ZhiKe | With Games Leading the Way and AI Charging Ahead, Will Tencent's Earnings Report Showcase Its Strength Again?

Author | Ding Mao, Fan Liang, Huang Yida

Editor | Zheng Huaizhou

After the Hong Kong stock market closed on March 19th, Tencent Holdings (hereinafter referred to as: Tencent) released its financial report for Q4 and the full - year of 2024.

The financial report shows that in Q4 2024, benefiting from the upgrade of the AI - empowered advertising platform, the increase in user engagement on Video Accounts, and the growth of evergreen games, the company recorded revenues of 172.45 billion yuan, a year - on - year increase of 11%, exceeding the market expectation of 9%. While the revenue expanded steadily, Tencent's performance on the profit side remained remarkable. In Q4 2024, the company's gross profit was 90.65 billion yuan, a year - on - year increase of 17%, corresponding to a gross profit margin of 53%; the Non - IFRS operating profit was 59.48 billion yuan, a year - on - year increase of 21%, outperforming the revenue growth rate for 9 consecutive quarters, corresponding to an operating profit margin of 34.5%.

Looking at the full - year performance, in 2024, Tencent recorded revenues of 660.26 billion yuan, a year - on - year increase of 8%. During the same period, the gross profit was 349.25 billion yuan, a year - on - year increase of 19%, corresponding to a gross profit margin of 53%; the Non - IFRS operating profit was 237.81 billion yuan, a year - on - year increase of 24%, corresponding to an operating profit margin of 36%.

However, in addition to the high - quality growth of its performance, the market is more concerned about Tencent's progress in the current AI competition. Since the fourth quarter of last year, Tencent has fully ramped up its AI capital expenditure. According to the disclosure, Tencent's capital expenditure in the fourth quarter reached as high as 36.6 billion yuan, among which the capital expenditure payment related to the development of AI projects was 39 billion yuan, far exceeding the market expectation of 26 billion yuan. The market expects that the company's capital expenditure in 2025 will exceed 100 billion yuan.

Supported by the huge capital expenditure, the potential explosion of AI business, especially AI - related applications, will undoubtedly bring new valuation logic to Tencent. Benefiting from the imagination space of the AI business, since the beginning of January this year, Tencent's stock price has rebounded by nearly 45%.

So, what are the highlights of Tencent's financial report this quarter? What kind of imagination space will AI bring to the company?

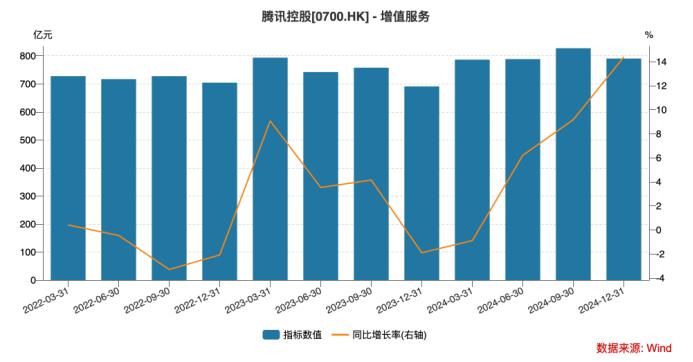

01 Value - added Services: The Return of Games to the Peak Drives High Revenue Growth

The financial report data shows that in Q4 2024, Tencent's value - added services business recorded revenues of 79 billion yuan, a year - on - year increase of 14%. Among them, the game business revenue was 49.2 billion yuan, a year - on - year increase of 20%, far exceeding the market expectation; the social network revenue was 29.8 billion yuan, a year - on - year increase of 6%.

For the whole year of 2024, the value - added services recorded revenues of 319.2 billion yuan, a year - on - year increase of 7%, accounting for 49% of the total revenue. Among them, the game business revenue was 197.7 billion yuan, a year - on - year increase of 10%, exceeding the market expectation; the social network revenue was 121.5 billion yuan, a year - on - year increase of 2%.

