ZhiKe | With Soaring Performance and Doubled Stock Price, Can Tencent's AI Narrative Unlock Upward Valuation Potential?

Author | Huang Yida

Editor | Zheng Huaizhou

After the Hong Kong stock market closed on May 14th, Tencent Holdings (hereinafter referred to as: Tencent) released its financial report for Q1 2025.

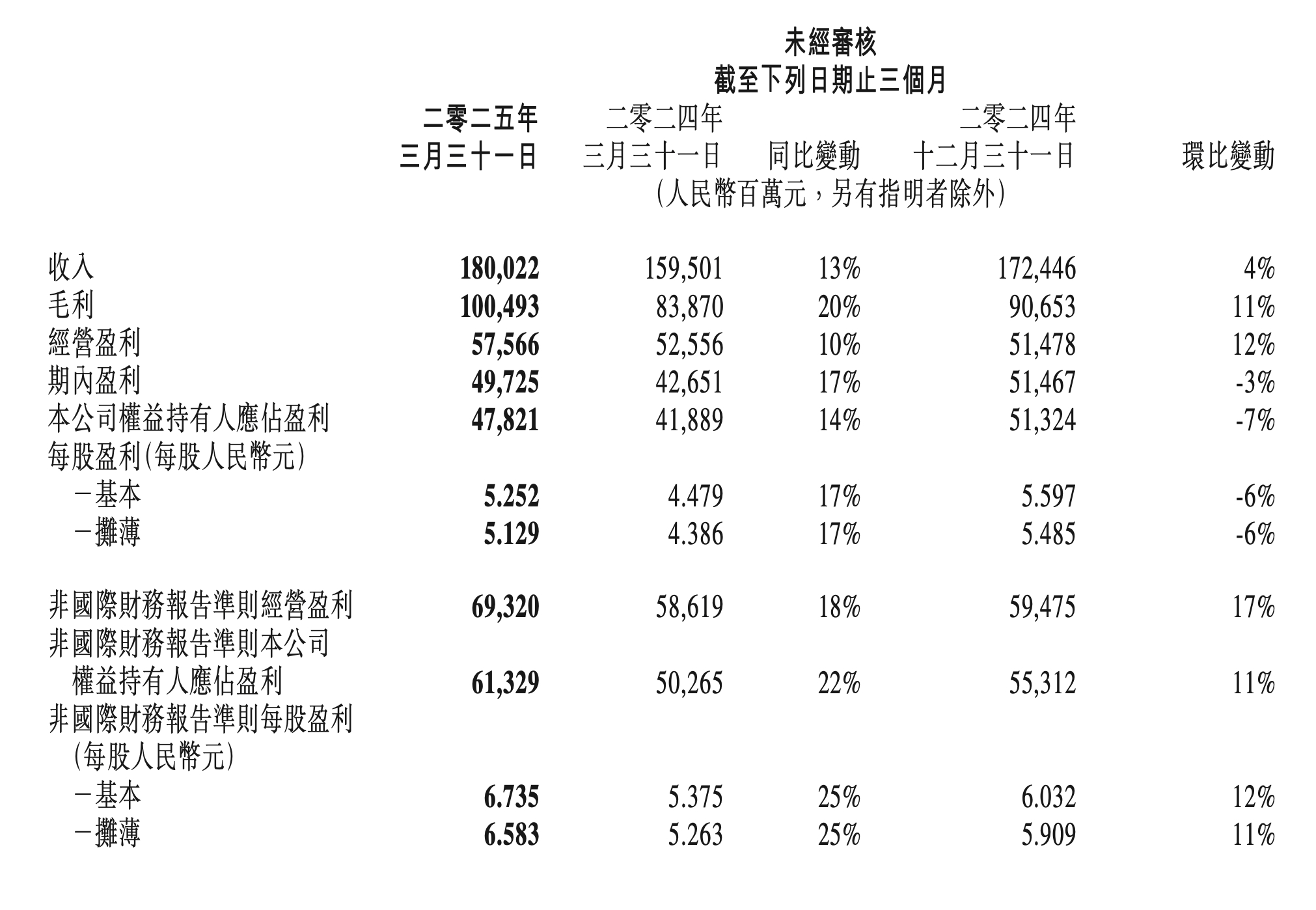

In Q1 2025, benefiting from the continuous intensification of the AI strategy, the revenues and profits of core businesses such as value-added services, marketing services, financial technology and enterprise services all increased. The financial report shows that Tencent achieved revenues of 180 billion yuan this quarter, a year-on-year increase of 13%, far exceeding market expectations.

