Jiangsu is set to witness an IPO. Its net profit declined by 21.6% in 2024 | Specialized and Sophisticated Express

Author | Zhou Qinbing

Editor | Peng Xiaoqiu

Hard Kr has learned that recently, Zhuohai Technology Co., Ltd. (hereinafter referred to as "Zhuohai Technology") submitted a prospectus to the Beijing Stock Exchange.

The company submitted an application for listing on the Growth Enterprise Market of the Shenzhen Stock Exchange in June 2022 and went through the listing review in January 2023, but the listing process was terminated in January 2023. In August 2024, the company successfully listed on the innovation layer of the New Third Board, with the code 874380.

Founded in 2009 and headquartered in Wuxi, Jiangsu Province, Zhuohai Technology is a national-level specialized and sophisticated "little giant" enterprise focusing on the R & D, repair, and sales of front-end semiconductor metrology and inspection equipment.

Front-end metrology and inspection equipment uses media such as light and electron beams to measure key indicators or detect potential defects in the processing results of process equipment such as lithography machines, etching machines, and thin-film deposition equipment.

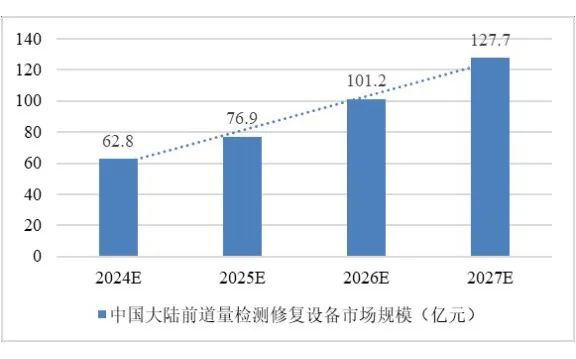

According to SEMI data statistics, front-end metrology and inspection equipment accounts for about 13% of the semiconductor equipment market. According to Sullivan data, from 2019 to 2023, the market size of front-end metrology and inspection repair equipment in mainland China increased from 1.48 billion yuan to 4.98 billion yuan, with a compound annual growth rate of 35.44%.

(Data source: Sullivan)

In the future, with the continuous construction of China's chip manufacturing production lines, the market size of front-end metrology and inspection repair equipment still has significant growth potential. It is expected to reach 12.77 billion yuan in 2027, with a compound annual growth rate of 26.69%.

(Data source: Sullivan)

Meanwhile, China's recently introduced "wafer source determination" policy, which determines the "origin" of chips based on the location of the key "wafer fabrication" factory in the manufacturing process, is also conducive to promoting the domestic substitution process of semiconductors.

Currently, China still faces a "bottleneck" dilemma in the field of front-end semiconductor metrology and inspection equipment. As the "eyes" of chip manufacturing, front-end metrology and inspection directly affect the yield rate of wafers.

In terms of the market pattern of new front-end metrology and inspection equipment in mainland China in 2023, the market share of domestic self-developed brands was only about 5%. The new equipment market is mainly monopolized by international giants such as KLA and AMAT in the United States and Hitachi in Japan.

In the field of repair equipment, the company's market share has been increasing year by year, growing from 2.07% in 2018 to 7.39% in 2023. It ranks third in the global market share, second only to the repair departments of KLA and Hitachi.

The company's repair equipment covers 12 - inch specifications and 14nm processes. Its repair business technology, covered processes and product categories, and scale are all at the leading level in China.

The semiconductor equipment industry in which the company is located belongs to the core upstream link of the chip industry chain, and its downstream is mainly wafer manufacturing enterprises.

From the upstream perspective, the company mainly purchases retired equipment discarded by international IDM enterprises (such as KLA's defect detection equipment) and develops independent repair technologies to improve the equipment performance.

The company has established long - term cooperation with equipment traders in South Korea, the United States and other places, and obtains retired equipment through auctions, targeted purchases and other methods, forming a stable supply chain. In 2024, the company's inventory scale reached 741 million yuan, accounting for 74.87% of current assets, reflecting its control ability over upstream resources.

However, the upstream equipment procurement is greatly affected by international geopolitics, which may lead to fluctuations in the supply chain of retired equipment.

From the downstream perspective, the company's customers include Huahong Semiconductor, Silan Microelectronics, CSMC Technologies, etc. In 2024, the end - customers covered mainstream domestic chip manufacturers and well - known domestic listed companies such as BYD and Gree Electric Appliance.

Due to the huge investment in wafer manufacturing production lines and high requirements for technology and talent reserves, the competition pattern is relatively concentrated. In 2024, the revenue of the company's top five customers accounted for 56.12%. Although it decreased compared with 70.64% in 2022 and 66.01% in 2023, there is still a risk of high customer concentration.

The company's main business includes four major business segments: repair equipment, self - developed equipment, core components and parts, and chip production line operation and maintenance services. The revenue structure shows the characteristic of "one main and three auxiliary".

