Hotel transactions have entered an active period, and hotel assets in first-tier cities are the most favored.

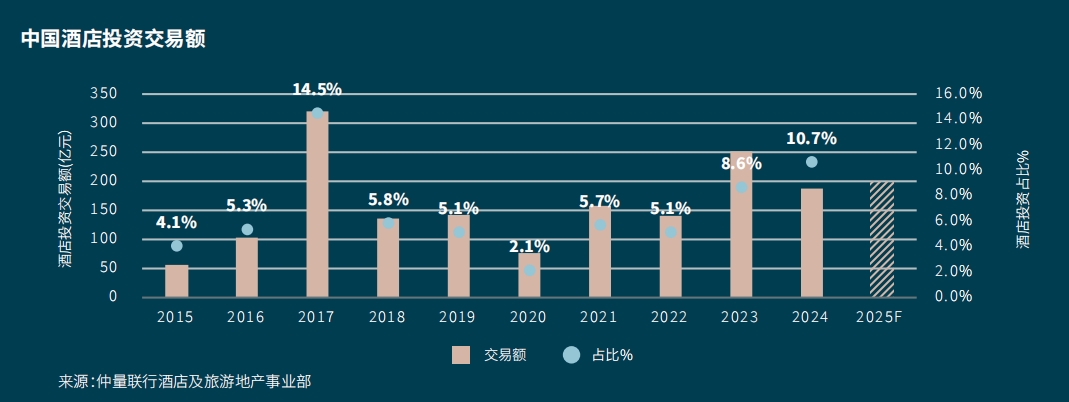

In recent years, the hotel market in mainland China has entered an active investment period. The white paper "Full - cycle Strategy for Hotel Investment in China: Key Decision - making Paths from Hotel Asset Acquisition to Exit" shows that from 2015 to 2024, the total transaction volume of hotel investment in mainland China was approximately 168.54 billion yuan, with an average annual transaction volume of about 13.94 billion yuan.

Source: JLL Hotels & Hospitality Group

The active hotel asset transactions contrast sharply with the increasing operational pressure on hotels.

Wei Junya, the vice - president of JLL Hotels & Hospitality Group in Greater China, believes that there are mainly three reasons for the upward climb against the trend in large - scale hotel transaction volume:

- Affected by macro - economic fluctuations and real - estate policies, some hotel asset holders are facing cash - flow pressure and are trying to revitalize their working capital by divesting non - core assets. A large number of high - quality hotel assets are being sold at discounted prices, attracting the attention of domestic and foreign investors.

- While asset transactions are increasing, the new supply in the entire market is on a downward trend, and the industry has entered an era dominated by existing inventory. Especially in first - tier cities, the characteristics of the existing inventory market are more obvious, so a large amount of investment demand has shifted to the field of existing asset transactions.

- On the consumer demand side, both the domestic and inbound tourism markets have recovered. In 2024, the number of domestic tourists reached 5.62 billion, a year - on - year increase of 14.8%, and the number of inbound tourists was approximately 132 million, a year - on - year increase of 60.8%. With the growth of consumer demand, hotel assets are expected to appreciate in the future.

Based on long - term optimistic expectations, international hotel groups have also strengthened their layout in the mainland market. According to the statistics of brands monitored by the Asia Tourism and Hospitality Data Research Institute, 313 new hotels opened in the Chinese hotel market in April, a month - on - month increase of 41.6%. Among them, 254 mid - to - high - end hotels opened, accounting for the highest proportion.

The mid - to - high - end brands under giants such as Marriott and Hilton have achieved stable expansion in the first quarter. In the first quarter of 2025, Marriott signed contracts for new projects in several core locations in cities such as Beijing Capital Airport, Shanghai Xujiahui, Chengdu Tianfu Square, and Changchun Renmin Street. Hilton Group announced that its Hilton Garden Inn reached 19 signed hotel contracts and cooperation intentions in the first quarter, covering core locations in new first - tier cities to cultural and tourism destinations, and for the first time entered emerging destinations such as Xining, Weihai, Changbai Mountain, and Yiwu.

Both the opening of new hotels and hotel asset transactions are increasing. Hotel assets in first - tier cities have become the focus of capital competition due to their irreplaceable anti - cycle ability and composite value.

