With the accelerating population aging, how can the silver economy break the deadlock? | Smart Money

“My parents are busier than me after retirement. They travel, dance, and attend senior universities. I can't stop them from spending money!” — This might be a true picture of many families.

“There's a shortage of beds in nursing homes. Where can I find a reliable caregiver?” — With the accelerating aging process, the pain point of service shortage is becoming increasingly prominent.

“People say the silver - haired economy is a blue ocean. How can enterprises 'dive' into it?” — Facing the large market of the elderly population, there are both opportunities and challenges.

As China rapidly enters an aging society, the consumption power of the “silver - haired group” is quietly reshaping the market landscape. In 2022, China's population structure reached a historical turning point, and the aging process significantly accelerated. In 2024, the state issued three important policy documents in a row to fully address aging and improve people's livelihoods.

Meanwhile, the “pioneer experience” of neighboring Japan is of great reference significance to China when population aging will bring about profound changes in the consumption structure.

Changes in the consumption structure after population aging

(1) The aging process in China has accelerated

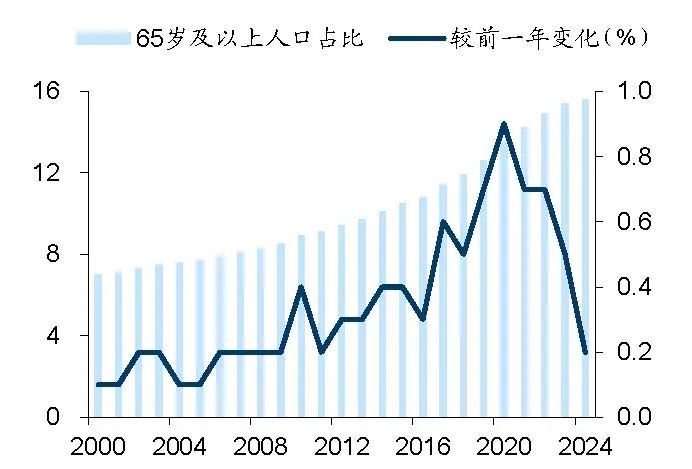

In recent years, the proportion of the elderly population aged 65 and above in China has been continuously rising. From 2020 to 2024, it increased by about 0.6 percentage points annually, faster than the 0.3 percentage points from 2010 to 2015 and the 0.5 percentage points from 2015 to 2019.

Chart: The proportion of the population aged 65 and above in China has increased (%). Data source: Wind, calculated by the Research Institute of Soochow Securities

Compared with Europe and the United States, Asian countries such as China, Japan, and South Korea are entering a deeply aging society at a faster speed and in a shorter time.

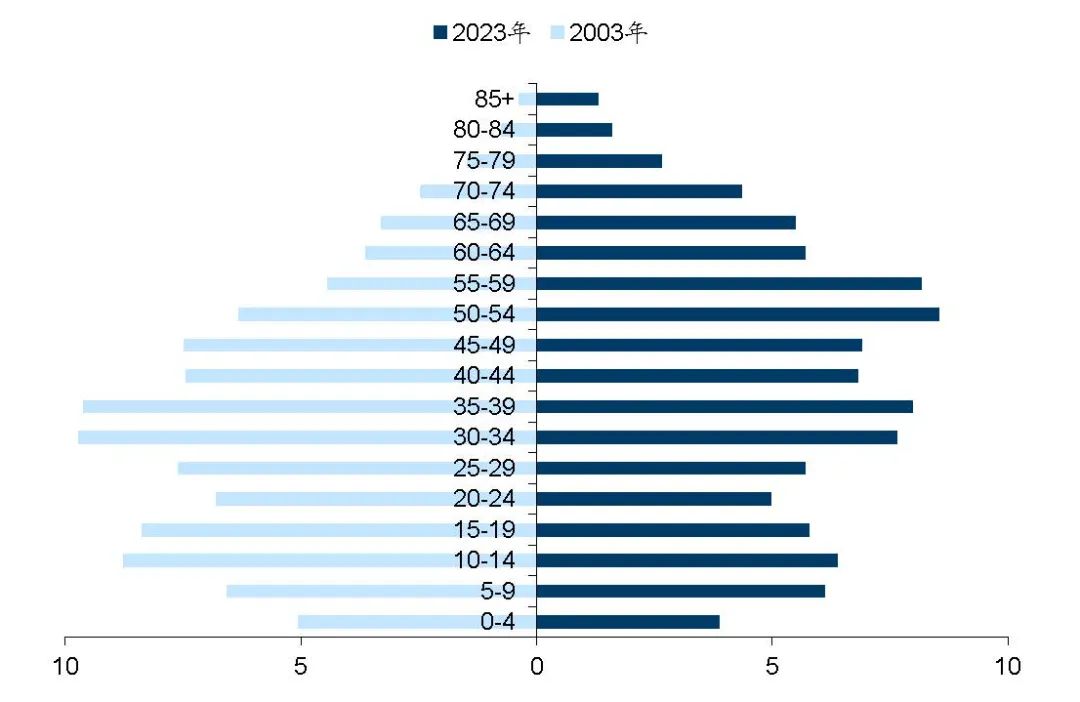

As of the end of 2023, the population aged 50 - 60 is the main component, and the elderly population in China is generally young - aged, with strong consumption demand in services such as nursing and tourism. Therefore, the next 5 - 10 years are a critical period for the development of the silver - haired economy.

