Li-Ning Launches "Offensive and Defensive Battle" after Selling 28.6 Billion in a Year | Krypton - Big Consumption

Li Ning continues to maintain stability.

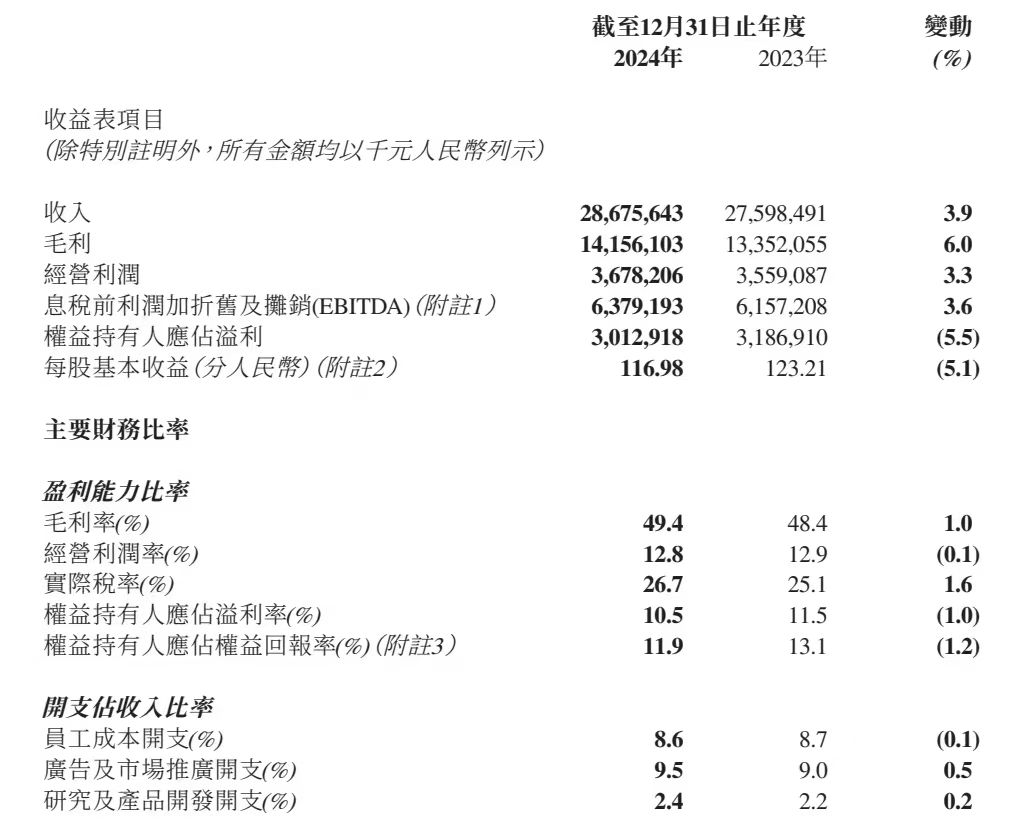

On March 28th, Li Ning Company released its 2024 annual report. The annual revenue reached 28.676 billion yuan, a year - on - year increase of 3.9%. The net profit was 3.013 billion yuan, a year - on - year decrease of 5.46%. The overall gross profit margin of the group was 49.4%, up 1 percentage point from last year.

It is generally believed in the industry that Li Ning's annual performance met expectations.

Morgan Stanley said that the decline in Li Ning's net profit was due to the impairment of "investment properties". The market will interpret the performance results positively, which means that the company's profitability may be better than some investors' expectations.

After the release of the annual report, Li Ning's stock price rose. During the session, it increased by more than 6%, hitting a weekly high, and closed at HK$17.16 per share on that day.

The picture is taken from Li Ning's annual report

"In 2024, we operated steadily, consolidated our foundation, and developed pragmatically. The same goes for this year. However, it should be noted that being steady does not mean being conservative. We attack when we should, control when we should, and adjust when we should." At the annual report press conference, Qian Wei, the co - CEO of Li Ning Group, said so.

Since 2023, the growth rate of the sports goods industry has generally slowed down. It was also at this time that after tasting the sweetness of "China Li Ning", Li Ning began to emphasize its positioning as a professional sports brand. At the same time, it closed inefficient stores to improve its business structure.

At the press conference, Qian Wei also told 36Kr, "We cannot sacrifice our pursuit of professional attributes and professional technology platforms. We will stick to the current path."

Judging from the current annual report, the internal adjustment of Li Ning Company has achieved results. The key question is whether Li Ning, which has been developing steadily for multiple consecutive quarters, can seize the opportunity for rapid growth in the future and bring more imagination space to the capital market?

Attack in running, defend in basketball

Based on the annual performance, Li Ning's focus in 2024 was on "multiple categories".