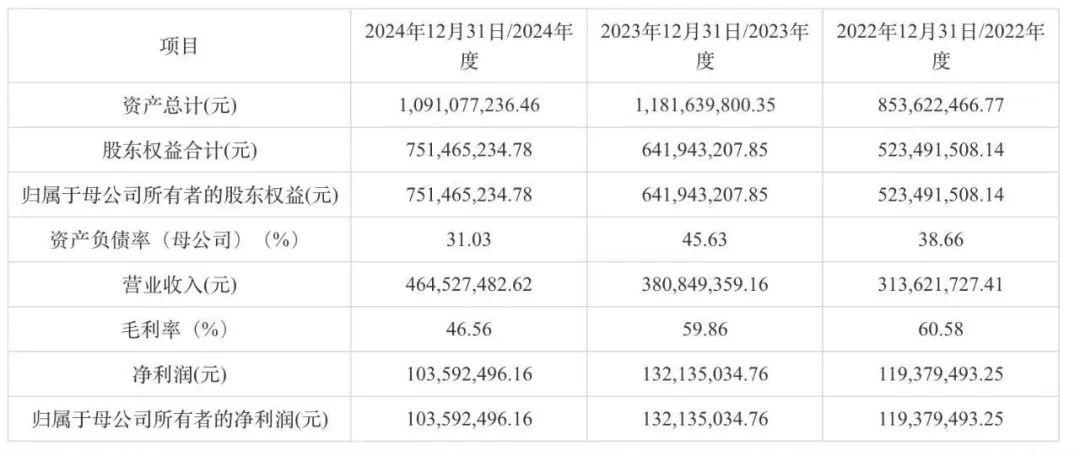

From 2022 to 2024, the company's revenues were 314 million yuan, 381 million yuan, and 465 million yuan respectively, and the net profits were 119 million yuan, 132 million yuan, and 104 million yuan respectively. The gross profit margins of the main business were 60.58%, 59.86%, and 46.56% respectively. Among them, the company's net profit in 2024 decreased by 21.6% year - on - year, mainly due to the decline in profit margins caused by the semiconductor cycle. The decline rate of the company's net profit was lower than that of listed companies in the same industry.

(Image source: Prospectus)

Specifically, the revenue from repair equipment in 2024 was 428 million yuan, accounting for 92.24%. The sales volume increased by 22.3% year - on - year, and the gross profit margin was 46.49%. This business realizes secondary sales by repairing retired equipment. The main models include electron beam defect detection equipment and thin - film thickness measuring instruments, covering the 14nm - 28nm process.

The revenue from self - developed equipment in 2024 was 12 million yuan, accounting for 2.62%, and the gross profit margin was 37.43%. The commercialized self - developed equipment includes stress measuring instruments and four - probe square resistance measuring instruments, and the technical indicators have reached the level of international original manufacturers, but market promotion still takes time.

The revenue from parts and components accounts for about 3.39%. The main products include high - repetition - rate pulsed lasers and precision transmission systems. Some components have been used for the upgrade of self - developed equipment and repair equipment.

The revenue from technical services accounts for about 1.75%. It mainly enhances customer stickiness by providing value - added services such as equipment operation and maintenance and production line debugging.

(Image source: Prospectus)

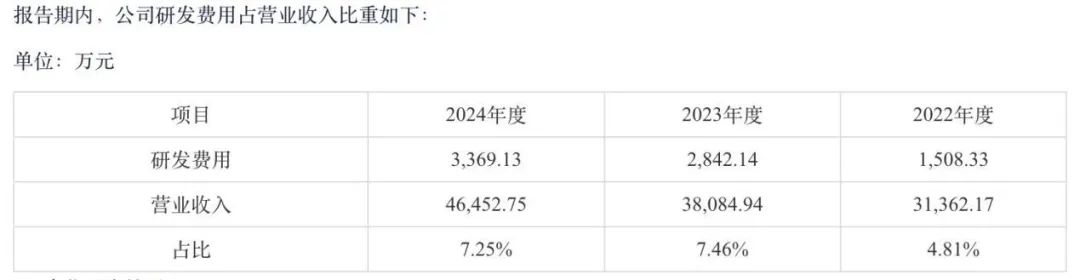

However, the company's R & D shortcoming is still significant. From 2022 to 2024, the proportion of the company's R & D expenses to operating income was 4.81%, 7.46%, and 7.25% respectively. Although it has increased, it is still significantly lower than 36.07% of Zhongke Feice and 30% of Jingce Electronics in the same industry.

(Image source: Prospectus)

In addition, the repair equipment business depends on the supply of international retired equipment. In 2024, due to the increase in procurement costs and pressure on sales prices of some models of equipment, the gross profit margin decreased by 14.01% year - on - year.

Although the self - developed equipment has made breakthroughs in technology, its revenue accounts for only 3%, and the company still faces the pressure of technological iteration.