ZhiKe | Has the consumer sector really made a comeback?

Text by | Huang Yida

Edited by | Zheng Huaizhou

Last week (March 10th - 14th), the A - share market oscillated upwards. The Shanghai Composite Index rose 1.39% during the week, closing at 3,420 points on March 14th. The Wind All - A Index rose 1.49% last week.

In terms of sectors, 28 out of the 31 Shenwan primary industries rose last week, while 3 declined. Among them, sectors such as beauty care, food and beverages, coal, textiles and apparel, and social services led the gains, while the computer, machinery and equipment, and electronics sectors declined last week.

In terms of style, the dividend sector was relatively dominant, while technology stocks were relatively sluggish. Reflected in the performance of style indices and broad - based indices, the CSI Dividend Index, FTSE China A50, SSE 50, and Shenzhen Dividend Index led the gains, while the STAR 50, STAR 100, STAR Composite Index, STAR Market and ChiNext Innovation 50, and STAR 200 indices lagged in terms of gains and losses during the same period.

The Hong Kong stock market oscillated downwards last week. The Hang Seng Index fell 1.12% during the week, and the Hang Seng Tech Index fell 2.59% last week. In terms of sectors, among the 12 Hang Seng industry indices, 5 sectors rose and 7 declined. Sectors such as essential consumption, raw materials, and energy led the gains, while the comprehensive, information technology, and non - essential consumption sectors led the losses.

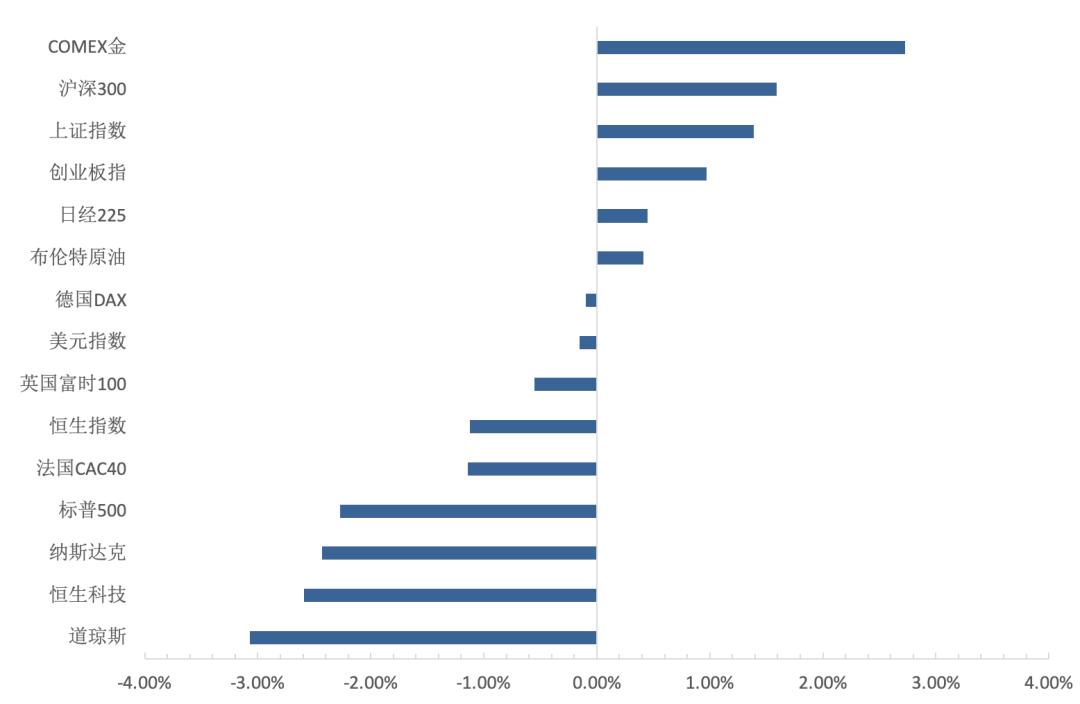

In terms of overseas major asset classes, the three major U.S. stock indices all closed significantly lower last week. Stock markets in European countries showed obvious differentiation. Most major stock indices in Western Europe, except for Italy, closed lower, while most major stock indices in Eastern Europe closed higher. In the Asia - Pacific region, most major stock indices, except for the Nikkei, closed lower. In terms of commodities, crude oil closed higher last week. The performance of base metals was differentiated, with copper rising and steel and aluminum falling. Precious metals rose significantly last week, and gold hit a new record high. Among agricultural products, most varieties closed higher, except for corn and soybeans, which declined. The U.S. dollar index fell slightly overall last week.

Chart: Weekly gains and losses of major global asset classes; Source: Wind, 36Kr

01 Why is the dividend stock dominant in the pro - cyclical environment?

Last week's differentiated market in the A - share market can be simply summarized as a general upward trend driven by large - scale consumption and large - scale finance. At the same time, many leading science and technology innovation companies experienced varying degrees of decline.