Different from Anta's "multi - brand" strategy to counter market cycles, Li Ning has always adhered to the "single - brand, multi - category" strategy. On many occasions, Li Ning himself has also emphasized the reasons for adhering to the single - brand strategy. "The purpose of establishing Li Ning Company is to create a professional sports brand that can contribute to the development of Chinese sports and inject sports spirit into the entire service and operation of the enterprise."

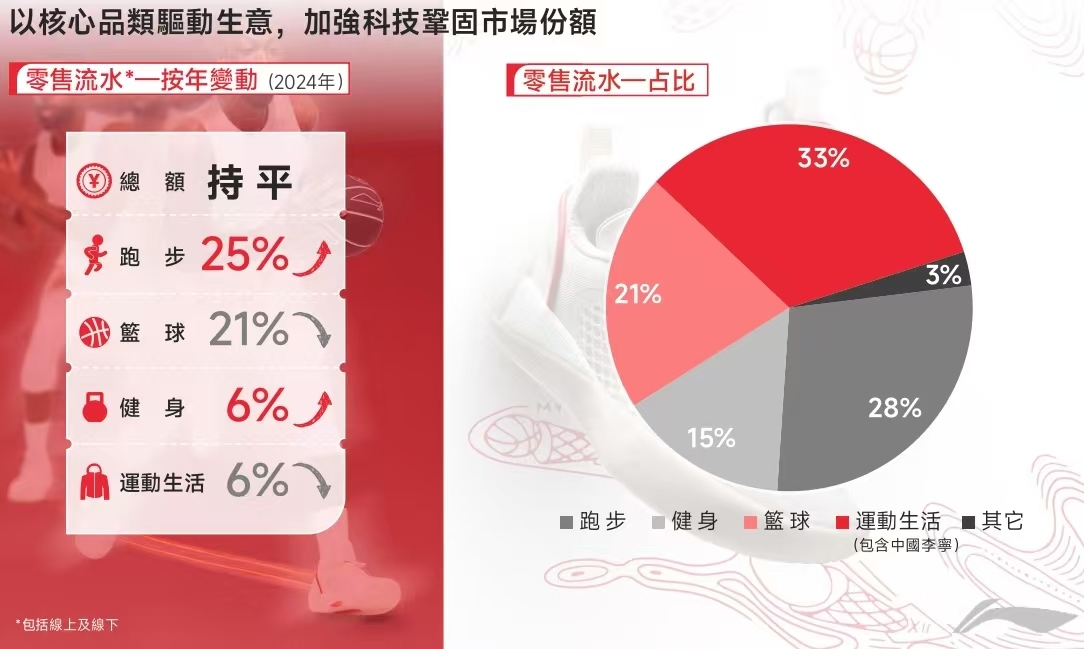

In the previous year, while adhering to the single - brand strategy, Li Ning further deepened its core categories. Zhao Dongsheng, the CFO of Li Ning Group, summarized this strategy as "driving business with core categories".

So far, Li Ning has six core categories: "running, basketball, comprehensive training, badminton, table tennis, and sports lifestyle". In 2024, the retail sales of the three professional sports categories of running, basketball, and comprehensive training accounted for 64% of the total.

Among them, the retail sales of running increased by 25%, accounting for 28% of the total. In terms of products, Li Ning launched "Ultra - Beng" based on "Beng" technology, as well as shoe models such as Longque and Feidian 5 ULTRA equipped with "Ultra - Beng" technology. In terms of sales volume, the annual sales of the three core running shoe IPs, "Ultra - Light", "Chitu", and "Feidian", exceeded 10.6 million pairs.

In the basketball field, Li Ning chose to defend actively, and the retail sales in 2024 decreased by 21%.

According to Qian Wei, the reason for Li Ning's adjustment in the basketball field is that "price chaos will damage the core value of the category."

Last year, Li Ning also launched products equipped with unique technologies such as "Carbon Core" and GCU outsole, which promoted the improvement of the professional attributes of basketball sports. "I can say with confidence that every pair of Li Ning's professional basketball shoes can be used in professional leagues."

In 2012, Li Ning signed a contract with NBA star Dwyane Wade and launched the game shoe product series "Way of Wade". In 2023, Anta spared no expense to sign Kyrie Irving. While enhancing the brand image, it also strengthened its influence in the basketball field.

Anta's annual report shows that in the previous year, its higher - priced Kyrie series was sold out in many parts of the world. The sales volume of shoe products in the entire basketball business is also planned to increase from 6 million pairs to 12 million pairs. In addition, until 2037, Nike will be the exclusive on - court jersey and apparel supplier for the NBA, WNBA, and NBAG League. Jordan under Nike is almost a cultural belief in the entire basketball world.

