The "volcano" is burning towards the cloud services of major tech companies.

Text by | Zhou Xinyu

Edited by | Su Jianxun

At the "Motivation Conference" on June 11, 2025, the most important release node for Volcengine, Tan Dai, the president of Volcengine, used the word "aggressive" to respond to questions about the growth and revenue targets for 2025.

This aggressiveness can be seen in the revenue data previously disclosed by the media. According to the report of "Highlight the Key Points", in 2024, Volcengine's revenue scale exceeded 12 billion yuan, and the revenue target for 2025 is over 25 billion yuan.

This means that this "cloud newcomer" who entered the market in 2021 not only has to achieve a 100% growth rate, but also its revenue volume will be comparable to that of Baidu Cloud, which entered the market in 2015 - Multiple institutions predict that the revenue growth rate of Baidu Smart Cloud in 2025 will be 30%, with a scale of about 28 billion yuan.

The competition between Baidu Cloud and Volcengine has already begun. In February 2025, Shen Dou, the president of Baidu Smart Cloud Business Group, hinted at the price war initiated by Doubao at an internal meeting, saying, "The price war of domestic large models last year led to the overall revenue of the industry being several orders of magnitude lower than that of foreign countries."

Immediately afterwards, Tan Dai countered on his WeChat Moments: "Everyone should focus on the basics and innovation like DeepSeek, be calm and patient, and make fewer baseless speculations and external attributions."

Tan Dai was once a technical expert at the T11 level of Baidu. Under his leadership, Volcengine is about to overtake its former employer, adding more intensity to this competition.

Until 2023, the market's view of Volcengine was still "coming late" and "at the wrong time". In just two years, Volcengine has transformed from the "others" with a tiny volume on the list to a "catfish" whose growth rate can shake the cloud market pattern.

The large model has contributed greatly to achieving such results.

During the interview session of the June 11 press conference, Tan Dai told media such as "Intelligent Emergence" that among all of Volcengine's products, the large model has the fastest growth rate and the highest gross profit.

Volcengine's rise is inseparable from the Doubao large model in 2024. With its "price butcher" stance, it quickly enabled Volcengine to gain momentum - IDC data shows that Volcengine's call volume in 2024 accounted for 46.4% of the market share, ranking first, even exceeding the sum of Baidu Smart Cloud and Alibaba Cloud.

At the "Motivation Conference" on June 11, Doubao "repeated the old trick" of its low - price strategy.

For the newly released Doubao 1.6, the lowest prices for input and output are 0.8 yuan per million tokens and 8 yuan per million tokens respectively, and the comprehensive cost is only 1/3 of that of Doubao 1.5 Deep Thinking Model and DeepSeek R1.

△ Comparison of the comprehensive cost of Doubao 1.6 with that of Doubao 1.5 Deep Thinking Model and DeepSeek R1. Source: Volcengine

The "Price Butcher" in the Large - Model Market

In the large - model battlefield, ByteDance, which entered the market with the large model "Doubao" in mid - 2024, does not have the first - mover advantage nor an absolute technological barrier.

Under the double dilemma, extreme low prices have become Volcengine's weapon to break through.

Actually, Volcengine is not the first to stand out with low prices in the large - model arena. One week earlier than the release of Doubao, DeepSeek V2 set the model price at rock - bottom. For the model supporting a 32k context length, the output price (referring to the process of the model generating results) is only 1/60 of that of Baidu Wenxin 4.0 - 8k.

However, like Xiaomi, Doubao is the only one that has made "price butcher" a brand label.

This is mainly due to the fact that from the start, Doubao set the low price extremely low - On May 15, 2024, when Doubao was released, it could process more than 1,500 Chinese characters for only 0.8 cents, and the price was 99.3% cheaper than the industry average.

In the cloud industry where pricing generally faces commercialization pressure, Volcengine, which doesn't have much "revenue burden", has set the low price to an extent that Baidu dare not. For example, even though Baidu later followed Doubao's low - price strategy, it first cut the prices of small - parameter lightweight models.

The customer growth brought by the "low price" to Volcengine is obvious. "Everyone can innovate in AI without any burden, and the scale has grown rapidly." Tan Dai once told "Intelligent Emergence". Less than three months after the release of Doubao, the average daily Tokens usage per customer increased by twenty to thirty times.

The newly released Doubao 1.6 has also come up with some creative pricing strategies.

△ Pricing model of Doubao 1.6. Source: Volcengine

Volcengine first adopted a unified pricing model, creating an atmosphere of "more quantity without a price increase". Even if users use the more costly deep - thinking and multi - modal capabilities, the API pricing is the same as that of the basic language model.

For specific usage scenarios, Doubao 1.6 sets prices according to the input context length.

In the input range of 0 - 32K, which is the most used by enterprises, Volcengine particularly emphasizes the low price: The corresponding price of Doubao 1.6 is only 1/3 of that of DeepSeek R1; if the customer does not use the deep - thinking mode, the output price of Doubao 1.6 can be reduced from 8 yuan per million Tokens to 2 yuan per million Tokens.

