Which Hang Seng Tech Fund Is the Best? | Zhike

Author | Ding Mao, Fan Liang

Editor | Zheng Huaizhou

Since the Spring Festival, driven by the combined effects of proactive macro - policies, the recovery of consumption data, and the popularity of DeepSeek, the capital market has begun to re - evaluate the investment opportunities in Chinese assets.

However, compared with the shift from bearish to bullish on A - shares since September 24 last year, the biggest marginal change in 2025 is that the market is more optimistic about offshore Chinese assets, especially Chinese technology assets represented by the Hang Seng Tech Index. From February this year to date, the Hang Seng Tech Index has accumulated a gain of up to 26%, and 34% since the beginning of the year. If we extend the period to September last year, it has rebounded by 71%, outperforming the major A - share indices and the US NASDAQ significantly.

Behind the market's optimism about the Hang Seng Tech Index, apart from the view that Hong Kong stocks have greater room for valuation repair, the more important reason is that the Hang Seng Tech Index has a higher technology/AI content.

However, it is not easy for ordinary investors to participate in the Hong Kong stock market as offshore assets. The most direct way is to participate in the trading of individual stocks and funds in the Hong Kong market by opening a Hong Kong Stock Connect account, but this method has requirements for the investor's capital volume and trading experience. In addition, participating in the Hong Kong stock market through index - linked funds issued in the Chinese mainland is a more common way.

So, why is the Hang Seng Tech Index worth paying attention to at this stage? And how should investors choose fund products?

What market changes are reflected by the "smart money"?

As the most sensitive indicator of the market, ETF funds are an important reference for investors to understand market trends and conduct asset allocation. Since February, there have been two significant changes in ETF funds:

(1) From "passive defense" to "active attack"

During the rebound from February to date (as of March 4), the ETF market has shown an obvious trend of selling broad - based ETFs and buying industry and thematic ETFs. The specific reasons may include two aspects: First, market sentiment improved significantly in February, with the average daily trading volume in the A - share market reaching 1.8 trillion yuan. Investors' attitude towards the market changed from passive defense to active attack. Second, since February, it has been a typical structural market. The AI and robotics sectors have risen significantly, while traditional industries such as public utilities and finance have performed averagely. Investors grasped the structural market through thematic ETFs.

Affected by this, since February, the net share reduction of broad - based ETFs has reached 76.4 billion shares, while the shares of thematic and industry indices have increased by 14.4 billion and 7.9 billion shares respectively. Specifically, most of the previously popular broad - based ETFs have experienced net outflows. For example, the CSI A500 ETF has a net outflow of 23.9 billion shares, and the STAR 50 ETF has maintained a net outflow since the second half of 2024, with a net share outflow of 28 billion shares during this statistical period.

Chart: Changes in the shares of various types of ETFs. Source: Wind, 36Kr compilation

On the contrary, industry and thematic ETFs have been favored by the market. By theme, the shares of the robotics/AI thematic indices have increased by 7.5 billion/5.7 billion shares respectively, with the share numbers increasing by 82%/41% compared to the beginning of February. By industry, the shares of ETFs linked to the securities company, 800 consumption, and CSI All - Share Power indices have increased significantly.

Chart: Changes in the shares of thematic indices. Source: Wind, 36Kr compilation

(2) Rising preference for Hong Kong technology stocks

In addition to being more active in the A - share market strategy, since February, there have also been some structural changes in the cross - border investment of ETF funds.

First, ETF funds' preference for Hong Kong stocks has increased, while their preference for US stocks has decreased. Wind data shows that from February 1 to date, among the top 10 funds with the largest increase in cross - border ETF shares, all are products linked to Hong Kong - related indices. The largest - scale ones are the Hong Kong Stock Connect Internet, Hong Kong Innovative Drugs, and Hong Kong Technology 50. At the same time, among the top 10 products with the largest share outflows, 3 are linked to Internet - related indices.

