The profit of Roborock is twice that of Ecovacs. The battle of floor-cleaning robots is spreading overseas | Focus Analysis

Author | Huang Nan

Editor | Yuan Silai

The battlefront of floor-cleaning robots remains intense.

Recently, Ecovacs released its performance reports for 2024 and the first quarter of 2025. In 2024, Ecovacs achieved double growth in revenue and profit. However, while its revenue reached a new high, the company faced pressure on profitability. This is similar to Roborock, which previously released its financial report. Roborock's revenue increased significantly, but its profit declined slightly.

According to the financial report data, Ecovacs' full-year revenue in 2024 reached 16.542 billion yuan, a year-on-year increase of 6.71%, setting a new historical high. The net profit attributable to shareholders of the listed company was 806 million yuan, a year-on-year increase of 31.70%. In the first quarter of 2025, Ecovacs' revenue was 3.858 billion yuan, a year-on-year increase of 11.06%. The net profit attributable to the parent company was 475 million yuan, a year-on-year increase of 59.43%.

In contrast, in 2022 and 2023, Ecovacs' net profit declined for two consecutive years, and in 2023, it dropped by 60%. Obviously, Ecovacs achieved a certain rebound in performance last year.

However, Ecovacs' net profit level has not yet returned to its historical high. In 2021, Ecovacs' revenue was 13.09 billion yuan, the net profit attributable to the parent company was 2.01 billion yuan, and the net profit margin was as high as 15.39%. In 2024, Ecovacs' revenue increased by more than 3 billion yuan compared with 2021, but its net profit was less than half of that in 2021, and the net profit margin was only one-third of that in 2021.

Chart by Hard Krypton, data from official sources

In contrast, Roborock's total revenue in 2024 was 11.945 billion yuan, a significant year-on-year increase of 38.03%. The net profit attributable to the parent company decreased by 3.64%. Although the profit decreased slightly, the overall net profit was still twice that of Ecovacs. In the first quarter of 2025, Roborock's revenue reached 3.428 billion yuan, a year-on-year increase of 86.22%. The net profit attributable to shareholders of the listed company was 267 million yuan, a year-on-year decrease of 32.92%.

