Tencent Teams Up with Ubisoft for €1.16 Billion: A High - stakes Gamble on "Making AAA Games Evergreen" | Focus Analysis

Text | Liu Shiwu (36Kr Games)

On March 27, 2025, the global gaming industry received significant news: French game company Ubisoft announced the spin-off of its three flagship IPs, Assassin's Creed, Far Cry, and Tom Clancy's Rainbow Six, along with their development teams, to form independent subsidiaries and introduced a strategic investment of 1.16 billion euros from Tencent.

After the transaction is completed, Tencent will hold a 25% stake in the new subsidiary, and the pre - investment valuation of the subsidiary reaches 4 billion euros (approximately 31.3 billion yuan), which is twice Ubisoft's current market value.

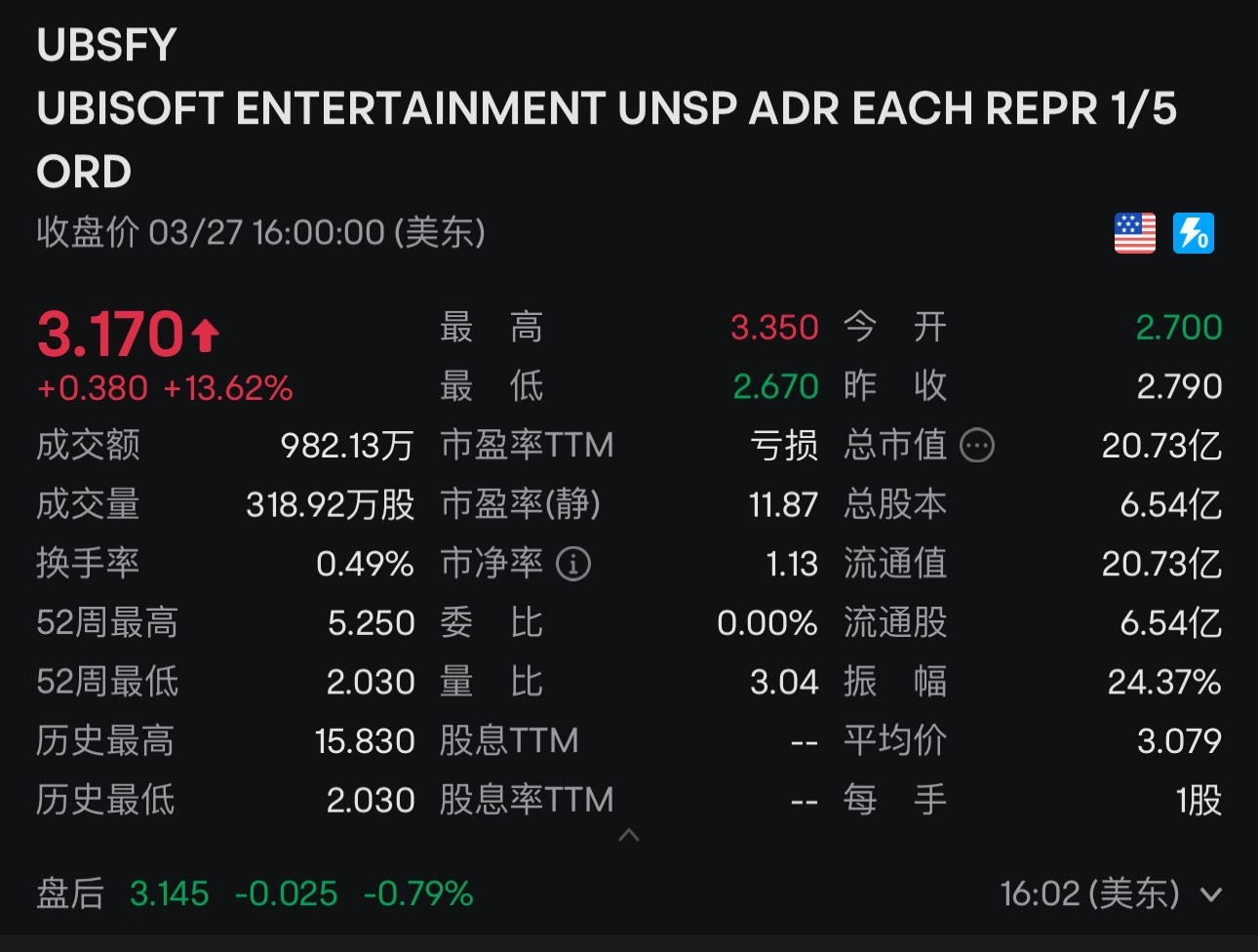

Stimulated by this news, Ubisoft's stock price rose nearly 14% after hours, and the capital market initially cast a vote of confidence in this "IP capitalization experiment."

Ubisoft's long - awaited "big rise"

The core terms of this transaction show that Tencent's investment will be used to repay Ubisoft's debts and for the operation of the new company, but it will not involve creative decision - making power —— Ubisoft retains the ownership and 100% control of the IPs and only grants the "global exclusive and permanent IP license" to the subsidiary in exchange for royalties; Tencent will get a non - voting board observer seat and enjoy the regular minority shareholder protection clauses (such as the right to veto major asset disposals).

