Latest data from the National Bureau of Statistics: In April, the number of cities with rising housing prices decreased, and the adjustment trend of the second-hand housing market was more obvious.

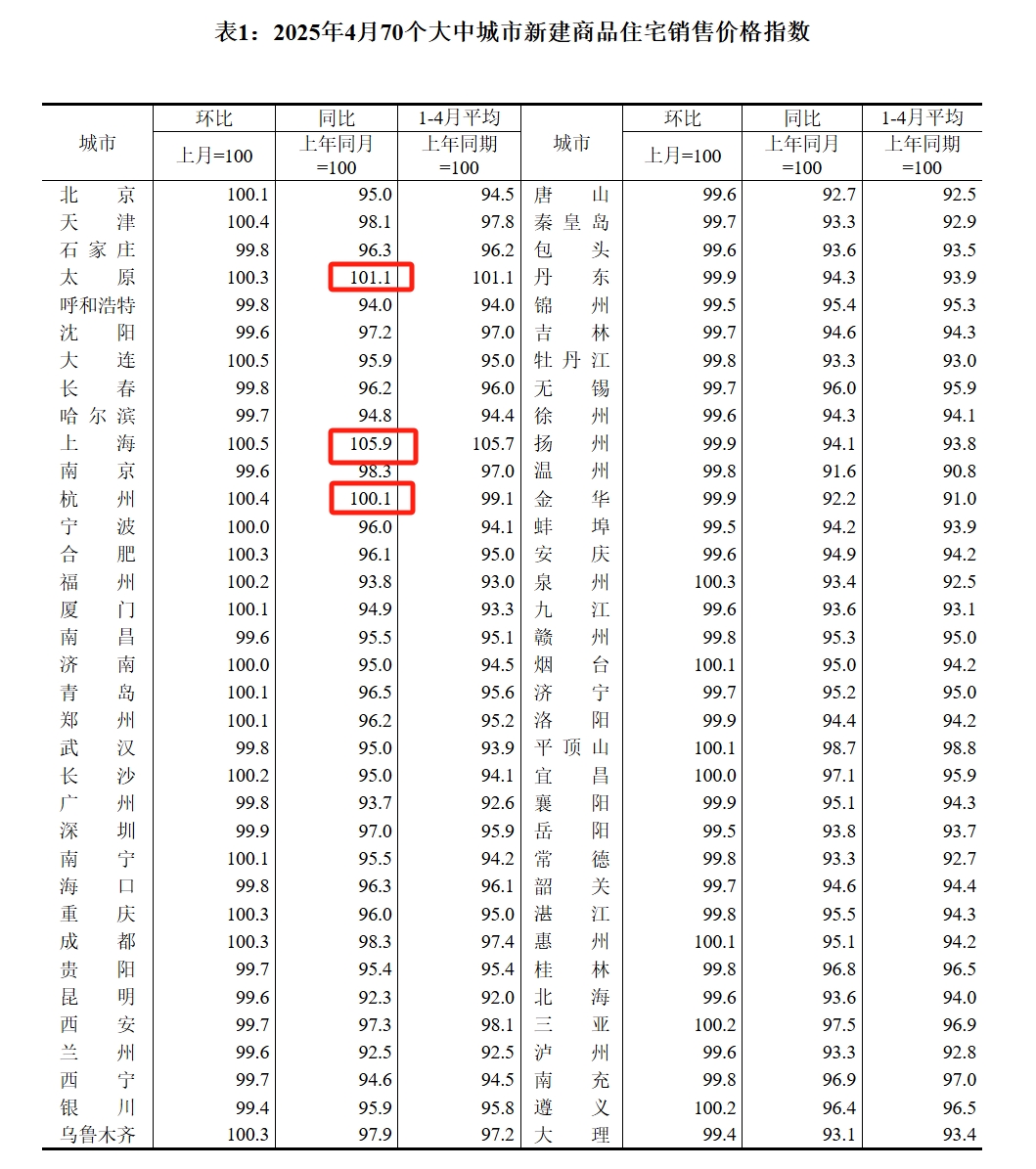

On May 19th, the latest data released by the National Bureau of Statistics showed that in April, among 70 large and medium-sized cities, the number of cities where the prices of newly built commercial residential buildings increased month-on-month was 22, 2 less than the previous month. The prices in Beijing turned from a decline to an increase.

