Alibaba, an AI service provider, must bear the weight.

Text by | Peng Qian

Edited by | Qiao Qian

Alibaba has released a quarterly report that is not stunning but still decent.

Overall, in Q4 of fiscal year 2025 (i.e., Q1 of the natural year), Alibaba's revenue increased by 7% year - on - year, slightly lower than the market's expected growth rate of over 8%. Its adjusted operating profit increased by 36% year - on - year, meeting market expectations.

At the earnings conference, Alibaba's executives also stated that excluding factors such as RT - Mart and Intime, Alibaba Group's revenue increased by about 10% year - on - year, which actually exceeded the market's expected growth rate of over 8%.

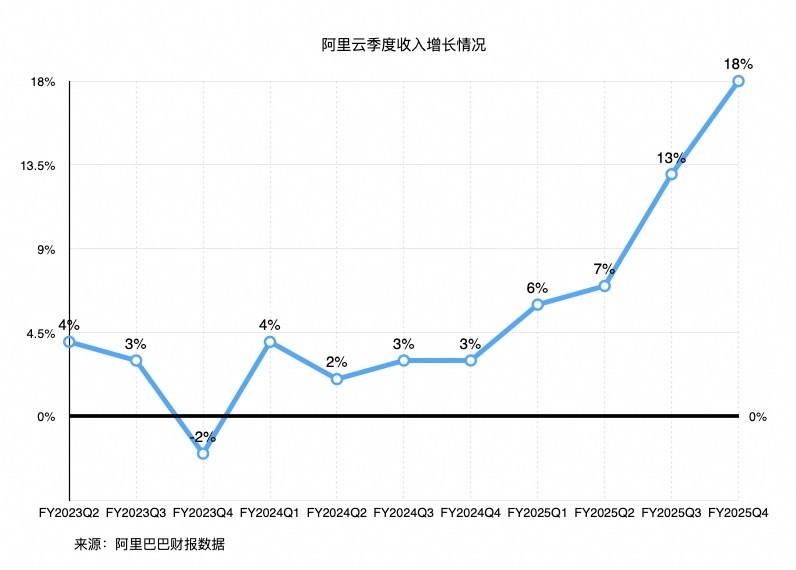

By business segment, in terms of the revenue of the top four businesses, international commerce still led in terms of growth rate, reaching 22% year - on - year. Alibaba Cloud's year - on - year revenue growth rate reached a record high of 18%. Taotian's revenue increased by 9% year - on - year, showing further improvement compared with previous quarters. Cainiao's revenue declined by 12% year - on - year, with a relatively obvious drop. This reflects the result of Alibaba's further integration of logistics services in its e - commerce business. However, due to the sale of direct - operation businesses such as Sun Art Retail Group and Intime, the revenue growth brought about by Taotian's incorporation of some of Cainiao's businesses was offset.

In terms of profit performance, Taotian's operating profit and profit margin improved significantly. Alibaba's media and entertainment business, which was always considered a drag on profits, turned profitable again. The losses of international commerce and Cainiao continued to narrow, while the loss of local life expanded.

The core data basically met expectations, but the market, which was looking forward to a "stunning performance," was not satisfied. After the release of the earnings report, Alibaba's U.S. stocks fell by more than 5% in pre - market trading, dropped nearly 8% during the session, and opened down by more than 7%. The next day, its Hong Kong stocks opened nearly 6% lower.

After the previous quarterly report brought long - awaited surprises, and with the excellent quarterly reports of JD.com and Tencent in the past two days, the market clearly wanted to see a more impressive quarterly report from Alibaba. Especially since Alibaba announced at the previous earnings conference that it would invest 380 billion yuan in AI and cloud services within three years, the "AI - crazy" market was eagerly looking forward to further progress in this area.

In addition, the investment in cloud infrastructure led to a significant decrease in free cash flow. However, the market still believed that the Capex (capital expenditure, mainly focusing on investment in digital infrastructure and technology assets in the Internet industry) was not enough, lower than expected and that of peers such as Tencent, which triggered negative sentiment towards Alibaba.