Chart: The proportion of the population in each age group in China (%). Data source: wind, Research Institute of Soochow Securities

(2) Changes in the consumption structure after aging in Japan

Japan is a country with a serious aging problem. In 2023, the proportion of the population aged 65 and above was nearly 30%, and it entered a period of negative population growth in 2006.

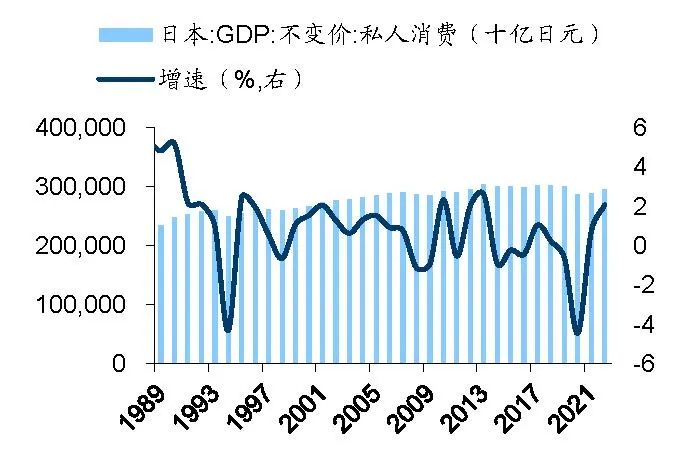

The total consumption “stalled”. From 1994 to 2006, the average annual compound growth rate of private consumption in Japan was 0.8%, and it dropped to 0.2% from 2007 to 2024. This is mainly because there are fewer young people, and the main consumer group has shrunk. Although the elderly have a high willingness to consume, their income is low, and the increase in consumption cannot offset the loss of youth consumption.

Chart: The central growth rate of Japan's consumption has been continuously declining under population aging. Data source: Wind, Research Institute of Soochow Securities

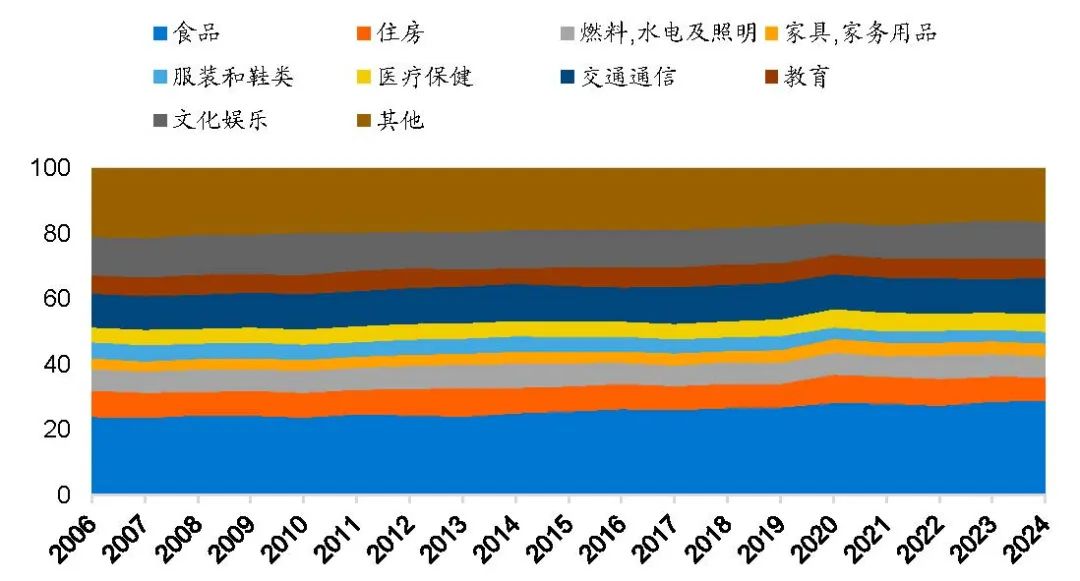

The consumption structure “reshuffled”. The proportion of necessary consumption such as food and medical care in Japanese households has increased, while the proportion of optional consumption such as housing - related and clothing and footwear has decreased. The growth rate of medical care consumption is relatively fast, while the growth rates of clothing and footwear, transportation and communication, culture and entertainment have significantly slowed down.

