Investing hundreds of millions of yuan and taking four years, Lefen targets the most reluctant-to-spend users | Product Observation

Author | Zhang Ziyi

Editor | Yuan Silai

After six years of entrepreneurship, Laifen has finally ventured into the last major category of the "personal care trio" – razors.

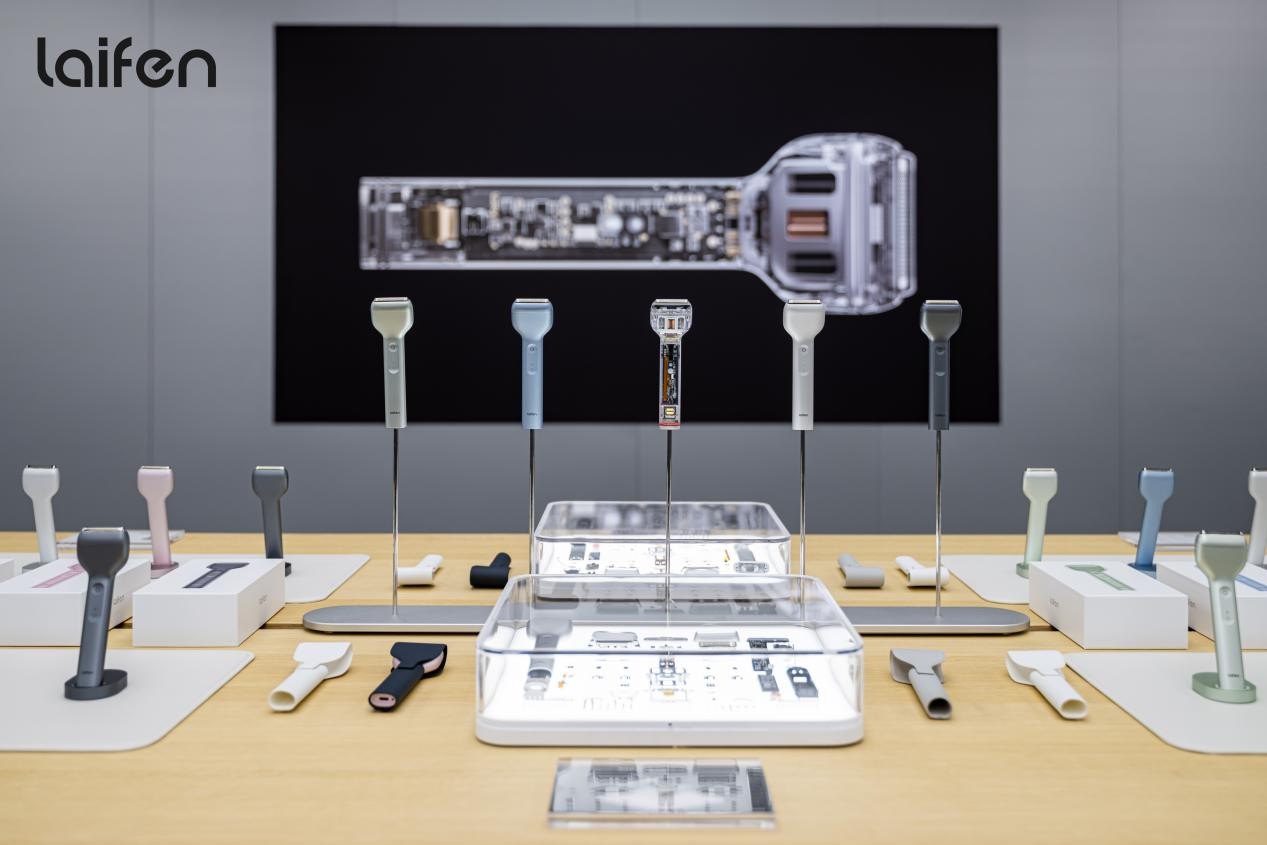

On May 23rd, at Laifen's 2025 new product launch event, Ye Hongxin, the founder of Laifen, presented various parameters of the Laifen razor: its CNC technology, self-developed linear motor, and 120-minute battery life...

Laifen has high ambitions for the razor market.

According to the introduction, the development of the Laifen razor took four years and an investment of 100 million yuan. It employs some technologies typically used only in high-end products. For example, the "stainless steel mesh stamping process" is one of the core processes in the razor manufacturing industry. Before Laifen, only Panasonic in the world could achieve this, and Laifen has become the second in the world.

"Is this technology really difficult? We were outsiders at first. After getting involved, we found that it's really hard to achieve because the mesh holes are very small and it still has to maintain sharpness," said Ye Hongxin.

(Image source/Enterprise)

This is quite rare in the personal care appliance field. The highly mature Chinese supply chain has spawned a large number of small home appliance enterprises. With low entry barriers, the competition is extremely intense. Continuous minor innovations and rapid iterations are the norm.

For a startup in the high-growth stage, long-term and substantial investment is not easy. "To gain a large market share, if it's just a single-digit share, we wouldn't have to put in so much effort," said Ye Hongxin.

