Luxury brands have joined hands with major beauty brands again. Is it a desperate alliance or a money-making formula?

Text | He Zhexin

Editor | Qiao Qian

When 28-year-old popular South Korean idol Jennie strolled under the early summer sun on the island of Capri in an A-line ankle-length skirt by Jacquemus, almost everyone was convinced that this French designer brand, which had been established for only 15 years, would be the next Lemaire, Loewe, or even CELINE. Despite the fact that Jacquemus had lost a small number of fans who valued design and quality more during its rapid expansion in recent years.

But there was one person who didn't care, or rather, didn't care that much. That person was Simon Porte Jacquemus himself.

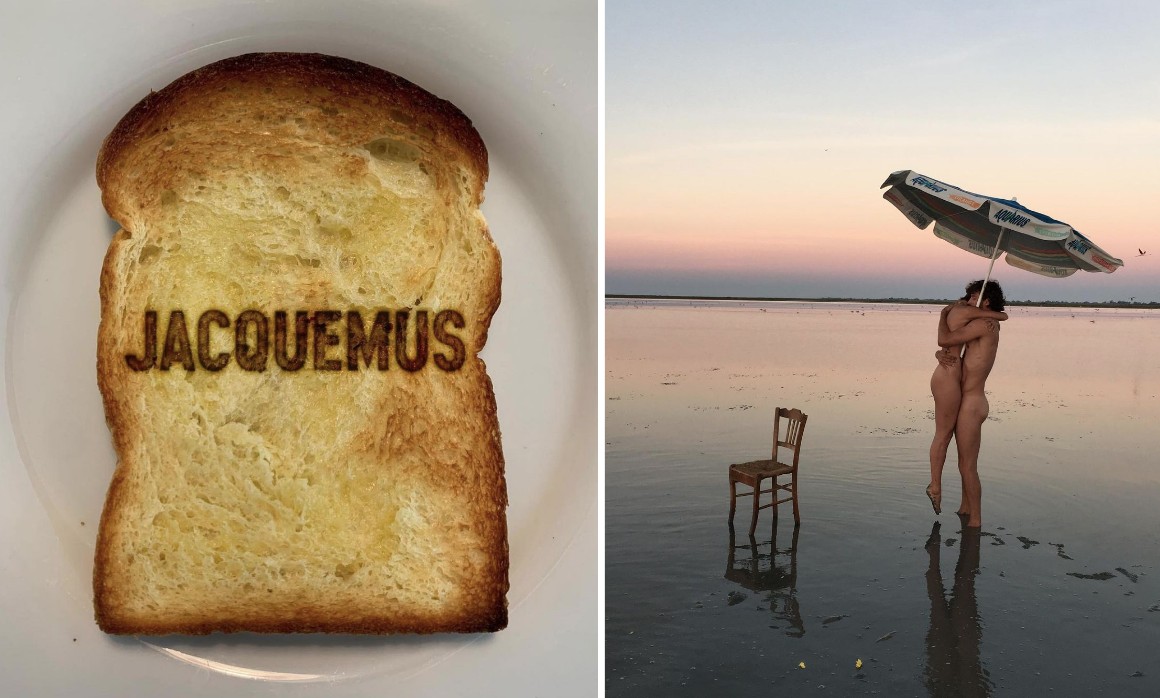

In the past three years, Jacquemus has created countless iconic moments: the giant Le Bambino speeding through the streets of Paris, the huge straw hats like parasols, and the tiny Le Chiquito bags that can only hold a keychain. There are also the bizarre everyday items printed with Jacquemus on its Instagram account, and of course, the various elaborately designed runway spectacles. In other words, Jacquemus is a luxury brand with a strong sense of internet popularity.

Image source: Jacquemus IG account

In this era, visual stimulation can always be easily converted into sales. Jacquemus sold 270 million euros in the post-pandemic period, almost doubling compared to the previous year. Its bags are also regulars in the TOP 10 of the LYST list and are crowned as "the favorite designer brand of Generation Z".

However, in a luxury market dominated by chaebols and becoming increasingly volatile, it has become difficult for independent brands to grow continuously. Last month, Chiara Ferragni, who has 30 million followers, faced a halving of the sales of her personal brand. At her peak, Ferragni owned two companies and was given the title of "the blogger of the universe". She was also an independent director of Tod's for a while.