From the perspective of industry competition, Li Ning's advantage in the basketball field is not prominent. Li Ning also realizes that while strengthening the professional performance in the basketball field, it should also "be deeply involved in basketball culture and have an attitude."

According to Qian Wei, Li Ning's basketball business has three business lines: "professional basketball, Anti - Wu, and Way of Wade". Among them, Anti - Wu, representing street basketball, will hold more activities in 50 cities across the country to establish connections with basketball enthusiasts.

The picture is from Li Ning's official website

Can Li Ning seize the outdoor opportunity?

Undoubtedly, running and basketball have always been the core of sports brand development. On this basis, Li Ning also achieved year - on - year growth in badminton and table tennis businesses in 2024 and expanded into emerging sports such as outdoor sports, tennis, and pickleball.

In the past two years, the commercial value of badminton and table tennis, two national sports in China, has been continuously expanding. After the establishment of the WTT (World Table Tennis Professional League), the commercialization of table tennis has become inevitable. Nevertheless, the market scale of badminton and table tennis is still small.

When talking about this, Qian Wei replied to 36Kr, "We don't only look at the market potential of the vertical fields when developing badminton and table tennis."

Data shows that since 2000, Li Ning has cooperated with the Chinese national table tennis team, and in 2009, it developed the badminton business. To date, Li Ning has become one of the most competitive brands in the world's badminton and table tennis fields. According to Qian Wei, Li Ning hopes to "transform this influence across categories".

In other words, Li Ning not only provides professional products for table tennis lovers but also considers how to attract them to buy other categories. Therefore, after 15 years of experience in the "racket sports" of badminton, Li Ning expanded into the tennis and pickleball businesses.

Of course, the competition in the tennis field is very fierce globally. Wilson, a brand under Arc'teryx, has been investing in tennis equipment for more than a century. During the Shanghai Masters, Nike arranged for Jannik Sinner and Carlos Alcaraz to appear at the offline event "Winner's Home Court". Before the China Open, Zheng Qinwen also attended this event.

It is certain that as one of the most professional sports in the world, tennis requires long - term investment from brands. It is not easy for local brands to enter the market temporarily to gain popularity.

In the outdoor sports field, as the most likely "high - growth" track in the sports industry, Li Ning completed the category setup last year and divided it into two sub - categories: "professional outdoor" and "light outdoor". Among them, the market feedback of the "Wanlongjia" windbreaker was good.

However, judging from the SKUs and revenue, the proportion of Li Ning's outdoor products is still small. Qian Wei also told 36Kr frankly that Li Ning will continue to improve the outdoor product matrix, and many outdoor lifestyle products will be included in the overall large - scale outdoor category. "We hope to quickly cultivate an independent category that can drive business growth."

Previously, a person close to Anta told 36Kr that the group is comprehensively deploying in the outdoor sports field. Last year, Anta's champion stores were transformed into outdoor stores. In addition to the Anta main brand and FILA, "other brands" represented by Descente and Kolon all achieved high - speed growth.

From this perspective, Li Ning, which just established its outdoor sports system last year, seems to have entered the market late. Whether it can fully seize the opportunity of the high - speed development of the outdoor sports track remains unknown. If Li Ning cannot catch up quickly in the outdoor category, it may have a certain impact on future growth.

"Control when you should, adjust when you should"

