Is there a major turning point ahead for the China-US tariff war? Small and medium-sized suppliers are still waiting and seeing | Krypton·Big Consumption

Author | Xie Yunzi

Editor | Zheng Huaizhou

The trade friction between China and the United States over "reciprocal tariffs" may be turning a corner.

According to Xinhua News Agency, the leading officials of the economic and trade teams of China and the United States will hold talks in Switzerland from May 9th to 12th. At a regular press conference of the Ministry of Foreign Affairs on May 7th, spokesperson Lin Jian further stated that the talks were held at the request of the US side. China's firm opposition to the US abuse of tariffs remains unchanged.

For many small and medium-sized exporters, the upcoming talks in Switzerland may bring a turning point to this tariff friction that has lasted for more than a month.

Behind the shift from crazy tariff hikes to a change of course is the game between the Chinese and US governments, as well as many large technology companies and retail enterprises.

On April 29th, US media reported that e-commerce giant Amazon was planning to mark "tariff costs" on product prices. The White House immediately reacted strongly, calling this practice a "hostile act."

Almost simultaneously, the attitude of global retail giant Walmart also changed. The South China Morning Post reported that some manufacturers in Jiangsu and Zhejiang provinces had received notices from major US retailers such as Walmart, asking them to resume shipments recently. An exporter said, "The cost of the new import tariffs will be borne by US customers."

Compared with giant enterprises, small and medium-sized trading companies with little "say" have always been in a passive position. Under the temporary calm, most small and medium-sized business owners are also in a wait-and-see state.

"It has been implemented according to the 145% standard."

In 2019, Zhang Li followed a group of leading domestic e-commerce enterprises to set up overseas warehouses and expanded his business to North America.

In the following years, the development of China's cross-border e-commerce industry became more and more concentrated, and the self-built warehouse businesses of various platforms in North America also continued to shrink. Zhang Li then shifted his business offline, supplying small household appliances, pet products and other products to large supermarkets such as Best Buy, Walmart and Costco, and selling beauty products from Canada and the United States to China.