Judging from the performance of industry indices, the weekly gains of the beauty care and food and beverages sectors exceeded 8% and 6% respectively. The weekly gains and losses of the textiles and apparel and social services sectors both exceeded 3%. Among large - scale finance, the weekly gain of non - banking financial institutions exceeded 3%. In the general upward trend, the weekly gain of banks was also 1.41%. At the same time, the cyclical sector performed well last week, with the weekly gain of the coal sector approaching 5%.

Speaking of the dividend sector, in the traditional perception of investors, dividends are a typical defensive strategy. Therefore, in the market environment of counter - cyclical economic conditions in the past few years, the dividend sector naturally became a safe haven for various funds. Recently, the pro - cyclical trend has been strong, and it is a common view that consumption and technology are the current main market themes. So why did the dividend sector dominate last week? This question can be answered from the following three aspects.

Firstly, in the general upward trend, the high - weight components in the dividend sector, typically coal and finance, performed very well last week. In addition, recently, foreign capital has been bullish on China, and foreign capital's preference for A - shares is still mainly large - cap stocks. These obvious marginal incremental funds have also flowed into sectors with a large number of large - cap stocks such as banks and coal and a dividend - oriented style;

Secondly, from the beginning of the year to the end of last week, the Shanghai Dividend Index had a cumulative decline of 6.8%. This has led to a certain passive increase in the dividend yield. From a strategic perspective, the investment value of the dividend sector has increased, and continuous adjustments have also thickened the safety cushion of the dividend sector, making it more attractive to relatively conservative funds;

Thirdly, from the perspective of major asset classes, the dividend strategy earns money from the bond - like nature of stocks, so it has a certain comparison relationship with bonds. The market currently believes that there is still room for the decline of the national debt interest rate. In the short term, it is expected that interest rates will be cut, and in the long term, it mainly depends on the low - interest - rate environment created by policies related to reducing the financing costs of the real economy. When the national debt interest rate remains low for a long time, the dividend strategy with relatively higher dividend income is more attractive to funds with relatively lower risk preferences.

Looking forward, due to the relatively high dividend yield, the dividend strategy is more attractive than bonds at least in the medium term. From a macro - expectation perspective, the economy is still in a weak recovery. The current inflation data is still some distance from the inflation target, which also indicates that the recovery process is still relatively long. This is the main support for the dividend strategy to be the main trading theme in the future.

It is worth noting that foreign capital is an important variable. Because large - cap stocks such as banks and coal with high weights in the dividend sector are all within the preference of foreign capital, and a large part of foreign capital is trading capital. The inflow and outflow of foreign capital will have a significant marginal impact on the dividend sector. To judge the logic of the inflow and outflow of this part of foreign capital, one is to look at the short - term profit - making effect of A - shares, and the other is to look at whether there are strong themes in A - shares in the short term.

Chart: Weekly K - line of the CSI Dividend Index in recent years; Source: Wind, 36Kr

02 Investment Strategy

Since the Spring Festival this year, the two main trading themes in the market have been technology and consumption. The core theme of technology is the AI investment boom triggered by DeepSeek, while consumption is mainly driven by relevant stimulus policies. Compared with last year, there has been a significant marginal change in the trading themes of A - shares. That is, in the presence of the above - mentioned strong trading themes, combined with the traditional spring market rally, market sentiment is obviously optimistic, and the impact on the economic fundamentals seems to have been ignored in investment.

However, from the perspective of the economic cycle, high - frequency data such as finance, inflation, and social consumption all show that China's economy is still in a weak recovery, and the process of bottom - building has not ended. At the same time, attention should also be paid to external shocks, which may have a certain impact on the economic recovery process. At that time, with the switch of investment logic, multiple factors such as marginal changes in sentiment and the trading behavior of foreign capital may lead to the possibility that the old investment logic will become dominant again.

Therefore, in terms of investment direction, due to the macro - level uncertainties, combined with the current reality of weak recovery and the comparison relationship with bonds, the dividend strategy can still be the main theme for long - term allocation. Especially after the previous adjustments, with the passive increase in the dividend yield, the cost - effectiveness of allocation has also increased to a certain extent.

In the short term, whether it is the profit - making effect or referring to external factors, especially from the perspective of valuation, technology represented by AI has not been significantly overvalued at present, so it will still be the main investment theme in the near future. In terms of sub - sectors, it mainly focuses on popular themes such as AI applications, computing power, and robots. In terms of consumption, the short - term focus is on relevant consumption - promotion policies, such as the recent encouragement of child - bearing. In terms of trading, the trading congestion in the consumption sector is not high, which makes trading sustainable. In terms of specific directions, the market generally favors sectors such as home appliances, consumer electronics, commerce and retail, and social services.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention to provide underwriting services or any services that require specific qualifications or licenses for the trading parties.