Second, the characteristics of the structural market are obvious, with a greater preference for technology. Wind data shows that from February 1 to date, 5 of the top 10 funds with the largest increase in cross - border ETF shares are linked to Hong Kong technology - related indices. Among the top 10 funds with the largest share outflows, the largest - scale one is the Hang Seng Internet ETF. The top 5 heavy - weighted constituent stocks of this fund are Kuaishou, Meituan, Tencent, Alibaba, and JD.com, with a total weight of 60.2%. The top 5 heavy - weighted stocks of the Hong Kong Stock Connect Internet ETF are Alibaba, Xiaomi, Tencent, Meituan, and Kingdee, with a total proportion of 64.3%. It can be seen that the Hong Kong Stock Connect Internet ETF has a higher technology/AI content.

In addition, looking at the top 10 funds with share outflows, especially after entering March, products related to biomedicine and innovative drugs have also been affected by the theme switch in the Hong Kong stock market.

Chart: Changes in the shares of cross - border indices. Source: Wind, 36Kr compilation

Chart: Changes in the shares of cross - border indices. Source: Wind, 36Kr compilation

Why pay attention to the Hang Seng Tech Index?

As mentioned above, since February, the market's attention to Hong Kong stocks has increased significantly, and technology - related targets have become the main direction for market position - adding. Against this background, the popularity of the Hang Seng Tech Index has increased significantly. So, what are the characteristics of the Hang Seng Tech Index?

1. High technology content and good quality. The Hang Seng Tech Index (HSTECH) was compiled and released by the Hang Seng Indexes Company Limited in July 2020. It consists of the 30 largest technology companies listed in Hong Kong, aiming to reflect the performance of leading companies highly related to the technology theme among Hong Kong - listed companies. It is known as the "Hong Kong version of NASDAQ" and represents the best - quality technology leaders in China.

