Top 15 household appliance brands in February. AI initiates the active service ecosystem for household appliances.

Image source: Shiyan Big Consumption Index

During the current monitoring period, home appliance brands Haier, Xiaomi, and Midea ranked in the top three of the list with comprehensive popularity indexes of 1.85, 1.84, and 1.79 respectively, leaving a gap with other brands behind.

AI Launches the Active Service Ecosystem of Home Appliance Brands, Realizing the Transition from "Controlling Devices" to "Being Understood by Devices"

In terms of brand distribution, traditional leading home appliance brands continue to rank high on the list, while ecological brands such as Xiaomi and Huawei are also not far behind. Haier ranks first with a comprehensive index of 1.85, which is closely related to its in - depth layout in the AI active service ecosystem. In February, Haier launched several new AI air - conditioner models at the Health Air - conditioner Festival and announced that Haier Smart Home would connect to the DeepSeek large - model, achieving in - depth integration of smart home and AI. TCL achieved the first place in sales popularity with multiple products such as AI refrigerators, air - conditioners, and companion robots, and officially became an Olympic Global Partner in February. Xiaomi and Huawei are good at AIoT ecosystem integration. Xiaomi relies on its AI hub to seamlessly connect home appliances with terminals such as mobile phones and cars; Huawei launched a new - generation smart home solution with the distributed capabilities of the HarmonyOS, breaking down ecological barriers. These brands all reflect the in - depth penetration of AI technology in the home appliance field. Users' demand for intelligence has exceeded the basic networking function, and they are pursuing "seamless interaction" and "scenario - based active services", which essentially aims to meet users' demands for "convenience and effort - saving". Leading brands consolidate their advantages through an open ecosystem and cross - terminal collaboration. International brands such as Samsung and Siemens seize the market through localized AI R & D, while emerging brands achieve overtaking on curves with technological breakthroughs in vertical fields. Future competition will focus on data closed - loop capabilities and the depth of user scenario penetration.

Technology and Aesthetic Equality Drive the Popularization of High - end Home Appliances, and Users Seek a Sense of Gain in Exquisite Life

From a segmented perspective, traditional high - price brands such as Dyson and Siemens have started to launch affordable product lines, while domestic brands such as Xiaomi and Little Swan are seizing the mid - to high - end market with the strategy of "luxury design + flagship performance", promoting the popular distribution of technological and aesthetic resources. Specifically, Dyson launched the "Asia - exclusive" V8 Slim Fluffy handheld vacuum cleaner in its home product series, with a starting price of 2999 yuan. While maintaining the iconic metallic texture and lightweight design, it reduces production costs through a modular structure, and its marketing focus has shifted from "a status symbol" to "a necessity for a refined life". Siemens launched the "Cross - star" series of refrigerators, which are in line with the design concept of the high - end line in terms of appearance materials, embedded design, and refrigeration technology, and the price has dropped to 5999 yuan. Brands like Xiaomi Home Appliances and Little Swan, which focus on cost - effective products, have set high - end development as the new goal for their large - home - appliance business by launching multiple high - end flagship products such as washing machines and air - conditioners.

From an industry perspective, the improvement of supply - chain maturity and the popularization of modular design have enabled the large - scale application of high - end materials and processes. The popularization of aesthetics driven by social media has forced brands to shift their design investment from "niche customization" to "mass resonance".

Explanation of the List

The Shiyan Consumption Compass Series Index Report is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List", "Industry Consumption Heat Index List", "Product Consumption Wave Index List", "Consumption Popular Event List", and extended list reports for corresponding scopes. It aims to objectively and truly present the trend characteristics of the consumption world through index evaluation, help the industry and brand owners continuously track consumption market trends, provide references for enterprise operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass Series Index List continuously monitors the following industries:

3C digital products, footwear, clothing and accessories, food and fresh produce, household appliances, sports and outdoor products, beauty and cleaning products, mother and baby products, home decoration, automobile consumption, toys, models and musical instruments, pet products, and medical and health products, a total of 12 major industries.

