Falling average customer spend and a surge in store openings: Meet You Noodles is deeply trapped in the "expansion paradox" | Jike Research

Author | Ding Mao

Editor | Zheng Huaizhou

With the successive listings of Xiaocaiyuan and Green Tea Group, Chinese restaurant stocks have become active again in the IPO market of the Hong Kong Stock Exchange.

On April 15th, Meet Noodles submitted its prospectus to the Hong Kong Stock Exchange, aiming to become the "first stock of Chinese noodle restaurants". For this listing, Meet Noodles has carried out a crazy expansion in the past three years, hoping to win the recognition of the capital market through good growth performance and thus obtain the ticket for IPO.

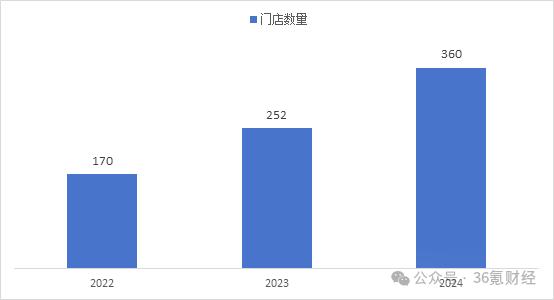

According to the prospectus, from 2022 to 2024, the number of Meet Noodles' stores increased from 170 to 360, with a compound annual growth rate (CAGR) of up to 45.5%. During this period, the number of newly opened stores was 43, 92, and 120 respectively. In other words, in 2024, Meet Noodles launched a scale sprint at a speed of opening a new store almost every three days.

This aggressive expansion strategy has indeed worked. From 2022 to 2024, Meet Noodles' operating income nearly tripled, with an average annual compound growth rate of up to 66.2%, showing strong growth potential. At the same time, starting from 2023, the company turned losses into profits and continued to make profits in 2024.

Under what seems to be a perfect situation, the bitter fruits of crazy expansion have also emerged.

Most notably, in 2024, the operating efficiency and profitability of Meet Noodles' restaurants continued to decline. In addition, the rising debt level brought about by the rapid expansion has also kept the company's asset - liability ratio at a high level of around 90% for a long time.

So, what is the fundamental performance of Meet Noodles? What hidden worries does the company currently face? Can it successfully list on the Hong Kong Stock Exchange and achieve a comeback this time?

Rapid Expansion but Deteriorating Operating Efficiency

Meet Noodles was established in 2014 and is a chain brand of Sichuan - Chongqing noodle restaurants featuring Chongqing small noodles. According to Frost & Sullivan, based on the total merchandise transaction volume in 2024, Meet Noodles is the largest operator of Sichuan - Chongqing flavored noodle restaurants and the fourth - largest operator of Chinese noodle restaurants in China.

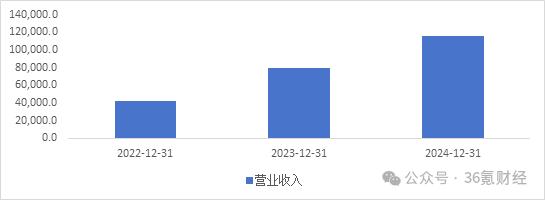

In recent years, Meet Noodles has expanded very rapidly. According to the information disclosed in the prospectus, from 2022 to 2024, the company's operating income was 420 million, 800 million, and 1.15 billion yuan respectively, nearly tripling in three years, with year - on - year growth rates of 91.5% and 44.2%, and an average annual compound growth rate (CAGR) of up to 66.2%. The company is in a period of rapid expansion.

Figure: Changes in Meet Noodles' revenue in the past three years. Data source: Wind, compiled by 36Kr.

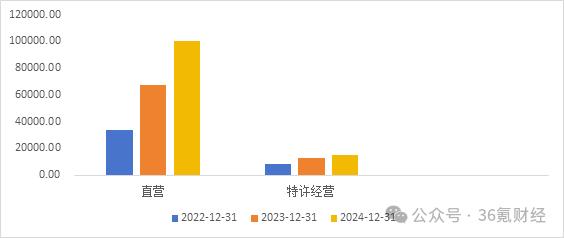

From the perspective of the business structure, similar to other catering institutions, Meet Noodles' main business also includes the revenue from direct - operated restaurants and the franchise and license management revenue contributed by franchisees. Among them, the rapid expansion of direct - operated revenue has been the main driving force for the company's growth in recent years.

According to the prospectus, from 2022 to 2024, the company's direct - operated revenue showed a continuous expansion trend and its proportion increased year by year, expanding from 340 million yuan to 1.01 billion yuan, with a CAGR of 72.3%. During the same period, the revenue proportion increased from 80.6% to 86.7%. In contrast, the franchise revenue showed a contraction trend during this period. From 2022 to 2024, the franchise and license management revenue contributed by franchisees only expanded from 80 million yuan to 150 million yuan, with a CAGR of 36.9%, and the revenue proportion decreased from 19.3% to 13.2%.

