The list of the top 15 automobile brands in February is here, with new energy vehicles leading the market! | The brand list of the World Research Consumption Index

Image source: Shiyan Big Consumption Index

During this monitoring period, BYD, Audi, and Toyota ranked in the top three of the list with comprehensive popularity scores of 1.98, 1.73, and 1.70 respectively.

Domestic new - energy brands lead the market, and high - level "intelligent driving" experience becomes the core of competition among automakers

In terms of brand distribution, domestic Chinese brands such as BYD, Wuling, and Geely occupy half of the top ten positions in the list. Among them, BYD ranks first in both social media popularity and sales popularity, highlighting its position in the new - energy vehicle field. Specifically, BYD's sales in February increased by 164% year - on - year. On the 10th, it launched 21 intelligent driving models and announced that the "Tian Shen Zhi Yan" intelligent driving system would cover all models, from the million - yuan Yangwang U8 to the 69,800 - yuan Seagull intelligent driving version, all of which are standard - equipped with the high - speed NOA function. This reflects BYD's continuous in - depth exploration of new - energy technology. It is not only a strong challenge to traditional fuel vehicles but also a brave exploration in the new - energy vehicle market. Wuling, through mini - electric vehicles such as the Hongguang MINIEV, seizes the urban short - distance travel market with cost - effectiveness and has become the first choice for young users.

Meanwhile, although traditional luxury brands such as Audi, BMW, and Mercedes - Benz still rank among the top, they face periodic pressure in the electrification transformation. Although these brands have launched electric models such as the e - tron and the i series, problems such as high pricing and insufficient localization of the intelligent experience have limited their market penetration.

Brands respond to travel experience needs by "defining products based on scenarios" and seize niche markets through differentiation

From a segmented perspective, automaker brands quickly respond to needs by "defining products based on scenarios". In addition to the extension of the family travel scenario, daily commuting, short - distance transportation, and the trendy play needs of the young technology group have become the focus of competition among automakers. Among them, the performance of emerging brands such as Geely Galaxy and Chery highlights the opportunities in niche markets. Geely Galaxy targets the young technology user group with "intelligent electric + high - end design". With the continuous hot sales of hit models such as the Galaxy Starship 7EM - i, Xingyuan, and Galaxy E5, as well as the support of multiple new products, Geely Galaxy will enter a new era of "one million Galaxies" in 2025. Chery expands the sinking market through exports and low - cost pure - electric models. In addition, the high - end business scenario is dominated by the Hongqi H9, which seizes the market of government and corporate executives with its national - trend design, customized rear seats (heating/massage), and state - guest - level services.

Overall, automaker brands need to further explore segmented scenarios (such as transportation for the elderly and off - road leisure) and strengthen ecological linkage (vehicle - machine interconnection, charging network), and meet the diverse needs of users through differentiated products to consolidate market barriers.

List description

The Shiyan Consumption Compass series of index reports is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List", the "Industry Consumption Heat Index List", the "Product Consumption Wave Index List", and the "Consumption Popular Event List", as well as extended list reports within the corresponding scope. The aim is to objectively and truly present the trend characteristics of the consumption world through index evaluation, help industries and brand owners continuously track consumption market trends, provide references for enterprise operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass series of index lists continuously monitors the following industries:

3C digital products, footwear, clothing and accessories, food and fresh products, household appliances, sports and outdoor products, beauty and cleaning products, mother and baby products, home decoration, automobile consumption, toys, models and musical instruments, pet products, and medical and health products, a total of 12 major industries.

Image source: Shiyan Big Consumption Index

Disclaimer

This list is independently compiled by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision - making basis.

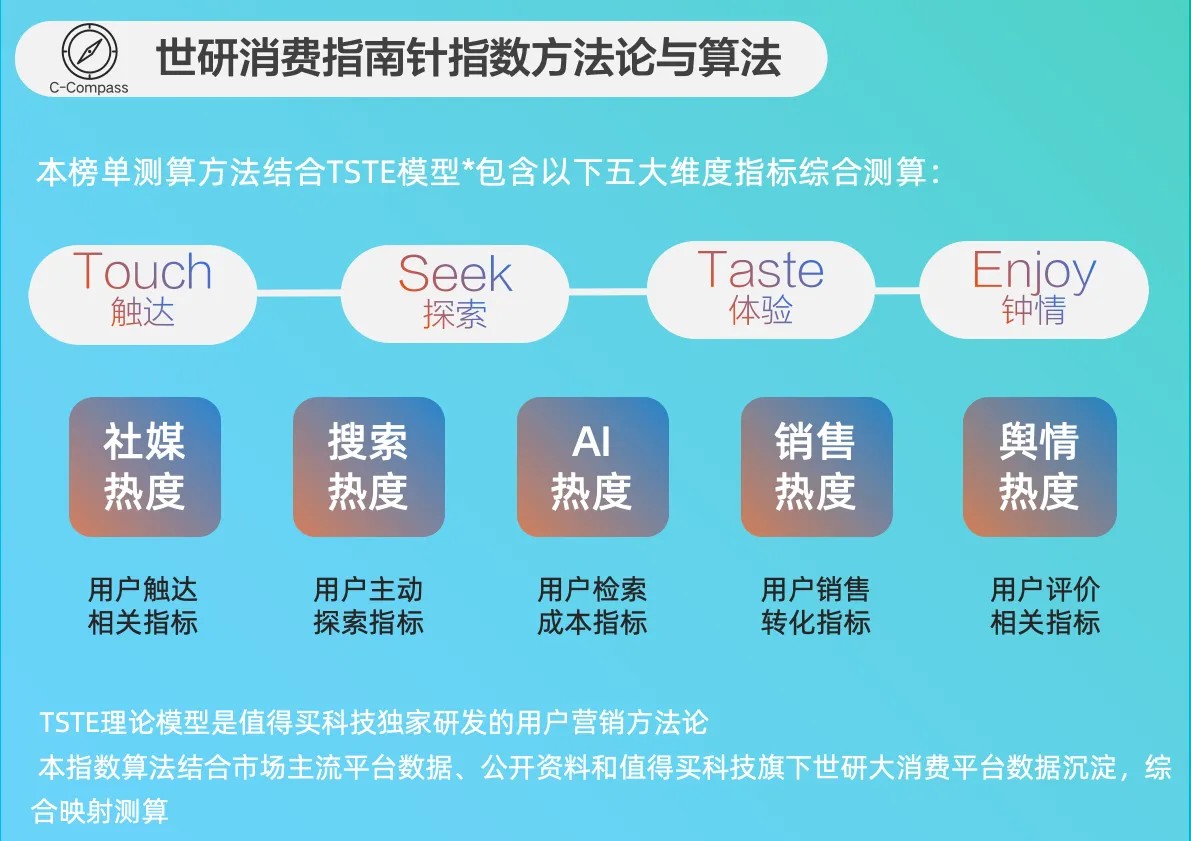

The list data calculation combines public data from mainstream platforms and data precipitation from the Shiyan Big Consumption Platform under the Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the provided data as much as possible, but we cannot rule out some errors or deviations due to the limitations of the data itself. In addition, some data in this report have not been formally audited by an independent third - party auditing institution, so there may be unrecognized errors or omissions. It is particularly noted that the market situation may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third - party names, brands, or products mentioned in the report are for illustrative purposes only and do not constitute recognition or recommendation of them. Any mention of these third parties should not be regarded as an endorsement or recommendation in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index. It shall not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not assume any legal liability for any losses or damages caused by the use of the information in this report.