In - depth analysis of the M&A market: What do the "buyers" and "sellers" think? | A review of OpenTalk

Text | Liu Jingqiong

Editor | A Zhi

On February 26, 2025, 36Kr hosted an OpenTalk live sharing event titled "The Era of Mergers and Acquisitions? Seeking the 'Greatest Common Divisor'". The live broadcast specially invited two guests, Gao Feng, the Executive General Manager of the M&A Group in the Investment Banking Department of China International Capital Corporation Limited, and Gong Yanhang, the Managing Director of Hanergy Investment Group. They conducted in - depth discussions on multiple elements such as the market trends, policy interpretations, trading strategies, and the seller's perspective of mergers and acquisitions and reorganizations, and had an on - site Q&A interaction with the audience.

Regarding how to seize the market opportunities of mergers and acquisitions and reorganizations, deal with challenges, and maximize enterprise value, the two guests shared their insights and experiences respectively. The following is a summary of the key points from this live broadcast. Welcome to read, share, and collect.

Breaking the Deadlock and Reconstructing New Opportunities in the Chinese Mergers and Acquisitions and Reorganizations Market in 2025

Guest Speaker: Gao Feng | Executive General Manager of the M&A Group in the Investment Banking Department of China International Capital Corporation Limited. He has nearly 20 years of experience in investment banking and holds the qualification of a Chinese sponsor representative, as well as Class 1 and Class 6 practice licenses in Hong Kong. Mr. Gao has participated in and led multiple influential domestic and overseas mergers and acquisitions, reorganizations, and securities issuance projects, and has rich transaction experience in fields such as A - shares, Hong Kong stocks, cross - border mergers and acquisitions, and the reorganization of central and state - owned enterprises. Mr. Gao graduated from Fudan University with a bachelor's degree and from the PBC School of Finance at Tsinghua University with a master's degree.

Keywords of the Sharing: #New "Nine - Point Plan for the Capital Market" #Trends in the M&A Market #New - quality Productivity #Success Factors and Risk Control in Mergers and Acquisitions

Gao Feng conducted an in - depth explanation around four aspects: the retrospective development of mergers and acquisitions and reorganizations in the Chinese capital market, the insights into the recent merger trends of listed companies, the analysis of the characteristics of recent cross - border mergers and acquisitions by Chinese enterprises, and the analysis of the key success factors in merger transactions, combined with the cases of CICC.

Evolution of the Mergers and Acquisitions and Reorganizations System in the Chinese Capital Market

Looking back at the development of the Chinese capital market over the past 20 years, Gao Feng introduced that the evolution of China's mergers and acquisitions and reorganizations system can be roughly divided into five stages:

2000 - 2013: The stage of system formation. The government and regulatory authorities issued a large number of laws and regulations to standardize the mergers and acquisitions and reorganizations of listed companies, and the institutional framework of China's mergers and acquisitions and reorganizations market was initially established. In 2004, the first "Nine - Point Plan for the Capital Market" was released.

2014 - 2015: The stage of increased support. Against the background of the increasing demand for the transformation and upgrading of traditional industries and the rapid development of emerging industries such as the Internet, policies further increased support to stimulate the vitality of the mergers and acquisitions and reorganizations market. However, there were individual irrational investment behaviors in the market during its rapid development, which was also the main reason for the subsequent tightening of supervision. In 2014, the second "Nine - Point Plan for the Capital Market" was released.

2016 - 2017: The stage of problem - solving. After the market adjustment, the supervision of mergers and acquisitions and reorganizations was significantly strengthened starting from 2016. Under the tightening policies, the mergers and acquisitions market gradually cooled down, and the transaction volume of mergers and acquisitions and reorganizations decreased from its peak in 2015 to 1.41 trillion yuan in 2017.

2018 - 2023: The stage of marginal relaxation. The mergers and acquisitions and reorganizations system in this stage was characterized by cautious relaxation, adjustment and optimization, and adaptation to the new situation. The "three highs" problems in mergers and acquisitions and reorganizations continued to be strictly regulated, and illegal and irregular behaviors such as malicious speculation of shell companies were cracked down on, and chaos such as "fraudulent" reorganizations and blind cross - border reorganizations were curbed. With the official implementation of the comprehensive registration - based system reform in February 2023, the relevant regulations on mergers and acquisitions and reorganizations were also revised.

Since 2024: The stage of policy re - stimulation. In April 2024, the State Council introduced the third "Nine - Point Plan for the Capital Market". It encourages listed companies to focus on their main businesses and comprehensively use methods such as mergers and acquisitions and reorganizations and equity incentives to improve the quality of development. The reform of mergers and acquisitions and reorganizations was intensified, and multiple measures were taken to activate the mergers and acquisitions and reorganizations market. In the same year, the "Eight Measures for Science and Technology Innovation", the "Six Measures for Mergers and Acquisitions", and the "Administrative Measures for Strategic Investors" were successively introduced, and the popularity of the mergers and acquisitions and reorganizations market increased significantly.