Chart: Tencent's quarterly revenue and year - on - year growth rate of value - added services; Source: Wind, 36Kr

Specifically, in the international game market, benefiting from the rapid growth of the performance of Tencent's Finnish mobile game subsidiary Supercell and the release of the new mobile game Age of Empires and the early access version of Path of Exile 2, the game revenue in the international market in the fourth quarter reached 16 billion yuan, a year - on - year increase of 15%, hitting a new historical high. The annual revenue in 2024 was 58 billion yuan, a year - on - year increase of 9%.

The data shows that Supercell, which produced popular games such as Brawl Stars and Clash of Clans, had sales revenue of nearly 3 billion US dollars in 2024, a year - on - year increase of 77%. Meanwhile, on the day of its release, the early access version of Path of Exile 2 topped the global best - selling list on Steam. Two weeks after its launch, it won multiple honors on the Steam platform, including the Platinum - level for new products in 2024, the Platinum - level for the most popular games, and the Gold - level for the best - selling games.

In the domestic game market, the revenue in this quarter reached 33.2 billion yuan, a year - on - year increase of 23%. The annual revenue in 2024 was 139.7 billion yuan, a year - on - year increase of 10%. The steady growth of Tencent's game business in the fourth quarter mainly depends on the following three points:

(1) The low - base effect in the same period last year;

(2) The further expansion and continuous steady growth of the evergreen game matrix, which provides a basic performance guarantee for the company. In 2024, the number of evergreen games under Tencent increased from 12 to 14. Meanwhile, ace games such as Honor of Kings, Teamfight Tactics: Wild Rift, and Valorant have been contributing stable revenues for a long time. Taking Teamfight Tactics: Wild Rift, which was launched in 2021, as an example, according to Sensor Tower statistics, the revenue of Teamfight Tactics: Wild Rift in the fourth quarter increased by 30% year - on - year, achieving double - digit growth for eight consecutive quarters;

(3) Against the backdrop of the remarkable performance of ace games, the newly launched games in the fourth quarter also showed strong growth momentum, contributing new increments. Delta Force, which was launched in September last year, is quite popular on the PC platform.

While the revenue side expanded steadily, the profitability of value - added services also improved further. In Q4 2024, the gross profit of Tencent's value - added services business was 44.2 billion yuan, a year - on - year increase of 19%, continuously exceeding the revenue growth rate in the same period. The gross profit margin also increased from 54% in the same period of 2023 to 56%. Looking at the full - year performance, the gross profit of the value - added services business increased by 12% year - on - year, corresponding to a gross profit margin of 57%, a 3 - percentage - point increase compared with 2023.

Overall, in Q4 2024, benefiting from the recovery of the industry, the steady growth contribution of the evergreen game matrix, and the active promotion of new games, Tencent's game business showed a strong recovery and growth trend, driving the further enhancement of the revenue and profitability of the value - added services business. Considering the stable contribution of evergreen games and the fact that the company still has promising games such as Valorant Mobile and Honor of Kings: World in reserve in 2025, the value - added services business is expected to continue its high - growth trend.