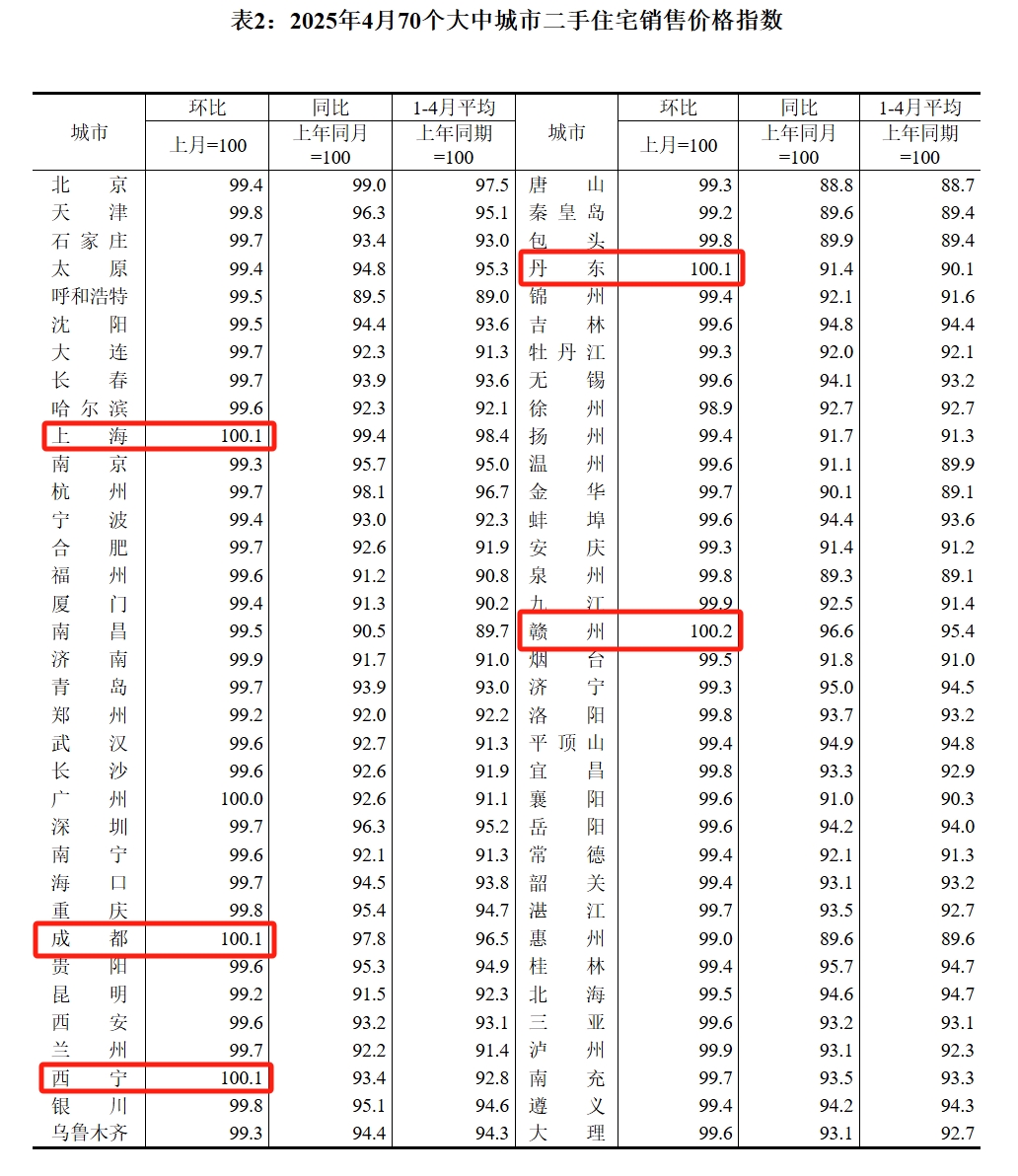

The number of cities where the prices of second-hand housing increased month-on-month was 5, 5 less than the previous month. The prices in Beijing and Shenzhen turned from an increase to a decline.

Fu Linghui, a spokesperson for the National Bureau of Statistics, said that under the effect of various policies to promote the stabilization of the real estate market, since the beginning of this year, China's real estate market has continued to move towards stabilization. Transactions in some first - and second-tier cities have recovered to some extent, and housing prices have generally remained stable. However, it should also be noted that currently the real estate market is still in the process of adjustment and transformation. Rigid and improved housing demands still need to be released. The pressure to destock real estate in some areas remains high, and more efforts are still needed to promote the stabilization of the real estate market.

Month-on-month data showed that in April, the sales prices of newly built commercial residential buildings in first-tier cities remained flat month-on-month, compared with a 0.1% increase in the previous month. Among them, the prices in Beijing and Shanghai increased by 0.1% and 0.5% respectively, while those in Guangzhou and Shenzhen decreased by 0.2% and 0.1% respectively.