While the revenues grew steadily, the profits continued their previous strong performance. The gross profit during the same period reached 100.5 billion yuan, a year-on-year increase of 20%; the Non-IFRS operating profit during the same period was 69.3 billion yuan, a year-on-year increase of 18%. It is worth noting that the growth rates of gross profit and operating profit have led the revenue growth rate for ten consecutive quarters.

Chart: Summary of Tencent Holdings' financial report; Source: Company financial report, 36Kr

In terms of AI, Tencent still maintained a relatively high intensity in R & D. This quarter, R & D investment increased by 21% year-on-year, and capital expenditure increased by 91% year-on-year. Benefiting from the continuous empowerment of core businesses by AI technology, the high-quality growth of the business side can in turn support R & D, thus forming a virtuous cycle. Ma Huateng, Chairman of the Board and CEO, said: "During the investment stage of the AI strategy, the operating leverage brought by the existing high-quality revenues will help digest the additional costs generated by these AI-related investments and maintain financial stability."

Against the backdrop of a weak economic recovery, Tencent's strong performance growth is the core driving factor. Coupled with the imagination space brought by AI empowering core businesses, as of May 14th, Tencent's Hong Kong stocks have continued to rebound in the past more than a month, with an increase of 25% during the period.

So, what are the highlights of Tencent's financial report this quarter? What kind of imagination space will the "AI in All" strategy bring to the company?

01 Value-added Services: AI Strengthens Hematopoietic Ability

Tencent's value-added services business achieved revenues of 92.1 billion yuan in Q1 2025, a year-on-year increase of 17%. The revenue share of value-added services this quarter was about 51%, a 5-percentage-point increase compared with Q4 2024.

From the perspective of the business structure, domestic games achieved revenues of 42.9 billion yuan during the same period, a year-on-year increase of 24%; international games recorded revenues of 16.6 billion yuan during the same period, with a year-on-year growth rate of 22% at constant exchange rates; the social network revenues (including sub - businesses such as music, game live streaming, and video live streaming) during the same period were 32.6 billion yuan, a year-on-year increase of 7%.

The sharp increase in the revenues of domestic games this quarter was not only due to the low base last year. On the product side, both new games and long - standing games contributed to the revenue growth. In terms of long - standing games, the revenues of many long - standing games, including "Honor of Kings" and "CrossFire Mobile", reached new historical highs this quarter.

In terms of new games, the incremental revenues brought by "Delta Force" provided strong support for the sharp increase in the revenues of domestic games this quarter. From the operation data, the number of users of "Delta Force" reached a new high this quarter. The peak DAU exceeded 12 million in April 2025, and "Delta Force" has the highest average DAU among the games launched in the past three years.

In terms of international games, games such as "PUBG MOBILE", "Brawl Stars", and "Clash Royale" continued their previous strong performance and were the core driving force for the growth of international game revenues.

AI empowerment played a crucial role in the revenue growth of the game business. By applying AI technology to improve user experience and product activity, the hematopoietic ability of the game business was strengthened. A typical example is the introduction of the DeepSeek large - model in "Peacekeeper Elite", launching AI assistants and AI teammates to provide game guidance for players and play against players. The improvement of user experience helps to enhance the user stickiness of long - standing products.

In terms of profits, the value - added services business segment achieved a gross profit of 54.9 billion yuan this quarter, a year - on - year increase of 22%. The growth of the business segment's gross profit was mainly driven by the growth of the domestic game business and the service fees of the mini - game platform. In terms of profitability, the gross profit margin of the value - added services business segment this quarter was 60%, a 3 - percentage - point and 4 - percentage - point increase year - on - year and quarter - on - quarter respectively.

02 Marketing Services: AI Upgrade and Increased Video Account Ad Load Support Revenue Growth

The marketing services business segment achieved revenues of 31.9 billion yuan this quarter, a year - on - year increase of 20%. The revenue growth accelerated, and the growth rate exceeded market expectations. The revenue share of marketing services this quarter was about 18%, a 2 - percentage - point decrease compared with Q4 2024.