Chart: Changes in the consumption structure of Japanese households (%). Data source: Wind, Research Institute of Soochow Securities

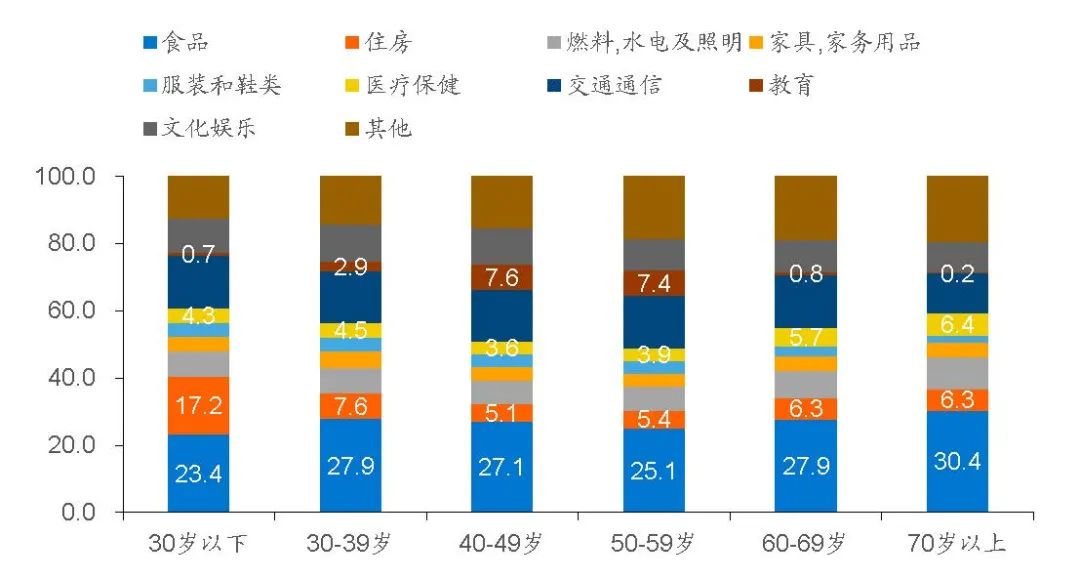

Consumers of different age groups spend money in different ways. Young families spend a lot on renting, dressing up, and cultural entertainment. For middle - aged families, education expenditure is the major part, and the budget for clothing and entertainment is reduced, while the demand for personal care increases. Elderly families mainly spend their money on food, medical care, and personal care consumption, but they also have the willingness for enjoyment - type consumption.

Chart: The differences in consumption preferences of different age groups determine the changes in the overall consumption structure (%). Data source: Statistics Bureau of Japan, Research Institute of Soochow Securities

(3) The impact of the deepening aging in China on consumption may be weaker than that in Japan

Compared with Japan's dilemma at that time, China may be more resilient in dealing with the impact of aging.

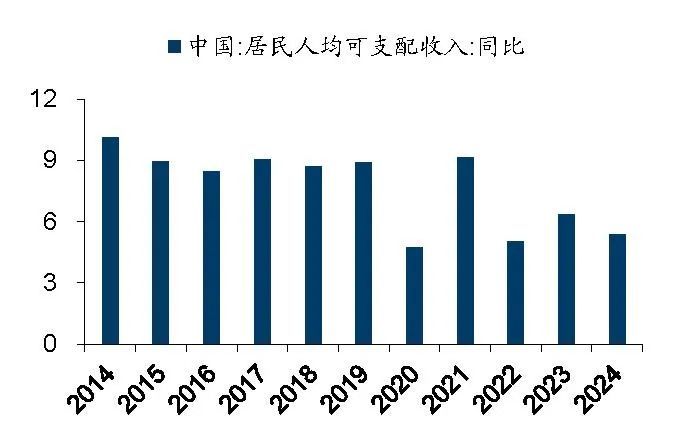

Firstly, in terms of residents' income, after the real - estate bubble burst in Japan in the 1990s, the disposable income of households had long - term low growth and even experienced a period of negative growth. In China, after 2022, the per - capita disposable income of residents has been growing steadily at a rate of over 5%, providing a basis for consumption.