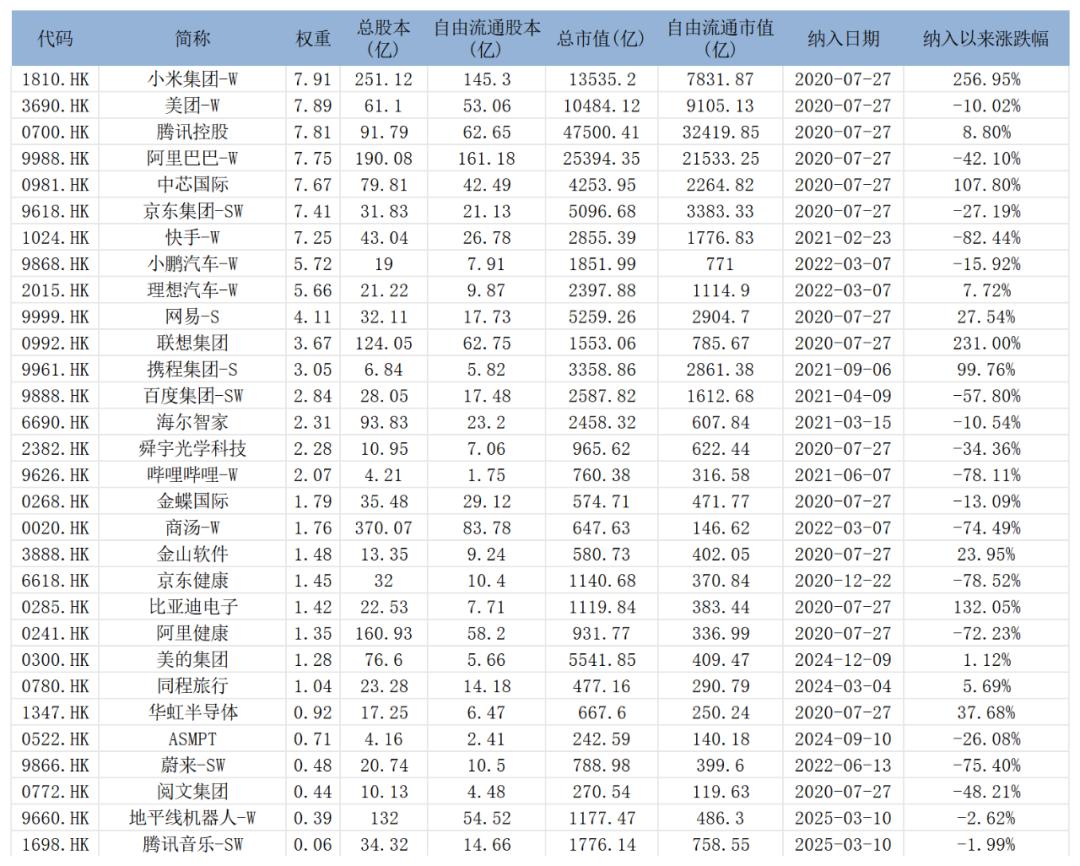

2. Even distribution of constituent stock weights, which helps to diversify risks. The Hang Seng Tech Index is compiled using the free - float adjusted market - capitalization weighting method. Regarding the weight limit of a single stock, it is stipulated that the weight limit of constituent stocks of non - foreign companies is 8%, and that of foreign companies is 4%, with a total limit of no more than 10%. Currently, there is only one foreign company, ASMPT (00522.HK), in the index, whose main business is semiconductor advanced packaging equipment and surface - mount technology. Since the weight limit of a single company is not high and the distribution is relatively even, the influence of individual stocks on the index is effectively reduced, making the index more representative of the trend of technology leading companies.

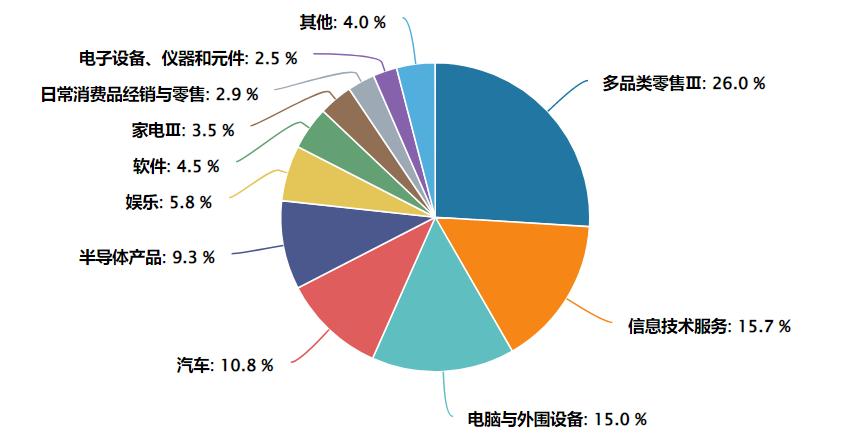

3. Balanced industry and individual stock distribution, wider coverage, and more conducive to tracking the performance of Chinese technology assets. In terms of industry proportion, the industry distribution of the Hang Seng Tech Index is more even. Based on the Wind three - level industry classification, the industries covered by the Hang Seng Tech Index include multi - category retail and information technology, as well as computers, automobiles, semiconductors, electronic components, software, etc.

Chart: Industry composition of the Hang Seng Tech Index. Source: Wind, 36Kr compilation

Looking at the specific constituent stocks, the Hang Seng Tech Index includes not only Internet leading companies such as Alibaba, Tencent, and Meituan, but also new - energy vehicle manufacturers such as Li Auto and XPeng, domestic semiconductor leading enterprises such as SMIC and Huahong Semiconductor, as well as consumer electronics brands and hardware leaders such as Xiaomi, Lenovo, BYD Electronic, and Sunny Optical, and software leaders such as Kingsoft and Kingdee.

Chart: Composition of the Hang Seng Tech constituent stocks. Data source: wind, 36Kr compilation

Meanwhile, compared with the Hong Kong Stock Connect Internet Index, not all the constituent stocks of the Hang Seng Tech Index are eligible for the Hong Kong Stock Connect. It covers some targets with high technology content and quality that are not included in the Hong Kong Stock Connect. Therefore, its overall coverage is more comprehensive than that of Hong Kong Stock Connect products.

Overall, for ordinary investors, from the perspective of long - term asset allocation, if they want to participate in the technology - themed market of Hong Kong stocks, products linked to the Hang Seng Tech Index, which has high technology content, even industry distribution, wide individual stock coverage, and good quality, are undoubtedly a more prudent choice.

How to choose funds?

Currently, domestic fund investors who want to participate in the investment opportunities of the Hang Seng Tech Index can mainly do so through three ways: 1. Buy Hang Seng Tech ETF funds issued in the Chinese mainland with a securities account; 2. Buy offshore Hang Seng Tech index funds or Hang Seng Tech ETF linked funds through fund sales institutions; 3. Buy Hang Seng Tech ETF funds issued in Hong Kong through a Hong Kong Stock Connect account.

