A clinic that treats middle-class families and earns 1 billion yuan annually is gearing up for an IPO.

On March 18th, Zhuozheng Medical updated its prospectus for the Hong Kong stock market. In 2024, its total revenue reached 959 million yuan, and its adjusted net profit exceeded 10 million yuan, marking its first turnaround from losses to profits.

As early as 2021, when Wang Zhiyuan, the founder and CEO of Zhuozheng Medical, was interviewed by 36Kr, he pointed out that “going public” must meet three conditions: a mature business model and a stable commercial model; achieving scale; and annual revenue exceeding 1 billion yuan.

In 2025, this general practice chain, which features pediatrics and targets high - end medical services, finally approached the “small goal” set four years ago.

In an era of affordable consumption where everyone is talking about “consumption downgrade”, Zhuozheng Medical targets its customer base at “the mass affluent population”. It uses the essential pediatric services as a traffic entry point to attract other family members for medical treatment. In 2024, the average cost per pediatric visit at Zhuozheng Medical was 821 yuan. Although it is expensive, it remains popular. The total annual number of pediatric visits at Zhuozheng exceeded 247,000, and it was even difficult to make an appointment with some well - known doctors.

Currently, the medical service sectors of the A - share and Hong Kong stock markets are filled with specialized chains such as those in dentistry, ophthalmology, and physical examination. The service items in these departments are mainly self - paid and have high unit prices, so they have carved out a niche for private medical care in a market dominated by public medical services. Many listed medical chains face problems such as “high customer acquisition costs, low consumption frequency, and heavy asset operations”, achieving scale but not profit.

So, how did Zhuozheng Medical, which follows the “general practice clinic” route, “position itself” to double its revenue in three years? If it allocates 60 - 70% of its revenue to pay doctors' salaries, can the company further increase its scale and profit? Will Zhuozheng be impacted by “AI pediatricians” and other new phenomena in the oncoming technological wave?

“Spare no expense for children”, acquiring customers through essential services

A child's illness is an important trigger for parents' “anxiety about raising children”.

To avoid misdiagnosis, missed diagnosis, and ensure accurate medication, parents often flock to large tertiary - grade hospitals. In 2024, the outpatient volume of the Children's Hospital Affiliated to the Capital Institute of Pediatrics reached more than 2.75 million person - times, which means more than 7,500 person - times of visits per day. During the peak season of respiratory diseases, it is common for doctors to see 70 - 80 patients a day.

This not only means a short average consultation time for children but also a high risk of in - hospital infection.

In December last year, Ding Lin (a pseudonym) took her one - and - a - half - year - old child to a public hospital for vaccination. Within just ten days after returning, the child was infected with three different viruses in succession. “After the first infection, we went to the hospital for several days of infusion. Just when the child got better, she got influenza A the next day and we went to the hospital again. After she recovered from influenza A, the third virus came along.” Recalling that period, she said she was “on the verge of collapse” and then started looking into commercial insurance that supports high - end medical services such as the international departments and special needs clinics of public hospitals.

In fact, the problem of difficult access to pediatric medical care has persisted for many years. Pediatrics is actually a “mini - general practice”. Coupled with the fact that children have difficulty accurately describing their symptoms, doctors face challenges in communication and diagnosis. The variety of pediatric medications is limited, and most dosages are determined “at the doctor's discretion”. In addition, from an economic perspective, pediatrics is not suitable for large prescriptions and extensive examinations, and the department's efficiency is usually poor, resulting in relatively low incomes for pediatric doctors.

With the shortage of pediatric doctors and the scarcity of high - quality public medical services, parents have a strong motivation to actively seek high - end private medical services.

When Zhuozheng's first clinic opened in Shenzhen in 2012, it only had pediatrics and internal medicine. In addition to having a medical environment that is more in line with children's interests and effectively avoiding in - hospital infections, in the diagnosis and treatment process, Zhuozheng Medical emphasizes “in - depth consultations” to ensure that patients have sufficient diagnosis and treatment time. In terms of the doctor team, in 2024, Zhuozheng Medical employed 379 full - time doctors, of which 81% had previous work experience in top - tier tertiary - grade hospitals, and nearly 90% had a master's degree or above.

Moreover, due to medication restrictions, pediatrics is the department where “preventive medicine” and “value - based medicine” are most easily practiced. Under the concept of scientific parenting, parents in first - tier and new first - tier cities usually take their children for regular self - paid pediatric health checks (including vision and hearing, motor development, intellectual development, etc.). “Pediatric health checks” have also been an important business for Zhuozheng since 2013.