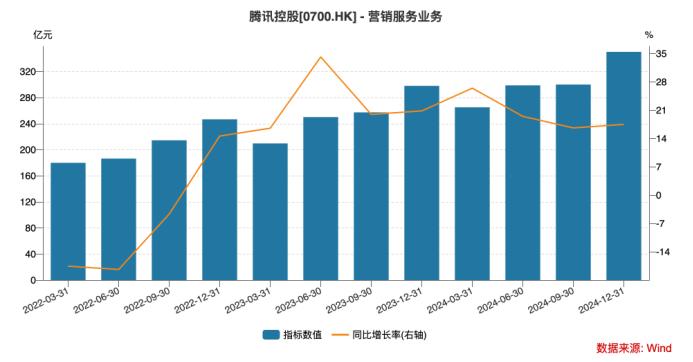

02 Marketing Services: The Recovery of Market Sentiment and Technological Upgrades Jointly Drive Revenue Growth

The marketing services business segment achieved revenues of 35 billion yuan in Q4 2024, a year - on - year increase of 17%. The core driving factor for the revenue growth of the advertising business in this quarter is the increasing demand from advertisers for advertising on Video Accounts, mini - programs, and WeChat Search. The underlying core logic is that as the economy gradually recovers, the advertising investment in key industries has increased, and the advertising industry's beta is improving. As the industry leader, Tencent naturally benefits from this.

Chart: Tencent's quarterly advertising revenue and year - on - year growth rate; Source: Wind, 36Kr

In recent years, against the backdrop of a counter - cyclical market, Tencent's advertising revenue has maintained a relatively strong growth momentum. On the one hand, Tencent's national - level social network itself is a huge traffic entrance, which is the foundation for Tencent to be the leader in the advertising industry. On the other hand, Tencent has continuously upgraded and iterated its advertising technology platform, especially by empowering the advertising business with AI in recent years.

At the technical level, the core point of AI - empowered advertising business is to achieve more accurate matching in multiple dimensions. The specific direction is to learn user behavior through AI, such as interests, reactions to advertisements, and transaction behaviors through advertisements, to improve the relevance of advertising recommendations; and to further optimize the advertising sorting system through large - language models to improve the advertising click - through rate and advertisers' investment.

In terms of profit, the advertising business segment achieved a gross profit of 20.2 billion yuan in this quarter, a year - on - year increase of 19%. The growth of the business segment's gross profit is mainly driven by the revenue growth of sub - businesses such as high - gross - margin Video Account advertising and WeChat Search advertising. In terms of profitability, the gross profit margin of the advertising business segment in this quarter was 58%, a 1 - percentage - point increase year - on - year and a 5 - percentage - point increase quarter - on - quarter.

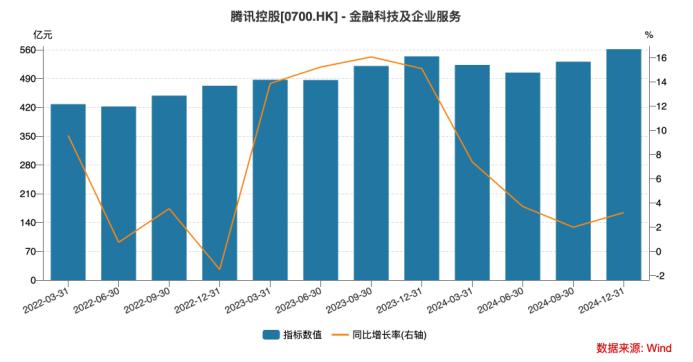

03 Financial Technology and Enterprise Services: Payment Services Stabilize

The financial technology and enterprise services business segment achieved revenues of 56.1 billion yuan in Q4 2024, a year - on - year increase of 3%. Compared with the average year - on - year growth rate of 15% of the business segment last year, the revenue growth rate in this quarter is still at a relatively low level.

The continuous slowdown of Tencent's financial technology and enterprise services business revenue is mainly affected by the weak recovery. Against the backdrop of weak consumption, the stable growth of payment service revenue in this quarter is a highlight of the performance. The growth of wealth management service and consumer loan service revenues, as well as the growth of merchant technology service fees and enterprise WeChat revenues, are the main factors driving the revenue growth of financial technology and enterprise services in this quarter.

Chart: Tencent's quarterly revenue and year - on - year growth rate of financial technology and enterprise services; Source: Wind, 36Kr

In terms of profit, the financial technology and enterprise services segment achieved a gross profit of 26.5 billion yuan in this quarter, a year - on - year increase of 11%. The core driving force for the growth of the business segment's gross profit is mainly the revenue growth of wealth management services, consumer loan services, and enterprise WeChat, as well as the improvement of the cost - effectiveness of cloud services. In terms of profitability, the gross profit margin of the financial technology and enterprise services business segment in this quarter was 47%, a 3 - percentage - point increase year - on - year and a 1% decrease quarter - on - quarter.