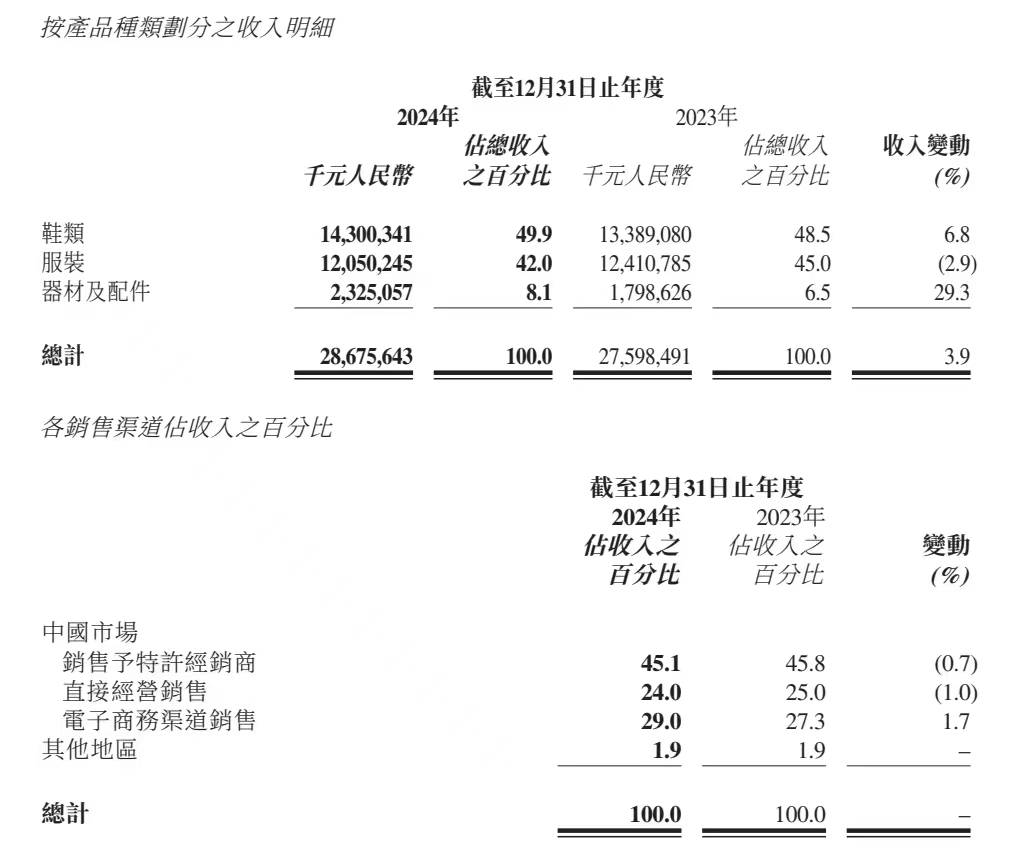

In addition to the category level, Li Ning's active adjustment is also reflected in the channels.

At the performance meeting, Zhao Dongsheng said that the group faced challenges in offline operations last year. The average daily passenger flow throughout the year was under pressure, with a year - on - year decline of 10% to 20%. The overall offline retail sales decreased by a low - single - digit percentage year - on - year.

He further pointed out that on the one hand, Li Ning consolidated and improved the operational efficiency in high - level markets and accelerated the closure of inefficient stores; on the other hand, it also accelerated the expansion in emerging markets, such as opening campus stores.

In terms of the total number of stores, as of the end of last year, the number of sales points of the Li Ning brand (including the Li Ning core brand and Li Ning YOUNG) was 7,585, a net decrease of 83 compared with the previous year. Among them, the number of Li Ning main brand stores decreased by 123, and the number of Li Ning YOUNG stores increased by 40 to 1,468. In addition, the brand accelerated the upgrade plan of the 9th - generation stores last year. During the reporting period, the number of Li Ning's 9th - generation stores exceeded 1,026, with an average monthly store efficiency of about 360,000 yuan.

In the online channel, due to the improvement of the business environment, the proportion of Li Ning's e - commerce revenue increased by two percentage points to 31%, and the direct e - commerce sales increased by 10% to 20%.

The picture is taken from Li Ning's annual report

In addition, in 2024, Li Ning's R & D investment accounted for 2.4%, a year - on - year increase of 0.2 percentage points. In the past decade, the total R & D investment of Li Ning Group has exceeded 3.5 billion yuan. Thanks to the focus on sports technology, during the reporting period, the revenue proportion of Li Ning's footwear business, which best reflects professional ability, increased from 48.5% last year to 49.9%.

Regarding the inventory issue that the footwear and apparel industry is most concerned about, Li Ning's inventory - to - sales ratio across all channels was maintained at 4 months last year, and the inventory turnover days were 64 days, a year - on - year increase of one day, which is at the leading level in the industry.

At the performance press conference, Qian Wei expressed satisfaction with the company's inventory management. "We have established a real - sense inventory management system. We set the inventory target for this year at the end of last year and manage the overall progress across departments on a weekly basis."

It is a clear fact that in an uncertain macro - environment, traditional sports brands represented by Li Ning will find it difficult to get out of the economic cycle dilemma in the short term.

At present, the international brand Nike is also in an adjustment period. After "veteran" Elliott Hill took office, Nike refocused on professional sports and optimized operational efficiency. On the other hand, Anta, in the context of consumer segmentation, is vigorously developing high - cost - performance store formats and running shoe products and reducing the number of future stores.

The consensus in the industry is that it will no longer simply pursue scale, nor will it sacrifice professional and sustainable interests for short - term low prices. Regarding the performance outlook for 2025, Zhao Dongsheng expects that the annual revenue will be flat year - on - year, and the net profit margin will increase by a high - single - digit percentage.

It is worth mentioning that not long ago, Li Ning "took over" from Anta and became the official sports clothing partner of the Chinese Olympic Committee (COC) from 2025 to 2028. In the previous few years, the Anta brand improved its reputation through the COC and also opened up resources for top - level sports events for the entire group.

Whether Li Ning can seize the opportunity of the COC in the future remains to be verified. Li Ning himself also said that he will actively seize this opportunity to promote high - quality business growth.

Follow for more information