This also enables Zhuozheng to transform the low - frequency illness - seeking medical behavior into high - frequency health - care behavior, making the “paid membership system” feasible. According to the prospectus, the proportion of its sales expenses to revenue decreased from 2.7% in 2022 to 1.7% in 2024. The relatively low unit customer acquisition cost also leaves room for future profit growth.

In addition, using pediatrics as a traffic entry point, Zhuozheng Medical extends its service objects from children to the entire family. Its members can bind up to six family members. The departments have also expanded from pediatrics, dentistry, and ophthalmology, which mainly serve common childhood diseases, to dermatology (including light medical aesthetics such as skin whitening and anti - aging) and gynecology, which are more in demand by mothers.

From a commercial perspective, the expansion of departments has increased the average cost per visit (the average cost per visit in dermatology is 3,116 yuan, and in gynecology is 1,317 yuan) and enhanced the “scale” potential. In the revenue contribution of each specialty at Zhuozheng, dermatology has remained stable at around 20% for three consecutive years, even exceeding pediatrics, indicating the consumption power of the mother group.

The consultation situation of each specialty at Zhuozheng Medical. Source: Zhuozheng Medical's prospectus

Zhuozheng Medical's target customer group is “the mass affluent population with an annual disposable income of more than 200,000 yuan”, which is quite similar to the membership customer group of Sam's Club. In 2024, Zhuozheng had a total of 108,000 membership accounts, and the membership renewal rate was 64%. Obviously, there is still room for improvement.

For private medical institutions, the scale effect is very important. Most of them choose to pursue both internal growth and external mergers and acquisitions simultaneously.

According to the prospectus, Zhuozheng's revenue increased to 959 million yuan in 2024, more than doubling from 467 million yuan in 2022, mainly due to: the expansion of medical institutions, an increase in paid members, and the acquisition of hospitals. Next, its new clinics in Nanjing and Xi'an will open one after another; it also plans to open new clinics in cities such as Hangzhou and Shanghai; and it is seeking new acquisition opportunities. Further expansion of scale also tests the management radius and operational efficiency of the team.

Personnel expenses account for 60% of revenue. Can AI reduce it?

The core asset in the medical industry is “people”.

Among Zhuozheng Medical's expenses, employee salaries and welfare expenses account for the largest proportion. In 2024, employee salaries and welfare expenses were 564 million yuan, accounting for 59% of the total revenue, showing a certain decline compared with the previous year.

In the overall human resource expenditure, the salaries and welfare expenses of Zhuozheng's “medical professionals” were 348 million yuan, covering more than 1,000 employees, including 379 full - time doctors and 537 nurses. In recruitment on different platforms, depending on different departments, the monthly salary of doctors recruited by Zhuozheng ranges from about 30,000 - 60,000 yuan and 40,000 - 70,000 yuan.

In addition, another major expense comes from the share - based compensation and welfare expenses of management and support staff. In 2024, it was 209 million yuan. Although it did not further elaborate on the situation of this group of people, it can be inferred that in order to retain high - quality medical and management talents, a certain cost of equity or options was paid.

