RoboSense Releases Q1 Financial Report: General Robotics Business Grows by 87%, Secures Million - level Lawn Mower Orders | Latest Frontline News

Author | Huang Nan

Editor | Yuan Silai

On May 30th, RoboSense (2498.HK) released its financial report for the first quarter of 2025. The data shows that RoboSense's total revenue in Q1 was approximately 330 million yuan; the gross profit was 77.01 million yuan, a significant year-on-year increase of 73.1%. Thanks to the substantial improvement in the gross profit margins of ADAS, robotics, and other product applications, the overall gross profit margin reached 23.5%, a year-on-year increase of 11.2%; the net loss significantly narrowed to 98 million yuan, a year-on-year improvement of 24.4%.

Specifically, the revenue from ADAS lidar was 229 million yuan; the revenue from general robotics lidar reached 73.403 million yuan, a significant year-on-year increase of 87.0%; the revenue from solutions and others was 26 million yuan, a year-on-year increase of 61%.

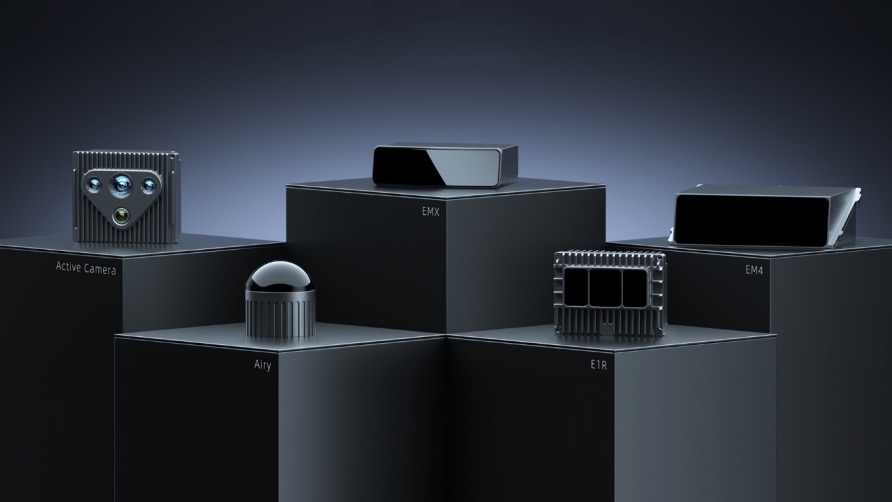

Orders for all business lines exploded. Products such as E1R and Airy have basically won exclusive orders from all leading lawn mowing robot brands. In the ADAS field, EM4 and EMX have been designated for nearly 17 models by 5 global automakers. Digital lidars have fully entered the L4 autonomous driving market and reached order cooperation with over 90% of the world's core Robotaxi and Robotruck enterprises. In the unmanned delivery field, orders have been signed with over 90% of the leading customers in the industry, and cooperation has also been established with over 20 intelligent robotics enterprises.

RoboSense Product Portfolio Diagram

Among them, the robotics business has grown rapidly, becoming a new pillar growth point for the company. The sales volume of its lidar products was approximately 11,900 units, a year-on-year increase of 183.3%. It has reached cooperation with over 2,800 global robotics customers, covering application fields such as industrial warehousing, delivery robots, commercial cleaning, and unmanned mining trucks.

At the beginning of this year, RoboSense launched two new solid-state digital lidars for robotics - E1R and Airy. As the world's first all-solid-state digital solution, the E1R lidar adopts a vehicle-grade design, which can help robots accurately complete operations such as obstacle avoidance, mapping, and navigation. It has gradually started mass production and delivery. Airy is the world's first ultra-lightweight hemispherical digital lidar, about the size of a ping-pong ball. It can achieve an ultra-wide hemispherical FOV of 360° horizontally and 90° vertically, covering a range with a diameter of up to 120m.

In the field of lawn mowing robots, with advantages such as high reliability, environmental perception ability, and system integration, RoboSense reached a deep strategic cooperation with Kuma Technology, and the two parties signed an initial order for 1.2 million units.

RoboSense pointed out in the earnings conference that the current global lawn mowing robot market is undergoing a new round of transformation. According to public data, the annual scale of lawn mowing tools in Europe and the United States was 12 million units in 2024, and the number of lawn mowing robots was about 1 million units. This means that the conversion rate from traditional lawn mowing tools to intelligent robots will exceed 50%, and the future market scale is expected to reach over 6 million units per year.

Technically, the traditional RTK + vision combination solution has a natural "boundary effect". When facing complex scenarios such as satellite signal loss due to tree shade occlusion and misjudgment of visual features caused by house edges, the positioning accuracy decreases, and the operation efficiency drops, making it difficult to meet users' requirements for high-precision and continuous operations. In contrast, lidar performs better in practical application scenarios such as precise edge mowing and obstacle avoidance. Market forecasts suggest that the penetration rate of the lidar solution is expected to reach 60% - 70%, and as its cost continues to decrease, this penetration rate will continue to rise.

Since the lawn mowing robot industry shows significant seasonal characteristics, RoboSense revealed that based on the current trend, it is expected that orders will start to increase from Q3, and the concentrated delivery period will be from Q4 this year to Q1 next year. This rhythm is highly consistent with the company's revenue growth expectations. In the next two years, as the market scale continues to expand, the order volume is expected to maintain a stable growth trend, and the specific increase progress will be dynamically adjusted according to the terminal sales performance.

Currently, RoboSense has obtained exclusive cooperation from 2 global leading lawn mowing robot customers and has basically locked in exclusive cooperation with global leading lawn mower customers except for Dreame. With the leading effect brought by the launch of the first product, RoboSense said that it is confident to establish closer cooperation with more garden robot enterprises and launch more products to meet diverse needs.