A comment from an attending developer is: Compared with Doubao's performance, what is more worth looking forward to is the pricing tricks of Doubao.

Beyond Low Prices, Volcengine Needs a Technological Business Card

Compared with having a large Token call volume, a more important question for Volcengine to answer is: How can the scale be converted into real revenue?

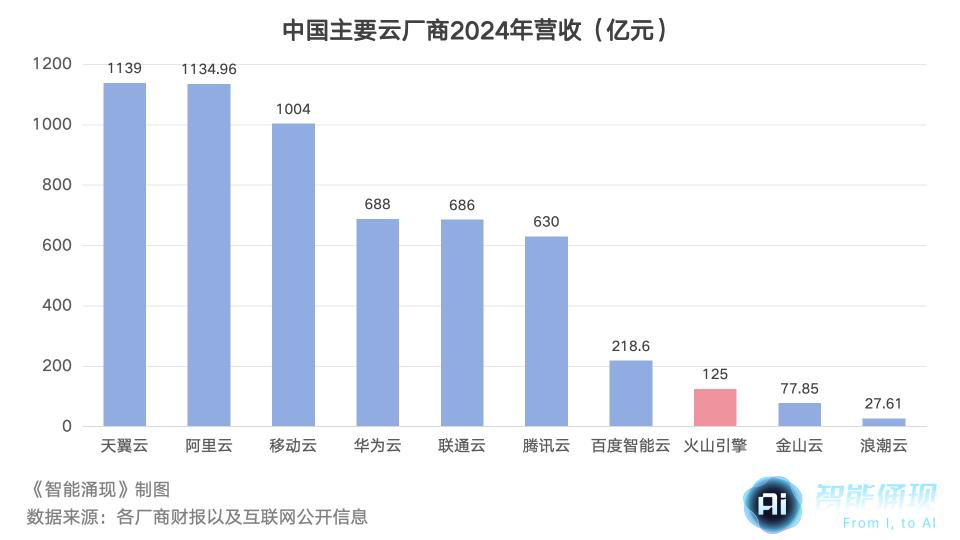

In the cloud industry where revenue is the key criterion, currently, Volcengine obviously does not have the achievements to rank among the top. In 2024, Volcengine's revenue was 12.5 billion yuan, which is an order of magnitude lower than that of Alibaba Cloud in the first echelon; Baidu Smart Cloud, which is right behind, has nearly twice the revenue of Volcengine.

Chart by Intelligent Emergence

Even though its call scale far exceeds that of Baidu Smart Cloud, it is still not easy for Volcengine to bridge the more than 10 - billion - yuan revenue gap and catch up with the former.

According to the public information compiled from the China Tendering and Bidding Network, in the first quarter of 2025, Baidu Smart Cloud ranked first among domestic large - model manufacturers in terms of the number of winning bids and the bid amount.

More notably, under the trend of the industry following price cuts and the development of the open - source ecosystem, Volcengine's main "low - price" narrative is no longer as appealing as it was in 2024.

If you look closely, Doubao 1.6 does not have an obvious price advantage. The newly released multi - modal base model Baidu Wenxin 4.5 Turbo has an input price of 0.8 yuan per million Tokens and an output price of 3.2 yuan per million Tokens, which is even cheaper than Doubao 1.6 - 32k.

Obviously, Volcengine has also realized this: Low price is no longer Volcengine's advantage. To rank among the first echelon in terms of revenue, model performance and service are the core factors for customer acquisition.

"Price is no longer a bottleneck. After reducing it to such a low level, no matter how much it is further reduced, the gain for users is not significant." Tan Dai once told "Intelligent Emergence".

He also mentioned: "Now, it is more important to improve the model's capabilities at the same price. This is a more meaningful thing." Improving the model's capabilities means that Volcengine's business territory can expand to more industries and convert more customers.

Now, Doubao has a heavier burden on its shoulders. After achieving the phased goal of Volcengine's scale expansion, Doubao's current mission is to be truly recognized by customers in terms of product technology, rather than just being bought because of the low price.

Since 2025, ByteDance has continuously increased its investment in model research by establishing the research - oriented organization "Seed Edge" and setting the goal of "exploring the upper limit of intelligence".

At this Motivation Conference, Volcengine demonstrated some phased results of ByteDance's AI technology exploration: For example, Doubao 1.6 - thinking surpasses DeepSeek - R1 - 0528 in reasoning ability and instruction - execution ability;

The Doubao video - generation model Seedance 1.0 pro has surpassed its old rival, Kuaishou's Keling 2.0, in the evaluation.

△ Evaluation results of the Doubao video - generation model Seedance 1.0 pro. Source: Volcengine

The "low - price narrative" has come to a temporary end. In the To B cloud - selling track, Volcengine is far from the time to relax if it wants to overtake the BAT "veterans".

Welcome to communicate!