Ubisoft CEO Yves Guillemot said that this move is a key step in "unlocking the value of assets and accelerating agile transformation," while Tencent President Martin Lau aims to "build a long - lasting gaming platform."

Martin Lau said: "We are very pleased to further strengthen our long - term partnership with Ubisoft through this investment, which shows that we have always been confident in Ubisoft's creative vision and outstanding talents to continuously drive the development of the industry. We see great potential for these game series to develop into long - lasting gaming platforms and create engaging new experiences for players."

Original text of Ubisoft's announcement

So far, the "intimate relationship" between Tencent and Ubisoft has heated up again.

The in - depth cooperation between the two leading game companies can be traced back to seven years ago. In 2018, Tencent entered Ubisoft's shareholder list with a 5% stake, helping it get out of Vivendi's hostile takeover; in 2022, it increased its stake to 11% and became the second - largest external shareholder; after this transaction, Tencent will form a dual layout of "parent company equity + subsidiary interests" within the Ubisoft system.

In terms of product collaboration, the two sides have also advanced step by step: in 2023, Tencent acted as the agent for the Chinese version of Tom Clancy's The Division 2, increasing the DAU by 37% through social fission gameplay; in 2024, they jointly developed Tom Clancy's Rainbow Six Mobile. Although the project was suspended for several months, the product is still in progress.

Some analysts pointed out that Tencent's penetration into Ubisoft follows the path of "technology first, then IP." The spin - off of the three IPs for independent operation is actually a "roundabout control" strategy to avoid EU antitrust risks.

For Tencent, this "big bet" aims at three strategic gaps: First, to fill the short - board in the console/PC ecosystem. Although studios such as TiMi and Photon dominate the mobile market, the 3A genes of the Assassin's Creed series (with cumulative sales of over 200 million copies) are scarce resources; Second, to verify the possibility of grafting the free - to - play (F2P) model. The new subsidiary has the opportunity to combine Ubisoft's games with the GaaS operation methodology of Tencent's games such as PUBG Mobile and Honor of Kings by "introducing free entry points and enhancing social attributes"; Third, to build a global IP matrix. It is predicted that by 2026, the revenue of service - based 3A games will account for more than 45%, and mature IPs such as Tom Clancy's Rainbow Six: Siege (with 58 million MAU) are the sharp tools to seize the market.

Ubisoft's dilemmas and solutions are also worth pondering. Financially, its net debt reached 1.2 billion euros in Q3 2024, and spinning off assets can optimize the debt structure; organizationally, more than 30% of Ubisoft's employees (centered around the three ace studios in Quebec, Montreal, and Barcelona) are concentrated in the three IP teams, and independent operation is expected to improve labor efficiency; in terms of innovation, after retaining IPs such as Ghost Recon and The Division, Ubisoft can focus on the R & D of "disruptive technologies" such as AI - generated content.

It is worth noting that Ubisoft's stock price once plummeted by 61.68% due to the delay of Assassin's Creed: Mirage and the low sales of Star Wars: Outlaws. Ubisoft's minority shareholder, private equity fund AJ Investments, even called for privatization and a change of management. So this transaction may be a key defense line for the Guillemot family to resist external pressure.

In addition, this transaction may trigger three chain reactions: in terms of business models, the traditional buy - to - play model will accelerate the migration to the hybrid model of "base game payment + DLC + in - app purchases"; in terms of the competitive landscape, Sony and Microsoft may follow up with investments in mid - sized game companies, and EA has launched an evaluation of the independent studio for the Battlefield series; for Chinese game companies going global, "technology for IP" may become a new paradigm, and NetEase, miHoYo, etc. may accelerate their binding with overseas IP holders.

The potential risks therein cannot be ignored:

It may still need to pass the EU antitrust review to prove that it does not constitute "substantial control";

The risk of the loss of the core team: Tencent has promised a 5 - year lock - up period for the shares it holds in the new subsidiary. Unless Ubisoft no longer holds the majority of voting rights and equity in the new subsidiary, Tencent cannot transfer its shares within 5 years;

Ubisoft's shareholding restrictions: Within 2 years after the transaction is completed, Ubisoft cannot give up holding the majority of voting rights and equity in the new subsidiary;

The challenge of cross - cultural IP operation (such as the localization of Assassin's Creed works with a Chinese background).

Tencent's "precise cut" investment is essentially a targeted purchase of the industrialization ability of 3A games.

If Assassin's Creed: Mirage can verify the integration model of "single - player narrative + service - based gameplay," it may give birth to a new species of 3A games. For Ubisoft, whether it can break the curse of "good reviews but poor sales" with Tencent's help will determine its fate in the next decade.

After the capital frenzy subsides, the real test for both sides is whether they can find a dynamic balance between "creative freedom" and "commercial realization" —— The endgame of this big bet may be quietly counting down as the end of 2025 approaches.