The sales prices of newly built commercial residential buildings in second-tier cities remained flat month-on-month, the same as the previous month. The sales prices of newly built commercial residential buildings in third-tier cities decreased by 0.2% month-on-month, with the same decline rate as the previous month.

In terms of second-hand housing, in April, the sales prices of second-hand residential buildings in first-tier cities decreased by 0.2% month-on-month, compared with a 0.2% increase in the previous month. Among them, the prices in Shanghai increased by 0.1%, those in Guangzhou remained flat, and those in Beijing and Shenzhen decreased by 0.6% and 0.3% respectively.

The sales prices of second-hand residential buildings in second - and third-tier cities both decreased by 0.4% month-on-month, with the decline rates widening by 0.2 and 0.1 percentage points respectively compared with the previous month.

Source: National Bureau of Statistics

Compared with April last year, only 3 cities, namely Shanghai, Hangzhou, and Taiyuan, saw an increase in the prices of newly built commercial residential buildings. Among them, the sales prices of newly built commercial residential buildings in first-tier cities decreased by 2.1% year-on-year, with the decline rate narrowing by 0.7 percentage points compared with the previous month. Among them, the prices in Shanghai increased by 5.9%, while those in Beijing, Guangzhou, and Shenzhen decreased by 5.0%, 6.3%, and 3.0% respectively. The sales prices of newly built commercial residential buildings in second - and third-tier cities decreased by 3.9% and 5.4% year-on-year respectively, with the decline rates narrowing by 0.5 and 0.3 percentage points respectively.

In terms of second-hand housing, compared with the same period last year, none of the 70 cities saw an increase or remained flat. Among them, the sales prices of second-hand residential buildings in first-tier cities decreased by 3.2% year-on-year, with the decline rate narrowing by 0.9 percentage points compared with the previous month. Among them, the prices in Beijing, Shanghai, Guangzhou, and Shenzhen decreased by 1.0%, 0.6%, 7.4%, and 3.7% respectively. The sales prices of second-hand residential buildings in second - and third-tier cities decreased by 6.5% and 7.4% year-on-year respectively, with the decline rates narrowing by 0.5 and 0.4 percentage points respectively.

Wang Zhonghua, the chief statistician of the Urban Department of the National Bureau of Statistics, interpreted the data and said that in April 2025, among 70 large and medium-sized cities, the sales prices of commercial residential buildings in cities at all levels remained flat or slightly decreased month-on-month, and the year-on-year decline rates continued to narrow.

Judging from the housing price data for April released by the National Bureau of Statistics, there was a differentiation within first-tier cities. The increase in the prices of new houses in Beijing and Shanghai showed that the real estate markets in these two cities still had certain supporting factors. In particular, the overall slight increase in the prices of both new and second-hand housing in Shanghai was on the one hand due to its unique urban status and market demand structure, and on the other hand, it was also related to its strengthening of the supply of new houses in core areas. In April, the new house market in Shanghai showed a continuous increase in popularity driven by high - end improvement projects. For example, a project in Pudong refreshed the records of the highest subscription number and the highest qualifying points for new housing projects in Shanghai from January to April this year. In addition, the average premium rate of the third batch of residential land plots reached 30%, which all conveyed a positive expectation of the future real estate market.

Zhang Bo, the dean of the 58 Anjuke Research Institute, analyzed that in April, there was a differentiation within first-tier cities. The increase in the prices of new houses in Beijing and Shanghai showed that the real estate markets in these two cities still had certain supporting factors; the overall situation in second-tier cities was relatively stable, and the market was in a relatively stalemate state. It was worth noting that the trading activity in the second-hand housing market had decreased to some extent, leading to price adjustments. Further policy stimulus or improvement in the economic environment may be needed to boost the market; the downward pressure in third-tier cities continued to exist.

Source: National Bureau of Statistics

Zhang Bo reminded that in April, the real estate market, whether it was the new house or second-hand housing market, and whether it was the supply side or the demand side, showed a certain adjustment trend. Market confidence and trading momentum needed to be further enhanced.

It was worth noting that the land market boom in some core cities also drove up the market popularity. For example, the significant increase in land prices in Hangzhou accelerated the reconstruction of the new house price system in Hangzhou. From January to March, the record of the floor price in Hangzhou was refreshed three times, and the housing price expectations in some core areas also increased accordingly. Judging from the online housing search popularity on Anjuke, the housing search popularity for both new and second-hand housing around hot land plots was generally at a high level in April, which was also an obvious manifestation of the active cycle of the regional real estate market.