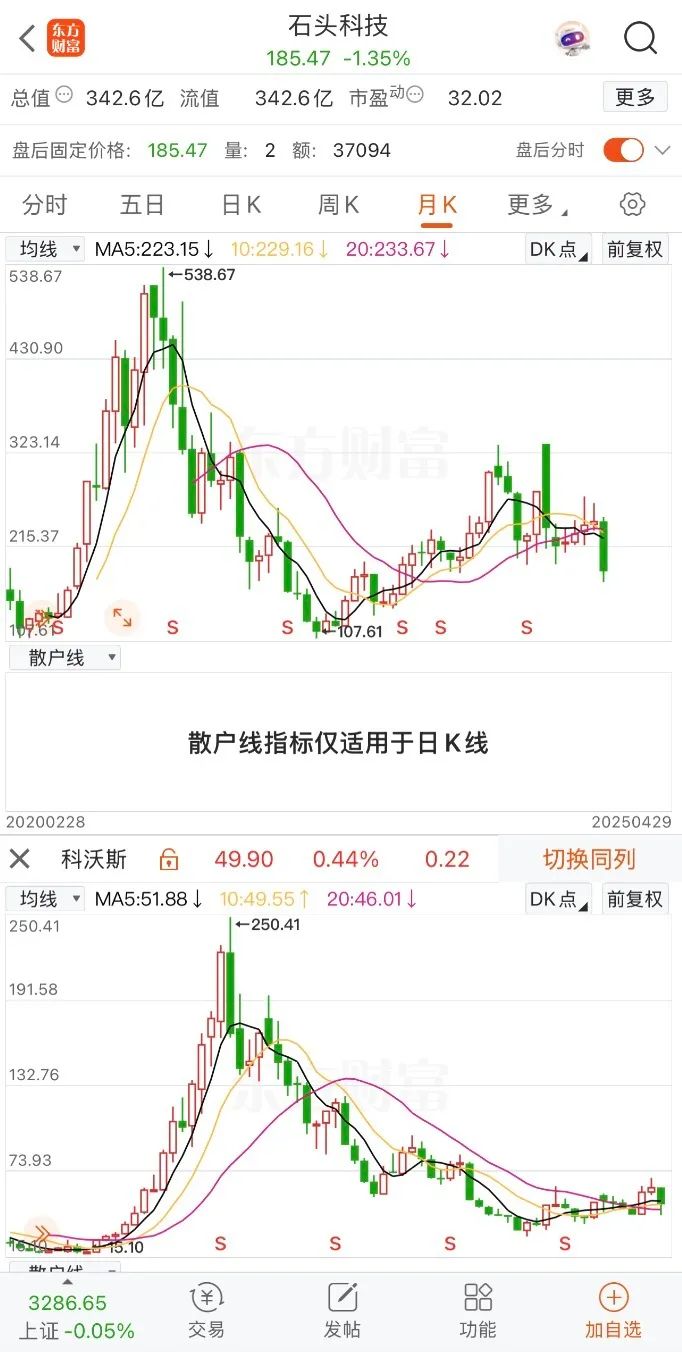

Above: Roborock's stock price chart from 2020 - 2025; Below: Ecovacs' stock price chart from 2019 - 2025

In terms of sales performance, Roborock has overtaken its competitors. According to the latest report from IDC, in 2024, Roborock's shipments reached 3.2965 million units, surpassing iRobot and Ecovacs, which had long held the top positions in shipments, for the first time.

In the past two years, floor-cleaning robots have quickly fallen into the dual dilemmas of market weakness and homogeneous competition from the peak of the trend. The overseas market is regarded as the key to breaking the situation. Although Roborock's profitability is currently better than that of Ecovacs, with the expansion of the overseas market, both giants have entered a bottleneck period where revenue increases but profit does not. This also means that the competition in the overseas market has truly become white-hot.

Overseas Battles

In the competition in the overseas market, as the most experienced company in the CR4 (the concentration ratio index of the top four companies in the industry) and the first to engage in overseas business, Ecovacs' overseas operating revenue in 2024 was 7.112 billion yuan. Its data in the European market was quite impressive. The revenues of the Ecovacs and Tineco brands increased significantly by 51.6% and 64.0% year-on-year respectively.

Ecovacs Deebot Mini (Source: Company)

In the past, relying on its first-mover advantage, Ecovacs built a wide distribution network in the domestic market, including a large-scale distribution system and many self-operated experience stores. Its sales terminals have been embedded in the core business districts and home appliance stores of major cities. This mature channel operation model has also been applied by Ecovacs to its overseas business.

Different from the general distributor sales strategy of its competitors, Ecovacs established its European headquarters in Germany in 2012 and formed a direct operation team. It conducts localized brand operations through local employees, strengthens its offline layout through high-end transformation to accelerate product promotion and penetration. Currently, the size of its European team is close to 50 people.

At the same time, in specific categories, Ecovacs' overseas business also shows a growth trend. The overseas revenue of its window-cleaning robots increased by 214.8%, and the overseas revenue of its lawn mowing robots almost tripled.

Ecovacs' booth at CES 2025 (Source: Company)

Roborock's overseas offensive is also fierce. In 2024, 53.48% of Roborock's revenue came from overseas.

Previously, Roborock mainly sold its products online. Through its independent website and cooperation with mainstream online platforms such as Amazon, it quickly established brand awareness in the US market.

Judging from last year's data, its offline market is also advancing steadily. Roborock has established an overseas subsidiary in the United States and built an independent after-sales service system. So far, its products have entered more than 1,400 offline stores around the world, including international retail giants such as BestBuy, Walmart, and Sam's Club.

Roborock's booth at AWE 2025 (Source: Company)

It can be seen that their performance reflects a common dilemma. Ecovacs' revenue reached a new high, but it faced pressure on profitability. With the acceleration of its overseas business expansion, the costs of logistics, transportation, warehousing, and localized operations increased significantly. At the same time, the resources invested in the technological R & D and market promotion of new product categories such as window-cleaning robots and lawn mowing robots also led to an increase in costs, forcing the company to strike a difficult balance between price and profit.

Roborock's revenue increased, but its profit did not. On the one hand, the sales, R & D, and management expenses increased significantly, among which the R & D expenses increased by 42.87% year-on-year. The pressure on the cost side eroded the profit margin. On the other hand, the price war in the industry was fierce. Under the influence of the "price-for-volume" strategy, the average price of some products may have declined, and the gross profit margin decreased. In addition, the adjustment of the overseas business model also pulled down the overall net profit margin.

Searching for Multiple Growth Curves

Floor-cleaning robots have long entered the stage of performance surplus. Floor-cleaning robot manufacturers can only strive in seemingly unimportant directions.

For example, the most popular trend at present is floor-cleaning robots equipped with robotic arms. Roborock launched a new product, the G30 Space, at CES 2025. This floor-cleaning robot is equipped with a five-axis folding bionic manipulator, which can organize and intelligently store items on the ground, extending two-dimensional planar cleaning to three-dimensional space.

