Ping An Healthcare Achieves Full - year Profit in 2024, and AI Empowerment Unlocks Valuation Potential | Intelligence Kr

On March 12, Ping An Health (1833.HK) announced its full - year results for 2024.

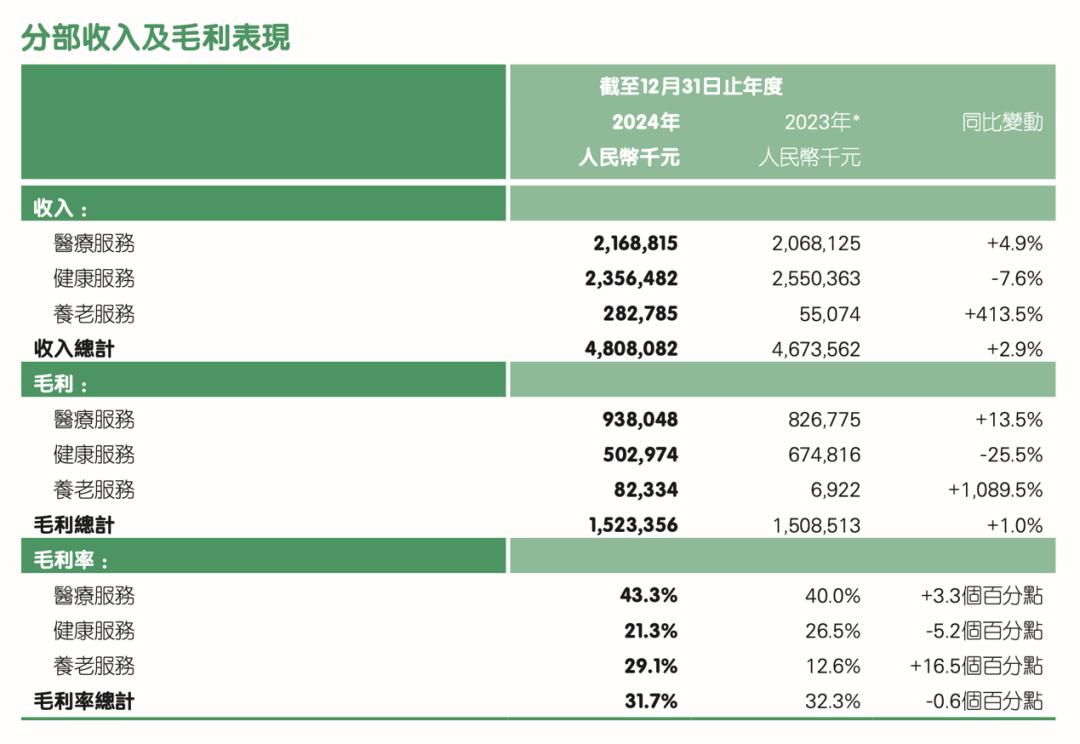

The financial report shows that Ping An Health achieved revenue of 4.808 billion yuan in 2024, a year - on - year increase of 2.9%, slightly exceeding the Bloomberg consensus forecast. Driven by reform measures such as Strategy 2.0 and continuous optimization of the business structure, the company's service level has been continuously improved. One of the important highlights of this financial report is that the revenue has returned to the growth track.

In terms of profit, the company achieved a net profit of nearly 90 million yuan in 2024, and the adjusted net profit for the same period was 158 million yuan. The performance has continued the good trend since the interim report in 2024. The core driving force for the company to achieve full - scale profitability in 2024 can be attributed to the above - mentioned strategic reform measures.

Chart: Key financial data of Ping An Health in 2024; Source: Company's financial report, 36Kr

In the long run, Ping An Health's achievement of full - scale profitability in 2024 is one of the most important phased achievements of its strategic reform. In recent years, the development of artificial intelligence has been in the ascendant. Based on its own business characteristics and long - term technological reserves, Ping An Health empowers its own business by promoting medical AI and actively explores new application scenarios of AI in the medical field.

So, what are the important highlights of Ping An Health's 2024 financial report? How should Ping An Health, with AI empowering its core business, be valued?

I. The enterprise health business is expanding rapidly, and AI empowerment is the most core highlight of the company's future

After long - term strategic reform, from the perspective of the revenue structure of Ping An Health in terms of channels, the revenue from the F - end and B - end businesses has become the pillar of the company's revenue. Benefiting from the group's endowment, both the F - end and B - end businesses of the company have maintained strong growth. Among them, the F - end business achieved revenue of 2.417 billion yuan in 2024, a year - on - year increase of 9.6%, and the B - end revenue for the same period was 1.432 billion yuan, a year - on - year increase of 32.7%.