Chart: The central growth rate of residents' income in China remains above 5% (%). Data source: Wind, Research Institute of Soochow Securities

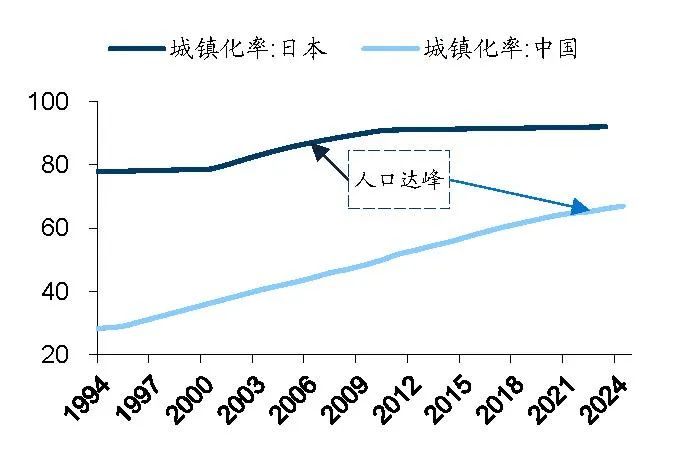

Secondly, in terms of the urbanization rate, when Japan had negative population growth, the urbanization rate was nearly 90%. In contrast, China's urbanization rate was only 65% in 2022, with great room for improvement. In addition, from the perspective of per - capita consumption expenditure, urban consumption is about 1.8 times that of rural areas, and China's urbanization rate is positively correlated with residents' consumption. Therefore, it can be inferred that China has great consumption potential.

Chart: There is still great room for China's urbanization process (%). Data source: General Administration of Customs, Wind, calculated by the Research Institute of Soochow Securities

How to develop the silver - haired economy under the intensifying population aging

(1) The policy context of Japan's development of the silver - haired economy

Japan's development of the silver - haired economy has gone through three clear stages, and policies are the key driving force.

First stage: 1970 - 1993.

Japan entered an aging society in 1970, and after the oil crisis, its economy was transformed into the service industry, which promoted the rise of elderly care services. In terms of policies, it promulgated the “Welfare Law for the Elderly” and established the Silver - haired Service Promotion and Guidance Office to guide the participation of social capital, and the silver - haired service industry began to be standardized.

Second stage: 1994 - 2005.

In 1994, Japan entered a deeply aging society. The bursting of the bubble economy promoted the development of the silver - haired industry, with an emphasis on the construction of public welfare facilities. In 1997, the “Long - term Care Insurance Law” was passed and implemented in 2000, promoting the marketization of the silver - haired industry. The government, enterprises, and society participated together to relieve the financial pressure and revitalize the market.

Third stage: 2006 - present.

In 2006, Japan had negative population growth, and the aging deepened, and the silver - haired economy developed rapidly. The long - term care insurance system was continuously improved, successfully attracting more enterprises and organizations to enter the nursing service field. At the same time, the Japanese government encouraged enterprises to research and develop nursing robots and gave certain tax exemptions to enterprises to promote the development of smart elderly care.

By sorting out the development context of Japan's silver - haired economy, it can be found that the key measure for the development of Japan's silver - haired economy is the implementation of the “Long - term Care Insurance Law” in 2000. It successfully promoted the market - oriented development of the economy, shared the huge cost of elderly care, and allowed the elderly to have more spare money for enjoyment - type consumption, thus alleviating the decline of overall consumption contraction.

(2) Lessons from the Japanese model for China

Learning from Japan's experience, China can focus on two key measures in developing the silver - haired economy.

Firstly, establish a perfect long - term care insurance system. China's long - term care insurance funds mainly rely on medical insurance and financial subsidies, which brings great pressure. We can learn from Japan's practice and formulate rules according to the population structure and income differences. The scope of insurance participation and the progressive payment ratio are designed differently, which can not only adjust income differences but also relieve the pressure on medical insurance. At the same time, unify the payment scope of long - term care insurance funds and dynamically adjust the reimbursement scope according to new products and services in the market supply to keep the guarantee in line with the demand.

Secondly, focus on improving the re - employment of the young - aged elderly group. The marginal propensity to consume of the elderly group is higher than that of the youth. That is to say, if the elderly group and the youth group earn the same amount of salary, the elderly group will be more willing to spend it. At this time, if they have income, it can directly drive consumption. In terms of the system, learn from Japan to introduce relevant laws for protection; in terms of employment channels, local governments provide information on suitable jobs and “light - employment” positions; in terms of employment ability, provide skills training; and give subsidies to enterprises that hire the elderly group to improve their enthusiasm.

The silver - haired economy is not a “sunset” but a “sunrise” industry. Seize the dividend period of the young - aged elderly in the next 5 - 10 years, learn from international experience to improve the institutional design, and stimulate market vitality. China's “silver - haired wave” is fully expected to be transformed into the “golden power” to promote economic growth.

*The original text is from the report “Consumption Changes and the Silver - haired Economy under the Aging Process” by Soochow Securities

The content of this article is organized by AI and does not represent the author's views.