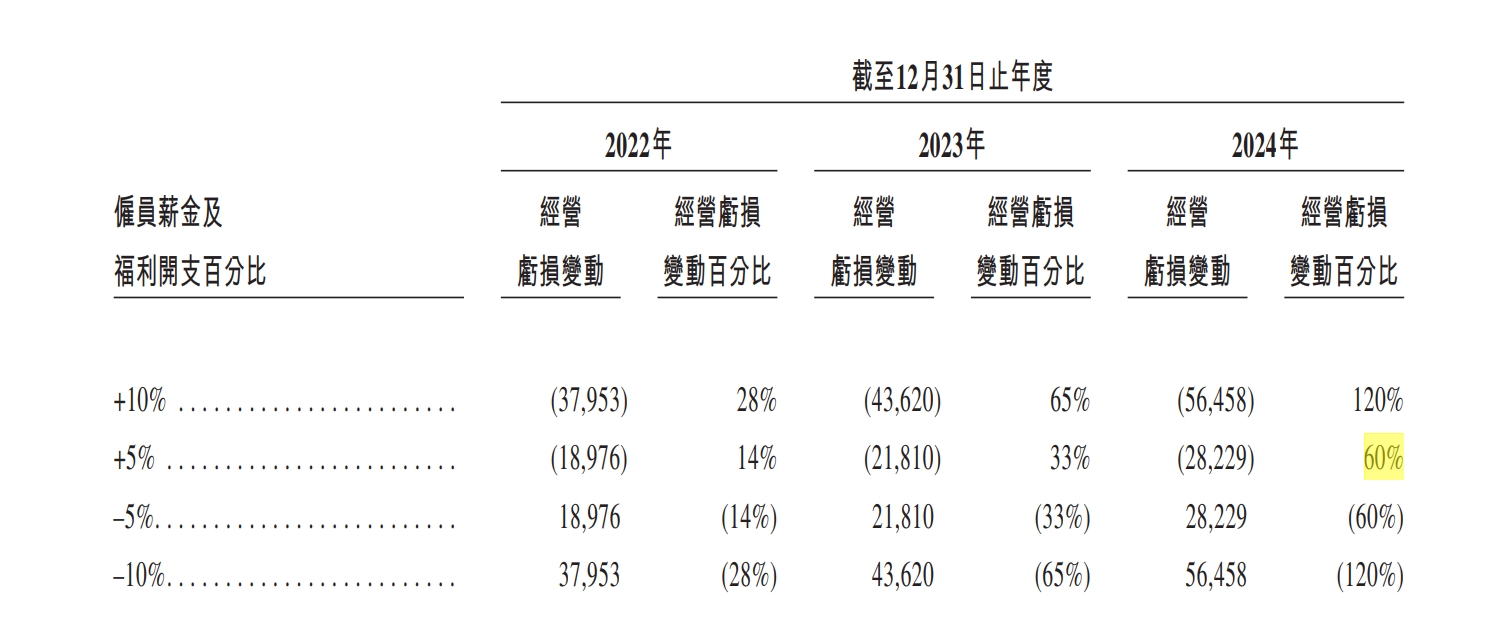

Zhuozheng's employee salary and welfare expenses are highly sensitive to its operating losses. According to its calculation, if the proportion of employee salary and welfare expenses decreases by 5% in the future, the operating loss will be reduced by 60%; conversely, the loss will increase by 60%.

Sensitivity analysis of the impact of hypothetical fluctuations in employee expenses on operating losses. Source: Zhuozheng Medical's prospectus

Normally, as the scale of medical institutions expands, the number of medical and service personnel will also increase accordingly. Coupled with market competition and employees' demand for salary increases, it is not easy to reduce the proportion of human resource expenditure, unless through technological innovation.

From the use of funds raised in Zhuozheng's IPO, the cooperation, R & D, and application of AI are listed first, “deploying artificial intelligence to revolutionize medical services and improve operational efficiency”. It plans to upgrade its IT and data infrastructure by the end of 2025. The main application directions of AI include: patient flow prediction and optimized personnel allocation, AI - assisted health consultation, and optimization of operational processes.

In addition to the above - mentioned AI technology applied within the B - end institution, Zhuozheng also proposes to establish an AI special team and cooperate with external institutions to apply AI in medical services for C - end customers, including consultation, explanation of diagnostic reports, and follow - up after treatment. Moreover, it will launch an AI application to help medical professionals make more accurate diagnoses and provide high - quality treatments.

Since the popularity of large models in 2023 and the breakthrough of DeepSeek in early 2025, the deployment and implementation of “medical AI” have become a consensus among hospitals. Medical large - model startups represented by Baichuan Intelligence have proposed the vision of “creating AI doctors”, and the first step is to enter the “pediatrics” field with the most prominent supply - demand contradiction.

On the supply side, if the ability of AI pediatricians to assist in diagnosis and propose treatment plans is strong enough, it may change the current supply situation where “the hierarchical diagnosis and treatment system for pediatrics is ineffective” to some extent and improve the pediatric diagnosis and treatment ability in the public medical system. For Zhuozheng, there is strong motivation to embrace AI. Whether technological application can truly help it reduce costs, increase efficiency, and expand operating profits still needs further observation.

Now, in the spring when the IPO market is showing a slight recovery, Zhuozheng Medical has submitted its prospectus again. Behind it stand a group of investment institutions such as Tencent, Matrix Partners China, and Tiantu Capital.

If it can successfully go public, the 2.4 billion convertible redeemable preferred shares in its balance sheet will be converted into common shares, and the company's huge pressure of current liabilities will also be relieved.