The revenue growth of the advertising business this quarter was mainly driven by the advertising revenues of Video Account, Mini - Programs, and WeChat Search. From the perspective of advertisers, the marketing service revenues of most key industries increased. According to the information disclosed in Tencent's earnings conference, an internal driving force for the revenue growth of the advertising business this quarter was the appropriate increase in the ad load of Video Account. Currently, the ad load of Video Account is still in the low single - digits, and there is still much room for improvement compared with competitors.

Another internal driving force for the endogenous growth of the advertising business comes from the AI upgrade of the advertising platform and the optimization of the WeChat transaction ecosystem. This quarter, Tencent's main work in upgrading the advertising technology platform was to improve the relevant technical capabilities of generative AI. For example, to accelerate ad production, it further improved image generation and video editing functions, launched digital human solutions to assist live streaming, and continued to deepen the learning of users' interests to improve the promotion effect.

In terms of profits, the marketing services business segment achieved a gross profit of 17.7 billion yuan this quarter, a year - on - year increase of 22%. The growth of the business segment's gross profit was mainly driven by the revenue growth of sub - businesses with high gross profit margins, such as Video Account advertising and WeChat Search advertising. In terms of profitability, the gross profit margin of the advertising business segment this quarter was 56%, a 1 - percentage - point increase year - on - year and a 2 - percentage - point decrease quarter - on - quarter.

03 Financial Technology and Enterprise Services: Slight Rebound in Revenue Growth Rate

The financial technology and enterprise services business segment achieved revenues of 54.9 billion yuan this quarter, a year - on - year increase of 5%. Compared with Q4 2024, the growth rate rebounded. The revenue share of the financial technology and enterprise services business segment this quarter was about 31%, a 2 - percentage - point decrease compared with Q4 2024.

From a long - term perspective, the revenue growth of Tencent's financial technology and enterprise services business has slowed down significantly in the past year compared with before, mainly affected by the current weak and continuous economic recovery. In the short term, the slight rebound in the revenue growth rate of the financial technology and enterprise services business in Q1 2025 was mainly driven by the revenue growth of consumer loan services and wealth management services, as well as the growth of cloud service revenues and merchant technology service fees.

In terms of profits, the financial technology and enterprise services achieved a gross profit of 27.6 billion yuan this quarter, a year - on - year increase of 16%. The core driving force for the growth of the business segment's gross profit included the improvement of the profitability of payment services and cloud business, coupled with the revenue growth of consumer loan and wealth management services. In terms of profitability, the gross profit margin of the financial technology and enterprise services business segment this quarter was 50%, a 4 - percentage - point and 3 - percentage - point increase year - on - year and quarter - on - quarter respectively.

04 The AI Narrative of Core Businesses Is the Core Point for Valuing Tencent in the Future

Currently, Tencent's business ecosystem is developing steadily. With the penetration of AI technology, Tencent's business map is being gradually reshaped. Therefore, in this context, when judging Tencent's investment value, in addition to predicting the future performance growth of each business segment based on the macro - economy and industry development laws, it is also necessary to fully consider the supporting ability of AI - related applications for its performance growth.

In terms of infrastructure, in order to accelerate the AI - based iteration of all its business lines, Tencent is promoting the "AI in All" strategy. In the C - end ecosystem, Tencent has achieved full - scenario coverage of AI applications. Native AI products such as Yuanbao and ima have performed outstandingly. In addition to the rapid iteration and update of its own platforms, Yuanbao also drives user growth through the dual - drive model of Hunyuan and DeepSeek. At the same time, Tencent is promoting the AI - based upgrade of its core C - end products. Products such as WeChat, QQ, Tencent Docs, Tencent Meeting, and QQ Browser are successively launching new AI functions, aiming to improve user experience and stickiness.

In the B - end, Tencent is accelerating the penetration of AI technology into relevant businesses. In particular, it opens up core technologies such as AI and cloud computing in the form of API and SDK to help customers improve efficiency, provide enterprise intelligent transformation solutions for customers, and continuously promote industrial innovation. Typical cases include helping FAW Toyota increase the resolution rate of its customer service robots to 84% and providing relevant technical support for Dashenlin to build the first AI knowledge base in the pharmaceutical retail industry.