So, what are the characteristics of these participation methods? And how should one choose?

1. Hang Seng Tech ETFs issued in the Chinese mainland

Hang Seng Tech ETFs are on - exchange funds. The most typical advantages are good liquidity, flexible operation (T + 0 trading mechanism), real - time quotation, and low fees. However, since ETFs are affected not only by the value of the underlying tracking target but also by market supply and demand, their price fluctuations may deviate from the value in the short term, resulting in a discount or premium state. Attention should be paid to investment risks when the premium is high.

At the same time, since the Hang Seng Tech Index is a broad - based index of the overseas market, Hang Seng Tech ETFs issued in the Chinese mainland are QDII funds, which have exchange - rate risks to a certain extent. Moreover, due to the difference in trading hours between the A - share and Hong Kong stock markets, Hang Seng Tech ETFs issued in the Chinese mainland are quoted according to the A - share market hours, while the underlying index actually fluctuates according to the Hong Kong stock trading hours, which may lead to additional price - fluctuation risks caused by the time difference.

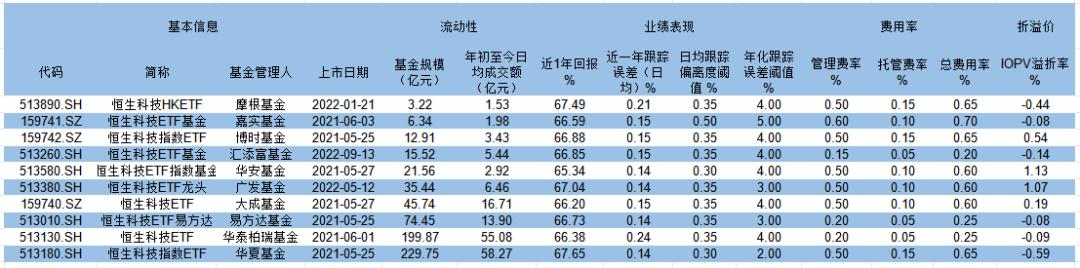

Currently, there are a total of 10 Hang Seng Tech ETF products listed in the Chinese mainland. When selecting, investors can make a choice by comprehensively considering the scale, performance, and fees. A larger scale means better liquidity of the fund product, and lower fees mean better cost - effectiveness of the fund product.

Generally speaking, the fees of on - exchange funds only include management fees, custody fees, and trading commissions. Trading commissions are mainly related to the brokerage firm where the account is opened and are relatively uniform for individuals. Therefore, in practice, only the total fee rate of custody fees and management fees needs to be considered as a cost reference.

Chart: Overview of Hang Seng Tech ETFs issued in the Chinese mainland. Data source: wind, 36Kr compilation

In comparison, among the 10 funds, the top three in terms of scale and average daily trading volume are the Huaxia Hang Seng Tech ETF, Huatai - Peregrine Hang Seng Tech ETF, and E Fund Hang Seng Tech ETF, with scales/average daily trading volumes of 22.98 billion yuan/5.83 billion yuan, 19.99 billion yuan/5.51 billion yuan, and 7.45 billion yuan/1.39 billion yuan respectively.

In terms of performance, in terms of the one - year return rate, the overall performance of the 10 funds is relatively similar, ranging from 65.3% to 67.7%. The top three are the Huaxia Hang Seng Tech ETF, Morgan Hang Seng Tech ETF, and GF Hang Seng Tech ETF, with annualized returns of 67.7%, 67.5%, and 67.0% respectively. The premium rates are not exaggerated, with only GF and Hua'an exceeding 1%.

In terms of the fee rate, the total fee of Huatai - Peregrine is the lowest, and that of Harvest is the highest. However, it should be noted that the tracking target of the Huatai - Peregrine Hang Seng Tech ETF is the CSOP Hang Seng Tech ETF listed in Hong Kong, so there is a double - charging problem, and the actual total fee rate is as high as 1.24%.

Comprehensively considering performance, liquidity, and cost, E Fund and Huatai - Peregrine perform more prominently.

2. Hang Seng Tech ETFs issued in Hong Kong

Compared with ETFs in the domestic market, Hang Seng Tech ETFs issued