The worst performance in a decade since going public. Can AI prop up Kunlun Tech? | Krypton·Major Events

Author | Geng Chenfei

Editor | Song Wanxin

On May 22nd, Kunlun Tech released the general Agent platform, Skywork Super Agents.

Three hours after the product was launched, Kunlun Tech issued an announcement stating that after the launch of Skywork Super Agents, due to the excessive number of users, there was a congestion, and traffic - limiting measures would be taken. Affected by this news, Kunlun Tech's A - shares rose by the daily limit in the afternoon, with a trading volume of 5.381 billion yuan.

Not long ago, Kunlun Tech presented its worst annual "report card" since its listing in 2015. The financial report shows that Kunlun Tech suffered a net loss of up to 1.595 billion yuan in 2024, a year - on - year plunge of 226.8%.

Entering 2025, the downward trend of Kunlun Tech's performance has continued to intensify. In the first quarter of this year, Kunlun Tech's net loss was 769 million yuan, a 310% increase compared with the net loss of 187 million yuan in the same period last year.

While under performance pressure, the company's stock price has also experienced significant fluctuations.

As one of the earliest technology companies to fully embrace AI, Kunlun Tech, which released its self - developed dual - trillion - level large language model "TianGong 1.0" two years ago, saw its stock price soar to 70.55 yuan per share at one point. However, now Kunlun Tech's stock price has dropped to 36.93 yuan per share, almost halved compared with the peak.

01 Running out of cash flow

From the financial report, the "sharp decline" in investment income and the "explosive increase" in R & D investment are the main reasons for Kunlun Tech's losses.

In 2024, affected by the fluctuations in the prices of financial assets, Kunlun Tech, which once relied on investment income to support more than half of its profits, suffered an investment loss of 820 million yuan.

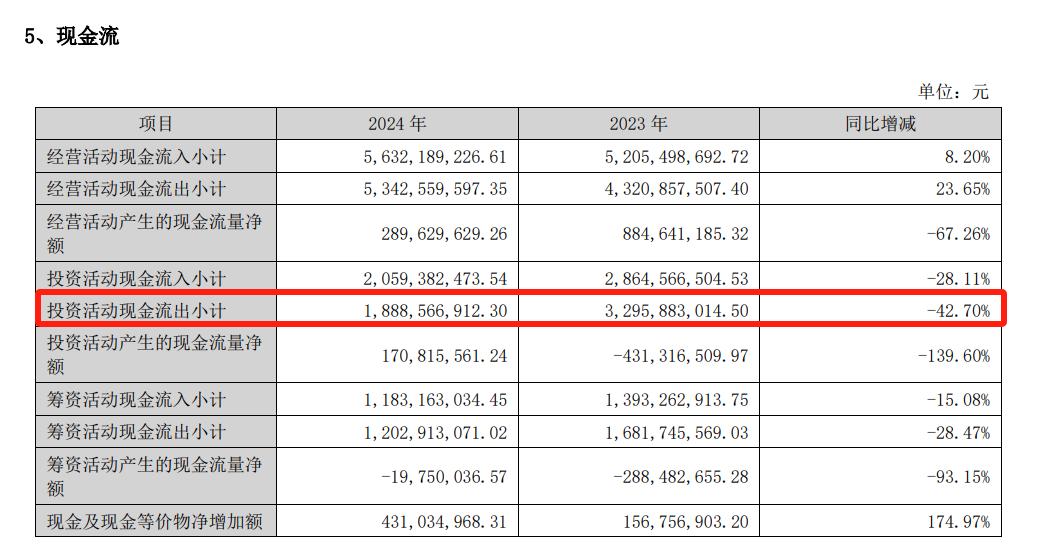

According to the 2024 annual report, the securities assets held by Kunlun Tech were iQiyi and Inkeverse. Among them, due to the decline in iQiyi's stock price, the company suffered a fair - value change loss of 501 million yuan. More importantly, the above losses occurred against the background of Kunlun Tech's active contraction of its investment scale. In 2024, the cash outflow from Kunlun Tech's investment activities decreased by 42.7% compared with the same period of the previous year.