Driven by the "AI in All" strategy, the endogenous growth ability of Tencent's core businesses has been greatly improved. In the advertising business, the AI - driven intelligent advertising placement system has significantly improved the accuracy of advertising placement, driving the year - on - year growth of advertising placements by advertisers in multiple industries. In the game business, the launch of AI assistants and AI teammates has enhanced the product activity and user stickiness of some long - standing games. In the financial technology and enterprise services business, the core cloud service is the focus of AI applications, which has also brought immediate results in terms of performance.

While the "AI in All" strategy drives the full - scale AI - based transformation of businesses, continuously improving its own AI technical capabilities is of top priority. To strengthen the technical foundation, Tencent's capital expenditure this quarter reached 27.5 billion yuan, a year - on - year increase of 91%, accounting for about 15% of the revenues during the same period; R & D expenses were 18.9 billion yuan, a year - on - year increase of 21%. The above data shows that Tencent is increasing its AI layout.

Although Tencent's capital expenditure on the R & D side far exceeds market expectations, its attitude towards capital expenditure is still mainly demand - driven and will respond dynamically according to market changes. It can be seen that strong demand still drives Tencent to significantly increase its capital expenditure. Considering that Tencent's attitude towards capital expenditure is not radical, it is expected that Tencent's capital expenditure will still maintain a balanced state with downstream demand, revenues and other aspects in the future.

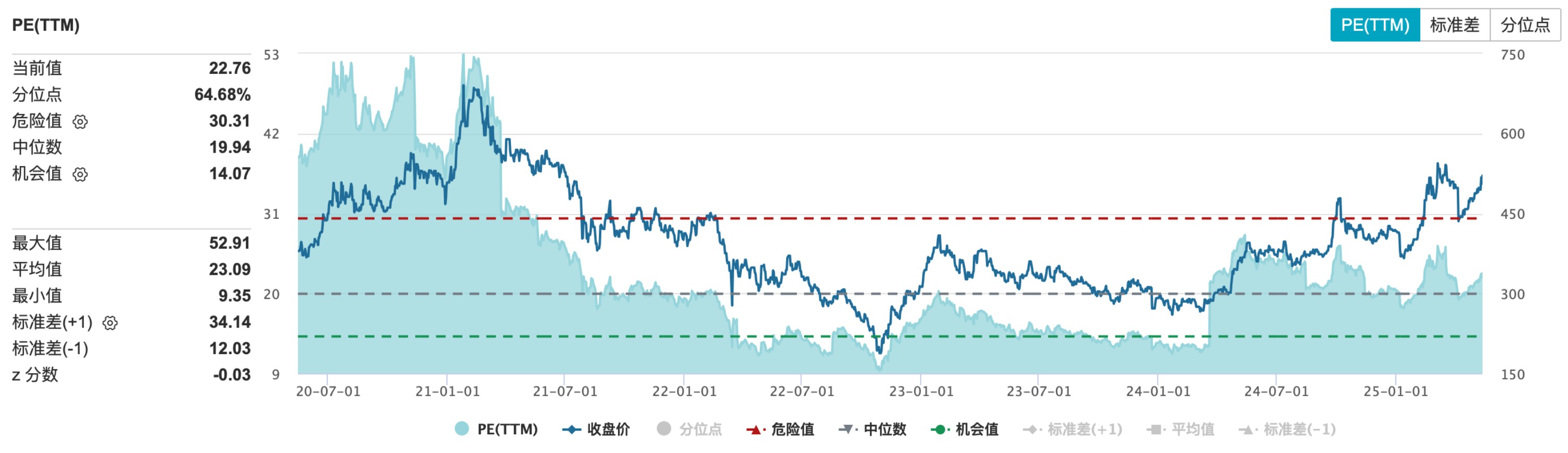

In terms of valuation, Tencent's stock price has doubled compared with the low point at the beginning of 2024. As of May 14th, the PE - TTM of Tencent's Hong Kong stocks is about 23x, at the 65th percentile in the past five years. After a round of valuation repair, although there is still much room for the stock price to rise compared with the previous high, considering the valuation percentile, investors need to pay attention to the current safety margin. Whether Tencent can open up upward valuation space in the future mainly depends on the endogenous growth ability shown after the AI - based transformation of its core businesses, which is also the long - term investment value of Tencent.

Chart: Tencent's PE - TTM percentile; Source: Wind, compiled by 36Kr

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. Under no circumstances do the information in this article or the opinions expressed constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make careful decisions. We have no intention to provide underwriting services or any services that require specific qualifications or licenses for all parties in the transaction.