Recent Characteristics of Chinese Enterprises' Overseas Mergers and Acquisitions

Regarding the recent characteristics of the overseas mergers and acquisitions market of Chinese enterprises, Gao Feng shared relevant insights:

The current transaction volume is at a relatively low level: Affected by the changes in the global political and economic situation, the overseas mergers and acquisitions market of Chinese - funded enterprises has declined after reaching its peak in 2016. In recent years, the number of ultra - large - scale overseas merger transactions has decreased. Based on their own development needs, Chinese - funded enterprises prefer high - quality "small and beautiful" targets, and the proportion of small and medium - sized merger transactions has increased. Chinese - funded enterprises' overseas mergers and acquisitions prefer controlling opportunities, and the proportion of controlling - stake acquisition transactions exceeds half, and there has been a further upward trend in recent years.

Diversified target regions: In line with the industrial development trend, the industries of target companies are gradually diversifying, and the regions where Chinese enterprises choose target companies for overseas mergers and acquisitions are also constantly changing. Around 2005 - 2011, overseas mergers and acquisitions were mainly resource - based mergers and acquisitions in industries such as energy and chemicals and metal mining, and the destination countries were concentrated in traditional energy and mineral countries such as Europe, America, and Australia. From 2012 to 2018, with China's industrial upgrading, the overseas expansion boom in industries such as TMT, consumption, and real estate made regions such as Europe, America, South America, and Africa popular. Since 2019, more Chinese - funded enterprises have begun to focus on emerging markets such as Southeast Asia and South America, and the merger strategy has shifted from technological upgrading to the expansion of new markets and new brands.

The Hong Kong stock market remains an important target market: The Hong Kong stock market has obvious international characteristics, with many international enterprises and financial institutions participating. It is one of the markets highly valued by Chinese - funded enterprises. In recent years, Hong Kong stock transactions have not only included the transfer of the control rights of listed companies but also a large number of privatization transactions of well - known listed companies. The transaction logic includes various aspects such as industrial mergers and acquisitions, value re - evaluation, enterprise transformation, and risk resolution, and many successful cases are worth studying.

Listed companies and private enterprises have become the backbone of overseas mergers and acquisitions: From the perspective of the characteristics of market participants, the following characteristics have emerged in recent years: A - share and Hong Kong - listed companies are playing an increasingly important role in the overseas mergers and acquisitions market of Chinese - funded enterprises. In addition to large leading companies, small and medium - sized listed companies have also become more active. In addition, from the perspective of enterprise nature, the demand of high - quality private enterprises for overseas expansion has become more and more vigorous in recent years, and they have become one of the important participants in transactions.

Key Factors in Merger Transactions

Mergers and acquisitions usually involve the balance of multiple parties' interests. Finally, Gao Feng shared three principles for the success of merger transactions, namely "timing, location, and harmony among people":

Timing: That is, clear merger goals and strategies. The buyer needs to fully consider multiple factors such as the macro - environment, industry characteristics, and its own strategic planning.

Location: That is, professional plan design and prudent due diligence and negotiation. The buyer needs to pay attention to many matters such as the due diligence situation, valuation and pricing, and commercial terms.

Harmony among people: That is, efficient cooperation between the two parties and subsequent integration. The buyer needs to balance the interests of relevant parties in the transaction, internal and external decision - making and approval, information confidentiality, and subsequent integration arrangements.

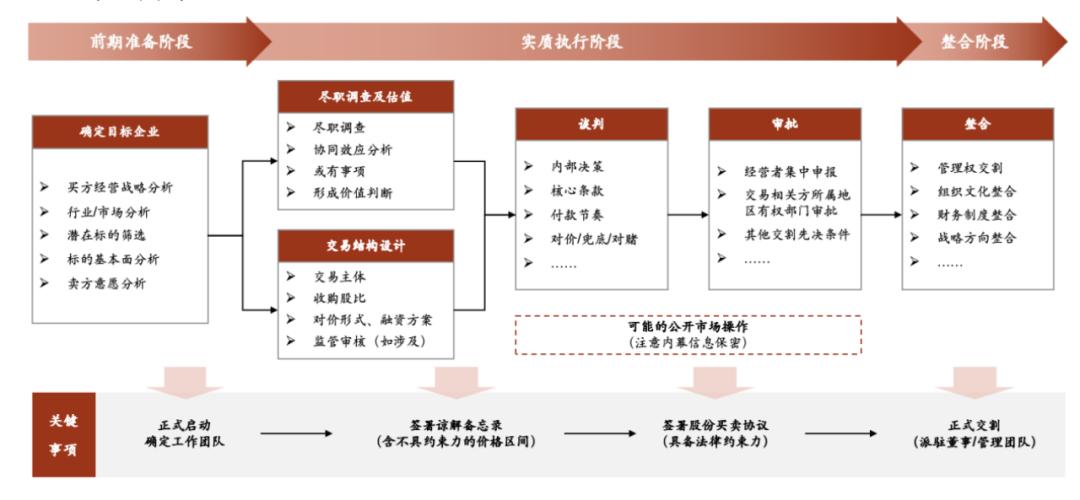

General steps and operation processes of merger transactions from the buyer's perspective