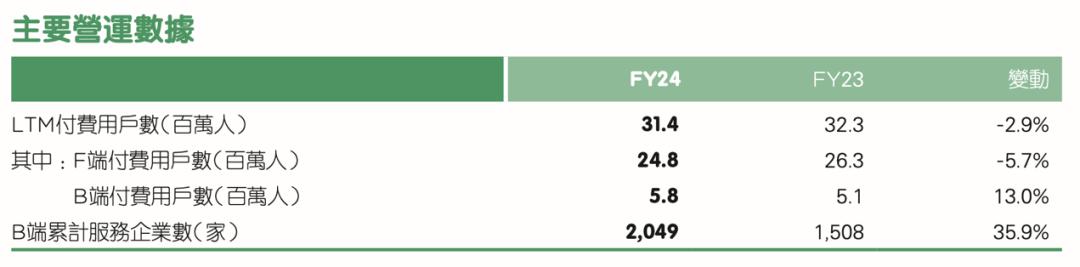

In terms of the elasticity of business revenue growth, the company made significant efforts in the B - end business in 2024. In particular, the accelerated expansion of the enterprise health business is also one of the highlights of this financial report. Reflected in the finance, the year - on - year growth rate of B - end revenue exceeded 30%, and the revenue share of the enterprise health business in the B - end business increased from 55% in the first half of 2024 to 92% in the second half of 2024. Reflected in the operating data, the number of paying users at the B - end in 2024 was 5.8 million, a year - on - year increase of 13%; the cumulative number of enterprises served at the B - end was 2,049, with a year - on - year growth rate as high as 36%. Among them, 86% of the enterprise customers came from the group channel.

In terms of the F - end business, mainly affected by the adjustment of the property insurance collaborative business model and the counter - cycle, the number of paying users at the F - end decreased slightly year - on - year in 2024, which affected the growth of the F - end business revenue to a certain extent. However, thanks to the explosive growth of the company's enterprise health business in 2024, the impact of the slight decline in the number of F - end users was offset.

Chart: Key operating data of Ping An Health in 2024; Source: Company's financial report, 36Kr

At the business level, after adopting the new business caliber since the interim report in 2024, Ping An Health's business model has become very clear. Its main business is divided into three major business segments: medical services, health services, and elderly care services. Judging from the growth of the revenue of each segmented business, both medical services and elderly care services maintained positive growth in 2024. Affected by the high - boom of the industry and the low - base factor, the year - on - year growth rate of the revenue of elderly care services in 2024 exceeded 400%.

The revenue growth of the core business essentially reflects the direction of Ping An Health's strategic reform, that is, taking family doctors and elderly care butlers as the core hubs in member management to provide users with one - stop family doctor services and elderly care services. With the improvement of relevant service capabilities and the continuous expansion of service scenarios, the home - based elderly care services covered 75 cities across the country by the end of 2024, and the number of relevant rights - holding users increased by as much as 143% year - on - year.

Chart: Revenue and gross profit performance of Ping An Health in 2024; Source: Company's financial report, 36Kr

From the significant increase in the penetration rate of the company's medical services and elderly care services in 2024 to the company's revenue returning to the positive growth channel and achieving full - scale profitability in the same period, technology - empowered business is an underlying logic for Ping An Health's business development and even performance growth. Therefore, from the perspective of the enterprise's attributes, Ping An Health is not only a medical enterprise but also a high - tech enterprise. It can be said that technology is one of the characteristics of Ping An Health, especially the relevant applications of AI are highly compatible with the company's existing business.

Since its establishment in 2014, Ping An Health has always attached importance to the exploration of technological innovation and maintained long - term investment. Long - term infrastructure construction is the foundation for Ping An Health to achieve AI - empowered business. Before upgrading and releasing the "Ping An Yibo Tong" medical large - model and the "Ping An Yijia Ren" doctor workbench in June 2024, the company had already built five major medical databases, including the disease database, prescription medical database, medical product database, medical resource database, and personal health database, covering 37,000 diseases, 220,000 drug instructions, 2 million classic cases, 30 million medical literatures, 1.44 billion consultations and other rich professional data.