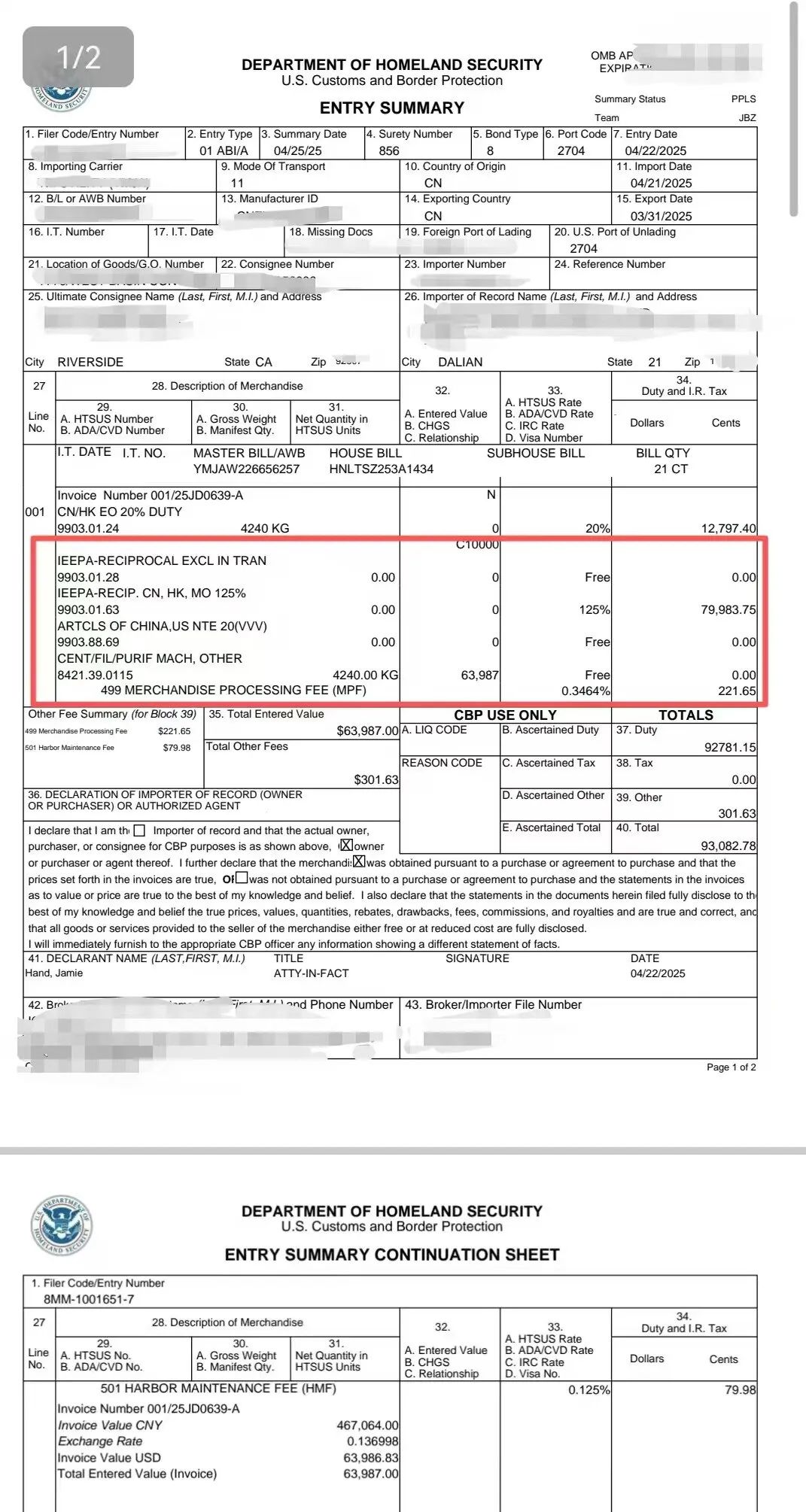

On April 22nd, a batch of air purifiers from Zhang Lin arrived at the Port of Long Beach in California. "During Trump's previous term, epidemic prevention materials such as air purifiers were exempt from tariffs. After the Biden administration took office, this policy was continued."

Since this batch of goods was shipped from Hong Kong before the tariff was imposed, it was originally supposed to be subject to a 145% tariff policy, but after "haggling", it was reduced to 20%. According to Zhang Li, starting from this batch of goods, goods that left the port after the tariff policy was announced have been implemented according to the 145% standard.

Based on his experience, Zhang Li told 36Kr that the trade friction between China and the United States has always existed. Even if the US government does not raise tariffs, it will introduce measures such as sales bans, embargoes, extended ship berthing periods and increased random inspections.

In fact, the Trump administration did exactly that.

On May 2nd local time, the United States cancelled the "T86 duty-free channel" for small-value goods from the Chinese mainland and Hong Kong, that is, cancelled the tariff exemption treatment for small parcels worth no more than $800. To a certain extent, this has plunged cross-border platforms such as Temu, Shein and TikTok, which are mainly targeted at the US market, into a wave of price increases.

"The T86 tariff system itself is imperfect. Many cigarettes and alcoholic beverages are falsely reported through small parcels." Therefore, Zhang Li's company uses a more traditional "trade customs clearance" method, forwarding the goods after they are transported to the United States, which is also more in line with the traditional retail format in the United States.

However, Zhang Li's export business was still hit. After the Trump administration announced the tariff increase, it gave enterprises a certain "exemption period", and goods that left the port within a certain period could still be exempt from tariffs. Because the T86 policy was about to be cancelled, more exporters hoped that their goods could arrive at the port before May 2nd.

This led to a short-term surge in freight volume, and the freight rates of cargo ships also skyrocketed.

"Previously, the price of each standard container might be around $6,000, but now it has risen to $12,000 to $15,000." Zhang Li observed that many daily necessities with low profit margins were affected.

The picture is provided by the interviewee.

Waiting and seeing with US retailers: "We're helpless."

In Zhang Li's perception, in recent years, American consumers' perception of Chinese products, especially electronic products, has shifted from the "three low products" of low-end, low-quality and low-price to the stage of brand recognition and trust in quality.

"Xiaomi has achieved a miracle in the West. We represent several of the most expensive products of Zhimi, and the product design itself is very in line with the style of Costco." With Xiaomi's success in the US market, Zhang Li's main competitor in offline retail supermarkets has become the British high-end brand Dyson.

"But our data is better than Dyson's. Judging from the offline business situation, the annual sales of one category of our Xiaomi products, such as air purifiers and electric toothbrushes, can reach $4 million."

In North America, each retailer has its own "operation algorithm". Among them, Costco uses a buyer system and takes a fixed commission from the purchaser, while Best Buy is deeply tied to the supplier.

"For example, if the front-end sales price of the supplier reaches $300, Costco only takes 18%, and all discounts and promotions are provided by the supplier. Best Buy takes a 50% commission, but participates in all pricing and promotion links."

Facing North American retailers, Xiaomi still follows the product logic of "small profits but quick turnover". If the US tariff amount continues to increase, suppliers can only reduce the discount rate and withdraw from some retail platforms.