The market is too impatient and has overly high expectations for AI and cloud services

Obviously, the performance of AI and cloud services has become the main factor controlling the rise and fall of Alibaba's stock price.

In terms of growth rate, the growth of cloud services is actually quite good. Especially when compared with the more than ten quarters in the past three years, the year - on - year growth reached 18%, falling within the market's generally expected range of 17% - 20%. However, the market is eager to see more stunning growth from Alibaba Cloud. An investment banker told 36Kr: "A growth rate of over 20% would exceed expectations, and a rate below 17% would fall short of expectations. After Q4, the market generally believes that it should exceed expectations."

According to 36Kr, some institutions even predicted an extremely high growth rate of 25% - 30% for Alibaba Cloud, which reflects the market's over - optimism about the rapid transformation of significant progress in the AI industry (such as strong inference demand) into high - speed growth of cloud services. It should be noted that several major U.S. technology giants (such as Microsoft, Amazon, Google, and Meta) also spent as long as two years before achieving remarkable growth with the help of AI and cloud services. Consistent with the previous six quarters, the year - on - year revenue growth rate of Alibaba Cloud's AI - related products still reached three digits. However, the market may be looking for more specific figures and tangible changes. After all, three - digit growth is a very broad range.

The overnight popularity of Deepseek has indeed triggered a global re - evaluation of China's AI technology strength and industry. In the short term, it has brought huge AI dividends to Chinese technology companies, greatly stimulating inference demand. The market previously thought that this would soon be reflected in the financial figures of large companies' AI and cloud services. However, the actual situation in the computing power industry (currently mainly with two types of demand: training and inference) is that the training demand is receding. At the end of March, Joseph Tsai also said bluntly at a summit that the current global data center construction speed exceeds the initial demand for artificial intelligence (AI), warning of the risk of a bubble.

Deepseek has indeed significantly increased inference demand, but the effect has not yet emerged, and it may not necessarily benefit large companies' cloud services, especially public cloud services, because many manufacturers purchase hardware on their own instead of renting.

Revenue growth rate of Alibaba Cloud from fiscal year 2023 to fiscal year 2025

The high expectations are largely based on Alibaba's huge investment in cloud and AI services. In Q1, Alibaba's free cash flow was $374 million, compared with $1.536 billion in the same period last year (when the "full - scale AI transformation" was not officially proposed), a significant year - on - year decrease of 76%. The money was mainly spent on technological investment in AI and cloud services.

Even though the free cash flow decreased significantly, the market is still worried that Alibaba's investment in AI and cloud services is not enough. Alibaba's Capex in Q1 did decline by 22% to 24.6 billion yuan compared with 31.4 billion yuan in the previous quarter. Since Alibaba announced its transformation into an AI service provider, its stock price has soared, and it has been regarded as the "No. 1 AI technology stock" by the market. This has led the market to have high expectations for Alibaba's Capex, as it directly affects the valuation of cloud services.

In addition, Alibaba's Capex in Q1 was slightly lower than that of Tencent, which was slower to make a statement in the AI field. Tencent announced at its Q1 earnings conference a few days ago that it would invest nearly 100 billion yuan in 2025, and it had already invested 27 billion yuan in Q1, slightly more than Alibaba. This has triggered some doubts in the market about Alibaba's determination to transform.

A senior AI industry insider had a more rational view. He told 36Kr: "Last quarter, in order to buy graphics cards before Trump took office, major technology companies stocked up on computing power, leading to a surge in Capex. Now it has just returned to normal levels."

Alibaba's executives once revealed that Alibaba would invest about 100 - 120 billion yuan in AI and cloud services in 2025, which is actually higher than the "nearly 100 billion yuan investment" revealed by Tencent at its recent earnings conference. This figure represents a significant increase compared with Alibaba's previous fiscal year investments. In the just - ended fiscal year 2025, Alibaba's Capex reached as high as 86 billion yuan, far exceeding the 53.3 billion, 34.3 billion, and 32 billion yuan in fiscal years 2022 - 2024. However, the market clearly has higher expectations for the Capex of the "No. 1 AI technology stock."