Image source: Shiyan Big Consumption Index

Disclaimer

This list is independently compiled by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision - making basis.

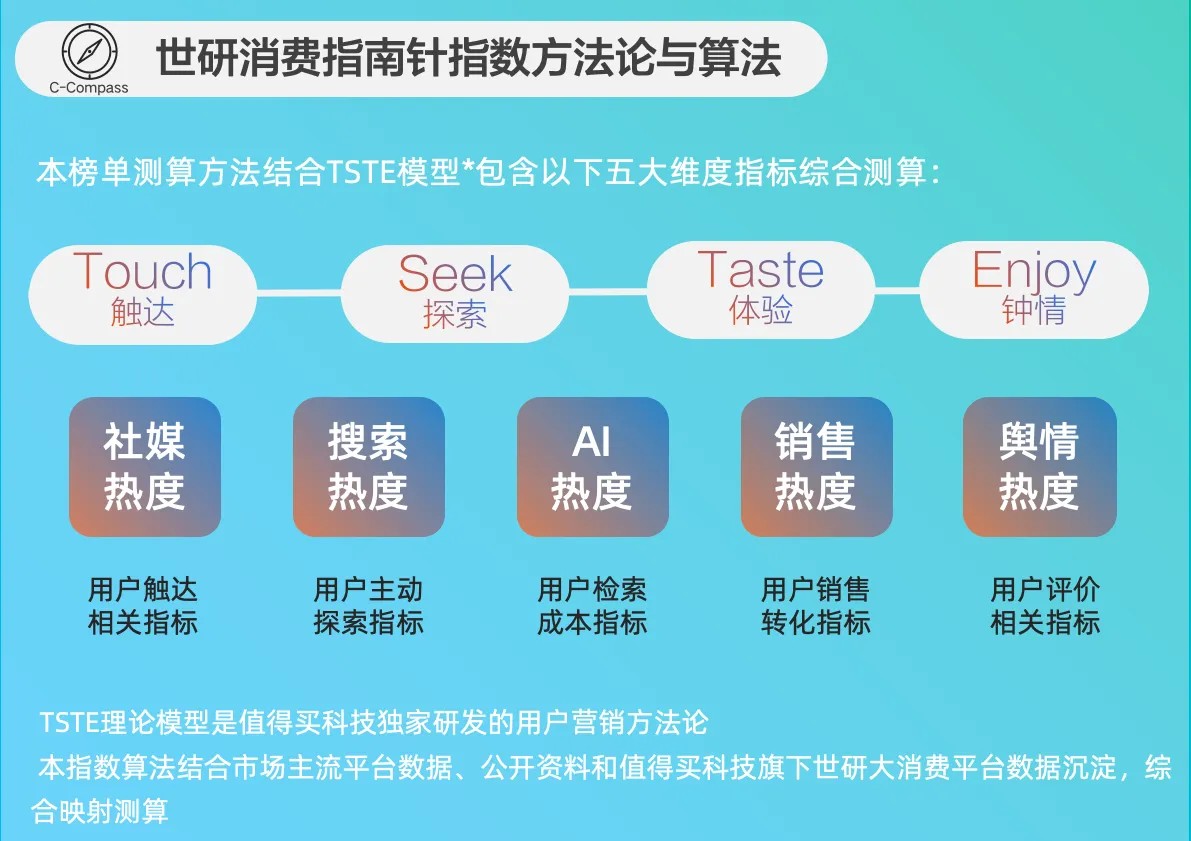

The calculation of the list data combines public data from mainstream platforms and data precipitation from the Shiyan Big Consumption Platform under the ownership of Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the provided data as much as possible, but we cannot rule out some errors or deviations due to the limitations of the data itself. In addition, some data in this report have not been formally audited by an independent third - party auditing institution, so there may be unidentified errors or omissions. It is particularly reminded that the market situation may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third - party names, brands, or products mentioned in the report are for illustration purposes only and do not constitute recognition or recommendation of them. Any mention of these third parties should not be regarded as an endorsement or recommendation in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index, and it shall not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not bear any legal liability for any losses or damages caused by the use of the information in this report.