"Household appliances have a long stocking period. For products like air purifiers and humidifiers, retail supermarkets may place orders 15 or 16 months in advance. If we adjust the discount rate, our inventory in North America can last for 6 to 8 months and we can survive the Christmas season." Currently, Zhang Li is relying on inventory and adjusting promotional discounts to get through the difficulties.

However, there is a limit to "giving up profits". If the tariff figure is as high as 145%, all algorithms and balances will fail. As Zhang Li said, this is no longer a mathematical problem. When the tariff is too high, any demand will return to "0".

Zhang Li judged that large retail supermarkets represented by Costco and Walmart also hold the same wait-and-see attitude as the suppliers. For these large supermarkets, rashly raising prices at the retail end will involve adjustments in the entire supply chain, including finance, taxation and other aspects. If after a series of adjustments, China and the United States reconcile and cancel the tariffs, it will also be very troublesome.

"So in the observation of many American consumers, the prices of offline retail products have not increased significantly. American local enterprises can't say they fully understand Trump's policies. Many of his instructions are chaotic. Apart from waiting and seeing, we're helpless."

Is "switching from export to domestic sales" a good way out?

If small household appliances with a long stocking period and a certain amount of inventory still have hope of seeing the dawn, suppliers of some daily necessities and clothing categories with a short stocking period and small profit margins have to find other ways out.

After nearly a month of coordination, the bathroom supplies produced by Lao Zhang were put on the shelves at the Wumart supermarket on Xueqing Road in Beijing. During the same period, more than a thousand foreign trade products were launched in the "Foreign Trade Premium Zone" of Wumart Cloud Supermarket.

In the United States, Lao Zhang also supplies goods to Costco. "Most of these small commodities we produce are sold for a few dollars in the United States. If the future tariff increase ranges from 20% to 30%, we can only raise the prices at the retail end, which the American people won't accept."

His view is that the US light industry is not well-developed, and excessive tariffs will damage the interests of ordinary American people.

The shelves of "Foreign Trade Premium Products" at Wumart supermarket. The picture is from 36Kr.

According to a report by Yicai, the US economic research firm NDR said in a study that the growth of the US real disposable personal income has slowed down in the past year. Consumer confidence has declined, and the index in April reached the lowest level in nearly five years. All these factors indicate that the US consumer demand will slow down this year, rather than strengthen.

While the "reciprocal tariff" friction between China and the United States is intensifying, many domestic retail enterprises such as Yonghui, Hema, Wumart and JD.com have extended olive branches to export traders.

Data previously released by Yonghui showed that since the "green channel" was opened on April 7th, it has entered into negotiation stages with more than 300 enterprises. According to 36Kr, as of now, Yonghui has continuously introduced new foreign trade products in some stores in Fujian, Zhejiang, Beijing, Shanghai and other places.

In Lao Zhang's view, the daily necessities he originally exported to the United States can also develop well in the domestic mid - to high - end market. However, for suppliers like Zhang Li who produce customized products, the possibility of switching from export to domestic sales is very small.

"The voltage, wire length and consumers' preferences for product colors are different between China and the United States. These involve only small - cost expenditures, and the mold - opening cost of our production line is as high as 2 million yuan."

Yang Chang, the chief analyst of the policy group at the Zhongtai Securities Research Institute, also believes that switching from export to domestic sales requires stable support from domestic demand. Judging from the current data of industrial enterprises, accounts receivable and product inventories are still at a certain scale, which need to be specifically addressed to expand the space for enterprises to switch from export to domestic sales.

Yang Chang told 36Kr that as of the end of April, both the China Export Container Freight Index and the Shanghai Export Containerized Freight Index had small fluctuations. Considering the large base last year, it means that the short - term export pressure has increased. The Ningbo Export Container Freight Index and the container freight indices of 10 shipping companies are differentiated between the East Coast and the West Coast of the United States, and the short - term directivity is not clear.

After the United States raised tariffs on China at the beginning of April, Zhang Li visited many places in the Middle East, Europe and other regions, hoping to find export markets that can partially replace the United States. The more than ten domestic brands he was originally negotiating with are still on hold. The sales manager may leave directly, and the initial quotes are also difficult to maintain.

"Now people's attitudes towards tariffs are mainly divided into two camps. Many people are optimistic, believing that Trump will eventually relent and things will return to normal. I'm more conservative, thinking that US tariffs will become a periodic event, although it has always been the case before. I'm even pessimistic enough to think that during Trump's term, globalization may be different from what we used to know, and we need to be prepared for hard work to deal with the continuous arrival of black - swan events." Zhang Li told 36Kr.

(Zhang Li and Lao Zhang in the article are aliases.)

Follow to get more information.

This article is from the WeChat official account "36Kr Finance". Author: Xie Yunzi, Zheng Huaizhou. Republished by 36Kr with permission.