New Trends in Merger Exits and Considerations from the Seller's Perspective in the Current Chinese Market Environment

Guest Speaker: Gong Yanhang | Managing Director of Hanergy Investment Group, responsible for Hanergy's M&A business. He was formerly the Investment Director and Head of Technology Investment at JD Group, and completed several merger and strategic investment transactions in fields such as cloud computing and artificial intelligence. Before joining JD, Mr. Gong was engaged in private equity investment work at institutions such as the Hong Kong - based Orient Securities Group and the China - ASEAN Investment Fund. Earlier, he was a senior manager of audit and consulting services at KPMG, with nearly 20 years of experience in the financial industry. Mr. Gong holds an MBA degree from the Ross School of Business at the University of Michigan in the United States and a bachelor's degree in economics from the Central University of Finance and Economics, and is qualified as a Chinese Certified Public Accountant and an International Certified Internal Auditor.

Keywords of the Sharing: #Current Environment #Merger Exits #New Trends #Seller's Perspective

Gong Yanhang conducted an in - depth analysis of the new trends in the current Chinese mergers and acquisitions market and the considerations from the seller's perspective in merger transactions.

New Trends in Mergers and Acquisitions

Gong Yanhang analyzed the reasons driving the warming of the mergers and acquisitions and reorganizations market from the supply side and the demand side:

From the supply side: A large number of projects cannot be listed in the primary market, resulting in problems such as the difficulty of shareholders' exit and subsequent financing. The number of A - share IPOs has dropped sharply, and the acceptance has almost stagnated. It is easy to list in the Hong Kong stock market, but there are problems with liquidity and stock price discounts. The US stock market has good liquidity, but due to geopolitical factors, it is unfriendly to Chinese concept stocks. In the 1980s in the United States, more than 80% of projects exited through IPOs. Today, more than 70% of projects exit through mergers and acquisitions, and less than 10% of projects exit through IPOs. In China, the situation is exactly the opposite, with less than 10% of projects exiting through mergers and acquisitions. History has proven that many things in the United States will gradually evolve in China, and there is still great potential in the Chinese mergers and acquisitions market.

From the demand side: First, in the economic downturn cycle, the growth of listed companies has stagnated, and mergers and acquisitions and integration are a good way to increase performance. Second, many industries are highly competitive now, and mergers and acquisitions for industry and industrial integration are also encouraged by the regulatory authorities. Third, in a low - interest - rate environment, products such as M&A loans from financial institutions such as banks provide good ammunition for M&A buyers. Fourth, many small - market - capitalization listed companies face delisting risks under the new regulations and hope to relieve the delisting pressure through mergers and acquisitions. Fifth, the rise of the government and M&A funds. The government hopes to carry out M&A investment promotion, and many PEs that previously invested in growth - stage projects are also transforming into M&A.

Differentiated Pricing and Performance Commitments

Gong Yanhang believes that in the current market environment where the financing valuation and the M&A valuation are inverted, the probability of the emergence of differentiated pricing will increase. The common practice of conventional differentiated pricing is that the valuation of later - stage investors > the valuation of early - stage investors ≥ the valuation of the management team. Later - stage investors have a high investment cost, so they can only get back the principal + interest. Early - stage investors have a low investment cost, so their valuation is discounted but there is still room for positive returns. The difference between the differentiated pricing of investors and the assessed value of the target is waived by the management team. However, there are also some variant methods, such as the management team bearing the obligation of the performance commitment, resulting in the valuation of the management team > the valuation of investors.

Another topic that cannot be avoided in mergers and acquisitions is performance commitments. Gong Yanhang found that the recent trend has slightly ebbed, and the proportion of enterprises not making performance commitments is a little higher than before. In the actual operation process on behalf of the seller by Hanergy, there are several situations where negotiations will be held with the buyer not to set up a performance commitment:

The first situation is the price issue. If the price is calculated based on the static price - earnings ratio or price - to - book ratio, sometimes it is possible to negotiate without a performance commitment, especially when calculated using the asset - based approach, the probability of no performance commitment is very high.

The second situation is that the target needs to be integrated immediately after being acquired. The team may be disassembled, or the products may be integrated. At this time, the target company cannot operate independently, so it is definitely impossible to make a performance commitment.

The third situation is that the buyer and the seller are competitors. For example, when a large company acquires a small one, it is also impossible to make a performance commitment in this situation. The reason is very simple. If the two parties are competitors in the same industry, they definitely hope that there will be no competition after the merger, and it is the best choice for them to serve customers in the same industry together.

The Seller's Perspective: What is a Good Buyer?

There are many buyers in the market who want to conduct mergers and acquisitions, but in fact, there may not be as many reliable buyers as expected. Mergers and acquisitions are an exclusive game. Negotiating with less - reliable buyers is a waste of time and may affect the normal operation of the target company. Based on the experience accumulated in operations, Gong Yanhang shared his views on good buyers: