ZhiKe | JD.com's Core Business Growth Exceeds Expectations, and the Outcome of Its Food Delivery Business Will Be Clear in Q2

Author | Fan Liang

Editor | Zheng Huaizhou

After the Hong Kong stock market closed on May 13th, JD.com Group released its financial report for the first quarter of 2025.

Qualitatively speaking, JD.com's Q1 report far exceeded market expectations. In terms of data, JD.com achieved operating revenue of 301.08 billion yuan in Q1 2025, a year-on-year increase of 15.8%, while market expectations generally ranged from 11% to 12%. In addition, on the profit side, JD.com's operating profit in Q1 2025 was 10.53 billion yuan, a year-on-year increase of 36.4%. The non-GAAP operating profit was 11.66 billion yuan, a year-on-year increase of 31.5%, maintaining high year-on-year growth for multiple consecutive quarters.

In terms of operational data, JD.com's quarterly active users achieved double-digit growth this quarter. Meanwhile, both the shopping frequency and transaction volume of PLUS members also achieved double-digit growth.

Looking at the business segments, JD Retail (including JD Health and JD Industry) achieved operating revenue of 263.845 billion yuan in Q1 2025, a year-on-year increase of 16.3%; JD Logistics achieved operating revenue of 46.967 billion yuan, a year-on-year increase of 11.5%; New businesses (including Dada, JD Property Development, Jingxi, and overseas businesses) achieved operating revenue of 5.753 billion yuan, a year-on-year increase of 18.1%.

Since JD.com officially launched its food delivery service in February, the capital market has been particularly looking forward to JD.com's financial report. So, how did JD.com perform in this quarter's financial report? And what's the progress of its food delivery service?

Expansion of the Core Business Advantage

In 2025, the national subsidies for mobile phones and household appliances were fully rolled out. According to statistics from the National Bureau of Statistics, in the first quarter of 2025, the retail sales of household appliances and audio-visual equipment increased by 19.3% year-on-year, and the retail sales of communication equipment increased by 26.9% year-on-year. As JD.com's core advantageous category, 3C and household appliances naturally benefited from this round of national subsidies.

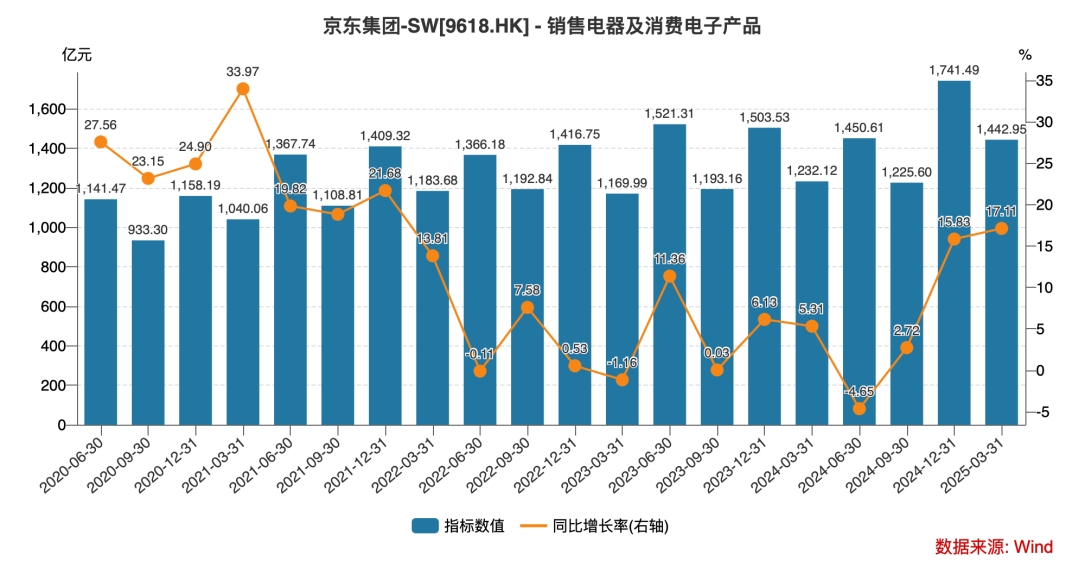

The financial report revealed that in the first quarter of 2025, JD.com's 3C and household appliances achieved operating revenue of 144.295 billion yuan, a year-on-year increase of 17.1%, reaching the highest year-on-year growth rate since 2022.

Chart: JD.com's 3C and household appliances revenue and year-on-year changes. Source: Wind, 36Kr compilation

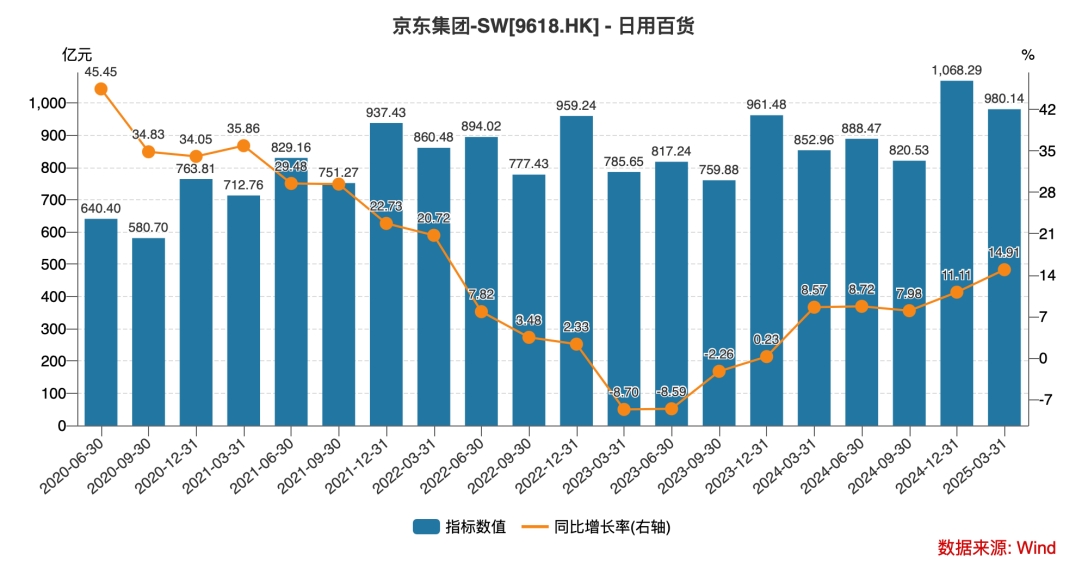

If the revenue growth of JD.com's 3C and household appliances was catalyzed by national subsidies, the growth of daily necessities revenue better reflects the internal driving force of JD.com's performance growth. In the first quarter of 2025, JD.com's operating revenue from daily necessities was 98.014 billion yuan, a year-on-year increase of 14.9%. In terms of trends, in 2023, affected by the high base and the recovery of the offline economy, the revenue growth rate of JD.com's daily necessities once hit rock bottom. However, with continuous improvement in subsequent quarters, it has now stabilized on an upward trend.

According to JD.com's earnings conference call, in the daily necessities category, the revenue of the supermarket category has achieved double-digit growth for five consecutive quarters, with both revenue and the number of users showing a steady growth trend. It is expected that the growth momentum of the supermarket category will continue throughout 2025. In addition, the fashion category also achieved double-digit year-on-year growth, and the growth accelerated quarter-on-quarter.

Statistics from the National Bureau of Statistics show that in the first quarter of 2025, the online retail sales of physical goods increased by 5.7% year-on-year. Whether it's the revenue from 3C and household appliances or daily necessities, JD.com significantly outperformed the industry average.

Chart: JD.com's daily necessities revenue and year-on-year changes. Source: Wind, 36Kr compilation

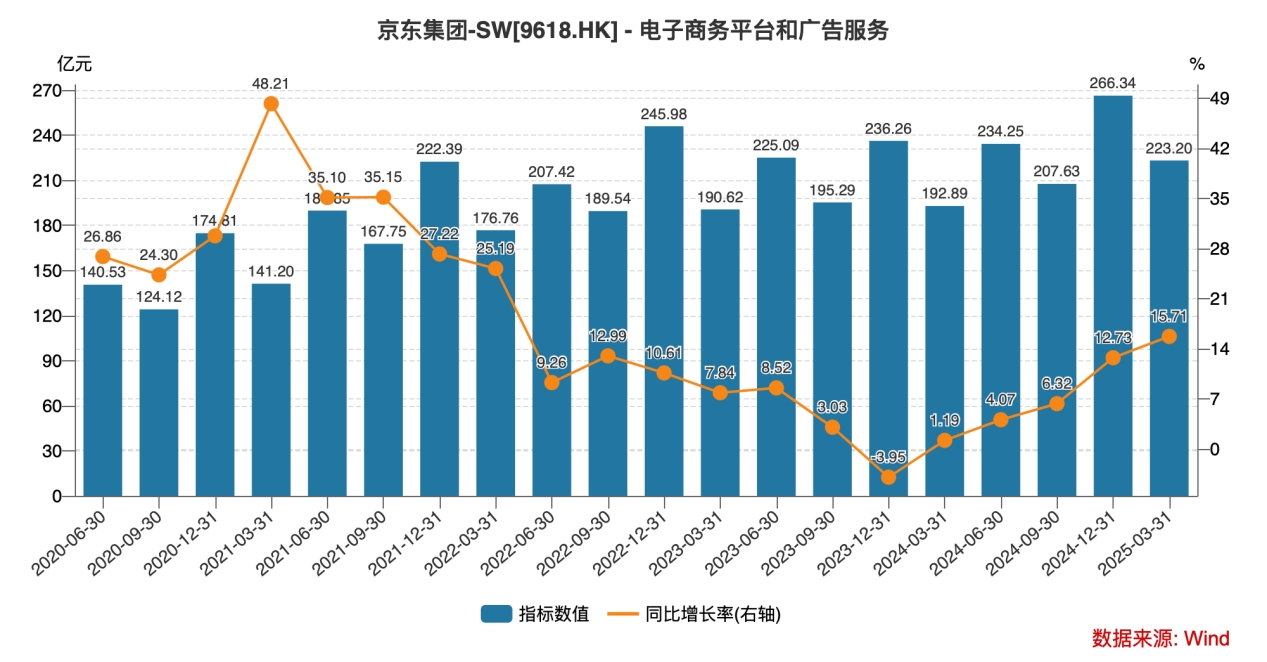

In addition, JD.com's 3P business has also started to contribute to the performance growth. After JD.com announced its focus on the 3P business in 2023, the core observation indicators mainly based on the revenue from the e-commerce platform and advertising services did not show obvious changes. However, since 2024, the revenue growth rate of this business has been increasing quarter by quarter. In Q1 2025, the revenue reached 22.32 billion yuan, a year-on-year increase of 15.71%.

Chart: JD.com's e-commerce platform and advertising revenue and year-on-year changes. Source: Wind, 36Kr compilation

Looking at the profit performance, in this quarter, JD.com's profit growth rate was significantly better than the revenue growth rate. The most direct reason is that the gross profit margin increased by 0.6 percentage points year-on-year to 15.89%, driving the operating profit margin to rise from 3% in Q1 2024 to 3.5% in Q1 2025, which directly brought an additional profit of nearly 2 billion yuan to JD.com.

Overall, the revenue and profit of JD Retail, JD.com's core business segment, have both achieved better-than-expected growth. The company's overall performance has entered an upward trajectory, which is the foundation for JD.com to dare to focus on the food delivery service.

The Impact of the Food Delivery Service on the Financial Report Will Appear in the Second Quarter

After the release of this financial report, the market's attention has basically focused on the food delivery service. From a time perspective, although JD.com officially launched its food delivery service on February 11th, it takes a certain amount of time for the order volume to increase. Therefore, the food delivery service did not have an obvious impact on JD.com's Q1 report. Currently, JD.com has not yet clearly defined the revenue disclosure scope for the food delivery service.

Considering that JD.com launched multiple subsidies for consumers after launching the food delivery service, these subsidies are generally included in the sales expenses. Therefore, starting from Q2 2025, JD.com's sales expense ratio is likely to increase. In the first quarter of 2025, JD.com's sales expense ratio was 3.5%, slightly lower than that in the first quarter of 2024. Therefore, investors cannot directly find information related to the food delivery service from this quarter's financial statements.

At the earnings conference, JD.com elaborated on the progress of the food delivery service in more detail. Specifically, the main points are as follows:

First, the daily order volume of the food delivery service is about to exceed 20 million orders. For comparison, Meituan exceeded 20 million daily food delivery orders in May 2018. Currently, its average daily food delivery order volume is in the range of 50-60 million, and Ele.me's average daily order volume is in the range of 20-30 million.

Second, compared with the ROI (return on investment) of the business scale and investment, at this stage, JD.com pays more attention to the experiences of users and merchants. The reason is not difficult to understand. The development of the food delivery and instant retail business requires the continuous enrichment of the ecosystem on both the supply and demand sides. As a new entrant in the industry, JD.com's primary goal is to consolidate and develop the business ecosystem. Of course, from a financial perspective, this will have an impact on JD.com's profits, but such investment is necessary and inevitable.

Third, it emphasizes the synergistic value between the food delivery service, instant retail, e-commerce retail business, and logistics business. JD.com further pointed out at the earnings conference that it has gradually seen the driving effect of the food delivery service on the traffic and new users of the entire JD.com platform, and it has also improved the overall traffic conversion rate. At the same time, it has initially observed the cross-category purchasing behavior of food delivery users, focusing on categories such as supermarkets and life services.

Generally speaking, JD.com's food delivery service is currently progressing rapidly. It currently focuses more on building the ecosystem of users, merchants, and riders. As the order volume of JD.com's food delivery service continues to grow in the second quarter, it is expected that the food delivery service will have an impact on JD.com's financial data. Therefore, the Q2 2025 financial report will be a better observation window.

Summary and Outlook

After JD.com announced its focus on the food delivery service, the capital market was mainly worried that this business would affect JD.com's performance growth rhythm. Therefore, after JD.com's stock price in early April significantly pulled back following the Hang Seng Tech Index, the rebound was not obvious.

However, JD.com's Q1 report has dispelled the market's concerns to some extent. The performance of JD.com's self-operated 3C and household appliances, daily necessities, and 3P business has all achieved better-than-expected growth, providing solid support for JD.com to withstand the impact of the food delivery service on profits. Looking at the future performance trend, as the impact of the food delivery service on the financial statements deepens comprehensively in Q2 2025, it is expected that the company's future sales expenses will increase significantly year-on-year and have a certain impact on profits. The subsequent financial reports should mainly focus on the extent of this impact.

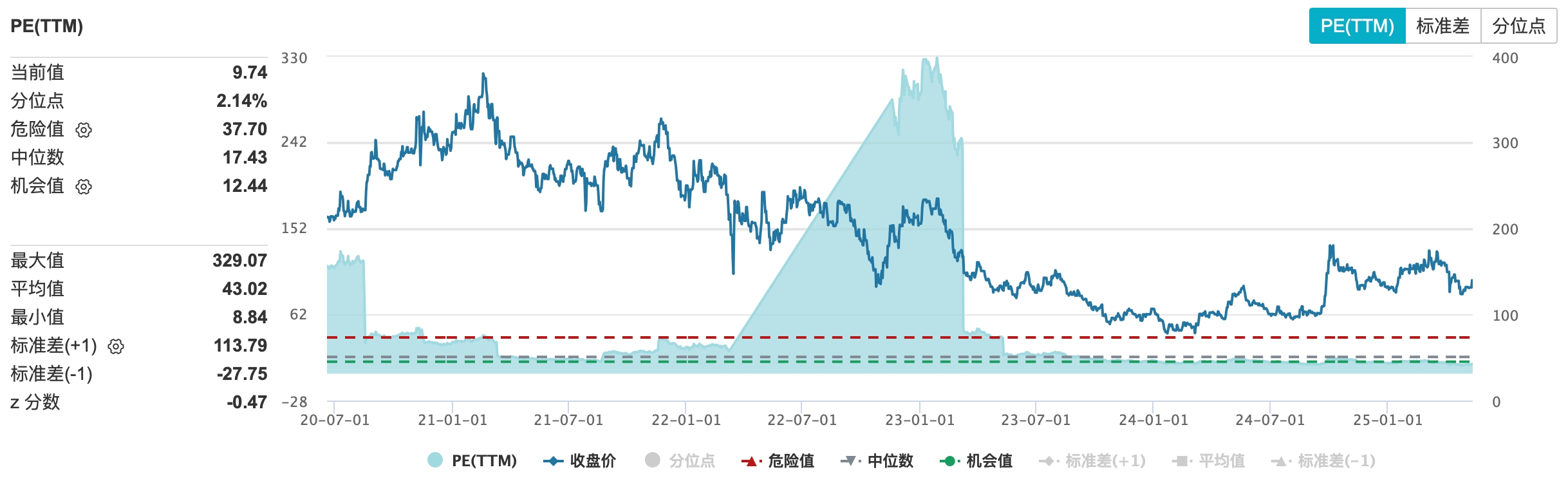

In terms of stock price performance, after the release of JD.com's Q1 2025 financial report, its US stocks rose by more than 3%, and its Hong Kong stocks rose by nearly 3%, indicating the capital market's recognition of JD.com's performance. In terms of valuation, JD.com's current PE-TTM is less than 10 times, far lower than the average price-earnings ratio of 20 times of the Hang Seng Tech Index. Even considering the potential impact of the future food delivery service on the company's profits, with the support of the performance growth of JD.com's core self-operated business, it is difficult for the company's profit level to decline significantly. Therefore, JD.com, with its current low valuation, remains a high-quality investment target in the Hong Kong stock market.

Chart: JD.com's valuation. Source: Wind, 36Kr compilation

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention of providing underwriting services or any services that require specific qualifications or licenses for the trading parties.