as revenue.

In addition to the two upfront payments already received in the above two BD transactions, the potential revenue from the transaction with Merck Healthcare could be as high as 1.4 billion euros, and the annual sales royalty rate in the future will be in double - digits. The expected revenue from the transaction with Kailera Therapeutics is even higher, specifically including up to 200 million US dollars in clinical development and regulatory milestone revenues, and the subsequent sales milestone revenues will not exceed 5.725 billion US dollars in total. The future sales royalty rate will be in the range of low single - digits to low double - digits. The consideration for this transaction also includes a 19% equity stake in Kailera Therapeutics.

After entering 2025, Hengrui disclosed two BD transactions with Merck & Co. and Merck KGaA around March and April. The consideration for the transaction with Merck & Co. includes a 200 million US dollar upfront payment, and the subsequent milestone revenues can reach up to 1.77 billion US dollars in total. There will also be corresponding sales royalties after the product is approved for marketing. The consideration for the transaction with Merck KGaA includes a 15 million euro upfront payment, certain milestone payments, and a double - digit sales royalty rate based on annual sales.

In recent years, Hengrui has mainly achieved going - global through licensing transactions, and has accelerated the internationalization process of domestic innovative drugs through a series of high - value BD transactions. Its partners include different types of institutions such as multinational pharmaceutical giants, innovative drug startups, and venture capital funds. The cooperation models are also quite diverse, not limited to the traditional license - out. The cooperation between Hengrui and Kailera Therapeutics is a typical NewCo model.

The so - called NewCo model is to establish a new company overseas. Domestic pharmaceutical companies contribute the pipeline, and overseas capital provides funds and management to jointly promote the development and commercialization of the pipeline. In this transaction, Hengrui licensed three GLP - 1 drugs under research to Kailera Therapeutics in a package. For Hengrui, the short - term performance is a 100 million US dollar upfront payment revenue, and the long - term performance expectation includes potential milestone revenues and sales royalties of over 6 billion US dollars. Since the transaction consideration includes Hengrui's approximately 20% equity stake in NewCo, the future revenue expectation will also include potential dividend income.

From the perspective of the pipeline, an important trend of Hengrui's above - mentioned BD transactions is the gradual extension from oncology to global hot areas such as metabolic diseases (such as GLP - 1) and cardiovascular diseases. A typical example is the transaction with Kailera Therapeutics, which involves the popular GLP - 1 drugs in recent years. After semaglutide exploded in the global market, Hengrui intends to promote its GLP - 1 products to the international market through the NewCo model, and this has become one of the largest drug BD cases in recent years. The Lp(a) oral small - molecule project (HRS - 5346) in cooperation with Merck & Co. this year further expands its global layout in the field of cardiovascular and metabolic diseases.

For investors, the impact of these high - value BD transactions on Hengrui's performance expectation is self - evident. But in terms of the rhythm of revenue, compared with the huge total transaction consideration, especially the milestone revenues and sales royalty revenues in the distant future, investors pay more attention to the short - term cash flow brought by BD transactions, that is, the upfront payment. It has to be said that the development of the pipeline is a long - term process, but the upfront payment after the official announcement of the cooperation will be recognized as current revenue. So the short - term highlight of overseas BD transactions in investment is the number of projects with official cooperation announcements and the scale of upfront payments.

Therefore, among the investors who are bullish on Hengrui, a considerable part are bullish on the logic of BD going global. Financially, they focus on the cash flow performance of current performance. From specific cases, the upfront payment revenue disclosed in the 2024 annual report is the continuous realization of the logic of BD going global. The new BD transactions disclosed in March and April have mainly boosted the performance expectations for the second and third quarters. Then, as the core logic of BD going global is continuously realized, and at the same time, the short - term performance expectation is also guaranteed to a certain extent, this drives these investors to firmly buy Hengrui, which is part of the reason for Hengrui's continuous rise since the beginning of this year.

02 Investment strategy

The logic of Hengrui's BD going global is a popular topic in recent years and has a certain performance explosive power. However, the long - term investment value of Hengrui still needs to be analyzed from a more comprehensive perspective.

First of all, as an established pharmaceutical company, the business logic of transforming from generic drugs to innovative drugs still applies. Even though Hengrui has long stopped the development of the generic drug pipeline, generic drugs still exist in its product portfolio. So the drag of centralized procurement on Hengrui's performance has always existed. Public information shows that from 2018 to 2022, there were 35 generic drug varieties involved in centralized procurement by Hengrui, and 22 of them were selected. The average price reduction after selection was as high as 75%.