Roborock G30 Space Exploration Edition (Source: Company)

Of course, there is still intense discussion in the industry about the solution of adding "hands" to floor-cleaning robots. Companies such as Ecovacs and Yunjing have not yet launched relevant products.

On the one hand, the structure of the robotic arm is complex, which easily leads to an increase in product failure rate and maintenance cost. Moreover, the robotic arm has high requirements for the thickness and space of the robot body, making it difficult to adapt to narrow areas such as the bottom of low furniture. At the same time, the robotic arm is prone to problems such as collisions and jams during the cleaning process. It can be said that the current robotic arm is, at best, a minor innovation squeezed out by manufacturers out of desperation.

In the stage of stock competition, in the final analysis, Ecovacs and Roborock cannot rely on floor-cleaning robots for growth.

At present, there are obvious differences in the product category expansion paths of Ecovacs and Roborock. Ecovacs continues the core logic of "robot + cleaning" and extends to product categories such as window-cleaning robots and lawn mowing robots. These cleaning devices have underlying commonalities with floor-cleaning robots, and the technology can be quickly transferred. The Tineco brand has also deployed household appliances such as cooking machines and water purification and heating all-in-one machines.

Tineco Smart Family Series (Source: Company)

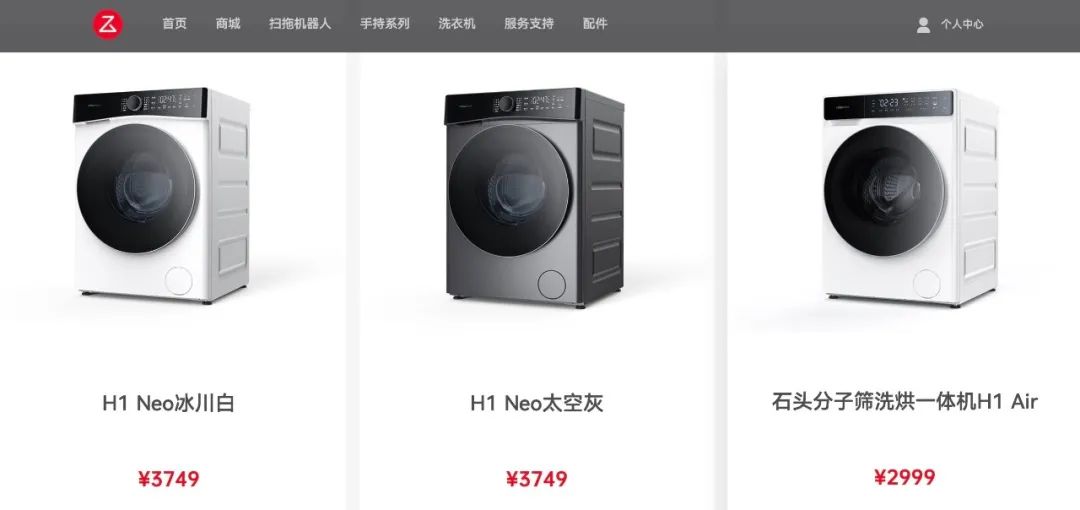

Roborock has entered the washing machine market. Since it launched its first washer-dryer all-in-one machine in 2024, Roborock also successively launched a molecular sieve washer-dryer all-in-one machine and a mini washer-dryer all-in-one machine at the beginning of this year, with an average customer price of about 2,000 - 3,000 yuan. This route is exactly the same as that of its former friend, Xiaomi.

Moreover, according to official information, Roborock has formed a special overseas market management team to be responsible for the overseas marketing of its washing machine business. In the future, it will also cover sub - categories such as washer-dryer sets, washing machines, and mini washing machines.

Roborock's washing machine series products (Source: Company)

However, neither Ecovacs nor Roborock has achieved very impressive results in the large home appliance market for the time being. Fortunately, there is still a large blank in the overseas market, and these Chinese companies have enough room for trial and error.

It should be noted that affected by the US reciprocal tariff policy, uncertainties continue to impact the global hard technology industry, directly pushing up the export costs of enterprises and squeezing profit margins. At the same time, the increase in terminal retail prices will also weaken the price competitiveness of Chinese products in the local market.

Currently, some enterprises are actively responding by optimizing the supply chain and adjusting market strategies. For example, Ecovacs is accelerating the layout of overseas localized production, and Roborock is strengthening cooperation with local distributors to share costs. However, in the long run, tariff barriers remain the core problem in their globalization process. If this problem cannot be properly solved, it will not only affect the continuous expansion of enterprises' overseas market share but may also force them to re - evaluate the global supply chain system and change their strategic layout, thus bringing further challenges to their international development.