The razor market has long been a red ocean. Laifen has entered a comprehensive battle involving channels, marketing, and financial capabilities. They have no room for error.

01 The Razor with High Probability of Loss but Worth Doing

In Ye Hongxin's view, it's quite logical for Laifen to enter the razor market because it shares common technologies with Laifen's previous products.

In the past, Laifen, by breaking through the "high-speed motor" technology, captured a share of the high-speed hair dryer market as a "Dyson alternative" and once became one of the fastest-growing consumer electronics companies in China.

The T1 Pro and P3 Pro razors launched by Laifen this time both adopt the self-developed and self-produced linear motors (Linear Motor) L1 and L2.

However, Laifen has reconstructed the overall structure of the motor. Compared with the plastic shrapnels used in traditional linear motors, the metal rotary shrapnels on both sides of the new motor can obtain greater resilience during reciprocating motion, increasing the cutting force and reducing energy consumption.

Both razors are equipped with a PID dynamic compensation algorithm, which can intelligently sense the state of the beard and dynamically adjust the cutting power. It can achieve precise control under different skin conditions and different densities and hardness of beards.

In the blade part, the Laifen T1 Pro uses a combination of a "nickel mesh + stainless steel inner blade", which can get as close to the skin as possible without scraping the skin. The internal blade structure inside the blade reaches 148.48 degrees, avoiding beard pulling when shaving at a large angle.

The P3 Pro is equipped with a three-blade system. Two deep-cleaning short-beard blades and one flexible long-beard blade cooperate with each other to cover different types of beards, whether soft or hard.

Laifen's razors don't follow the low-price-for-volume strategy. The T1 Pro is priced from 499 yuan, and the P3 Pro is priced at 699 yuan.

This price actually brings sales pressure. In the Chinese razor market, more than 70% of the high-end market share has long been monopolized by international brands such as Philips and Braun, while the low-end market is in a price war. The mainstream domestic razors are mostly priced below 300 yuan.

"Everyone can see that the price of 699 yuan is not very cheap. In fact, our gross profit margin is very low. After calculating the accounts, there is a high probability that we will have a 100% loss on the razors this year. But we think this should be a long-term thing, and we want to make the razor one of the options for consumers," Ye Hongxin told media such as Yingke.

02 The Expensive Entry Ticket

Even at the cost of losses, Laifen wants to be in the game.

Data from Aowei Cloud Network shows that in 2024, the online retail sales of electric razors reached 8.61 billion yuan, a year-on-year decrease of 8.1%. Compared with kitchen appliances, hair dryers, and cleaning appliances, the total online retail sales of razors last year were the lowest, and the decline was the largest.

Taking Feike Electric, a leading domestic electric razor enterprise, as an example, its performance declined on both fronts last year, and its net profit attributable to the parent company was halved, hitting a new low in the past decade.

Feike Electric focuses on core categories of personal care appliances such as razors, high-speed hair dryers, and electric toothbrushes. Personal care appliances account for up to 95% of the company's revenue, and the revenue of this business was 3.956 billion yuan, a year-on-year decrease of 17.05%.

In a saturated electric razor market, Feike's cost-effective brand "Borui" and high-end brand "Feike" have not performed as expected, and its market share has been significantly squeezed.

Feike's performance is undoubtedly a microcosm of personal care enterprises. The "price war" has become the norm under fierce market competition.

Laifen is trying to enter the mid - to high - end razor market with the feature of "technological innovation". It has ambition and courage, but of course, it also comes with risks.

To break through the encirclement, Laifen must give full play to its marketing advantages.

Looking back at Laifen's growth history, in the high-speed hair dryer field, Laifen was not the first "Dyson alternative", but it was able to achieve sales of 290 million yuan with a single category of hair dryers in 2022, achieving more than a tenfold increase.

Image source: Enterprise

According to the data released by Laifen, during the three consecutive Double 11 shopping festivals from 2021 to 2023, Laifen's sales were 20 million yuan, 290 million yuan, and 440 million yuan respectively. It can be seen that the growth has returned to a more moderate level.

Laifen's sudden rise is not only due to seizing the growth dividend but also related to its early entry into the high-speed hair dryer market and extensive marketing.

Laifen used to be well - versed in the marketing strategy of the founder's story. Ye Hongxin has told his entrepreneurial history on many occasions: he picked up garbage when he was a child and worked on the factory assembly line at the age of 17. In 2007, he caught the Taobao e - commerce wave and earned his first bucket of gold of more than 10 million yuan. Then, he lost all his capital in the research and development of manned aircraft and electric skateboards.

In Ye Hongxin's narrative, these experiences have been sublimated into concepts: coming from a humble background, he hopes to make technology accessible to all; having done business on Taobao, he is familiar with user needs; having researched manned aircraft, he has accumulated experience in electric motor technology. So he founded Laifen to develop high - speed hair dryers.

He did seize the opportunity. In the high - speed hair dryer market, Dyson had already completed user education, and the remaining task was to create domestic brands using China's manufacturing capabilities. However, there is no dominant brand like Dyson in the razor market that can define the category, so Laifen is bound to face challenges in breaking through.