Figure: Comparison of Meet Noodles' direct - operated and franchise revenue. Data source: Wind, compiled by 36Kr.

So, what are the driving factors behind the rapid expansion of direct - operated revenue?

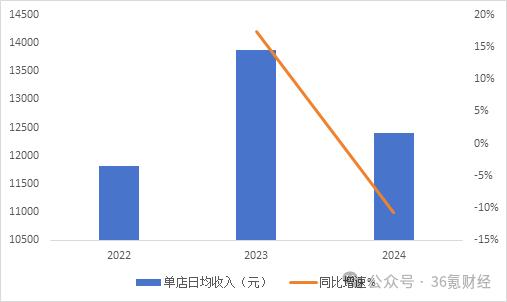

If we further break it down, we can find that the main reason for Meet Noodles' expansion in the past three years does not lie in the improvement of restaurant operating efficiency, but in the accelerated expansion of the number of stores.

According to the information disclosed in the prospectus, from 2022 to 2024, the average daily revenue per store of Meet Noodles was 11,822 yuan, 13,880 yuan, and 12,402 yuan respectively, with a CAGR of only 2.4%. Moreover, the average daily revenue per store in 2024 decreased by 10.6% compared with that in 2023. At the same time, the number of Meet Noodles' stores increased from 170 to 360, with a CAGR of up to 45.5%. The number of newly opened stores from 2022 to 2024 was 43, 92, and 120 respectively. Among these stores, the number of self - operated stores expanded from 111 to 279, with a CAGR of 58.5%, and the number of franchise stores increased from 59 to 81, with a CAGR of only 17.2%.

Figure: Changes in Meet Noodles' revenue per store. Data source: Wind, compiled by 36Kr.

Figure: Changes in the number of Meet Noodles' restaurants. Data source: Wind, compiled by 36Kr.

Therefore, it can be said that the accelerated expansion of stores, especially self - operated stores, is the main reason for the continuous expansion of Meet Noodles' scale in the past three years. However, while accelerating the opening of stores, Meet Noodles' operating efficiency has not improved and has even declined to some extent. This trend is very obvious from the restaurant's operating data.

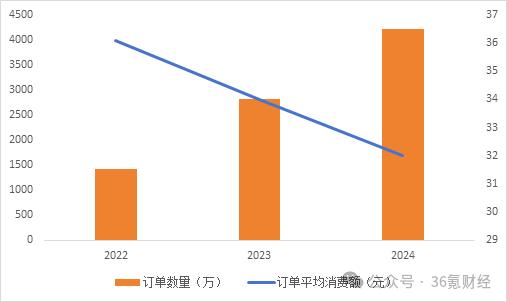

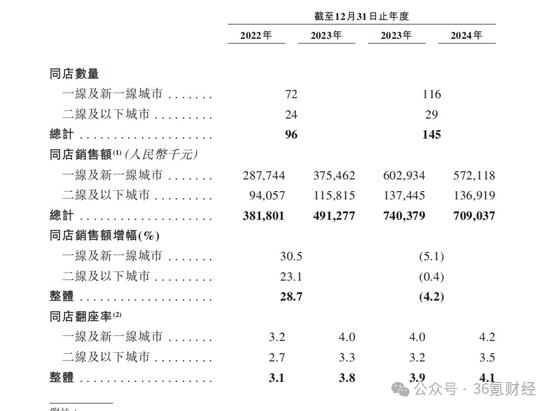

According to the prospectus, from 2022 to 2024, the number of orders of Meet Noodles increased from 14.16 million to 42.09 million, with a CAGR of 72.4%. However, the average consumption amount per order decreased from 36.1 yuan in 2022 to 34 yuan in 2023 and further to 32 yuan in 2024. The table - turnover rate did not change much during the same period, and the table - turnover rate in 2024 even decreased from 3.8 to 3.7. The operating situation of the same - store also showed a similar trend, and the sales in 2024 decreased by 4.2% compared with that in 2023.

Figure: Changes in the number of Meet Noodles' orders. Data source: Wind, compiled by 36Kr.

Figure: Operating situation of Meet Noodles' same - stores. Data source: Meet Noodles' prospectus, compiled by 36Kr.

Meet Noodles explained the decrease in the average customer price as an active price - cutting behavior. But considering the situation of the domestic catering industry in recent years, it is actually easy to understand. After the epidemic, with the rise of cost - effective consumption and the intensifying homogeneous competition in the catering industry, the catering industry as a whole has been trapped in a price war in recent years. In this context, "exchanging price for volume" has become the choice of most catering enterprises.

In the short term, the accelerated expansion of stores can indeed quickly improve Meet Noodles' performance, especially the rapid growth of scale, thus creating an illusion of high growth. However, in the long run, if the company relies too much on store expansion and low - price strategies to stimulate scale growth instead of optimizing the operating efficiency of single stores to cope with competition, it is likely to damage the brand influence and ultimately affect Meet Noodles' long - term profitability.