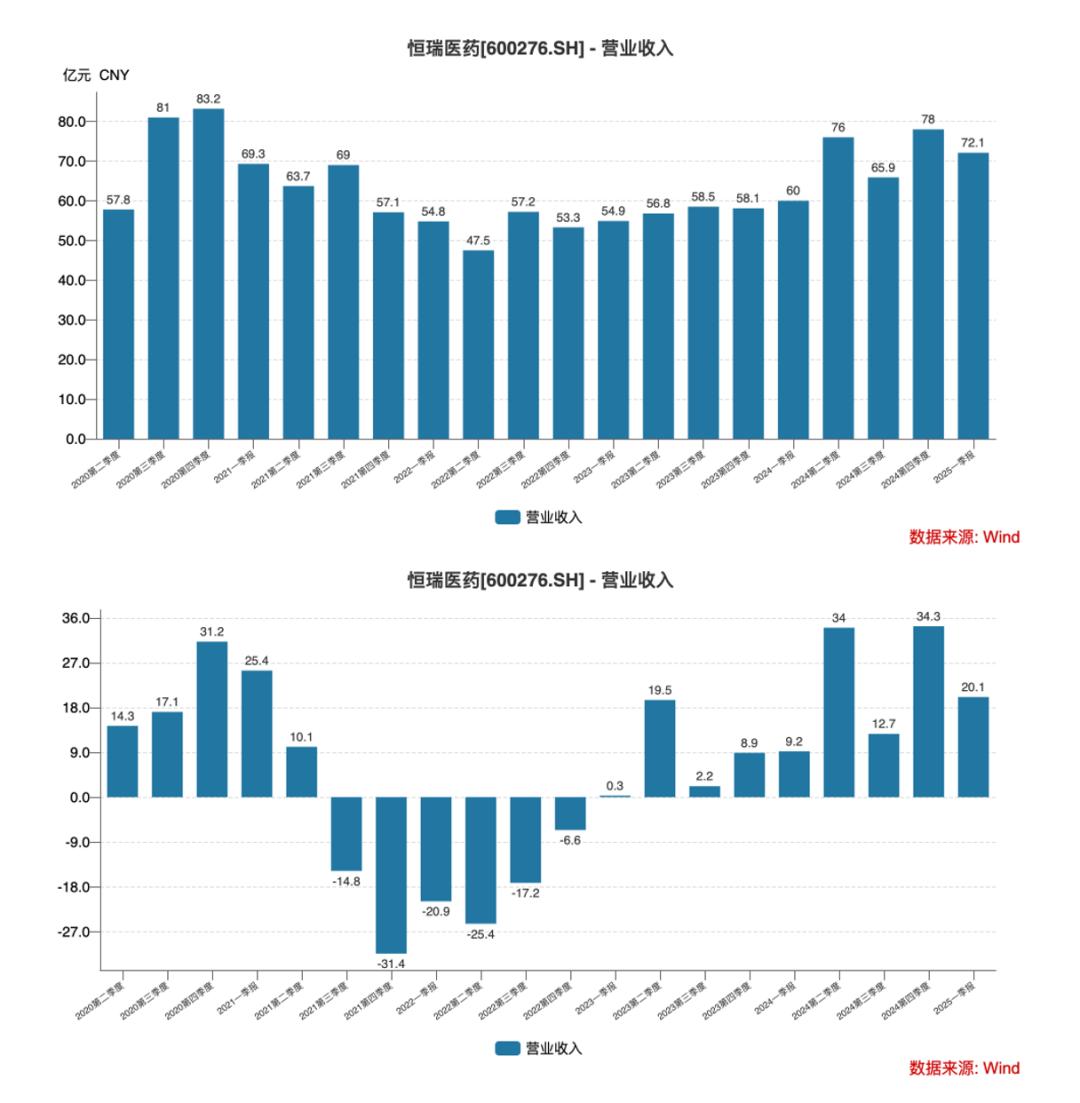

With the continuous advancement of centralized procurement, the prices of generic drugs participating in centralized procurement have almost dropped to the extreme. According to the data of sample hospitals and the execution prices of centralized procurement, the sales of the centralized - procurement varieties almost bottomed out in 2024. Looking at Hengrui's performance, according to the quarterly revenue, Hengrui's revenue bottomed out in Q2 2022, mainly affected by centralized procurement and the medical insurance negotiation for innovative drugs. After Q2 2022, Hengrui's revenue growth showed an obvious sequential recovery trend, and the year - on - year revenue growth turned positive in Q2 2023.

Chart: Hengrui's quarterly operating revenue and year - on - year growth rate; Source: wind, 36Kr

The gradual improvement of Hengrui's revenue in recent years is, on the one hand, due to the marginal weakening of the impact of centralized procurement. At the same time, Hengrui has also been continuously promoting the going - global of generic drugs. According to the company's financial reports, in about 14 years from 2011 to now, Hengrui has obtained more than 20 registration approvals for generic drugs overseas.