Looking at the EBITA margin of cloud services (i.e., adjusted profit margin, a core financial indicator to measure a company's profitability), it decreased from 9.9% year - on - year to 8.0%, which is indeed lower than the market's expected double - digit year - on - year growth. It also shows that the profitability of Alibaba Cloud's public cloud services has declined slightly compared with the previous quarter. However, considering that Alibaba Cloud is still in the development stage of investing for growth, a slight decline in profit margin is normal.

After the short - term frenzy, the market needs to be more patient with the growth of AI and Chinese technology stocks. This is always an industry that requires long - term investment. From a business perspective, a more important question is: How many industries and companies have chosen Tongyi Qianwen series products as their basic models?

Tongyi Qianwen is currently the world's largest open - source model family. Except for Apple and Tesla, which have not officially announced their cooperation, various industries are accelerating their access to Tongyi series large - scale models, including well - known enterprises and institutions such as BMW, OPPO, vivo, Honor, XPeng, NIO, ZEEKR, China Construction Bank, China Merchants Bank, China Life Insurance, Haier, Midea, Skyworth, Weibo, Ctrip, State Grid, Digital Chongqing, and the Chinese Academy of Sciences.

As for how much revenue these large customers can bring, it is still a long - term question. A person in the cloud computing industry revealed: "Many companies may still be in the stage of model selection and effect testing, and are also considering whether the cloud computing platform infrastructure provided has sufficient cost - effectiveness. The corresponding revenue performance can actually be observed for a few more quarters."

The market's attitude has changed in the short term, but Alibaba's determination to invest in AI and cloud services and promote the group's AI transformation remains unchanged. In an internal letter sent by Wu Yongming before May 10th, he also mentioned: "In addition to improving products and user experience, it is also particularly important to use AI technology to reshape the organizational operation mode and improve efficiency. We will fully support this in terms of tool support, organizational guarantee, and assessment mechanisms to ensure that the changes are not just empty words."

Taking e - commerce, its main business, as an example, employees have been given OKR indicators related to AI, such as the penetration rate of AI tools, the scale revenue of AI products (such as advertising), and the problem order resolution rate. For Internet platform product - type businesses such as AutoNavi, Fliggy, and Ele.me, the person - in - charge will report to Wu Yongming, quantify the growth brought by AI, and start using more AI tools for work. To encourage employees to focus on AI, Alibaba's various businesses have also proposed more incentive measures, such as free learning opportunities and more rewards.

After the release of Alibaba's earnings report triggered a short - term panic in the capital market about "possibly needing to adjust expectations for China's computing power industry" and dragged down Chinese concept stocks, top investment banks such as JPMorgan Chase also urgently issued statements saying: "The growth logic of Alibaba Cloud has not changed, and it is expected to achieve a 22% year - on - year revenue growth rate in the next quarter."

Taotian has its bright spots, but market competition is becoming more intense

How did Taotian perform in the first quarter after Jiang Fan's return?

Judging from the paper data, Taotian's performance had some bright spots. Its revenue increased by 9% year - on - year, exceeding the market's expected 5%. Customer management revenue increased by 12%, exceeding the market's expected 9%. Adjusted EBITA increased by 8% year - on - year, exceeding the market's expected 3%. The growth rates of these indicators were also higher than those in the quarter before Jiang Fan's official return (Q4 of 2024).

Undoubtedly, the most eye - catching data for Taotian in Q1 was CMR (customer management revenue, accounting for nearly 70% of Taotian's revenue), which increased by 12% year - on - year, almost returning to the level in 2021. This was also an important reason why Taotian's revenue exceeded market expectations. According to institutional data obtained by 36Kr, the growth rate of Taotian's CMR is now more than twice that of GMV, indicating a significant improvement in Taotian's commercialization efficiency.