Jacquemus was not spared from the turmoil either: the CEO left, discounts increased, inventory piled up, consumers complained about the "inconsistent" quality, and even the planned store opening in the United States was put on hold. Simon Porte Jacquemus had repeatedly rejected acquisition offers from large groups, but now he had to find a big tree to shelter under. "I need to find an investor now if I still want Jacquemus to survive."

Simon Porte Jacquemus didn't turn to LVMH, the one who had discovered him. Instead, he found L'Oréal, which already held a minority stake in Jacquemus. The two parties signed cooperation terms with the specific amount undisclosed. L'Oréal will not interfere with Jacquemus' fashion business but will be responsible for developing Jacquemus' beauty products.

This is a risky move. Before this, Jacquemus had never launched any beauty products, not even a memorable perfume. Even die-hard fans of Jacquemus would find it difficult to describe what the brand's beauty products should look like - it is too casual, too personalized, and too young. Simon Porte Jacquemus' aesthetics are "like a tomato, a sunset, or a stylish residence". These elements may spark people's imagination on social networks, but it is difficult to translate them into a bottle of essence, cream, or eyeshadow palette. Developing a perfume that "smells very Jacquemus" may be the easiest, but to be honest, there are already enough perfume brands with a Mediterranean style.

Jacquemus fits the fragmented aesthetics of the social media era. Image source: Jacquemus IG account

Fortunately, all these are things that L'Oréal needs to worry about. In the past two years, L'Oréal has been accelerating the "rental" of the beauty business of luxury brands . Miu Miu, which is the most popular among young consumers, has already been taken under its wing, and its cooperation with Prada officially started in 2021. In the same week when the cooperation with Jacquemus was announced, L'Oréal announced that it had acquired a minority stake in Amouage, a luxury brand targeting the Middle Eastern market.

Jacquemus will also be included in L'Oréal's luxury division along with the licensed products of brands such as YSL, Prada, and Valentino. This division contributed about 15 billion euros in revenue to the group last year, which is comparable to the scale of the mass beauty division where L'Oréal Paris is located.

The beauty market is ultimately a business of selling dreams, and the integration of luxury brands and beauty is becoming frequent again. Another piece of news last week was that Louis Vuitton started selling beauty products. This largest luxury brand in the world previously only had a series of perfume products, and they were not available in many places.

Although it is self-operated, Louis Vuitton also chose to cooperate with a makeup artist with a strong sense of internet popularity. The name Pat McGrath may not be well-known, but those who are slightly familiar with runway makeup will know the weight behind this name. At the Margiela Spring/Summer 2024 couture show helmed by "the Pirate King" John Galliano's comeback, the models' makeup with a highly glossy and almost porcelain-like finish became a hit on social networks. It was the creation of Pat McGrath. VOGUE commented that Pat McGrath had led this trend before the era of "self-declaration" beauty arrived.

The models' makeup at the Margiela Spring/Summer 2024 show

Although there are more players entering the market, the balance of power between luxury brands and beauty companies in cooperation has not shifted significantly: this is still a market that is unfamiliar to most luxury and fashion brands, and licensing the brand is the safest approach. The most powerful evidence may be that even during the heyday of GUCCI, Kering publicly hinted several times that Coty, the agent of GUCCI's beauty business, was less capable of creating hit products than the "eccentric" designer Alessandro Michele, but ultimately did not take back the beauty business.

The only change may be that the window period for beauty companies to monetize licensed brands has become extremely short. In the priority selection of product development, low-priced cosmetics have replaced high-priced perfumes and skin care products, aiming to boost sales more quickly.

L'Oréal took over Giorgio Armani's beauty business in 1988, and only new perfume products were launched in 12 years. In the autumn of 2000, Armani's first cosmetics series was officially launched, and the Black Code cream was born 7 years later.

In 2018, L'Oréal won the beauty business of Valentino from PUIG. After the agreement took effect, it started to develop a series of cosmetics. Three years later, the first Valentino lipstick was launched. Prada Beauty covered all core beauty categories in just two years.

However, for luxury brands, this strategy of quickly pursuing short-term sales may be a self-destructive approach. After all, brands like Hermès and Chanel haven't launched new cosmetics products for a long time, which shows that they prefer to maintain the uniqueness and high-end image of the brand rather than blindly follow the trend.