On the other hand, innovative drugs are gradually increasing in volume. The pipeline structure is centered around oncology, followed by autoimmune diseases, and is also deployed in popular fields such as diabetes and cardiovascular diseases. The pipeline structure basically corresponds to the business revenue structure. Currently, the main revenue growth is still contributed by drugs related to oncology and autoimmune diseases.

When it comes to the logic of Hengrui's innovative drugs, we have to mention the current medical insurance system. After a series of reforms to increase revenue and reduce expenditure, the payment pressure of medical insurance is still quite high. Therefore, against the background that the revenue of innovative drugs is under pressure due to medical insurance negotiation, Hengrui is actively seeking to promote the BD going - global of innovative drugs. This is also the main logic and background for domestic innovative drugs to go global collectively in recent years.

In terms of results, since Hengrui has long maintained a R & D intensity comparable to that of multinational pharmaceutical giants and leads the industry in pipeline reserves, when it starts to promote the strategy of innovative drugs going - global, it has relatively more leeway in project selection. Moreover, the short - term revenue from BD transactions has become an important marginal force to boost Hengrui's performance growth. Without considering the total transaction amount, the proportion of the short - term revenue from BD transactions in Hengrui's current performance has also increased significantly.

Then, from a relatively neutral perspective, in the pharmaceutical manufacturing industry, the revenue growth of the main businesses such as drugs, contrast agents, and anesthesia is relatively stable, especially after the impact of centralized procurement has been significantly weakened. However, the impact of the domestic payment structure on innovative drugs cannot be underestimated. The valuation of domestic innovative drugs cannot copy the experience of the European and American markets. This is why innovative drugs, as a high - tech industry, have long only enjoyed the valuation of the manufacturing industry in China.

From the perspective of investors looking at BD going - global, combined with the previous analysis, the current market pays more attention to short - term cash flow, mainly upfront payments and milestone revenues. This view is easy to understand. First of all, pharmaceutical R & D is a high - risk event. There are many cases where highly anticipated blockbuster drugs ultimately fail in R & D, which leads to considerable uncertainty in potential milestone revenues. Talking about future revenue sharing for unlisted drugs is no different from making empty promises. Secondly, against the background of the current weak economic recovery, the risk appetite is relatively low. So investors will naturally be more cautious about long - term events and high - tech.

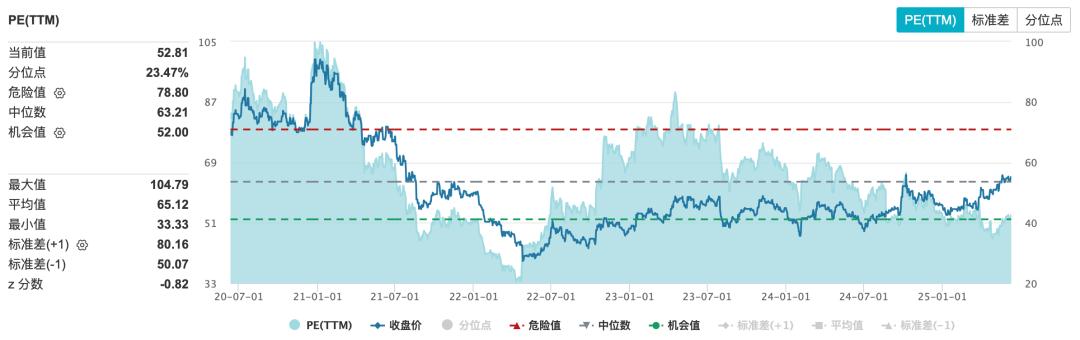

In terms of valuation, as of June 11, 2025, Hengrui's PE - TTM was recorded at 53x, and the 5 - year percentile was 23.5%. From the valuation level, it seems to be at a historical low. However, considering the previous wave of pharmaceutical capital enthusiasm before the pandemic, the historical background has changed greatly. Looking at it horizontally, the median PE - TTM of the pharmaceutical industry is currently only 22x. Hengrui's valuation level far exceeds that of its peers, so there is a certain pressure on valuation.

In the current A - share market, the money - making effect is obvious. A large amount of funds have crowded into the concept of innovative drugs this year. As the leading enterprise of domestic innovative drugs, Hengrui has naturally won the favor of investors. Its relatively solid fundamentals, combined with the continuous verification of the logic of BD going global, drive the continuous rise of its stock price this year. However, it should be noted that currently investors' focus on Hengrui lies in the continuous official announcements of BD transactions. Only when the short - term cash flow is guaranteed can it effectively support the stock price.

Chart: Valuation performance of Hengrui Medicine; Source: wind, 36Kr

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention to provide underwriting services or any services that require specific qualifications or licenses to engage in for the parties to the transaction.