The increase in the monetization rate is an important reason for CMR to return to the high - growth channel. The full - site promotion and the 0.6% software service fee continue to contribute significantly. According to 36Kr, the penetration rate of full - site promotion is now close to 30%, and it is expected to reach 45% - 50% in fiscal year 2026.

The boosting effect of AI on advertising, the cash - cow business of technology companies, was the focus of market attention this quarter. Tencent mentioned at its earnings conference that AI had a significant boosting effect on both advertising and gaming, which largely stimulated the market's optimistic sentiment towards its investment in AI.

The significant growth of the full - site promotion, which is based on Alibaba's underlying technology, is also due to the increased willingness of merchants to invest. This is inseparable from the product's use of AI technology, such as formulating a reasonable ROI, intelligent product selection, and precise push, which all help merchants improve investment efficiency.

Jiang Fan also said at the earnings conference that Taotian is committed to using AI to improve the user experience and reconstruct the search advertising system. This is Taotian's current priority, and some significant results have been seen. According to 36Kr, the Search and Recommendation Department established by Taotian in Q1 optimized the search strategy. For example, it modified the search and recommendation logic by combining AI technology to increase the conversion rate of search to transactions, which helped Taotian increase its order volume.

At the earnings conference, Wu Yongming also gave a relatively optimistic guidance for CMR in fiscal year 2026: The software service fee will continue to drive up the take - rate, and the penetration rate of full - site promotion will further increase, attracting many new merchants, especially small and medium - sized merchants and white - label merchants, to use it. This will drive up the take - rate, and CMR is expected to continue to grow at a high speed.

While continuing to invest heavily in marketing to optimize the business revenue environment and acquire new users, Taotian has also achieved good results in cost - cutting in personnel. As a result, its profitability is also improving. The year - on - year growth rate of operating profit continues to increase compared with the previous quarter, and the net profit margin is also higher than expected. This means that Taotian can still continue to invest heavily in its main business and support the investment in AI and cloud services.

The market's hidden concern about Taotian's main business is still the fierce competition. Taotian's competitors still have sufficient resources and are ready to attack at any time. In Q1 of 2025, with the support of multiple e - commerce projects such as national subsidies, JD.com Super, fashion categories, and Jingxi, JD.com achieved double - digit revenue growth. In the instant retail war that started in Q2, JD.com occupies an important position. Tencent also announced the establishment of a WeChat product department in recent days, signaling an increased investment in the e - commerce field. It is still unknown whether Pinduoduo will increase its investment in the domestic market after encountering some obstacles overseas.

Taotian's competitors have not relaxed their vigilance in the e - commerce market competition. At the earnings conference, Jiang Fan also emphasized that maintaining the market share in e - commerce is still the top priority at present, which means that more strategies and investments are still needed to continue to achieve GMV growth. This quarter, Alibaba's GMV growth rate was slightly lower than the market average and declined compared with previous quarters. The performance in the upcoming 618 promotion has become crucial. Tonight, the first stage of Taotian's 618 promotion will officially start.

Taotian is still exploring more incremental markets and returning to the narrative logic of "Big Taobao" (proposed by Jack Ma in 2008, later split, and later mentioned again by Dai Shan). In Alibaba's most important AI business at present, Taobao may also become an entry point in the future. The instant retail war that has attracted much attention this year may also be an opportunity.

Jiang Fan said: "Flash sales are a high - frequency scenario for Taobao. The user activity and scale will be better reflected. There will be more possibilities for integration between Taobao and near - field e - commerce. In the future, the focus will be on actively investing to convert more Taobao users into instant retail users and upgrading Taobao's business model based on this business in the long term."

According to 36Kr, Taobao's flash sales performance has exceeded internal expectations and has attracted the attention of several partner - level executives. There will also be more actions during the 618 promotion, and the integration of Taobao and Ele.me's teams is still ongoing.

In the long run, moving from GMV to AGI is a difficult but promising path. Alibaba is still continuously undergoing self - transformation. In the next few quarters of this year, stabilizing its core e - commerce business and maintaining high investment and growth in Alibaba Cloud are the