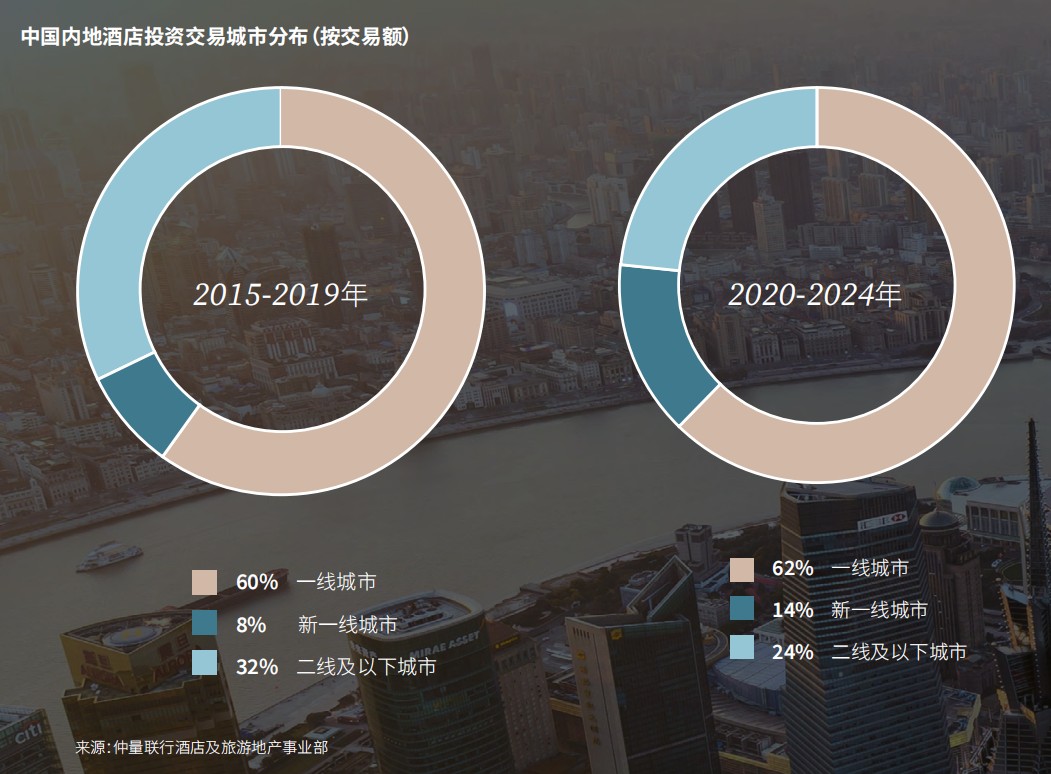

According to JLL statistics, in the past 10 years, more than 60% of hotel transactions occurred in first - tier cities. Among them, Shanghai was the most active, accounting for one - third of the national transaction volume in 2023 - 2024.

Source: JLL Hotels & Hospitality Group

Meanwhile, new first - tier cities are becoming a new blue ocean in the mainland hotel investment market. Compared with 2015 - 2019, the proportion of hotel investment transaction volume in new first - tier cities increased by 6 percentage points from 2020 to 2024.

New first - tier cities such as Hangzhou, Chengdu, Chongqing, and Xi'an, with their rich tourism resources, mature infrastructure, and continuously improving urban levels, have quickly absorbed domestic tourism demand. The hotel business performance has climbed against the wind, attracting the attention of hotel investors.

There are several characteristics different from the past in the new round of hotel investment peak.

Firstly, investors who are investing in Chinese hotel assets for the first time account for more than 50%, and the proportion of new players is rising rapidly.

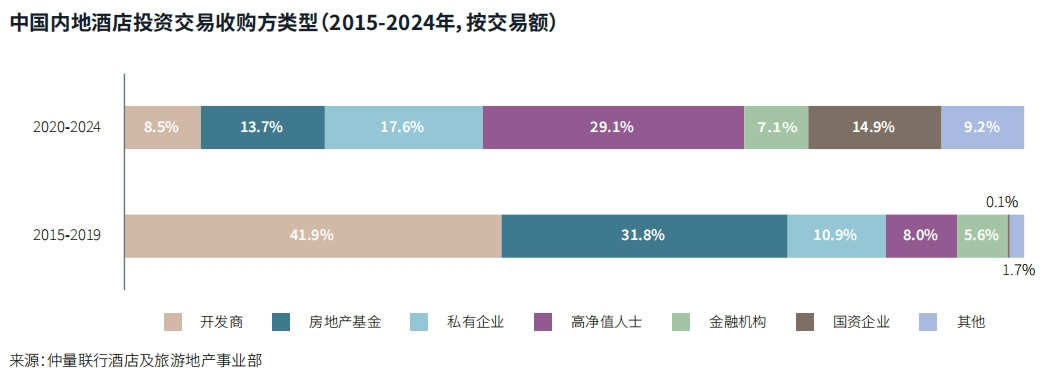

Secondly, real - estate funds have reduced their acquisitions of large - scale hotel projects. High - net - worth individuals and state - owned enterprises have become the main investment entities instead. Investors are gradually diversifying, continuously driving the activity of hotel investment transactions.

During 2023 - 2024, high - net - worth individuals accounted for as high as 76.4% of the acquirers in Shanghai's hotel investment transactions. Most high - net - worth individuals are backed by comprehensive enterprises in industries such as energy, building materials, and manufacturing. Hotels may be another extension and expansion of their business.

Source: JLL Hotels & Hospitality Group

Thirdly, hotel investors are paying more attention to the professional operation of the entire hotel life cycle, including "investment, financing, construction, management, and exit", and have high requirements for financial innovation such as REITs and the safety setting of transaction structures.