Chart: Kunlun Tech's cash flow situation in 2024. Source: Kunlun Tech's financial report

If the defeat on the investment side is "passive blood loss", then on the expense side, Kunlun Tech is "actively burning money".

Against the background of the continuous escalation of the AI arms race, Kunlun Tech's R & D expenses in 2024 reached as high as 1.543 billion yuan, a year - on - year increase of 59.46%. Compared horizontally with peer companies in the industry, the growth rate of iFlytek's R & D expenses in the same period was 11.79%, and that of 360 was 3.16%. Kunlun Tech's R & D investment growth rate was significantly higher than that of its peers.

The problem is that despite the grand momentum of the AI business, the performance is not ideal.

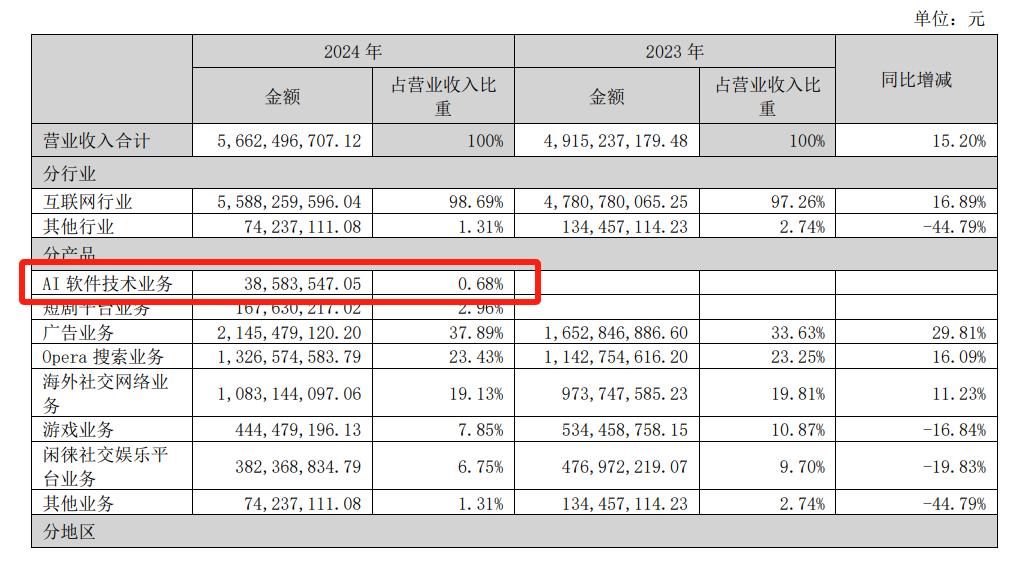

According to the financial report, in 2024, Kunlun Tech achieved a total operating revenue of 5.66 billion yuan, a year - on - year increase of 15.2%. Among them, the revenue contributed by the AI software technology business was only 38.584 million yuan, accounting for only 0.68%, and did not form a large - scale commercial return.

Chart: Composition of Kunlun Tech's operating revenue in 2024. Source: Kunlun Tech's financial report

On the other hand, the expansion of the AI business has led to an increase in Kunlun Tech's marketing and recharge channel handling fees. The sales expenses in 2024 reached as high as 2.304 billion yuan, a year - on - year increase of 42.23%, reaching the highest level in history, further dragging down the profit performance. The sum of R & D expenses and sales expenses has approached 70% of the current income.

The significant increase in asset impairment losses has further compressed the profit margin.

In 2024, Kunlun Tech accrued asset impairment losses of 321 million yuan, a 66 - fold increase year - on - year, mainly due to goodwill impairment and other current asset impairments.

Although most companies are in a stage of rapid increase in capital expenditure during the current AI investment period, Kunlun Tech's tight cash flow cannot well support its continuous investment.

In 2024 and the first quarter of 2025, the net cash flow generated from Kunlun Tech's operating activities was 290 million yuan and - 2.9713 million yuan respectively, a year - on - year plunge of 67.26% and 102.78% respectively.