04 AI Investment Exceeds Expectations, Reshaping the Business Landscape

Overall, Tencent has delivered a steady and appropriate performance report.

On the revenue side, Tencent's traditional value - added services business has shown an obvious recovery trend. In Q4 2024, the single - quarter revenue growth rate was 14%, especially the game business growth rate of 20%, reaching the highest point since Q2 2021. At the same time, the growth rates of the marketing services, financial technology, and enterprise services businesses have also increased quarter - on - quarter.

On the profit side, due to the increase in the proportion of high - gross - margin revenues, the gross profit margins of Tencent's various businesses in Q4 2024 have significantly increased compared with Q4 2023. Among them, the value - added services increased by 2 percentage points year - on - year, the financial technology and enterprise services increased by 3 percentage points, and the marketing services increased by 1 percentage point.

The steady growth on the revenue side, combined with the further improvement of the gross profit margin, has jointly contributed to the high growth of Tencent's adjusted net profit.

Of course, the market's focus on Tencent is no longer limited to the revenue growth and profit release of its original business. Since February 2025, Tencent's rapid deployment of DeepSeek in applications such as WeChat and Yuanbao after the popularity of DeepSeek not only demonstrates its confidence in the AI industry, but also ignites the capital market's expectation of AI reshaping Tencent's business landscape.

In terms of the reconstruction plan of Tencent's business landscape by AI, Tencent's current strategy is to conduct the integration of all - domain businesses based on a multi - model solution of "self - developed + open - source". On the one hand, Tencent's Hunyuan large - language model continues to iterate, successively launching the self - developed in - depth thinking model Hunyuan T1 and the fast - thinking model Hunyuan Turbo S. On the other hand, since the Spring Festival, Tencent Cloud has first achieved one - click deployment and access to DeepSeek - R1, followed by the access of ima, Yuanbao, and Tencent Docs. Subsequently, WeChat began small - scale testing. In addition, QQ Browser, Tencent Map, QQ Music, Tencent Financial Management, and Sogou Browser have also announced the full deployment of the Hunyuan large - language model and the DeepSeek - R1 model.

According to Tencent's disclosure, since the launch of the "Hunyuan + DeepSeek - R1" dual - model version of Tencent Yuanbao, a series of high - frequency function iterations have been carried out. From February to March, the daily active users soared by more than 20 times, making it the third - ranked AI - native mobile application in China in terms of DAU. At the same time, the AI real - time transcription, intelligent recording, and automatic summarization functions of Tencent Meeting have driven the monthly active users of its AI functions to 15 million; Tencent Docs has more than 200 million monthly active users, serving more than 1.2 million enterprises and organizations.

From this financial report, it can be seen that Tencent's decisive attitude towards accessing DeepSeek is not "a passing fancy", but a long - term bet. As disclosed in Tencent's financial report, the capital expenditure payment related to the development of Tencent's AI projects in the fourth quarter of 2024 was 39 billion yuan, exceeding the total capital expenditure in the first three quarters of 2024 and far exceeding the market expectation. This means that Tencent had already started to increase its AI layout before the popularity of DeepSeek.

However, Tencent is not radical in its subsequent capital expenditure arrangements in the AI field. It is expected that the capital expenditure in 2025 will account for a low double - digit percentage of the revenue. Based on this calculation, the market generally predicts that Tencent's capital expenditure in 2025 will be approximately in the range of 70 - 120 billion yuan. Of course, Tencent also further stated in the earnings conference call that its attitude towards capital expenditure will be mainly demand - driven and will respond dynamically according to market changes.

In addition, Tencent also announced its dividend and