Yuexiu Property: The sales target for 2025 is 120.5 billion yuan, and it plans to spend 30 billion yuan on land acquisition.

On March 31, Yuexiu Property announced its 2024 performance and held an earnings conference.

The annual report data shows that throughout 2024, Yuexiu Property achieved an operating income of approximately 86.4 billion yuan, a year-on-year increase of 7.7%. The gross profit margin was approximately 10.5%, a year-on-year decrease of 4.8 percentage points. The core net profit was approximately 1.59 billion yuan, a year-on-year decrease of 54.4%. The profit attributable to equity holders was approximately 1.04 billion yuan, a year-on-year decrease of 67.3%.

In 2024, Yuexiu Property's contract sales amount was approximately 114.54 billion yuan, a year-on-year decrease of 19.4%. However, its industry ranking rose.

According to CRIC statistics, Yuexiu Property entered the top 10 of the national real estate enterprise sales list for the first time in 2024, ranking 8th.

Lin Zhaoyuan, the Chairman and Executive Director of Yuexiu Property, said that the company has set a sales target of 120.5 billion yuan for 2025, a slight increase of 5.2% compared to last year. At the same time, it plans to allocate approximately 30 billion yuan in equity funds for land acquisition, basically the same as last year.

The scene of the earnings conference

Regarding the decline in net profit, Yuexiu Property's management explained that on the one hand, the company made asset impairments and depreciations of 4.39 billion yuan last year. On the other hand, the decline in profit margins is a common situation in the industry. It is hoped that with the promotion of policies and the bottoming out of the market, it will recover after this year.

For 2025, Yuexiu Property will focus on making precise investments in incremental projects, revitalizing existing assets, and spending based on income. It will maintain a certain intensity of investment and use lean management to eliminate ineffective costs. The core is to ensure stable performance, strengthen the management of operating cash flow, and optimize profit margins.

01

In the past two years, Yuexiu Property has continuously acquired land in core cities such as Beijing, Shanghai, and Guangzhou, becoming a strong competitor in the land market.

Judging from the annual report data, Yuexiu Property intends to focus deeply on first - and second - tier core cities. In 2024, Yuexiu Property acquired 24 plots of land in 8 cities, all located in first - and second - tier cities.

Among them, 3 plots were acquired in Beijing, with an additional land reserve of approximately 540,000 square meters; 5 plots were acquired in Shanghai, with an additional land reserve of approximately 300,000 square meters; 8 plots were acquired in Guangzhou, with an additional land reserve of approximately 1.1 million square meters. The proportion of new land reserves in first - tier cities exceeded 70%.

In the city - level proportion of sales, there is also a trend of gathering towards first - and second - tier cities. The annual report data shows that the contract sales from first - and second - tier cities accounted for as high as 99.3%, and first - tier cities contributed more than 50% of the sales performance.

At the earnings conference, Yuexiu Property's management said that in the future, on the one hand, it will continue to maintain the intensity of investment, allocating about 30% of the sales amount for land acquisition. On the other hand, in terms of city selection, it will focus more on the continuous in - depth development of core cities and core regions, with a focus on investing in the four first - tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen and key second - tier provincial capital cities.

Lin Zhaoyuan believes that with the continuous implementation of supportive policies, market confidence is gradually recovering. The market and the industry have relatively optimistic expectations for the value plasticity of good cities and good locations. The demand restricted by policies such as price limits will be released, and the price range of the market will be wider. In the future, the just - improved and improved demand will be the mainstream to be digested by the market, and the rigid demand will be mainly solved by the security end. In the market, good locations and good houses will still have a market.

Lin Zhaoyuan revealed that the company expects the market to bottom out this year. The passenger flow in Yuexiu Property's sales offices has increased significantly since the fourth quarter of last year. At this stage, the company has accelerated the pace and increased the intensity to reduce inventory, and established a special team to combine product, marketing, and cost for more efficient adaptation and implement a "one - project - one - strategy" pricing strategy. It hopes to improve performance in 2025 through strengthening investment ability, enhancing operating ability, improving product ability, and upgrading service ability.

In 2025, Yuexiu Property has arranged 235.4 billion yuan of salable goods, including 110.2 billion yuan of accumulated inventory and 125.2 billion yuan of new supplies.

02

In response to the market downturn, Yuexiu Property has made efforts in two aspects: seizing sales and collections and optimizing debt structure and costs.

In 2024, Yuexiu Property's contract sales collection rate rose to 87%, achieving a net inflow of operating cash flow of 21.73 billion yuan, a significant increase compared to 8.35 billion yuan in 2023.

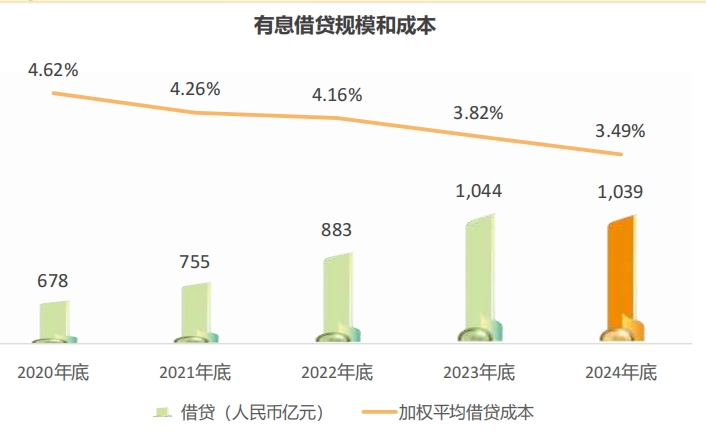

In terms of financing and debt, as of December 31, 2024, Yuexiu Property's total borrowing scale decreased slightly to approximately 103.89 billion yuan compared to the beginning of the year. The annual weighted average borrowing annual interest rate decreased by 33 basis points year - on - year to 3.49%.

The decrease in financing costs is mainly because Yuexiu Property had relatively smooth public market financing in 2024, including issuing 2.5 billion yuan of domestic bonds with an annual interest rate of 2.61%, obtaining 1.8 billion yuan of targeted debt financing with an annual interest rate of approximately 2.27%, and issuing more than 4 billion yuan of dim sum bonds in the overseas debt market.

The annual report data shows that as of the end of 2024, the total amount of Yuexiu Property's cash and cash equivalents, time deposits, monitored account deposits, time deposits, and other restricted deposits on hand was approximately 50.05 billion yuan, a year - on - year increase of 8.6%. The asset - liability ratio after excluding advance receipts, net borrowing ratio, and cash - to - short - term debt ratio were 68.1%, 51.7%, and 2.1 times respectively.

Data on the scale and cost of Yuexiu Property's interest - bearing liabilities

In addition, Yuexiu Property announced that it will not pay dividends at the end of the year.

The management explained that in the past nine years, the company has maintained a dividend payout ratio of approximately 40%. The interim dividend of HK$0.189 per ordinary share in 2024 has reached a dividend payout ratio of 44% corresponding to the annual net profit, so no dividend will be paid at the end of the period. In the future, it will continue to pay dividends at a ratio of 30% - 40%.