In terms of large - model construction, on the basis of the above - mentioned massive data, the company's medical large - model has also undergone multiple upgrades and iterations. The initial consultation - assistance system was based on the rule - engine data CDSS and only covered 3,000 common diseases. After upgrading to the second - generation consultation - assistance system that applied reasoning and neural network technology, through in - depth reasoning and learning of the large - scale medical knowledge graph, the coverage of disease types, terms, literatures, and clinical guidelines has been significantly improved.

With the continuous enrichment of the content of the five major databases, Ping An Health upgraded and released the "Ping An Yibo Tong" large - model in June 2024, which is characterized by the self - developed Dflow and LPO technologies, and has 200 billion medical - field tokens, 5 million medical - field instruction sets, and millions of medical text - image alignment data. On the application side, the massive data + advanced algorithms enable the "Ping An Yibo Tong" large - model to accurately complete different tasks in different scenarios. It can also be more adapted to doctors' needs through continuous annotation and feedback from doctors, and provide personalized customized services at a relatively low training and storage cost.

In February 2025, after Ping An Health connected to DeepSeek, taking advantage of the characteristics of its generalization model, the current integration mainly focuses on improving the interaction experience. It is worth noting that the medical field itself is highly serious. Compared with consumer - grade general large - models, Ping An Health's advantages in the AI field are mainly reflected in its professional capabilities.

It not only has five major databases with rich content, containing a large amount of professional medical information and data such as diseases, drugs, and clinical guidelines. More importantly, this information and data are not open - source. Moreover, the training of Ping An Health's medical large - model is mainly based on the above - mentioned vertical databases, and the annotation and feedback from doctors are also crucial for optimizing the output of diagnosis and treatment results. It can be seen that the professional capabilities in the vertical field are the company's moat, which is also the main reason why Ping An Health has very prominent AI capabilities in the medical field.

In contrast, although consumer - grade general large - models have advantages in algorithms and computing power, due to the non - open - source nature of a large amount of medical - related vertical data, general large - models lack targeted training in the medical field, resulting in an obvious gap in professionalism compared with professional medical large - models such as "Ping An Yibo Tong". Moreover, there is a large amount of redundant and false medical information and data on the Internet. Without doctor verification, the gap with professional medical large - models such as "Ping An Yibo Tong" is further widened.

II. Investment Strategy

Since the beginning of this year, DeepSeek has triggered a wave of AI fever. From the underlying logic, computing power is no longer the biggest constraint for China's AI large - models. Therefore, investors have focused their attention on technological progress and performance realization, and the market's investment logic for AI has gradually moved closer to fundamental investment. So, at present, the main logic for investors to value AI - related targets is based on technological progress and application - end realization.

On the basis of the five major databases, Ping An Health upgraded and released the "Ping An Yibo Tong" multi - modal large - model and the "Ping An Yijia Ren" doctor workbench in 2024. According to the information disclosed in the Ping An Health conference call, the recent connection to DeepSeek has achieved certain results in improving the interaction experience. Therefore, from a technological perspective, Ping An Health's AI capabilities are mainly endogenous, which can give full play to its professional capabilities, and the integration with general models is one of the important highlights for the future.

From the perspective of policy context, Internet + medical health is an important current policy direction, and the AI industry, as an important component of new - quality productivity, is also the focus of policy support. After strategic reform, Ping An Health has a clear strategic positioning and direction. The Internet - based medical service business is the company's core business, and AI empowerment of the company's business further enhances the company's technological attributes. Whether it is Internet + medical health or AI empowerment, a certain valuation premium can be given in terms of policy.

In terms of fundamentals, as the flagship of Ping An Group's elderly care ecosystem, Ping An Health continuously taps into the group's endowment. By deepening the synergy with the group's commercial insurance, comprehensive finance and other businesses, the business forms of the company's medical services, health services, and elderly care services have matured and are operating efficiently. Looking forward, with policy support and technological advantages such as big data and artificial intelligence, the company's performance is expected to maintain strong growth, thus opening up upward space for the company's valuation.

In terms of valuation, as a representative of the Hong Kong - listed medical and technology sectors, overseas economies are in an interest - rate - cut cycle. According to historical experience, the technology sector will benefit in the first and middle stages of the interest - rate - cut cycle, and technology stocks in the medical sector are among the best. From the perspective of the monetary - policy cycle, as a typical technology stock, Ping An Health has a solid fundamental basis, and the characteristic of AI - empowered business makes it quite scarce in the capital market. Therefore, the investment opportunity of valuation repair + technology benefit will last at least until the middle stage.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be made with caution. In any case, the information in this article or the opinions expressed do not constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention to provide underwriting services or any services that require specific qualifications or licenses for the trading parties.