Turned Profitable but with Thin Profit Margins

From the perspective of profit, since Meet Noodles mainly operates direct - operated stores with a heavier asset model, its profit cycle is obviously longer. It was not until 2023, nine years after its establishment in 2014, that Meet Noodles truly turned losses into profits, and it continued to make profits in 2024.

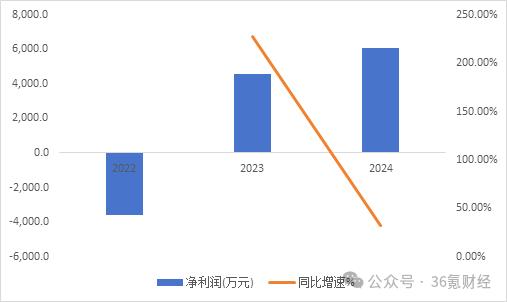

According to the prospectus, from 2022 to 2024, the company's net profit attributable to the parent company was - 35.973 million yuan, 45.914 million yuan, and 60.7 million yuan respectively, corresponding to net profit margins of - 8.6%, 5.7%, and 5.3%. The year - on - year growth rates of net profit were 227.6% and 32.2% respectively.

Figure: Changes in Meet Noodles' net profit. Data source: Wind, compiled by 36Kr.

From the perspective of profit composition, the company turned losses into profits in 2023. On the one hand, because the proportion of raw material and consumable costs decreased from 38.3% to 36.3% in 2023, the gross profit margin increased by two percentage points from 61.7% to 63.7%. The increase in the gross profit margin was based on the increase in the proportion of direct - operated restaurants with a higher gross profit margin. According to the data disclosed by the company, from 2022 to 2023, the gross profit margin of the company's direct - operated restaurants was 70.9% and 71% respectively, while the gross profit margin of franchise stores was only 53.9% and 55.7% during the same period.

On the other hand, it was because the proportion of three expenses, namely employee compensation, right - of - use asset depreciation, property, plant and equipment depreciation, and intangible asset amortization, decreased simultaneously in 2023. Among them, the proportion of employee compensation decreased from 26% to 22%; the proportion of right - of - use asset depreciation decreased from 23% to 16%; and the proportion of property, plant and equipment depreciation and intangible asset amortization decreased from 5% to 3%. The company disclosed that the decrease in the proportion of employee costs, rent depreciation, and equipment depreciation was mainly due to the strong rebound in restaurant revenue after the epidemic, which diluted the proportion of expenses.

Although Meet Noodles has made profits for two consecutive years, in fact, after completely eliminating the impact of the epidemic in 2024, under the heavy - asset direct - operation model and the strategies of crazy store - opening and low prices, Meet Noodles' profit performance not only did not improve further but also declined to a certain extent.

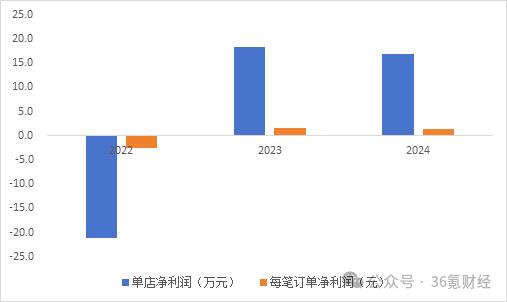

According to the prospectus, although the absolute value of Meet Noodles' net profit increased from 45.91 million yuan to 60.7 million yuan in 2024, and the gross profit margin increased from 64% to 66%. However, the company's net profit margin decreased from 5.7% to 5.3%, the net profit per store decreased from 182,000 yuan to 169,000 yuan, and the net profit per order also decreased from 1.6 yuan to 1.4 yuan.

Figure: Changes in Meet Noodles' net profit per store and per order. Data source: Wind, compiled by 36Kr.

It can be seen that the crazy opening of direct - operated stores in recent years has indeed significantly improved Meet Noodles' revenue scale and gross profit margin, but it has also brought about a relatively rapid increase in rent costs and labor costs. Coupled with the impact of the price war in the context of industry involution, in the end, Meet Noodles did not achieve economies of scale due to scale expansion. Instead, the profitability of single stores declined.

Another thing worth noting is that although the direct - operation - based model has brought good improvements in terms of gross profit margin, limited by the relatively high proportion of cost and expenses in the heavy - asset model, the company's profit margin has always been thin. In this context, even though Meet Noodles has shown good growth potential in terms of scale expansion, with an average profit of only 1.4 yuan per order, the space that the company can expect in the future for the capital market has also been greatly reduced.

Money - Burning Store - Opening Raises Debt Concerns

Another problem brought about by the rapid expansion of stores is that Meet Noodles' debt level has expanded sharply in recent years. According to the information disclosed in the prospectus, from