The AI investment has not yet yielded results, and the investment side continues to lose blood. Kunlun Tech's self - hematopoietic ability remains to be verified. And this situation may continue for a relatively long time.

Fang Han, the chairman and CEO of Kunlun Tech, previously told the media that currently, the company is still in the stage of expanding its market and acquiring users, and it is expected that the AI large - model business will achieve profitability in 2027.

"It's all about creating a gimmick rather than really considering business growth. It can't compete with the leading companies in the industry in AI, and it will give up sooner or later." A former employee of Kunlun Tech told 36Kr.

02 AI short dramas can't shoulder the heavy responsibility

In the past two years, Kunlun Tech has launched multiple product lines such as AI large models, AI videos, AI search, AI music, and AI social networking, covering almost all popular application directions.

In February last year, after OpenAI released the text - to - video model Sora, various companies' AI video - generation models were also launched one after another. For example, the AI creation platform, JiMeng AI, developed by the Jianying team under ByteDance, and the self - developed video - generation large - model product, KeLing AI, by Kuaishou.

Kunlun Tech closely followed the trend of short dramas and launched SkyReels, the world's first AI short - drama platform integrating a video large model and a 3D large model, entering the AI short - drama track.

In terms of distribution channels, Kunlun Tech has successively launched two short - drama applications overseas - DramaWave and FreeReels. Among them, DramaWave monetizes through advertising, subscriptions, and in - app purchases, while FreeReels seizes the market through a free model.

But can betting on "AI short dramas" really enable Kunlun Tech to overtake on a curve? At least in terms of product output, Kunlun Tech has fallen behind.

During this year's Spring Festival season, the 9527 Theater on Douyin launched the first AI animated short drama "The Nameless Special Agents", and Kuaishou's Xingmang Short Dramas launched the trailer for the first AI unit drama "New World Loading". The first AI paid short drama "Mysteries of the Greater Khingan Mountains" was also launched simultaneously on Fengmang App, the Douyin native platform, and Bilibili in February.

However, according to the information disclosed in Kunlun Tech's Investor Relations Activity Record in May, due to the lack of technological maturity, pure AI - generated content has not been put into the short - drama platform.

Reflected in the financial report data, in 2024, the revenue of the short - drama platform business, which Kunlun Tech had high hopes for, was only 168 million yuan, accounting for 2.96%, showing a significant gap compared with the high - level investment. Specifically, for the short - drama platform Dramawave, the annualized recurring revenue (ARR) was about 120 million US dollars (with a monthly revenue of about 10 million US dollars).

Chen Chen, the assistant consulting director of Analysys, told 36Kr that although these overseas applications have shown commercialization potential in niche scenarios, objectively speaking, there is still a significant gap compared with overseas leading applications such as Instagram and Reelshort. In fact, compared with AI - native applications, these mature applications with AI capabilities have more advantages in terms of proprietary data and user relationship chains.

On the technical level, the market's evaluation of the TianGong large model is also mixed.

The "2024 China Large - Model Capability Evaluation" released by Frost & Sullivan shows that Kunlun Tech's TianGong large model only ranks in the third echelon among domestic AI large models. Coupled with the departure of Yan Shuicheng, a core figure in the AI field, the market's concerns about the stability of its technical route have further intensified.

Industry insiders pointed out: "If it can't enter the first echelon, there won't be much room for development, and it will be quickly eliminated. Too much investment in technology iteration or a long - term delay in commercialization may turn into sunk costs."

The latest news is that Kunlun Tech's newly released Skywork Super Agents ranks first in the world on the relatively authoritative GAIA list in the AI industry, surpassing OpenAI Deep Research and Manus.

"The AI industry as a whole is still in the climbing stage of technological investment and business ecosystem construction. For Kunlun Tech's existing core applications such as AI music, social networking, and short dramas, in addition to technological innovation and breakthroughs, innovation in gameplay and content may be even more important. Products need to have unique value propositions and competitive advantages to form sustainable profit points." Chen Chen said.

Although losses are common among large - model manufacturers, squeezed by both leading companies and emerging players, the market is leaving less and less time for the "mid - tier" company Kunlun Tech.

Follow for more information